Forewords

Over the past year, the NFT space has witnessed a wealth of changes and trend shifts. As NFT players plot their next move, we have gathered data from whales – the industry’s biggest players in 2022 – and carried out expert analysis and interpretations. In terms of cycles, the NFT industry shares similar macro trends with the crypto industry, and its correlation with ETH is at an all-time high compared to the year 2021. As many other factors such as regulation come into the picture, it is apparent that we are in the midst of the first actual bear market in the history of NFTs. Therefore, how should we differentiate emerging trends? How will data help us in discovering market patterns?

In last year’s report, we analyzed trends on a macroscopic level and also explored opportunities on a microscopic level. This year, we will continue to deliver comprehensive data analysis and interpretation of the industry to our subscribers. In addition to that, whale movements and future market developments will be monitored.

By mid-2022, more companies, celebrities, and brands had begun realizing the potential of digital assets. Can companies utilize NFTs for digital transformation? What should the core message be for NFT marketing?

Against the backdrop of a global economic recession, 2023 is likely to be a challenging year for all sectors. Compared with the booming first half of last year, many people, including NFT traders, are already thinking about how to get through the economic downturn following a series of financial failures (FTX, Celsius et al). Once the winter is over and the recovery has begun, what do we need to talk about?

Let’s brace ourselves for the next wave.

—— Elsa, NFTGo Research Director

What Can You Expect From the Report?

This is the third annual report we’ve prepared for all web3 users. NFTGo Research has teamed up with well known researchers and NFT degens to co-write a 100-page report that includes macro and micro data trends, collector profiles, whale trends, and predictions for 2023. While this report will be of great help to rookie traders, experienced investors will also obtain a greater understanding of the NFT market.

(1) This report evaluates the capital flow of digital assets and reveals, compares, and predicts the upcoming plans of NFT projects that have an excellent performance history. This will serve as a valuable reference for users to grasp the future trend of the broader NFT market.

(2) This report includes every dimension of NFTs such as market capitalization, total volume and sales, holder portrait, and capital inflow.

(3) The 10 categories covered in the report are gaming, collectibles, avatars, art, metaverse, DeFi, IP, social, music, and utility. A study of all collections and future trends is also included.

(4) This report picks out interesting NFT data and explains the underlying logic. It covers topics such as how successful traders bottom-fish, the profitability of launching NFTs, and the resilience of blue chip NFTs in bear markets. In addition, the report addresses the cyclical nature of NFT speculation.

(5) Contained within the report is an analysis of the distribution of NFT projects based on various data levels, including market cap distribution, price range. It also includes interpretations from a data analysis on the current characteristics of NFT projects, such as the major wealth gap among core users and the higher liquidity seen on homogeneous projects.

(6) The report subsequently analyzes the capital movements and behaviors of whales. The specific timing of whales’ entrance and exit in last year’s market and their reactions when facing major industry events are labeled. Furthermore, the NFT investment preferences of whales are revealed.

(7) We’ve established collaborations with influencers on NFT predictions for 2023. The digital realm is inspirational and profitable, but it can also be speculative sometimes. Therefore, understanding data, tracking whales, and keeping in touch with degens are crucial in helping traders to make informed decisions.

Disclaimer

No Investment Advice: The content of this report is strictly for research purposes only and does not constitute investment advice. Any reference to an investment’s past or potential performance is not, and should not be, construed as a recommendation or as a guarantee of any specific outcome or profit.

Accuracy of Information: NFTGo.io will strive to ensure the accuracy of information listed in this report. However, it will not be responsible for any incomplete or incorrect information.

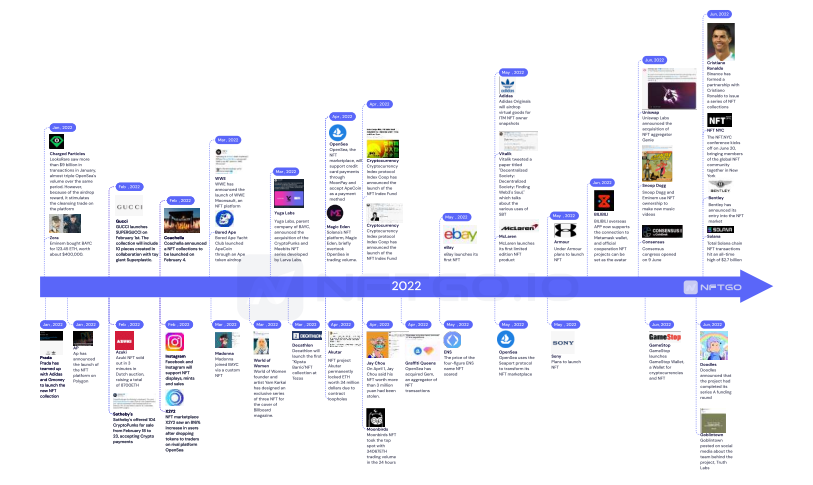

What happened in 2022?

