We hate them and we love them. Meme cryptocurrencies are an inseparable part of the crypto sphere. In this guide, I will tell you everything you need to know about meme coins and how to find and analyze them.

What are Meme Coins?

Meme coins are coins or tokens inspired by memes. Memes are often funny images, videos, and pieces of text that are copied and spread rapidly on the internet. Typically, meme cryptos have the following characteristics:

- They are not created for a specific use case, or to solve a specific problem.

- They have a very large or unlimited supply.

- In most cases, they are extremely cheap. One coin only costs a tiny fraction of a cent, so that people can own a large amount with little money paid.

- They are to be traded or shared among many people so they can go viral.

- Their prices are extremely volatile.

- They carry very high investment risk.

The most well-known meme coins are Dogecoin and Shiba Inu, ranking at 9th and 15th respectively by market cap. Both were inspired by the Doge meme.

There are several thousand meme cryptocurrencies with many not being tracked or verified. This doesn’t mean that they are illegal but simply that they are not considered to be serious (enough) projects.

Are Meme Coins Good Investments?

Meme coins have a high risk because they are usually very volatile and have no use case. If you want to include them in your investment portfolio, then they should only be a small part of it.

Are they worth the risk? Hard to say. Can meme coins make you rich? It depends. In a bull market, they often outperform the market. On the other hand, there is a high chance that they will become a total failure. It’s up to you to decide if you want to take that risk.

How To Find Meme Coins

Coinmarketcap and Coingecko have pages that list out meme coins.

- https://coinmarketcap.com/view/memes/

- https://www.coingecko.com/en/categories/meme-token

- CoinBrain is also a great place to discover new tokens. Their filter function allows you to sort coins by their age, chain, name, etc.

Who Let all the Doges out?

According to CoinBrain, there are about 80 verifiable meme coins (tokens created on an L1 chain) containing the name “doge”. 160 verifiable coins contain the name “Inu”.

This already shows one of the basic problems if you want to research meme coins — how do you even find the right one?

In the following, I will show you what to look out for when analyzing meme coins.

