The metaverse is a virtual shared space that can be accessed by multiple users at the same time. It has the potential to revolutionize many aspects of life, including entertainment, education, and business.

This article will dissect McKinsey’s Metaverse Report “Value Creation in the Metaverse” and look through the performance of metaverse related NFT projects in 2022 and forecast potential future trends. Is the Metaverse just your typical “Ready Player One”, or can it be something completely different?

Article Outline

- Value Creation in the Metaverse

- What is Driving Investment?

- How is Consumer and Business Behavior Evolving?

- What Role Will Web3 and NFTs Play in the Metaverse?

- Closing Remarks

Value Creation in the Metaverse

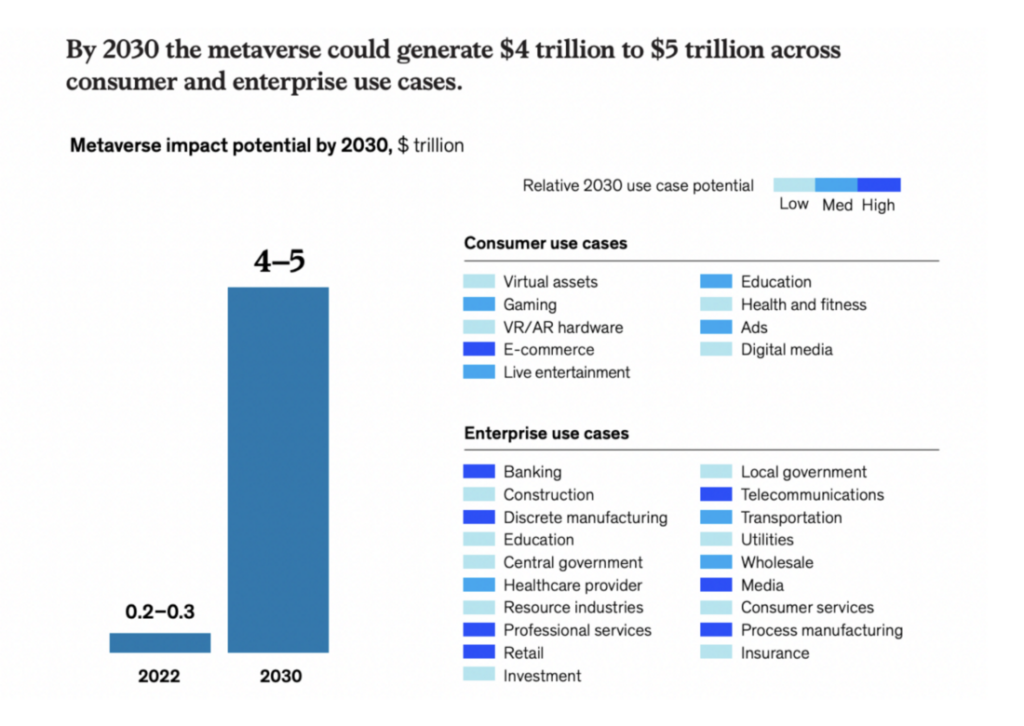

According to McKinsey & Company, the metaverse could create up to $5 trillion USD in value by 2030.

But, What is the Metaverse?

The metaverse is a term that has been in circulation for decades, however, despite the billions of dollars already invested in its development, it remains a term that is difficult to define.

It is seen as the next iteration of the internet, something that people are immersed in, rather than something they just view. Mark Zuckerberg has said that the metaverse will be “the successor to the mobile internet.” The consensus view is that the metaverse will seamlessly combine our digital and physical lives.

Some have defined it as a gaming platform, a virtual retail destination, a training tool, an advertising channel, a digital classroom, and some have defined it as a new gateway to digital experiences.

Ultimately, the metaverse has several foundational characteristics such as a sense of immersion, real-time interactivity, user agency, interoperability across platforms and devices, concurrency with thousands of people interacting simultaneously, and use cases spanning human activity.

Is the Metaverse Web3?

