Liquid NFTs are an intriguing opportunity. The winners will be massive, beyond our imagination.

Before we get into my 2023 outlook, I wanted to quickly outline what went on in December, a traditionally quiet month for markets and businesses. Many people go out on vacation, and new product launches are delayed till the new year. It’s an excellent time to go outside and touch grass. Yet, activity in the NFT space didn’t stop.

Yuga Labs took the spotlight with the launch of their new story arc, the Trial of Jimmy the Monkey. It’s a weird one that involves a monkey with explosive diarrhea, a portal, and interdimensional travel. I love how the mystery is revealed piece by piece, drawing the audience further into the story. ApeCoin DAO also successfully held its 1st election to replace 3 Special Council members, which was highly dramatic.

We haven’t reached the quiet and boring phase of the bear market yet, which was the primary characteristic of the 2018 – 2019 period. Will we ever get there? “This time it’s different” are famous last words, but I’m going out on a limb to say that I’m doubtful we’ll ever get there.✓

My Outlook for 2023

What can we expect from 2023? I’ve wiped the dust off my crystal ball and taken a peek. I’m a fan of Howard Marks (Oaktree Capital) and how he views market cycles.

Howard emphasizes that cycle positioning and asset selection are important, and it is the investor with skill in both of these areas that will achieve asymmetrical returns on both the upside and downside. Aggressiveness, timing & skill are key ingredients for success.

With this framework in mind, let’s look at each of these.

1. Cycle positioning

We are about 14 months into the current bear market. By all metrics, we are not just at the beginning, but deep into the down phase of the cycle.

- Economy? Sluggish

- Corporate Earnings Outlook? Negative

- Capital markets? Tight

- Interest rates? High

- Markets? Starved for attention

- Investors? Risk-averse and generally pessimistic (“prepare for a harsh winter”)

- Blowups? Yes, Lenders, hedge funds, and exchanges.

Valuations of legitimate projects have fallen significantly from their peaks and seem somewhat reasonable today. As a yardstick: ETH is at $1,260 today (at the time of writing) with a market cap of $153B. This is 75% down from its all-time high and back to the same price as exactly 5 years ago (January 2018). This is despite all of the major progress, innovation, and VC funding in the space.

In times like these, I lean more towards being aggressive rather than conservative. The fear of missing opportunities should begin to overpower the fear of losing money. This can be highly counterintuitive after the painful year we had in 2022. The battle here is to overcome our innate human instincts.

I’ll throw in a few caveats:

- Being deep down in a bear market doesn’t mean that a new bull run is imminent. Prices can remain depressed for a long time even if they don’t fall much further. It’s important to adjust timeframes and ensure we can make it through to the next cycle.

- Patience, not apathy, is the right attitude to adopt in these times.

2. Asset Selection

In low liquidity conditions, asset selection becomes critical. There isn’t enough money sloshing around for an entire sector to pump in tandem like in bull markets. Rather, some winners will far outperform everything else.

This makes for a curious environment:

- There is greater alpha in accumulating a keenly-eyed selection of assets rather than making index-type plays

- There will be many chances to accumulate things that fall below your fair estimate of their intrinsic value

There are opportunities in every single sector out there. For example, my friends deep into blockchain infrastructure favour Cosmos & Thorchain. I spend most of my time looking where I believe I have some expertise — NFTs.

From a big-picture perspective, these are a few of the big themes I believe will play out in NFTs from 2023:

- Prediction #1: We will see a Cambrian explosion for NFT finance (lending, derivatives, pricing tools, etc)

- Prediction #2: The great unbundling of NFT marketplaces will happen

- Prediction #3: Strong tailwinds for mainstream NFT adoption via Big Tech and large brands

- Prediction #4: NFTs will be the new social tokens, with a huge wave of creators, celebrities, and sports brands launching NFTs

- Prediction #5: “Phyigital” will take off, bringing the physical and digital worlds together

I wrote about these themes in depth in our NFT Year Ahead report at Delphi, which you can read here.

In my humble opinion, this is one of the best things you can read to prepare yourself for the year ahead in crypto. It covers everything: NFTs, Gaming, DeFi, Infrastructure & Markets.

— Teng Yan 🥕 (@0xPrismatic) January 6, 2023

The full report is open for everyone to read 😍 https://t.co/jQCiRaO8Xl

Liquid NFTs Are An Intruiging Opportunity

Liquid NFTs are interesting. It’s a new sector that has arisen in the past two years.