How To Research & Analyze Meme Coins

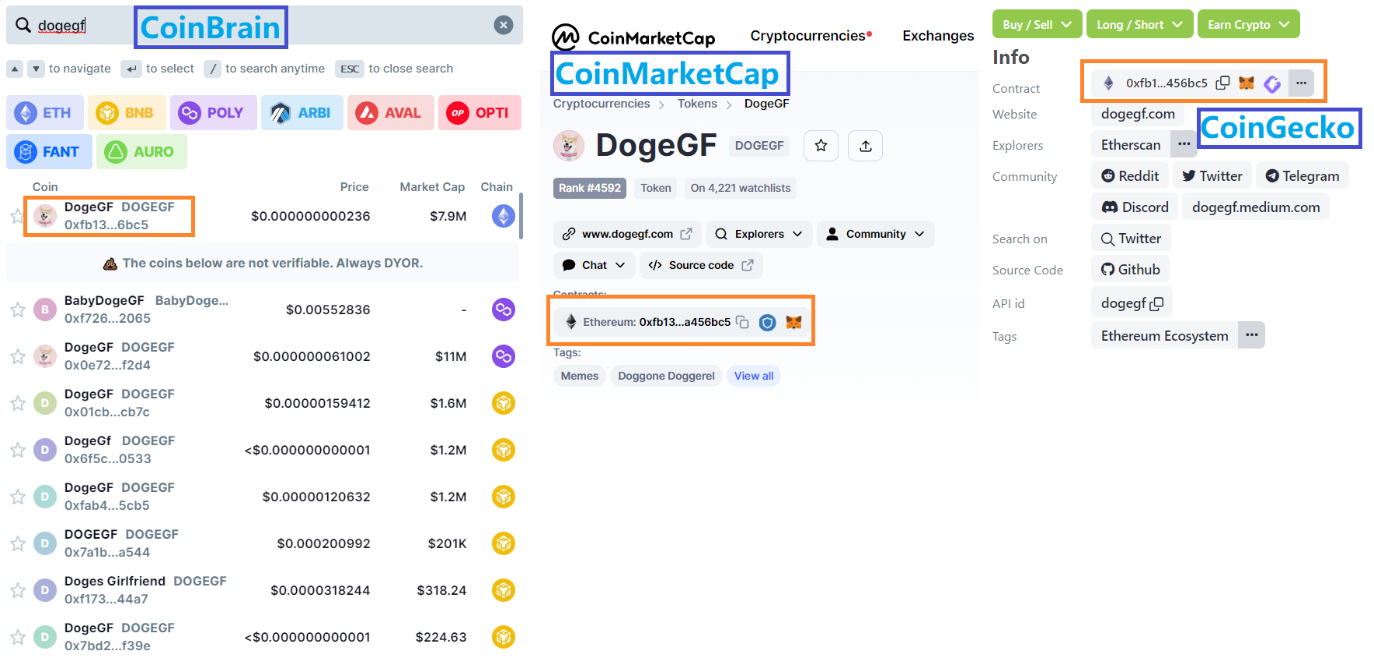

There are numerous meme coins that have the same names. It is important to make sure that you identify the right ones. To do this, you should cross-check the coin’s contract address on different platforms. Here is an example:

Basic Vetting Process to Check If A Meme Coin Is a Scam

Since many meme cryptos are not serious projects, there is a high risk that they are scams.

The following basic steps allow you to quickly check if a meme coin is a scam — although you will never be able to tell with 100% certainty.

- Go to the official website of the token or coin to see if it is well made. Check for red flags such as poor grammar or fake content.

- Google the recent and past news about the coin. Anything noteworthy?

- Since Meme coins generally do not have a real use case, it is OK if they do not have a whitepaper.

- But try to find out how the token is distributed. Do the developers hold a large portion? Did the creator burn a large portion?

After that, you should subject the cryptocurrency to a deeper analysis. The following points are essential.

Security

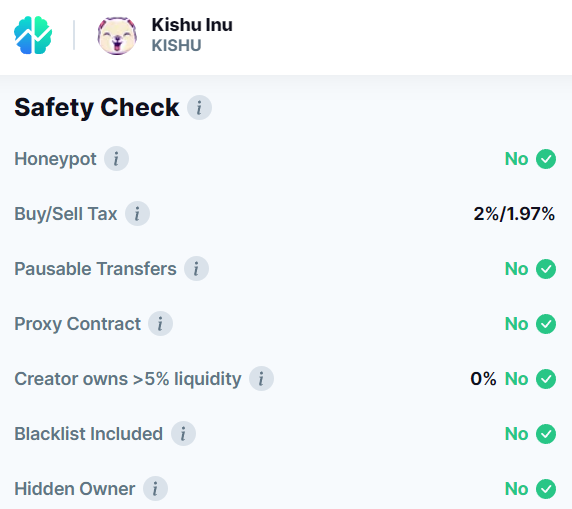

Check how secure the code of a meme coin is. Here are two websites that rate the security of crypto projects.