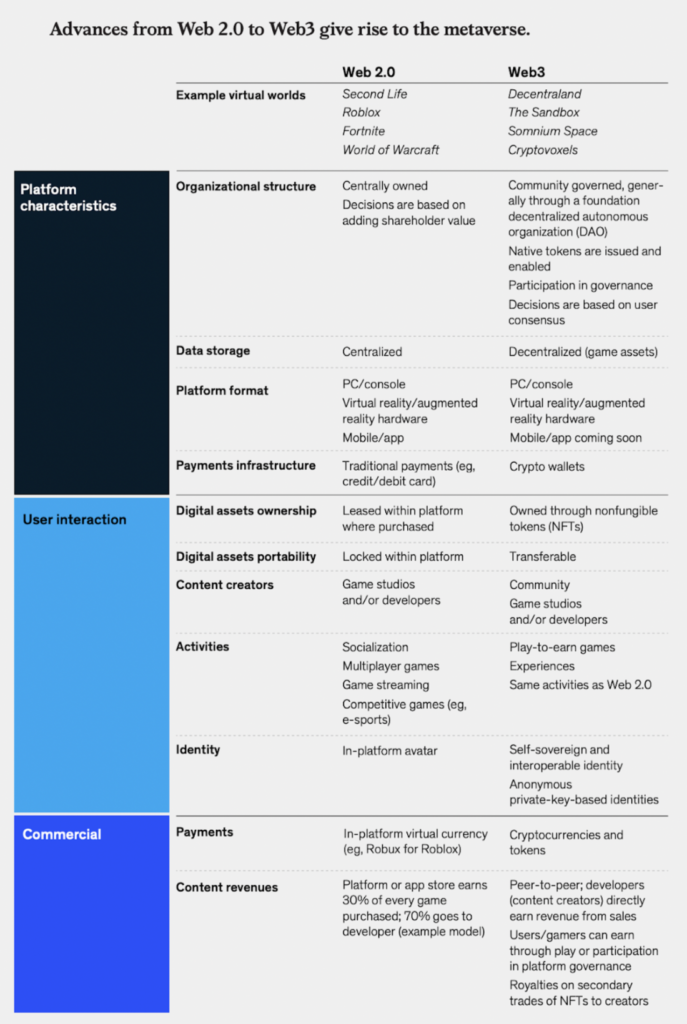

While Web3 promotes decentralization and the ability to connect with other systems, it is not the same as the metaverse, which focuses on creating immersive experiences that can be centralized, or decentralized.

Why do these two terms get mixed together? The simple answer is:

“Well, Web3, by definition, succeeds Web 2.0. The metaverse, by definition, succeeds our current computing and networking paradigm. The fact that they both succeed with what we experience as the internet today naturally intertwines the two.” — Matthew Ball in McKinsey’s At the Edge podcast

And while Web3 isn’t the metaverse, it’s important to note that it is advances from Web 2.0 to Web3 that give rise to the metaverse.

What is Driving Investment?

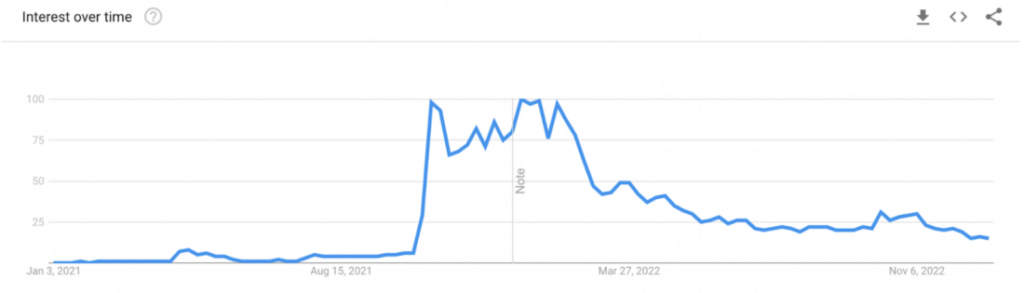

The Metaverse has gained a lot of attention and investment recently, with global Google searches for “metaverse” having skyrocketed 7,200% last year, and the metaverse-centric online gaming platform Roblox reportedly hitting over 55 million daily active users in February 2022.

Meta (formerly known as Facebook) committed more than $10 billion into its Reality Labs division, which makes metaverse-related hardware such as VR goggles. And Microsoft said it has planned a $69 billion acquisition of the gaming company Activision Blizzard that will “provide the building blocks for the metaverse” (although the status of the acquisition remains on pause as regulators push to block it).