There’s very little historical data to guide us, unlike fungible tokens. No one knows how to value NFTs with certainty — it’s very telling when you constantly see brilliant people saying that NFTs are overpriced or have no fundamental value. The truth is that no one knows what will happen next in the non-fungible markets.

It is precisely why I believe there is an unprecedented opportunity here (vs. more sophisticated markets) — for those who thrive in uncertainty and have good taste in culture.

In my opinion, the common adage that “99% of NFTs will trend toward zero” holds. They will either:

- run out of funds,

- remain a tiny, niche hobby community forever, OR

- founders eventually give up when they’re unable to gain sufficient traction and move on to the next exciting thing.

But the 1% of NFT teams that are able to survive and grow — these are going to be massive, way beyond our imagination. That’s my high-level thesis and what I will be keeping my eye on.

To illustrate this, I will outline a couple of liquid NFTs that I consider relatively compelling risk-reward opportunities. This is not meant to be a comprehensive list of NFTs I find interesting, nor an in-depth review of them — please always do your own research.

Disclaimer: I want to emphasize that none of this is investment advice, and it is not an inducement to buy or sell any assets. This post represents my purely personal views and not of Delphi Digital. I am penning them down so that I can look back and review my thinking in the future. I personally own several of the NFTs that are mentioned below.

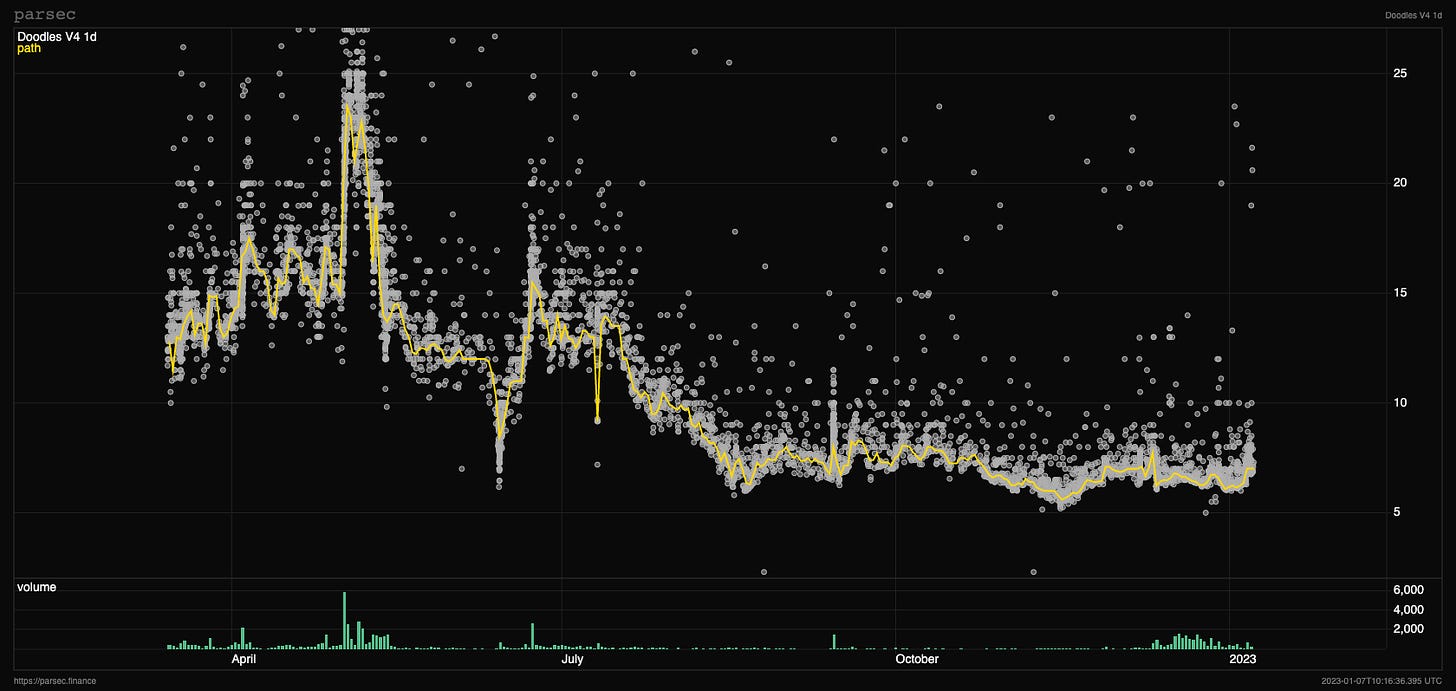

Doodles (7 ETH Floor Price)

Short Thesis: A tiny handful of Web3-native, community-focused PFP projects will emerge as strong brand/IP players in the coming years, rivaling that of large existing brands. Doodles could be one of them.