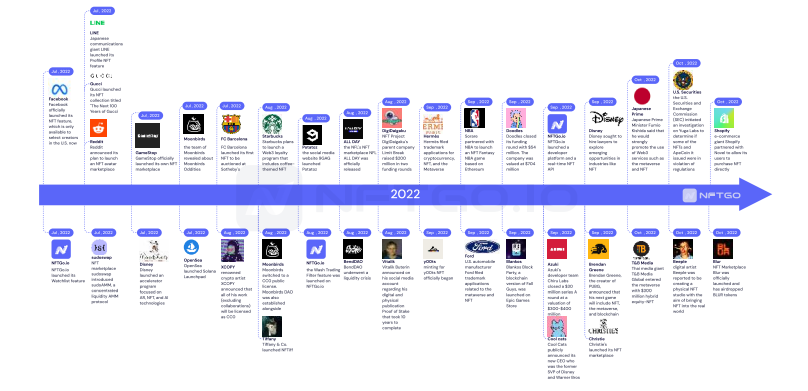

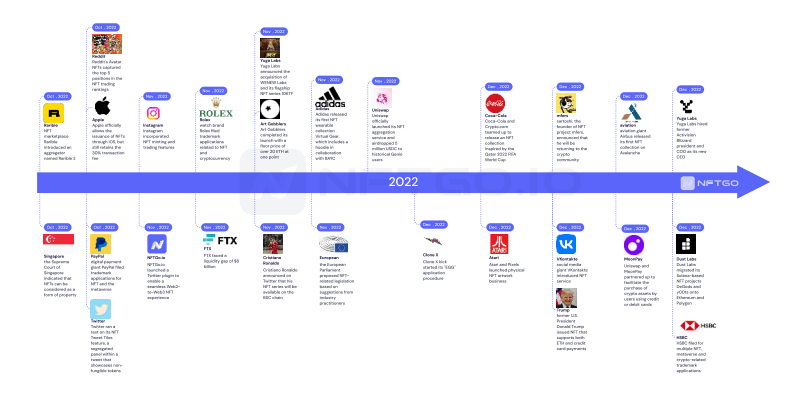

2022 NFT Key Events

2022 NFT Ecosystem

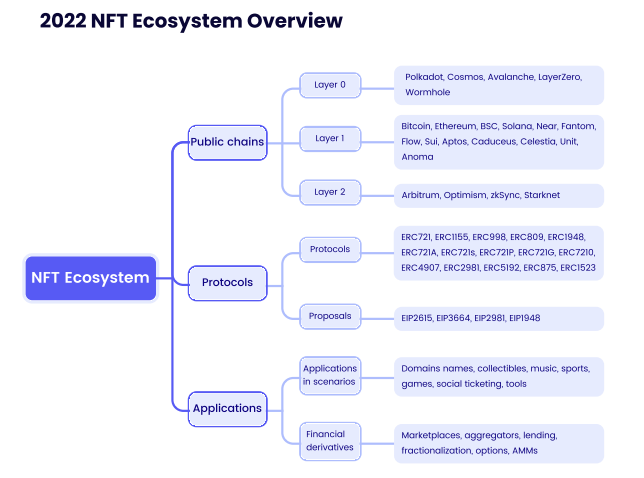

2022 NFT Ecosystem Overview

The Expansion of the Protocol Layer

Most of the NFTs in the market this year are still using the ERC721 and ERC1155 protocol, but new protocols designed to solve NFT problems have received a lot of attention and discussion.

ERC721 The first formal NFT standard that has been adopted widely that defines a set of code rules for the recording of NFT-related information on the Ethereum blockchain.

ERC1155 A multi-token protocol that is extended from ERC721 which supports the minting of many tokens from the same smart contract. This protocol makes minting and transferring more efficient.

Other than the most widely used standard protocols such as ERC-721 and ERC-1155, liquidity protocols, cross-chain protocols, attribute extension protocols, and SBT protocols have also made decent progress over the last year.

ERC998 Allows any NFT to be bundled with other NFTs or FTs, so that users can achieve ownership transfer of the entire CNFT hierarchy during CNFT transfer.