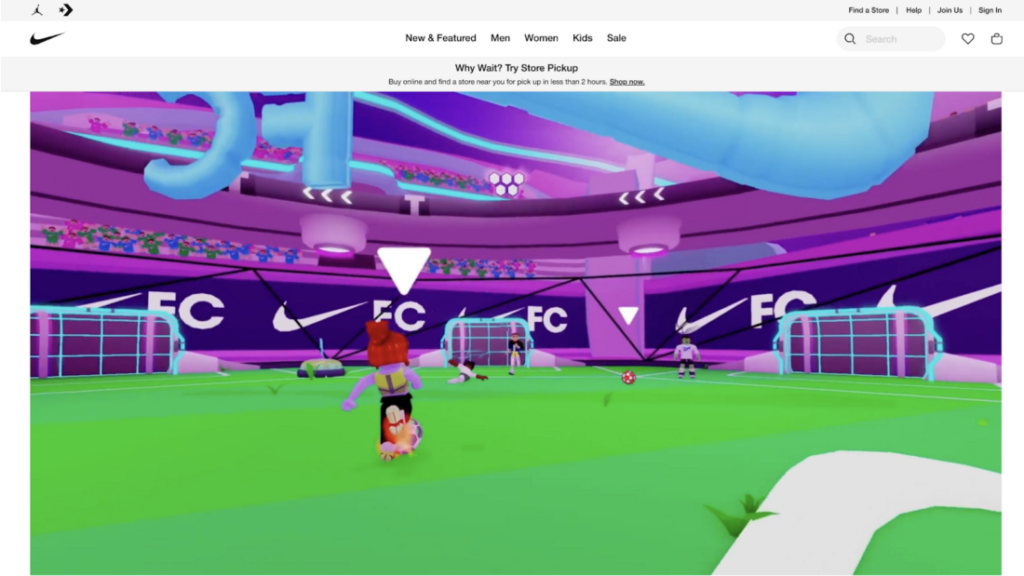

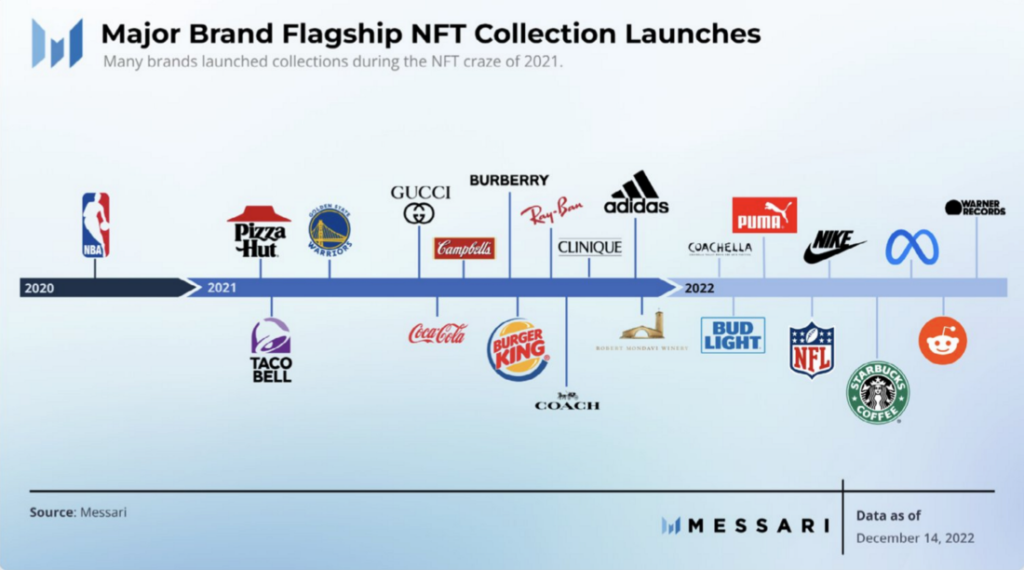

As the metaverse continues to mature, many brands are beginning to experiment with ways to engage with customers through this technology. Luxury goods company Gucci, for example, has had a presence across many platforms. Nike has Nikeland in Roblox. Fast-food company Wendy’s has had an event in Fortnite and has a presence on Horizon Worlds.

Virtual real estate has also been in the spotlight as people are buying virtual lands in platforms like The Sandbox to be used as a base of consumer interactions.

In addition, large enterprise use cases are also scaling, including specific categories such as retail, healthcare, and manufacturing, and also cross-sector examples such as learning and development, remote collaboration, conferences and events, and customer support.

McKinsey & Company expects that the fully developed, long-term version of the metaverse will encompass most daily activities and span five core categories:

- Gaming, which has, to date, been the main driver in the development of the metaverse.

- Socializing, which will extend existing consumer behavior through platforms such as Decentraland and The Sandbox.

- Fitness, which will marry gaming and connectivity through providers such as Peloton.

- Commerce, which includes Sotheby’s proprietary marketplace for curated NFT art, virtual-only fashion company Fabricant, as well as start-ups promoting an immersive retail experience, including Obsess and AnamXR.

- Remote learning, which will allow remote groups of individuals to meet in virtual classrooms.

There is also a belief among investors that the current technology paradigm is about to undergo a major reset, hence the large investments in the metaverse.

What Does All This Mean for Web3?

The metaverse offers new opportunities for creators and users to create and engage in immersive experiences, but the Web3-enabled metaverse takes it a step further by introducing a decentralized ecosystem.

In this system, users have more control over their data and monetization opportunities, and creators can monetize their content and skills in new ways.

This is made possible by blockchain technology, digital assets on blockchain, and smart contracts, which provide permanence, functionality, and interoperability that traditional VR experiences lack.

Additionally, the Web3-enabled metaverse provides access to a wider range of digital assets, such as cryptocurrencies, digital equities, stablecoins, and NFTs, that can be used in various ways like buying virtual real estate, skins and tools.

However, to fulfill its potential, core services need to evolve alongside emerging technologies, including digital user identification, better wallet experiences, improved graphical user interfaces, and the generation of true value through unique access to resources and experiences. This presents a significant opportunity for key players in Web3 to keep an eye on.

How is Consumer and Business Behavior Evolving?