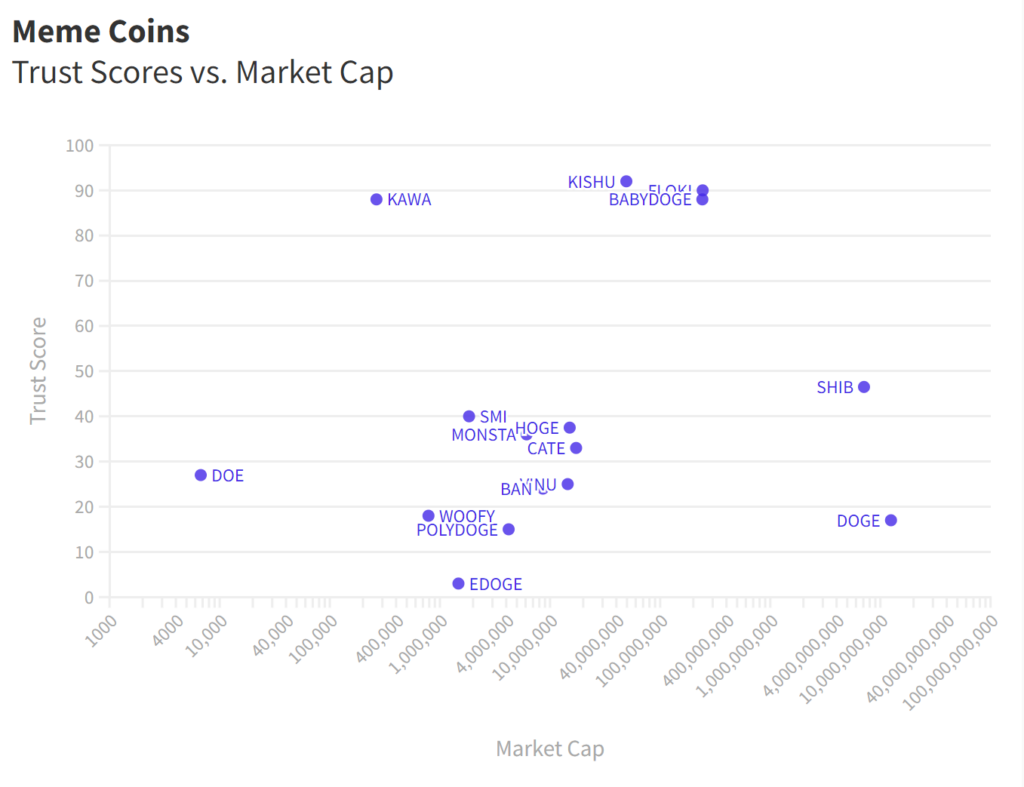

I collected the data of the top 50 meme coins ranked by market cap. Only 17 out of them have a security score from at least one of the above websites. Out of these 17, only two are rated at 90% or more. The following chart illustrates this.

CoinBrain cooperates with Go + Labs to scan the smart contacts of cryptocurrencies. Use this feature to complete your security analysis and to see if all sources have consistent results.