ERC809 A rental protocol. Smart contracts based on this protocol allow users to rent any rentable NFT by creating an API. Other users can no longer rent or use the NFT during the lease term.

ERC1948 The dynamic version of ERC721. Not only does it have the basic features of ERC721, but it also allows users to access the read function of the NFT. Besides, the owner of the NFT has the authority to change and update data.

Other protocols and proposals related to NFTs include: ERC721A, ERC721s, ERC721P, ERC721G, ERC7210, ERC4907, ERC2981, ERC5192, ERC875, ERC1523, EIP2615, EIP3664, EIP2981, EIP1948, etc.

Public Chains Continue to be Led by Ethereum

Ethereum continues to maintain its unshakable position in the NFT field, and the scalable EVM-based public chains that have emerged in tandem have formed a huge crypto ecosystem. This is happening not only in the NFT field, but also in the entire crypto industry. On September 15, 2022, the Ethereum blockchain completed

a historic upgrade by launching The Merge, which marked the transformation of Ethereum from Proof of Work (PoW) to Proof of Stake (PoS).

Aside from Ethereum, “multi-chain coexistence” has also been a hot topic for a long time. New public chains have launched with novel narratives for different tracks in 2022 such as LayerZero, Wormhole, Layer1 Sui, Aptos, Caduceus, Celestia, Unit, and Anoma.

Vitalik Buterin, founder of Ethereum, talked about Layer3 in October: “L2 is used for expansion, and L3 is used for customizable expansion. This customization accurately matches to special scenarios of users and to the applications preferred by developers. At the same time, L3 has trustless scaling that leaves data availability to trusted third parties or committees to further protect user privacy and safety.” As the technology develops, additional layers will gradually emerge.

Financial Attributes Generate More Derivatives

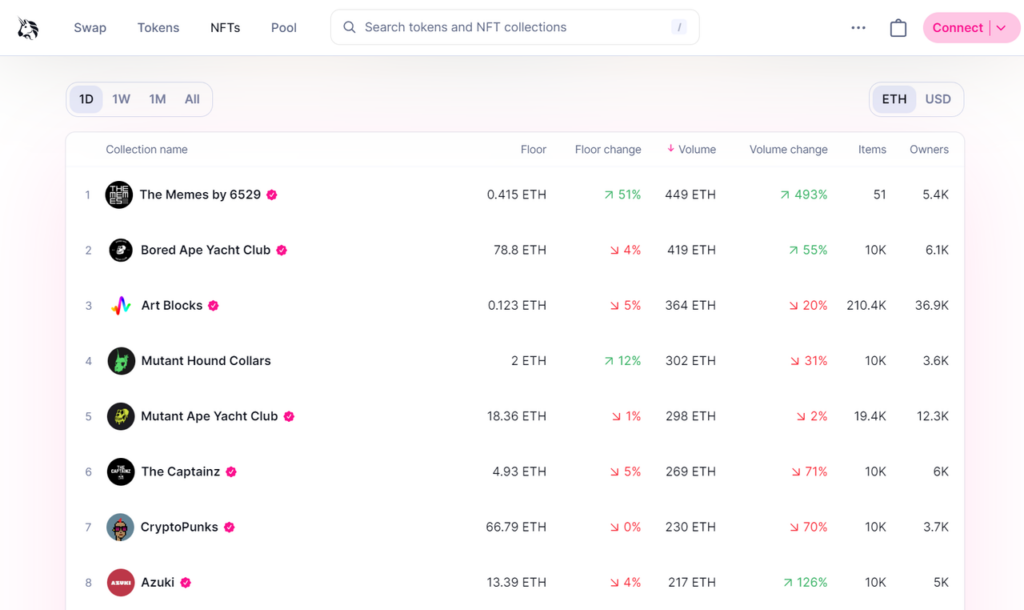

Like all blockchain assets, NFTs with asset attributes have enabled many projects to thrive over the past year such as NFT marketplaces, aggregators, automatic market makers (AMM), liquidity providers, etc. The huge demand for NFT transactions over the past year has made NFT marketplaces in demand, with OpenSea one of the biggest gainers. It has also led to more NFT marketplaces and aggregators competing against one another to get a slice of the pie.