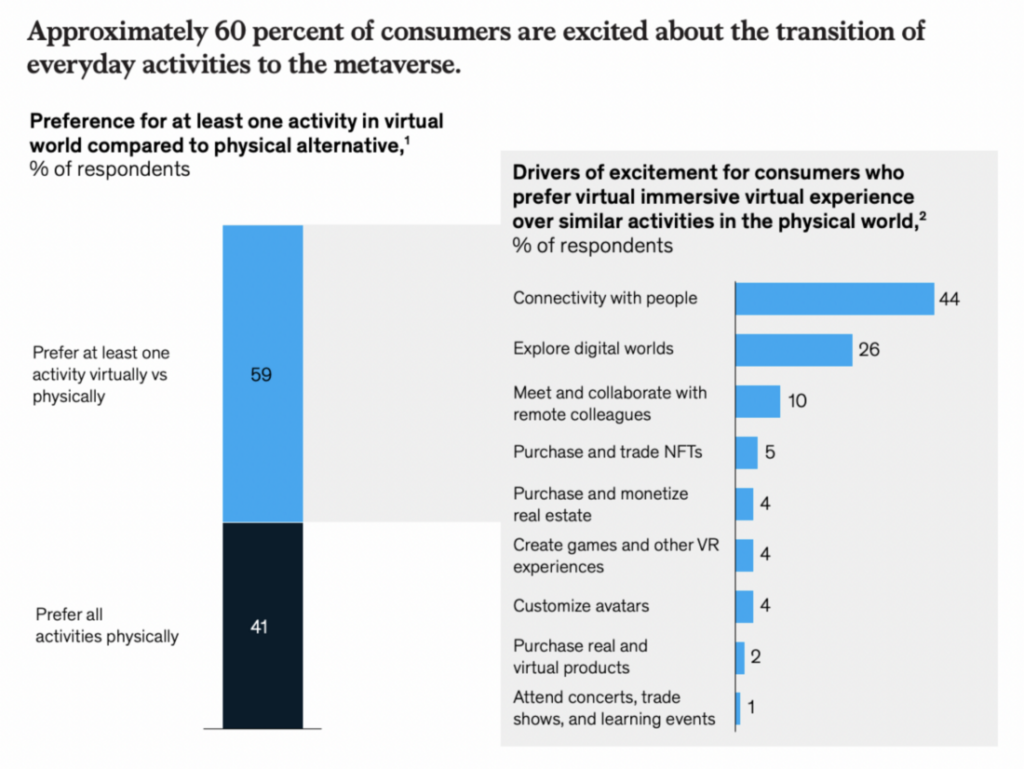

According to the McKinsey & Company report, almost 60% of consumers are excited about the transition of everyday activities to the metaverse.

The top drivers of excitement are connectivity and socializing with family and friends. This encompasses a broad range of activities offering commercial growth opportunities, such as entertainment (66% of consumers are excited about attending live events such as concerts and sports), gaming (66%), and shopping (62%).

Travel is another activity that consumers reported being excited about (62%) with the possibility of going beyond the limits of the physical world: time travel, fantastical places, exotic places that are difficult to access, and space travel.

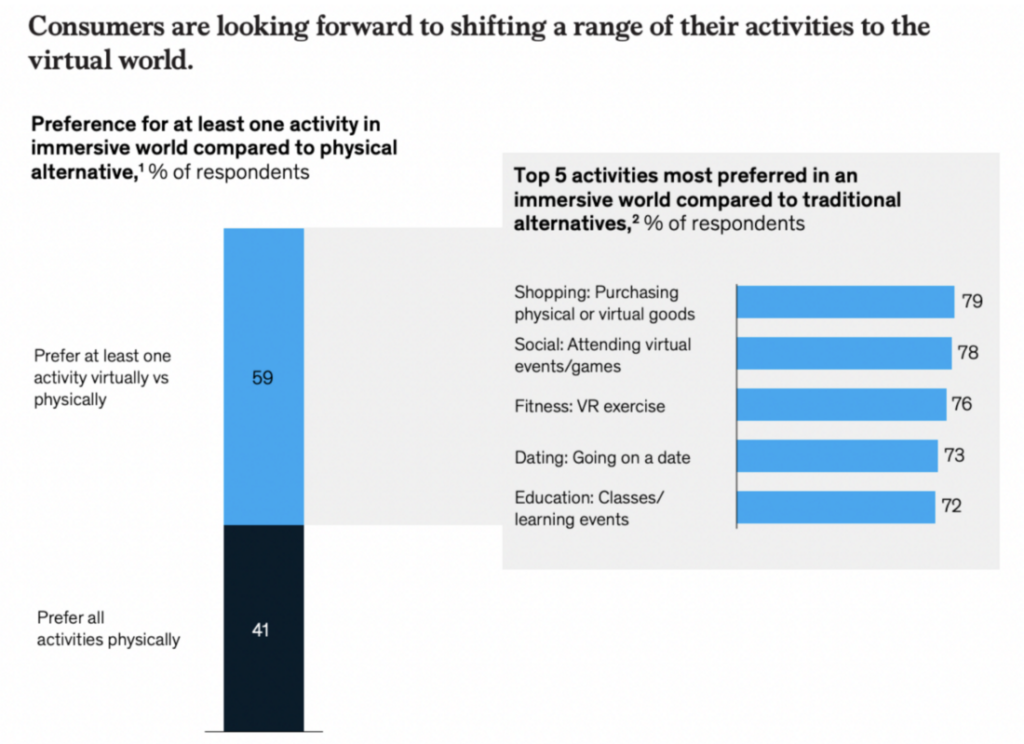

The survey also found that 80% of consumers appreciate shared virtual experiences, 63% prefer virtual work meetings, and 59% enjoy virtual education sessions more than in-person ones. With the wide adoption of virtual tools, the conventional core audience for gaming continues to solidify the central role of gaming in today’s entertainment landscape and the demographic expansion is reflected in the top five activities respondents most prefer in an immersive world.

