MEV solutions will require standalone networks specialized in order sequencing and block building

by Chris Powers

As financial activity accelerated on Ethereum over the last few years, so too did profit opportunities for those that secure the network. An MEV arms race was underway when we explored the topic last July, but then intensified following Ethereum’s transition to proof-of-stake in September. This rejiggered the market structure and redefined it from miner-extractable value to maximum-extractable value (MEV) for Ethereum validators.

Flashbots, the central player in the MEV saga, has since continued to see runaway success; nearly 90% of Ethereum validators are now running its MEV-boost client. This means they receive extra payments (outside of the protocol rewards) for reordering or adding transactions into blocks they propose. This, however, presents two issues: 1. It centralizes block production and 2. It requires complete trust in Flashbots to enforce the economic rules.

Flashbots take the whole decentralization thing seriously, so they are now on a mission to decentralize and minimize MEV. This has manifested in the unveiling of their master plan, SUAVE: a new blockchain to manage the MEV market on Ethereum (and any blockchain).

This vision is ambitious. But most strikingly, it assumes that MEV is an intractable problem that is baked into the market structure and can only be minimized and redistributed.

On the other side is a growing chorus that rejects the normalization of MEV. This crowd says Flashbots has surrendered any chance to drastically reduce MEV. The leading project in this camp is CoW Protocol, which uses batch auctions and a separate solver network to protect users from MEV extraction.

Lately, some have taken to calling MEV the “Millenium Prize of Crypto”. We agree; back in May 2021, we called MEV the “largest threat to Ethereum’s decentralization”. And now with a new crop of projects, it’s becoming increasingly clear that the optimal solution to the MEV crisis – be it CoW, SUAVE, or something else – will be a standalone, decentralized network focused entirely on sequencing transactions.

Flashbots: A fallen hero?

At the beginning, Flashbots was seen as the hero of the MEV story. Prior to Flashbots, the Ethereum network was clogged with secret bots competing over profit opportunities for arbitrage, liquidations, and to front-run user orders. To ensure a profitable transaction was included in a block, these bots (now called searchers) would put higher and higher gas prices in so-called Priority-Gas Auctions (PGAs) that raised gas prices for all Ethereum users. Flashbots created a forked version of Geth (MEV-Geth) for miners to run that allowed miners to auction off blockspace to searchers – outside of the protocol – so they could include profitable transactions. Moving this off-chain created huge cost savings for all Ethereum users.

In the 20-plus months since MEV-Geth launched, Flashbots’ image has changed dramatically. No longer a scrappy warrior charging through the Dark Forest, it’s now seen as a centralizing force that has arguably enabled censorship on Ethereum. While Flashbots previously focused on shipping immediate solutions (warts and all), SUAVE is an attempt to build a comprehensive, decentralized solution to the MEV crisis once and for all.

SUAVE’s heritage

SUAVE is a new blockchain designed to be “the mempool and block builder for all blockchains”. Instead of connecting MEV activity through the Flashbots network, an entirely new EVM compatible blockchain will serve as the economic foundation for this marketplace.

With the shift to PoS and MEV-boost, the Flashbots network expanded. So while it still connects searchers with validators (in lieu of miners) through relayers, a new role (block builder), was needed. This group specializes in constructing Ethereum execution payloads and optimal transaction ordering (or sequencing). It’s this role that SUAVE aims to decentralize.