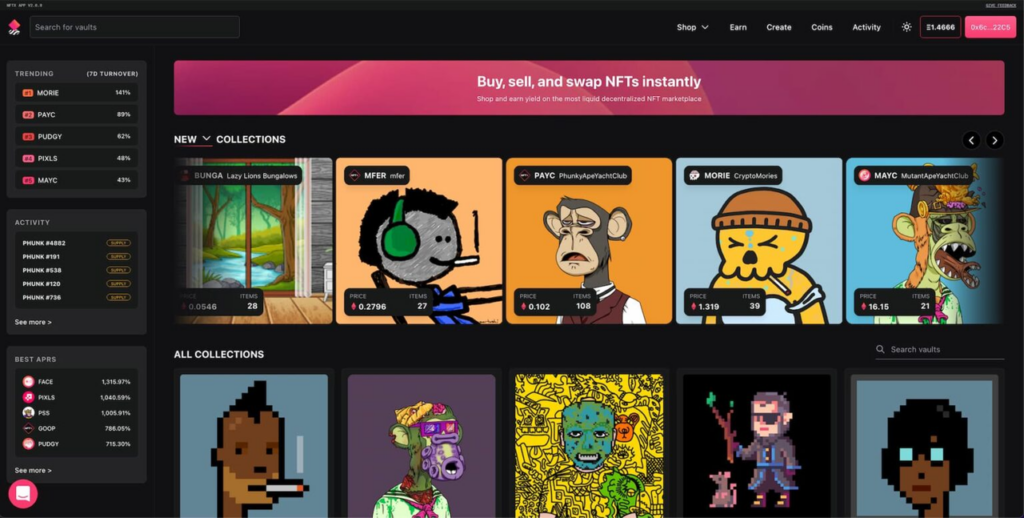

At the same time, the NFT financial track has focused on liquidity and asset utilization, giving rise to NFT fractionalization and NFT lending. From NFTX and Unicly to BendDAO, such projects have battled demand depletion due to the bull-bear transition, which has also caused other projects that survived this market shift to re-examine their business model.

Options projects in the NFT financial derivatives space elected to collaborate with NFT liquidity projects in 2022. For example, MetaStreet provides NFTfi with an annual interest rate of 10%. This allows users to create and trade more freely, but it’s hampered by dispersed liquidity. Regarding the matter of option pricing, some projects currently adopt a peer-to-pool solution.

Projects such as NFT valuation, liquidity, fractionalization, and options often have overlapping design structures that make them difficult to be categorized by functionality. Most of them are classified by product solutions.