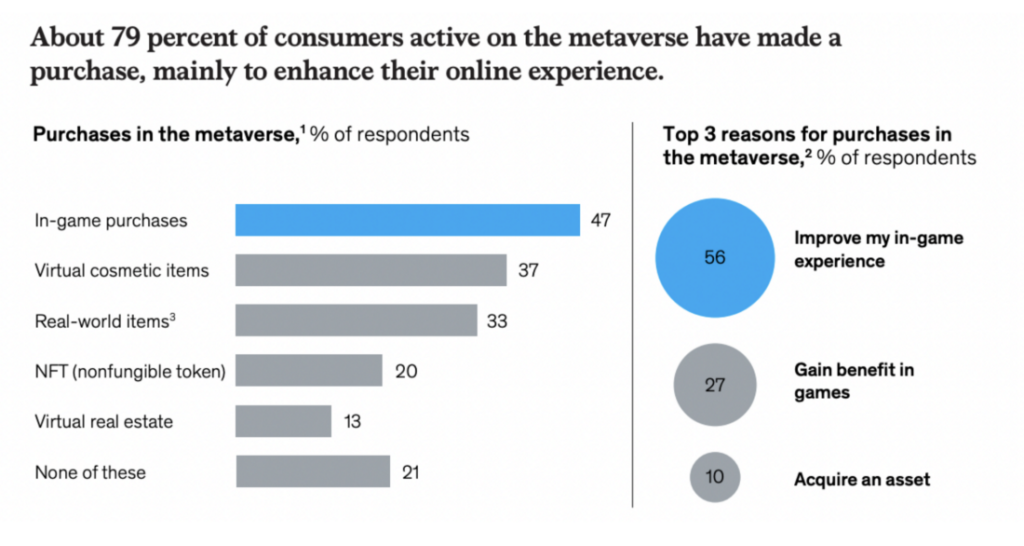

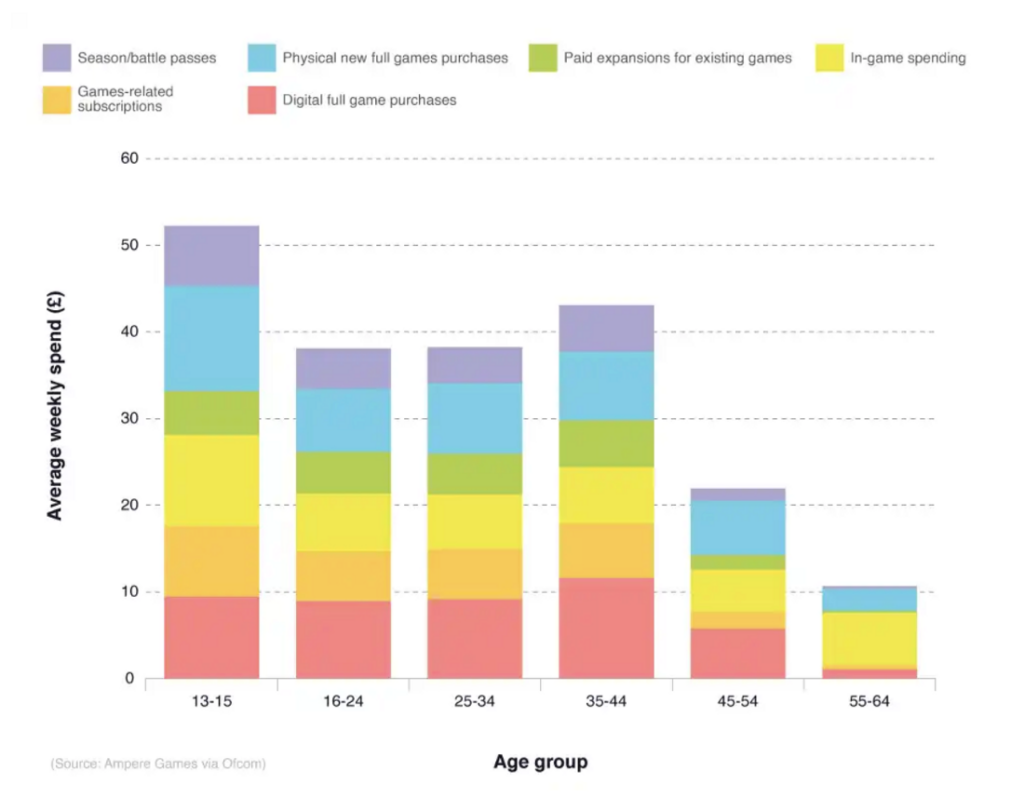

One large reason the metaverse’s value creation will expand is because of the amount of money consumers are willing to spend to enhance their virtual gaming experience.

For the three billion gamers in the world today, the virtual goods economy is estimated to comprise nearly 75% of global gaming revenues. In fact, of the surveyed individuals, about 79% of consumers active on the metaverse have also made a purchase with the main reason being to enhance their virtual experience.

It is also important to note that weekly spending for online gaming is highest among younger age groups, which tend to be the same age groups that play metaverse games the most.

Another reason is that excitement about the metaverse increases with income: 53% of consumers who identified as higher income were very excited compared with 32% of consumers with medium incomes and 25% among lower income earners.