- Solid team with a good mix of Web3 + Web2 + industry-specific experience: Ex-Billboard president as CEO, Pharrell Williams as Chief Brand Officer, and a doxxed crypto-native team who were involved in developing CryptoKitties, the OG NFT project.

- There’s a semblance of a plan to become a large media company and create its mainstream cultural moment — an inflection point for NFT projects clearly outlined by Mason Nystrom in his post on how media franchises and brands monetize culture. I’ve also previously talked about how PFPs need to build sustainable business models.

- Doodles are better funded than most teams and can survive a prolonged bear market. They were in the right place, right time, raising $54M in venture funding + 7700+ ETH from royalties (>$10M) during the bull market. I place a lot of weight on funding because many people severely underestimate how much money and time is needed to get to the end game for PFPs.

- Upcoming catalysts: Doodles 2 will happen in 2023, starting with the “opening” of Dooplicators later in Jan and Genesis Boxes in Feb. This will draw attention. A lot of people have been bearish on Doodles 2 with the delay and fear of diluting holders. My counter-perspective is that they are taking time to ensure they launch a solid product since timing is less important in a slower market, and dilution fears are overrated.

- On a relative basis, Doodles appear under-appreciated compared to other top PFPs. Floor prices haven’t changed much since August. Among the big 5 PFPs (BAYC, Azuki, Moonbirds, Doodles, Clone X), it is the lowest priced after accounting for supply. One reason is there has not been much news for Doodles in the past six months except for a few IRL activation events.

- I do think all the top PFPs have a fighting chance for mainstream brand success and are going about it in their own way. At current prices, I like the risk-reward profile of Doodles compared to BAYC, which is already 11x more expensive. There appears to be a floor of around 6 ETH where new buyers will step in, while the upside potential will be significant if the team executes well.

- The biggest near-term risk is that Doodles 2 turns out to be a flop — I will re-evaluate my views if so.