2022 Hot Topics

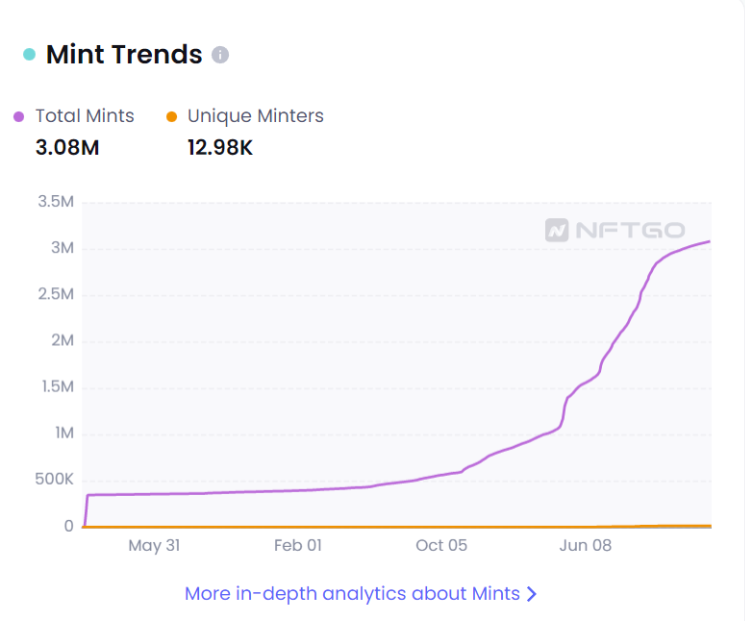

The Digital Identity Crisis Caused by SBT

SBT

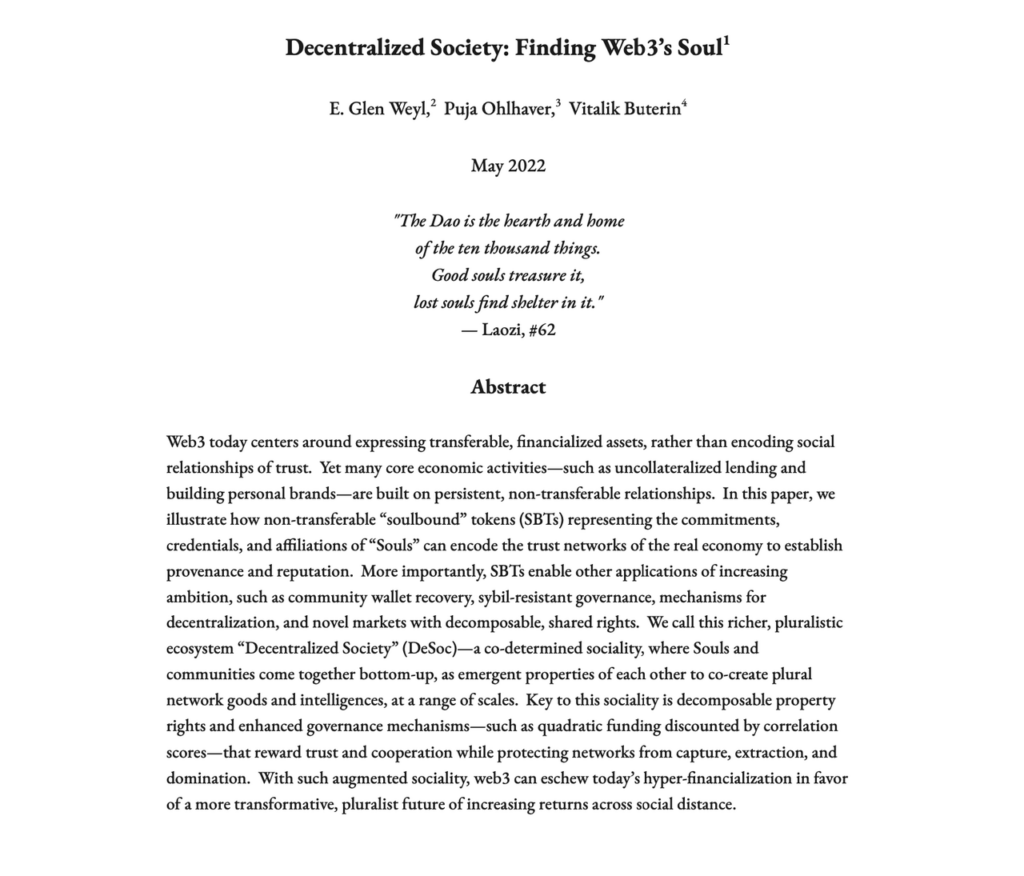

In May 2022, a paper titled “Decentralized Society: Finding Web3’s Soul” was published by Glen Weyl, Puja Ahluwalia Ohlhaver, and Vitalik Buterin. These authors are Microsoft’s Office of the Chief Technology Officer Political Economist and Social Technologist (OCTOPEST), Flashbots strategist, and Ethereum’s co-founder, respectively.

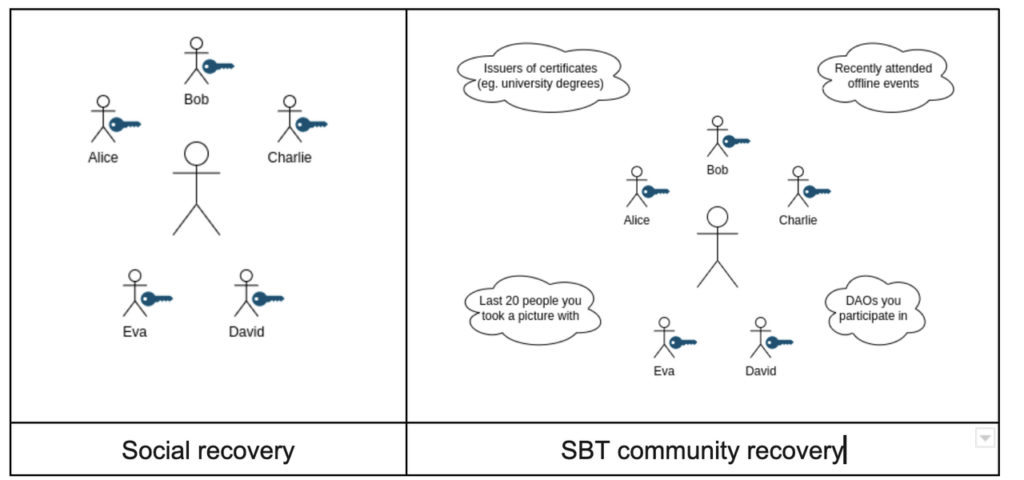

The paper describes the concept of SoulBound Tokens (SBT), which are programmable, non-transferable but revocable and retrievable tokens with verifiable information. This is verified through the wallet’s social relationship. The aggregation of accounts with SBT constitutes a decentralized society (DeSoc).