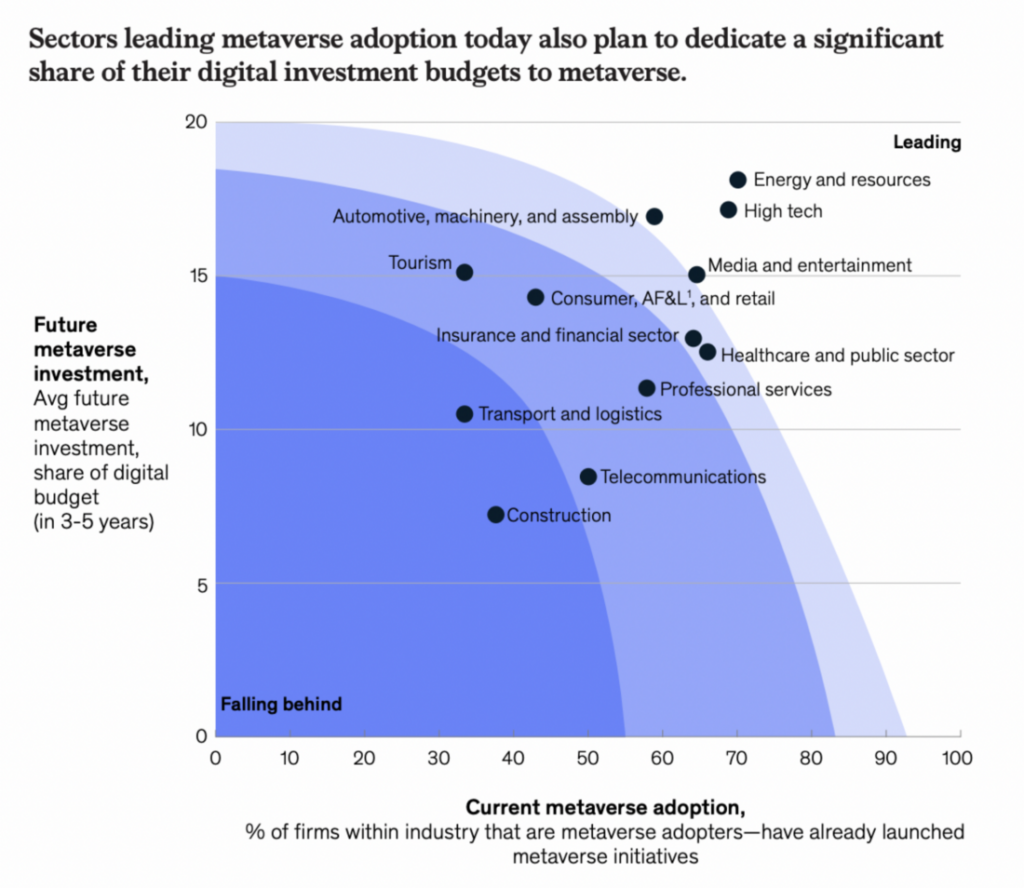

Lastly, McKinsey’s report highlights the largely positive outlook senior executives have on the metaverse, with 95% expecting the metaverse to have a positive impact on their industry in the coming 5–10 years, and 61% expecting it to change the way their industry operated.