Degree of centralization

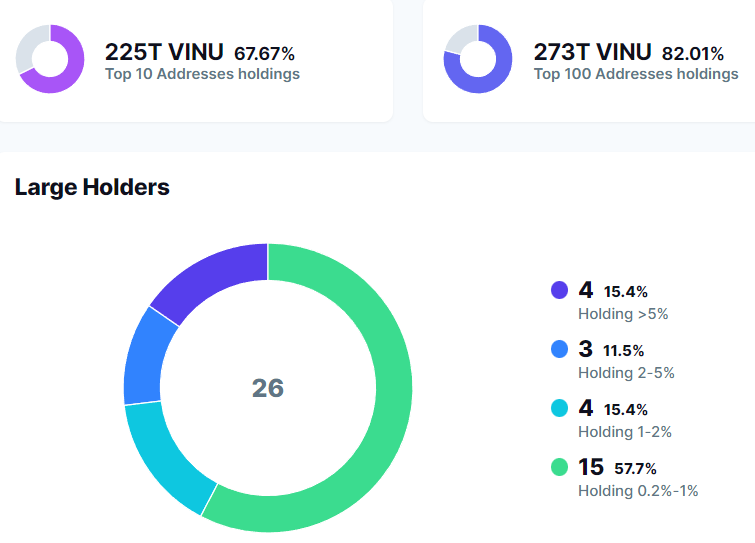

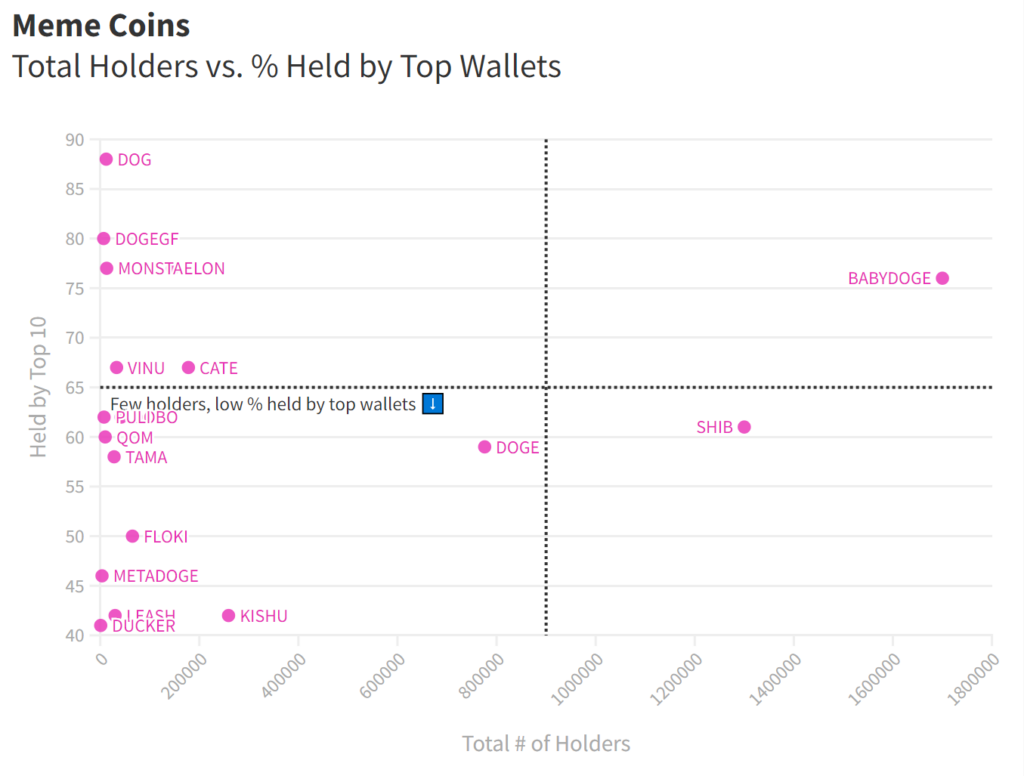

Because meme cryptos are mainly used for trading, it is important to know how centralized they are to get an understanding how easily their price is manipulated by whales. One way is to check the total number of holders and the percentage of the coins held by the top 10 addresses. If a large amount of the addresses are held by a few addresses, then the coin price can be very volatile by pumping or dumping activities.

Go to CoinBrain to find this information.

Here is a chart I made to visualize the distribution of holders for some of the largest meme cryptocurrencies.

You’d want to find your coin in the two lower quadrants.