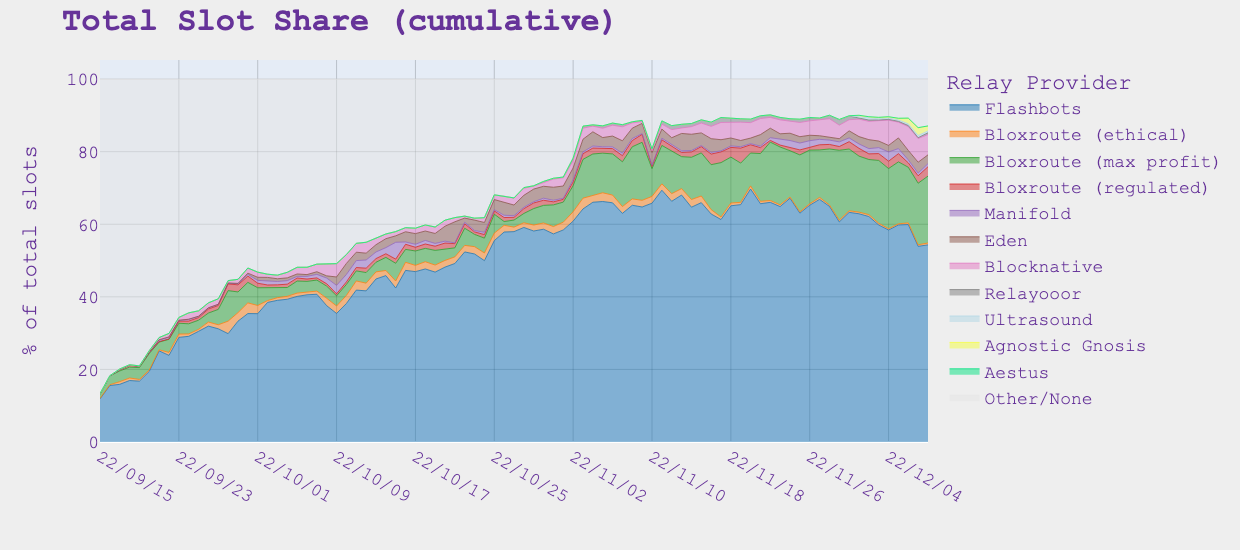

After the launch of MEV-boost in September, the Flashbots team rose to become the number-one relayer and block builder. Soon, it was relaying and bundling more than 50% of Ethereum blocks.

The Flashbots collective quickly moved to open-source its MEV-boost relay software and then later its MEV-boost builder package in an effort to aid the competition and stave off its own monopolistic rise. That has worked to some degree (see recent decline in chart above), yet block building is a naturaling centralizing activity. If not Flashbots, some other entity would rise to build the majority of Ethereum’s blocks and create censorship and rent-seeking opportunities.

The Ethereum perspective: Proposer-Builder Separation (PBS)

Of course, the Ethereum research community has not been neglecting the threat of MEV. The Ethereum network’s security model is threatened anytime actions in the protocol are determined by outside economic activity. MEV extraction is a sophisticated and computational-heavy activity, so even though it has high rewards, it’s not an effective reward mechanism for the Ethereum protocol, as it raises barriers to entry for validators. In PoS, the block proposer is in the privileged position to extract MEV, but it must be sophisticated to do so, which translates to an innate centralization of the validator set.

To combat this, Vitalik proposed a design framework called Proposer-Builder Separation (PBS), where instead of a block proposer generating a “revenue-maximizing” block by itself, it outsources to a market of outside actors (builders). MEV-boost is a “proto PBS” or PBS that exists outside of the protocol. It relies on the goodwill of Flashbots. If a more menacing actor was playing the Flashbots role, Ethereum would be in serious trouble.

It will take a long time and more engineering and research to enshrine PBS into the Ethereum protocol. Projects like Eigenlayer, which is a programmable slashing layer for staked ETH, could be helpful in aligning incentives. Regardless, what’s clear is that the process of block building (or transaction ordering) will not be done on Ethereum.