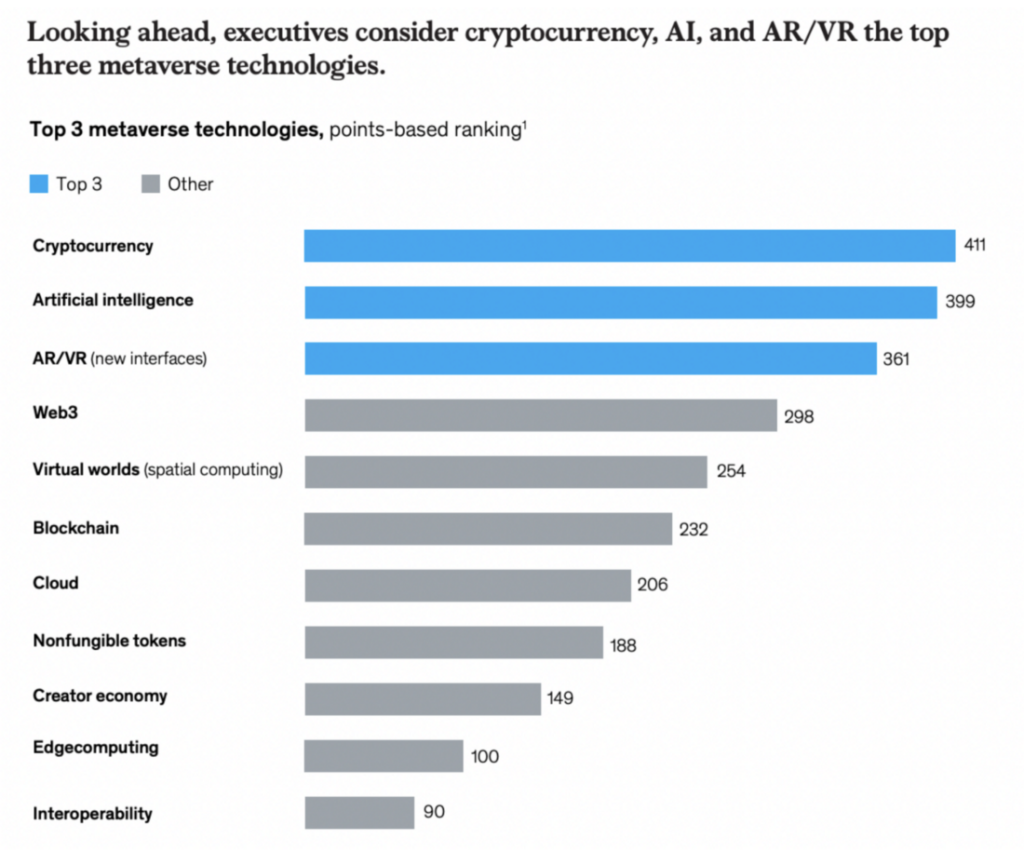

Surprisingly, the least-used metaverse initiative is allowing customers to pay with cryptocurrencies (22% of executives). Yet executives are most bullish about cryptocurrencies as a metaverse technology.

Web3 ranks as 4th among the perceived top technologies of the metaverse, while Nonfungible tokens (NFTs) ranks as 8th. If we assume that the total number of points-based rankings given by senior executives is equal to the total value creation chain, then it can be estimated that the NFT value creation in the metaverse could be between $280–350 Billion USD by 2030.

What Role Will Web3 and NFTs Play in the Metaverse?

The metaverse is an emerging field that has the potential to create a significant impact in various industries, including apparel, fashion, and luxury, consumer packaged goods, financial services, retail, and telecommunications, media, and technology.

It is likely to appeal to a wide range of demographics, with consumers already spending on digital assets, and companies investing heavily in metaverse infrastructure.

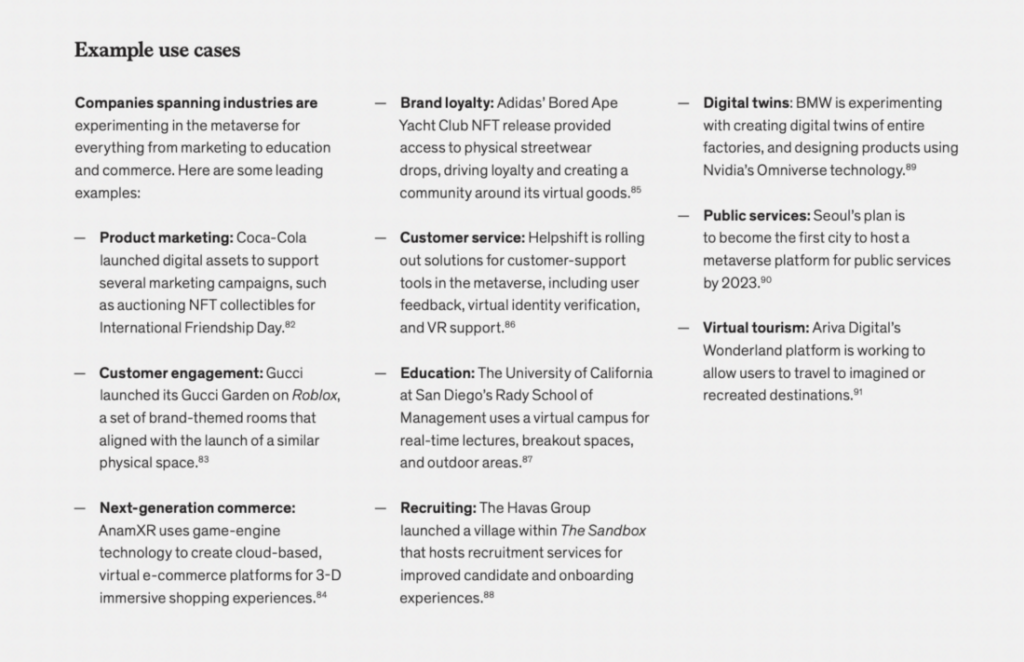

Of the opportunities brands have begun to explore in the metaverse, many use cases incorporate the use of NFTs.

For example, Coca-Cola used NFTs for product marketing by auctioning digital collectibles for International Friendship Day. Adidas used NFTs in order to increase brand loyalty, releasing a joint NFT with Bored Ape Yacht Club which provides its holders access to physical streetwear drops and creating a community around its virtual goods.

In fact, NFTs can create an impact across the value chain for sectors.

1/ Apparel, Fashion, and Luxury

The fashion industry is well positioned to shape the metaverse, as it is able to exist both in the virtual and physical world. For example, the gaming skins market reached $40 billion in 2020, and platform reinventions could make the metaverse the biggest growth opportunity for fashion since e-commerce.

Many brands are already embracing the opportunity to launch virtual clothing and tap into consumers’ appetite for creating digital identities, with many eying NFTs for these opportunities.

Decentraland’s Metaverse Fashion Week in March received a lot of industry attention, attracting a wide variety of brands, including Dolce & Gabbana, Estée Lauder, and Etro. The event was blockchain-based, created on “virtual land” and sold as NFTs, with digital fashion bought and worn as NFTs. This demonstrates that the industry is evolving and has a deeper understanding that digital can lead to enhanced client experiences.

Fashion brands are also engaging consumers with NFTs for more pragmatic purposes, such as digital twinning or loyalty benefits like early access to new NFT drops and physical products, essentially serving as a membership program. Brands such as Gucci, Adidas, and The Hundreds are using NFTs to offer loyalty perks, such as giving members early access to new NFT releases and physical products. This serves as a sort of membership program for consumers.