The difference between SBTs and NFTs is that NFTs represent assets and property, while SBTs represent the reputation of an individual or an entity. SBTs have zero monetary value and cannot be traded once issued to someone’s wallet. The article also introduced the application of SBTs, such as the establishment of a reputation system, credit loan, voting that grants governance power, etc. Aside from that, it also brought DID (Decentralized Identity) and blockchain technology into the discussion again.

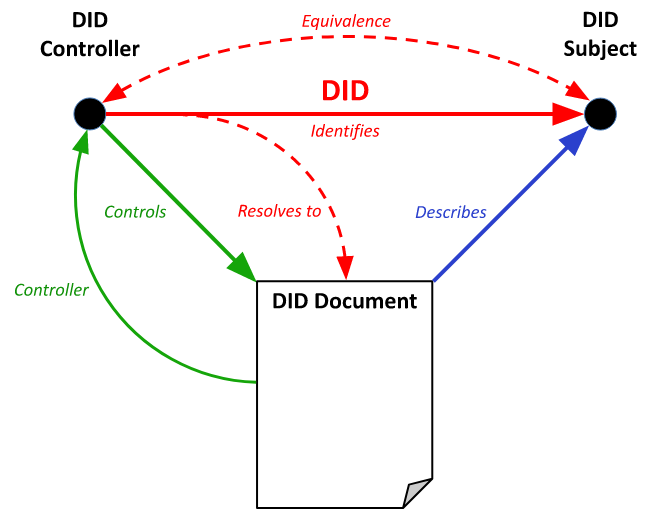

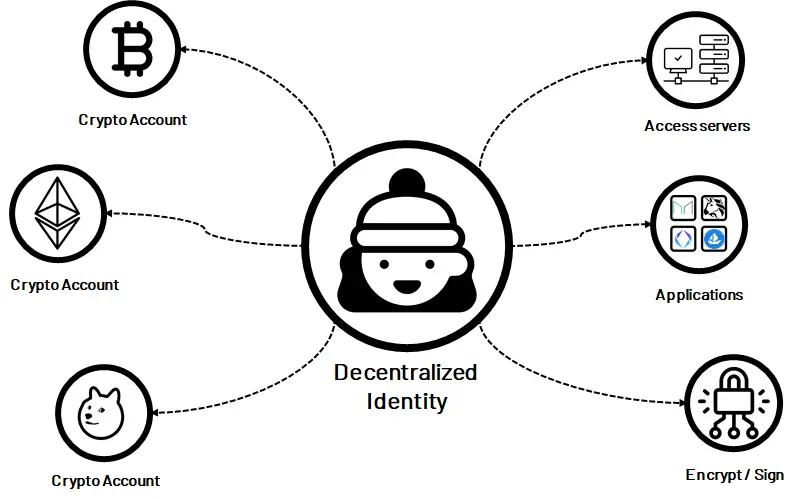

DID

Some people refer to DID as the key technical basis for supporting native Web3 applications. The reason being that everyone in the Web3 world needs a decentralized identity (DID). Blockchain technology can create a unique identity certificate that gives the user the ownership, control, and management of their digital identities.

DID provides users with control, security, privacy, and portability. It ensures that identity systems can be operated across different networks and platforms so that users can decide the particular circumstances to display a certain part of their web3 identity. In addition to the combined application with SBTs and NFTs, DID has inspired new ideas to solve problems like DeFi identity verification and the voting and governance of DAOs.