A new market structure

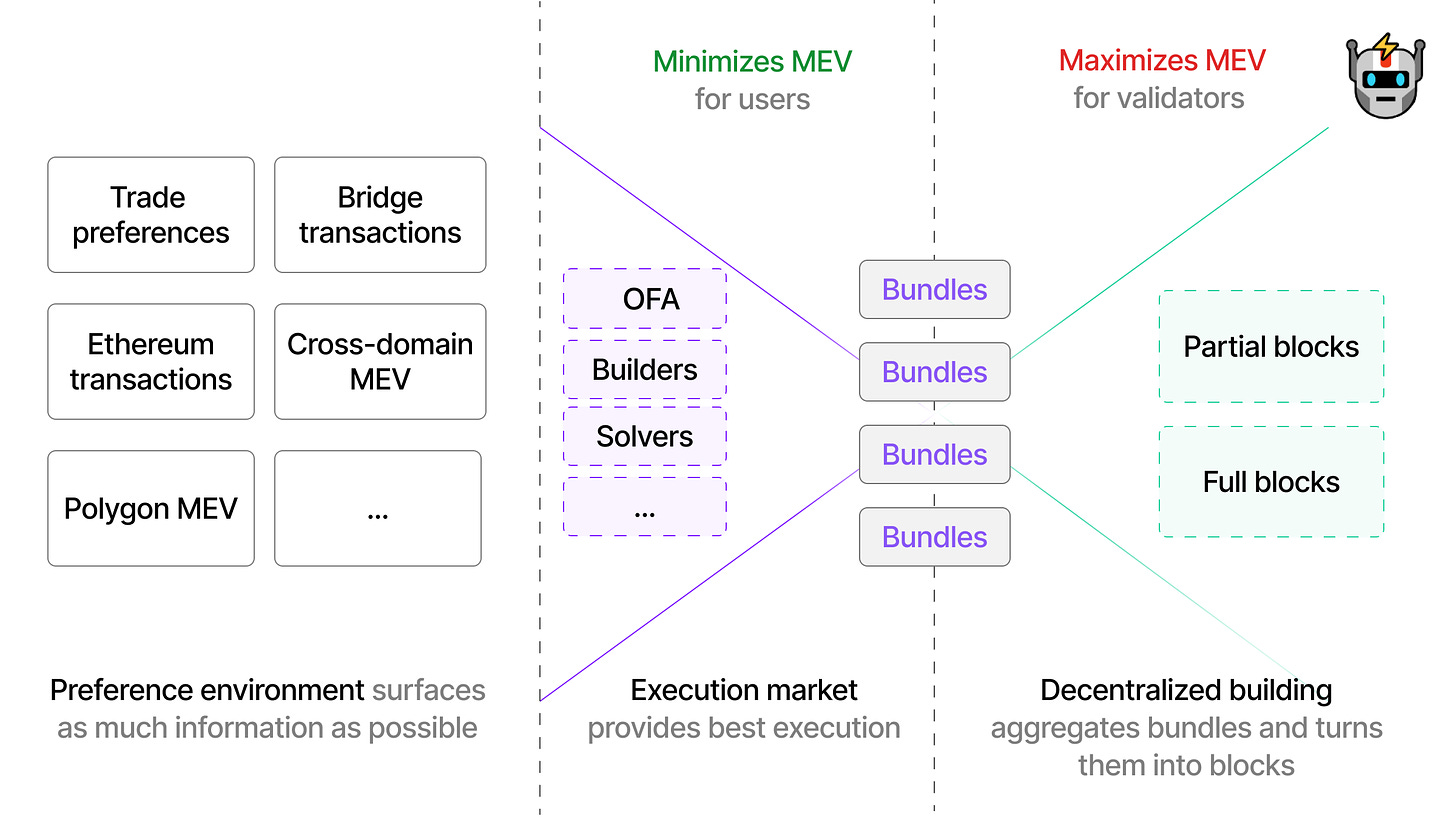

Instead of Ethereum, Flashbots hopes that block building will occur through SUAVE, and not just for Ethereum, but for every blockchain. There are three core components of SUAVE:

- Universal preference environment

- Optimal execution market

- Decentralized block building.

These are separate components that work together to achieve an optimal outcome for all parties.

Once again, Flashbots are expanding the cast of characters in the MEV ecosystem. They are finally incorporating regular users through the universal preference environment. This, coupled with the execution market, ensures that users can effectively have their extracted-MEV returned to them.

Is MEV inevitable?

SUAVE is Flashbots’ endgame . If successful, it would complete its vision of “frontrunning the MEV crisis” with MEV extraction being democratized. Yet there are still many who reject the assumption of MEV. Must users surrender to being front-run as a price of using public blockchains?

CoW Protocol says no. Its key philosophy: there should only be a single price per token per block. Instead of reordering transactions for the most profitable bundle, all trades are cleared at the same price through a batch auction every 30-90 seconds. In CoW, users sign and submit orders to a network of solvers. These solvers first try to match up traders P2P, which is completely MEV independent and then fill the rest of the orders with on-chain liquidity pools.

Batch auctions are a radical departure from how trading works today. In both TradFi and DeFi, there is a race to trade on market-moving information. An estimated 60-80% of all DEX activity is MEV bots rushing to arbitrage DEXs after new price movements on centralized exchanges. Large market makers want to get their order filled first (in TradFi) or have their order placement optimized (in DeFi). With batch auctions, there is no race because all trades clear at the same price. Solvers, meanwhile, receive a fee for producing a solution with the biggest surplus for all users (rather than itself).

There are some potential drawbacks. For starters, it’s very resource intensive – computation and capital – to run a solver, and it’s not clear whether there would be enough privacy protections to ensure solvers are not frontrunning user orders themselves.

SUAVE comes full circle

Perhaps surprisingly to some, there are a lot of similarities between CoW Protocol and what Flashbots are proposing with SUAVE. CoW is focused on “trading intent expression” while SUAVE intends to capture “generalized intent expression”. This is a fancy way of saying, “What do you want to buy or sell and for how much?” The protocol will then auction off this intent to either solvers (CoW) or builders (SUAVE). The key difference is that SUAVE is designed to extract most of its value from transaction ordering, whereas with CoW, trade order doesn’t matter because all tokens have the same price within a block. The other key difference is that SUAVE is intended as a single place to submit orders for multiple blockchains, though CoW may also move in this direction.

If you squint, SUAVE also touches on similar themes to Chainlink’s Fair Sequencing Service (FSS). FSS was designed for L2 sequencers, and not for block building, but both SUAVE and FSS are trying to build a decentralized network for activity that benefits enormously from scale. The other big difference, of course, is that block builders in SUAVE are trying to maximize MEV, whereas Chainlink node operators are trying to achieve the right order based on order submission times.

Regardless, this marks a new chapter in the MEV saga, where the arms race for profit and decentralization moves outside of Ethereum. That doesn’t mean the underlying issues are solved. Only that the potential solutions (SUAVE, CoW, etc) will be a specialized, independent network that balances decentralization and the need for a profit motive.