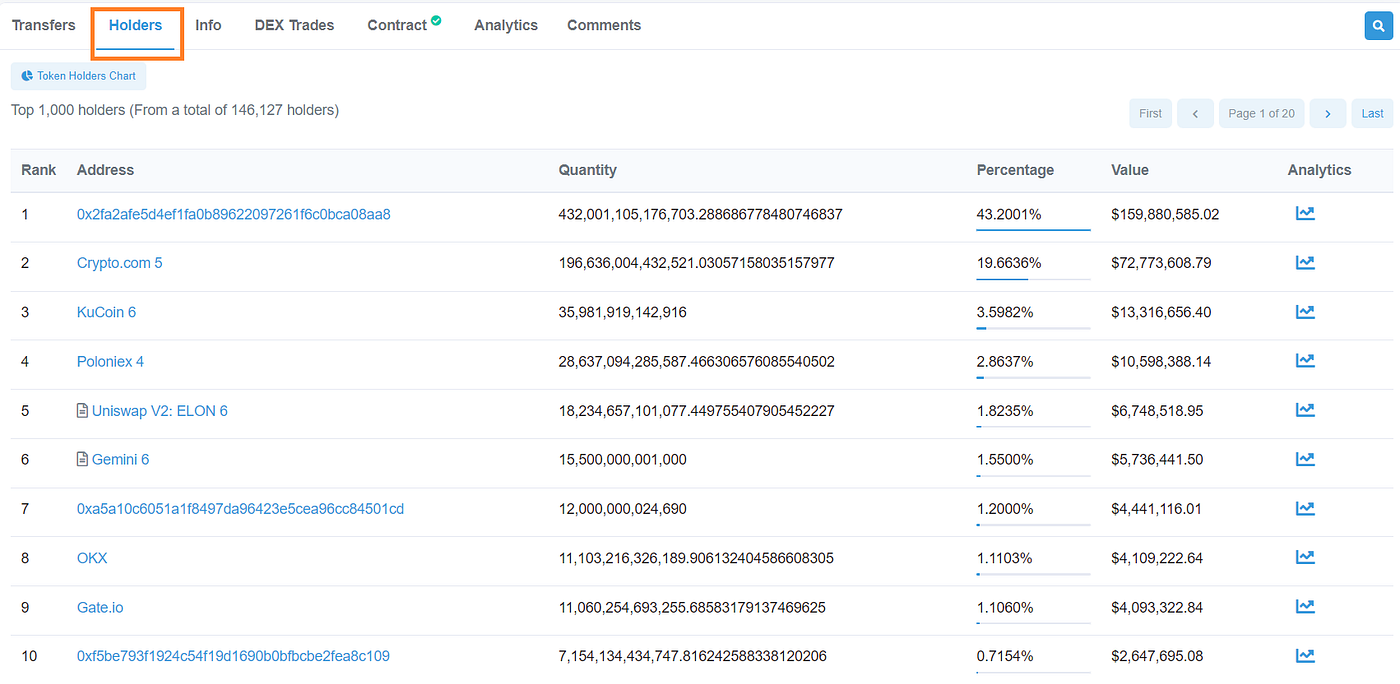

It is also useful to look into the details and explore who the holders of a coin are. Let’s take Dogelon Mars as an example, which is a token on the Polygon, BSC, and Ethereum blockchains.

After checking the top 10 holders information on CoinBrain, it looks like the token distribution is mostly concentrated on the Ethereum blockchain, where the top 10 addresses hold almost 77% of the token. Let’s copy the contract address and head over to Etherscan to see what else we can find out.

Click on the token name in the “Token Tracker” section. You will get to a page that contains more information about the token. Scroll down, and click “Holders”. You will see that actually 7 out of the top 10 addresses are labelled exchange addresses.

Liquidity

Another thing you should take into account when researching meme coins is liquidity. Check the 24-hour trading volume as well as from which exchanges the most volume is coming.

A large volume shows that a lot of people are interested in a coin. This means it will be easier to buy and sell it. The worst would be to end up with a pumping coin but not enough people you can sell it to.

Community

Go to the coin’s social media channels to see what the community is discussing and how active they are.

CoinBrain provides a good overview as they track Twitter followers, Telegram members, Discord members, subreddit subscribers, etc. In general, an increase of followers is a good sign as it means that the project is still active and interest is growing.

An active community is also a great source to gather more information in case you have questions or weren’t able to cover all the points I listed up above.

Stats of Top 50 Meme Coins by Market Cap

Let’s wrap this guide up with an analysis/summary of the top 50 meme coins by market cap.

The data I used comes from Coingecko, CoinBrain, CERTIK, and cer.live.

- Most of the current top 50 meme tokens were created in 2021 to ride the bull cycle. What followed was the classic pump-and-dump scheme.

- Currently, most of the tokens are ranked very far behind in terms of market cap.

- Many tokens are held in large proportions by the top 10 wallets. However, as we have seen in the example above, some of the top 10 addresses could belong to exchanges.

- Nonetheless, meme coins have the potential to generate very big returns. Currently, the median ROI of the top 50 meme coins is 409% — and that is when you have bought at all-time low and sold end of Jan 2023. However, as always with crypto, the right timing is crucial to actually generate such high profits.

Disclaimer: This article is intended for information and education purposes only. It should NOT be used as financial and investment advice. All the example tokens used in the article are randomly picked. I do not hold any of the tokens mentioned and I am not affiliated with any of them.