Domain Names

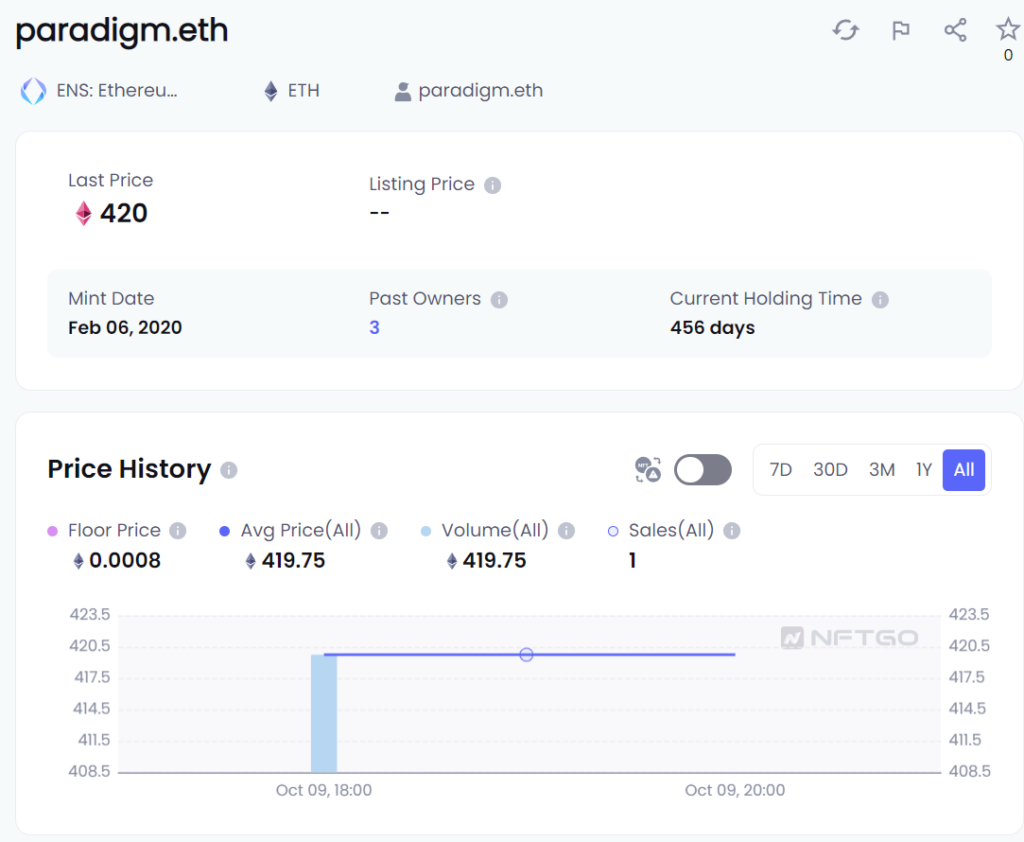

When the entire crypto market was bearish in the second half of the year, the trading volume of domain name NFTs represented by ENS surged. It led to the launch of various domain name NFTs in the market. The concept they popularized was that web3 domain names can not only be used as crypto addresses, but can also act as a web3 identity card. By embracing this concept, a large number of digital domain names and famous brand domain names were cybersquatted and sold at high prices in the secondary market. For example, paradise.eth was sold for 420 ETH.

NFT Fractionalization and Lending Crisis

Insufficient transaction liquidity is a problem that NFTs have faced since birth, mainly manifested in the difficulty of users converting NFTs into cash.

The NFT bear market in 2022 caused most NFT projects to face the problem of “liquidity exhaustion,” but over the same period, projects that solve NFT liquidity have been well financed. These factors have made more people begin to pay attention to the problems of NFT liquidity.

Fractionalization

NFT fractionalization is currently the most popular means of solving NFT liquidity problems. The main idea behind this solution is to convert ERC721 NFTs into ERC20 tokens for secondary minting to improve liquidity.