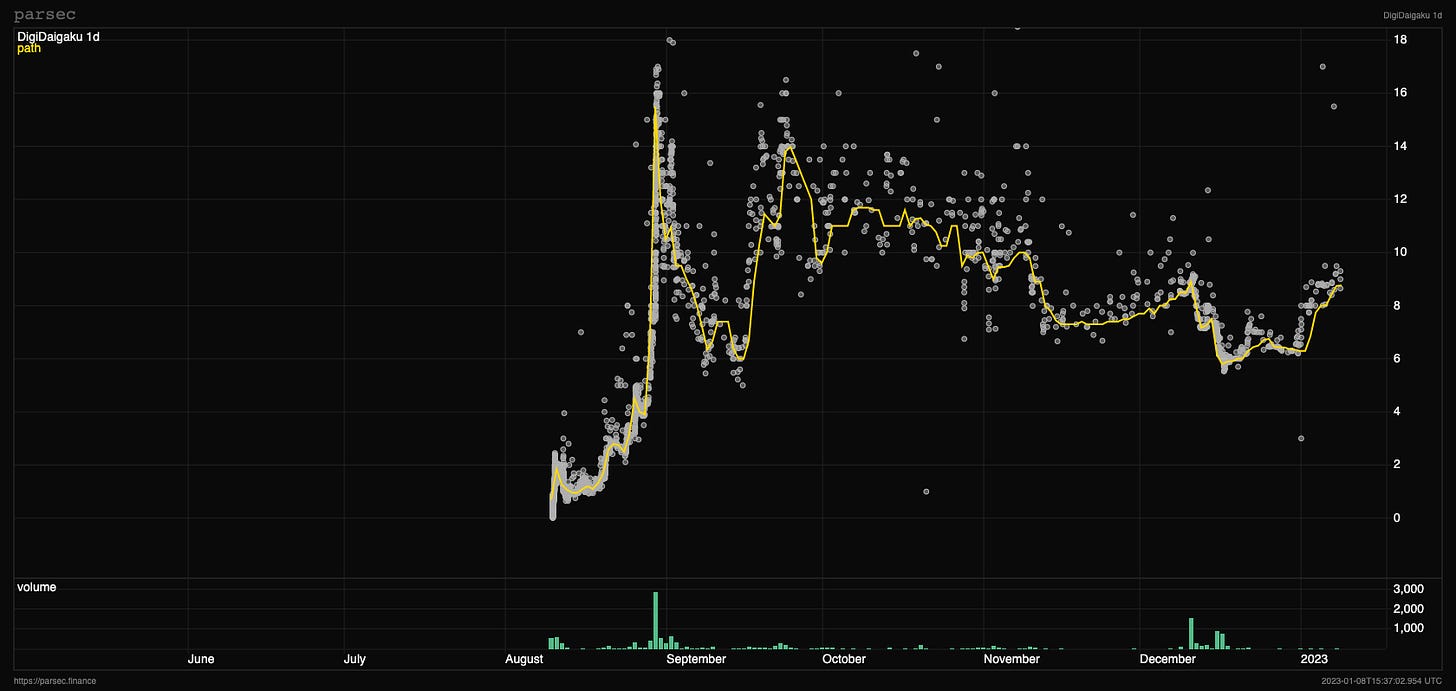

DigiDaigaku (7 – 9 ETH Floor Price)

Short Thesis: DigiDaigaku could be the Web3 version of Genshin Impact, a Gacha-based mobile game with >$3 billion in revenue

- Note: When I was writing this, DigiDaigaku was at 7 ETH. In the past few days, it has gone on a run to 12 ETH.

- Well-funded: Limit Break, the parent company, raised $200M (at a $1.9B valuation) mid-last year from top-tier investors, including Paradigm. This is a huge war chest that’s enough to fund the game development + heavy marketing.

- Founders have deep experience in building, marketing, and monetizing multiplayer games with huge user bases. In their previous company, Machine Zone, they developed one of the first MMORTS games (Game of War) that has grossed $2.8 billion in player spending.

- The “Factory NFT” model means that DigiDaigaku genesis NFTs will continue to receive airdrops that function as playable assets within games by Limit Break & its partners.

- Upcoming catalyst: Limit Break will be spending $6 million+ on Super Bowl ads (Feb 12) where they will drop a limited free mint of Dragon NFTs. They expect it to be the most anticipated free mint in history and be viewed by >50 million viewers. Suffice it to say there will be a lot of attention on DigiDaigaku in February

- The game is still in development with no official launch date. Games follow the blockbuster model, and it’s hard to predict which ones will be a hit. The biggest risk is a poorly-received game with few players.