Additionally, NFTs can host information about a physical or digital product’s history, authenticity, and ownership, which is especially beneficial to luxury retailers battling counterfeiting.

2/ Consumer Packaged Goods

Consumer packaged goods (“CPG”) companies may face challenges in the metaverse, as their products are traditionally connected with practicality and usability in the physical world. However, consumers seem excited to see CPG brands entering virtual worlds, which indicates there’s an opportunity for companies to actively shape their destinies.

CPG brands could consider using their brand power to venture into new business-building opportunities in the metaverse, especially as the digital world becomes more dominant. They can explore digital assets and virtual experiences as promotional vehicles, but also consider building virtual offerings that create long-term value independent of physical products.

Hasbro’s Nerf launched virtual in-game items, Coca-Cola launched a digital jacket in Decentraland, and many companies have also launched NFTs to foster customer loyalty. CPG brands are increasingly active in virtual experiences, P&G beauty entered the metaverse with a virtual storytelling world and L’Oréal filed 17 patents related to NFTs and the metaverse.

CPG companies could consider collaborating with established tech providers and balance maximizing additional customer engagement from the metaverse while maintaining profitability and allocation of resources.

3/ Financial Services

Financial services companies are exploring the potential opportunities in the metaverse, which brings together online social networks, gaming, cryptocurrencies, and diverse digital assets.

Web3-enabled metaverse venues are becoming more popular among financial services as they offer more creative models of engagement compared to traditional Web 2.0 metaverse.

For example, HSBC has purchased virtual land in The Sandbox, London-based fintech Sokin is building infrastructure for processing metaverse payments and transactions, and several companies including TerraZero are providing back-end support for virtual real estate financing in the metaverse.

Companies are also starting to explore the use of NFTs as an innovative way to foster customer loyalty by extending unique privileges to NFT holders.

The possibilities for financial services in the metaverse include creating digital branches, building trust for digital payments and custody of NFTs and other digital assets, offering cyber-insurance, and financialization of everything in the metaverse context.

4/ Retail

The metaverse offers new opportunities for retailers to enhance their stores and engage customers by building experiences and fostering brand community.

Some companies are already experimenting with the idea of virtual and digitally enhanced retail, such as Farfetch’s Store of the Future, appliance company Dyson’s digital store, and furniture retailers partnering with Pinterest to use AR to show customers how furniture will look in their living rooms.

Additionally, metaverse malls are being created that feature storefronts where users can interact through avatars, an example is Samsung creating a virtual store in Decentraland, modeled after its physical store in New York City and incorporating elements such as quests to earn NFT badges. Other retailers including Ralph Lauren, Urban Outfitters, and Walmart have also registered trademarks for virtual world stores and land in the metaverse such as Decentraland, which is being sold for the development of an online shopping mall.

The metaverse has the potential to revolutionize the way we connect and interact with each other, as well as how we conduct commerce and other activities.

By 2030, it is expected that a large portion of live events, commerce, learning, and collaboration will take place in the metaverse.

The emergence of NFTs will further boost this revolution as it allows for virtual assets to be tokenized, traded and owned by users.

With the metaverse being estimated to become a $5 trillion USD market by 2030, it is important for businesses, policymakers, and consumers to understand and familiarize themselves with it, its technologies, and its implications.

If you’d like to understand more about the themes, trends, patterns and activity in the NFT space feel free to reach out to Origins on Twitter or Discord. We are more than willing to guide you through the chaos, using objective data driven insights.

Closing Remarks

TL;DR

Here are the summarized points made throughout this article:

- The metaverse has several foundational characteristics such as a sense of immersion, real-time interactivity, user agency, interoperability across platforms and devices, concurrency with thousands of people interacting simultaneously, and use cases spanning human activity.

- According to McKinsey & Company, the metaverse could create up to $5 trillion USD in value by 2030.

- The metaverse has seen significant investment and attention lately, with companies like Google, Meta, and Microsoft committing significant resources. Additionally, virtual real estate has gained attention as people are buying virtual lands on platforms like The Sandbox.

- McKinsey expects the fully developed metaverse will encompass most daily activities in 5 core categories: gaming, socializing, fitness, commerce, and remote learning. It is believed that the current technology paradigm is about to undergo a major reset.

- The Web3-enabled metaverse introduces a decentralized ecosystem for creators and users with new monetization opportunities and more control over data. It also offers access to digital assets like NFTs for virtual real estate, skins, and tools.

- The metaverse is projected to bring a change to everyday activities, with entertainment, gaming and shopping being the top areas of interest for consumers.

- A significant percentage of senior executives expect the metaverse to have a positive impact on their industry in the next 5–10 years. Though NFTs rank 8th among perceived top technologies in metaverse, the role they play is still uncertain.

- NFTs can have a significant impact across various industries in the metaverse by creating new opportunities for digital assets, virtual experiences, and customer engagement.

- Companies, such as Coca-Cola, Adidas, and Gucci, have already begun to experiment with NFTs for product marketing and customer loyalty. The fashion industry, consumer packaged goods, financial services, and retail are among the sectors that can potentially benefit from using NFTs in the metaverse.