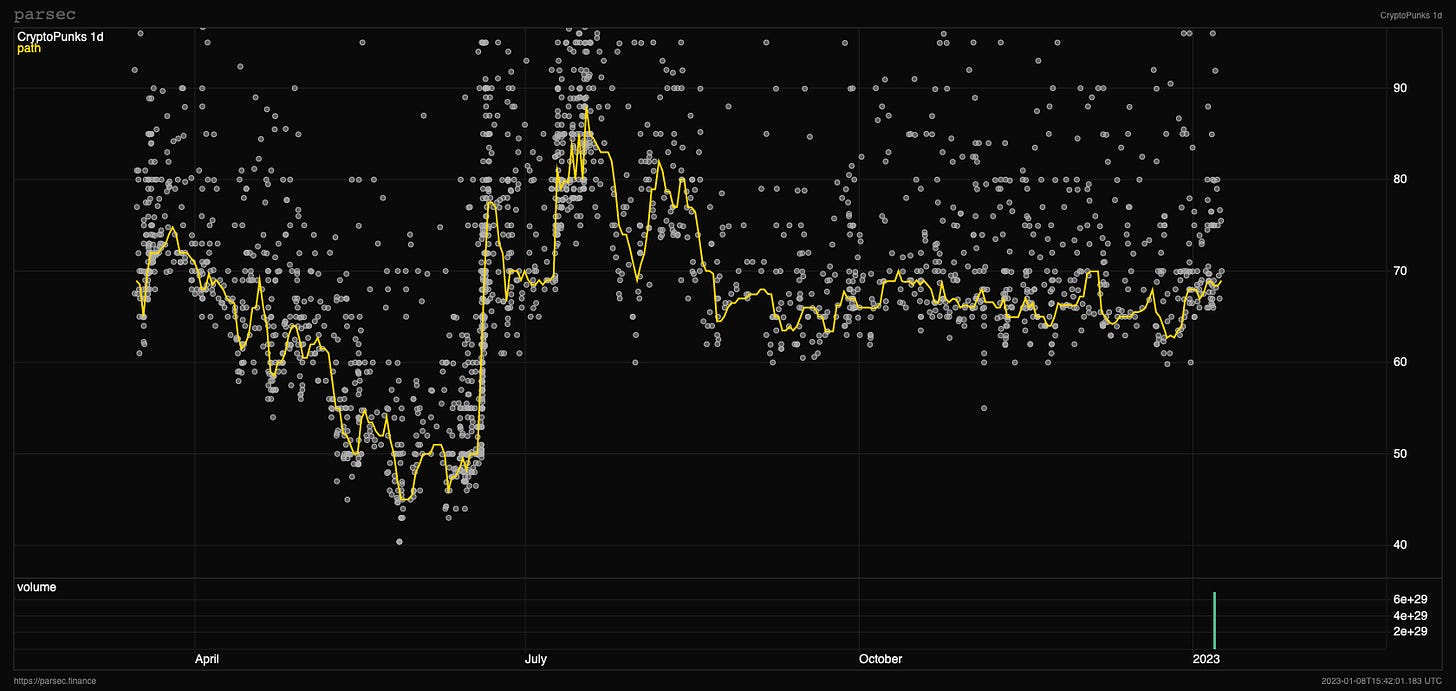

CryptoPunks (65 ETH Floor Price)

Short thesis: CryptoPunks are historical relics akin to centuries-old Ming Dynasty Vases or Roman pottery.

- Many people think of CryptoPunks as PFPs, but I view them as museum artifacts instead. Nothing can ever replicate the historical provenance of CryptoPunks.

- This implies that they can be priceless, just like the crown jewels or this authentic Qing dynasty vase. But two caveats:

- It will not happen immediately

- Crypto and NFTs have to become fundamentally indispensable in the real world rather than just fulfilling a small number of niche use cases. I believe in the former, but today we are still much closer to the latter.

- CryptoPunk holders are a different breed from typical NFT degens and are generally affluent and diamond-handed. Many holders use it as their profile pics, have built a personal brand around their punk, and are unlikely to sell. Top holders are wealthy enough that they don’t feel a need to sell; rather they see it as a flex.

- No roadmap means zero execution risk. It is the purest form of cultural, social/flex, and collectible value.

- Its prices are likely to slowly and steadily rise over time as collectors buy and hold, with lower volatility than other PFPs. It is less likely for CryptoPunks to have a huge run-up like in 2021 because there are no obvious attention-driving events, and there are many more legitimate projects fighting for attention now.

High-quality art

Short thesis: We are in the early days of crypto-native art, generative art, and AI-generated art. Many budding artists will go on to be cultural leaders in these emerging genres. Top-quality works will be culturally significant in years to come.

It’s beyond my intention with this article to go into the intricacies of art collection, but there are talented artists who produce beautiful works evoking emotions and deep thoughts — and their works are still at relatively affordable prices.

Art is a fun one. When people buy art to collect or invest, they often make a fundamental mistake in thinking that they are paying for that particular piece of work (physical or digital) — because it’s beautiful or gorgeous to the eyes.

Wrong. All of that is a red herring.

Here’s my mental framework: When we buy art as a collector/investor, we are essentially buying an “equity” stake in the clout/brand of the artist. The rarer or more coveted the art piece is, the larger the “equity” stake is. I use “equity” in inverted commas because I’m not referring to equity in a legal sense but rather the market perception of ownership.

How much do you think Picasso’s “Nude, Green Leaves and Bust” above would sell for if I painted it instead of him? Assuming the exact same output and brushstrokes. Probably a couple of dollars instead of the $106,482,500 it was auctioned for. When we buy art to collect/invest, we are speculating that the creator’s clout & brand value is going to grow many, many times in the coming years.

NFTs have created an opportunity because it enables these emerging genres to actually become investable through the creation of artificial scarcity — particularly for Generative art & AI-generated art.

The alpha here is to identify these genre-defining artists at an early stage, start collecting their works, and hold them for a very long time.

DCinvestor had a great thread on generational store-of-value art:

which NFTs do i think will become generational store of value assets?

— DCinvestor (@iamDCinvestor) December 4, 2022

Punks, Autoglyphs, XCOPY, and several top market cap sets in Art Blocks (including Squiggles, Ringers, Fidenza, et al)

for this use case, look at what's already attained value with low or no promised utility

The TL;dr:

- It’s probably time to start accumulating things that fall below your estimate of their intrinsic value. Many assets have dropped significantly in price. It could be NFTs, tokens, stocks, etc — wherever your expertise is.

- It’s alright to be patient since it’s unlikely that we shift gears into a roaring new bull market this year. Macro headwinds still remain, liquidity is low, and crypto took a reputational hit. The biggest mistake you can make is to be apathetic. Get prepared for 2024 and beyond.

- Cycle Positioning and Asset Selection can greatly impact your returns and is where a lot of the fun lies.

- NFTs are not ded. Trust me bro.

Have a wonderful and prosperous 2023, everyone!

Cheers, Teng Yan