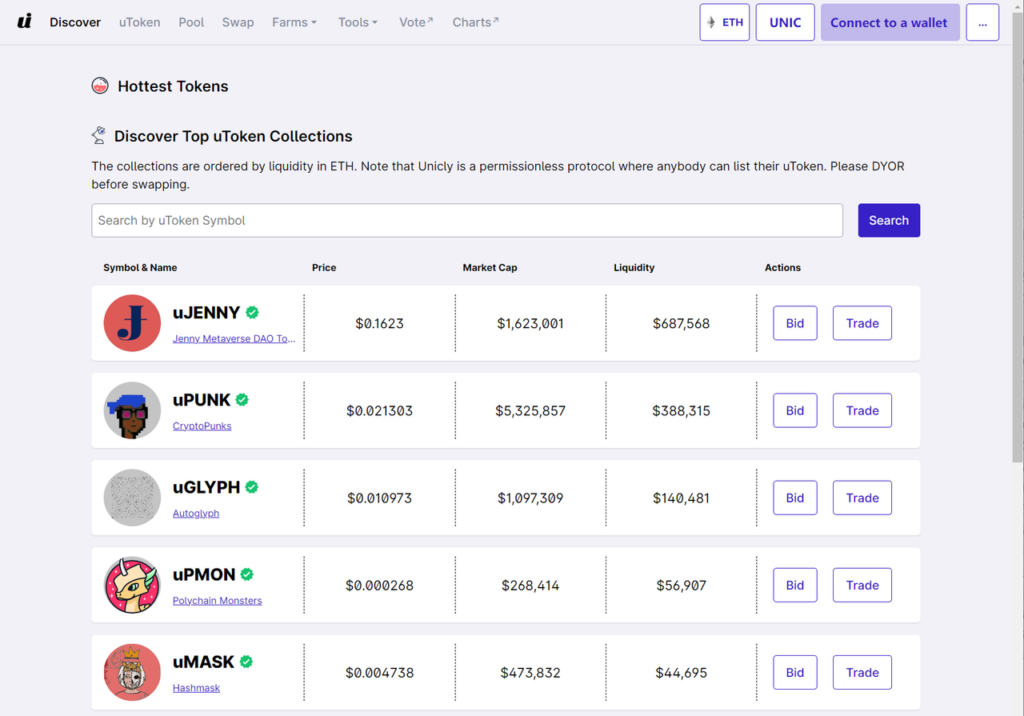

Projects such as NFTX, Unicly, and Tessera are designed to pinpoint different NFT types such as underlying assets, high-end assets, voting ability, and art. This allows users to use NFTs as collateral and create ERC20 tokens for transactions.

These fragmented products are often combined with DAOs to realize product functions. For example, the investment community JennyDAO adopts the Unicly protocol to divide NFTs, while Tessera tries to run the upgrade protocol on Nouns DAO, and KOL communities like UkraineDAO and Free Ross adopt the fractional protocol.

These fractional protocols have also been functionally upgraded in 2022. Examples include NFTX’s launch of Goerli to use Uniswap V3 to create a centralized liquidity position on NFTX while Tessera’s game NFT provides an aggregation service.

Lending

NFT lending is the main solution to improving fund utilization rate. While 2022 was a booming period for NFT lending projects, the financing of these projects mainly took place in April and May, including NFT lending protocols such as MetaLend, MetaStreet, AFKDAO, Flowty, Perion, and Pine Protocol.

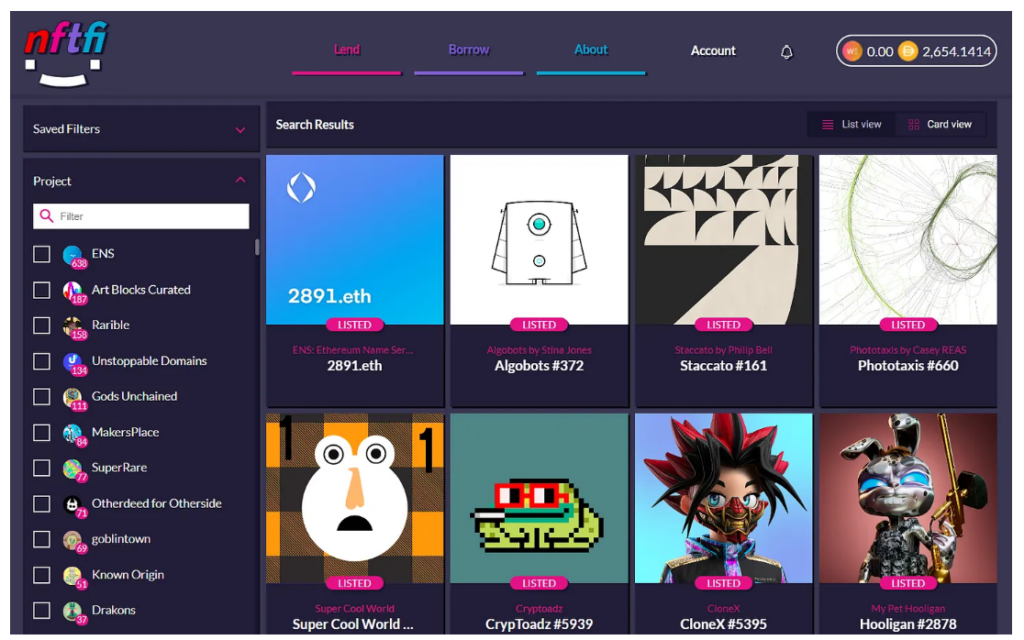

Mainstream lending protocols are divided into peer-to-peer and peer-to-pool types.

Peer-to-peer protocols allow users to directly lease NFTs to others, such as NFTfi. Lenders can earn interest by providing DAI or WETH loans whereas borrowers can obtain liquidity by staking listed NFT. The terms of the loan (term, interest, etc.) are agreed upon by transaction parties. In the event of a default, the NFT will be returned to the lender.

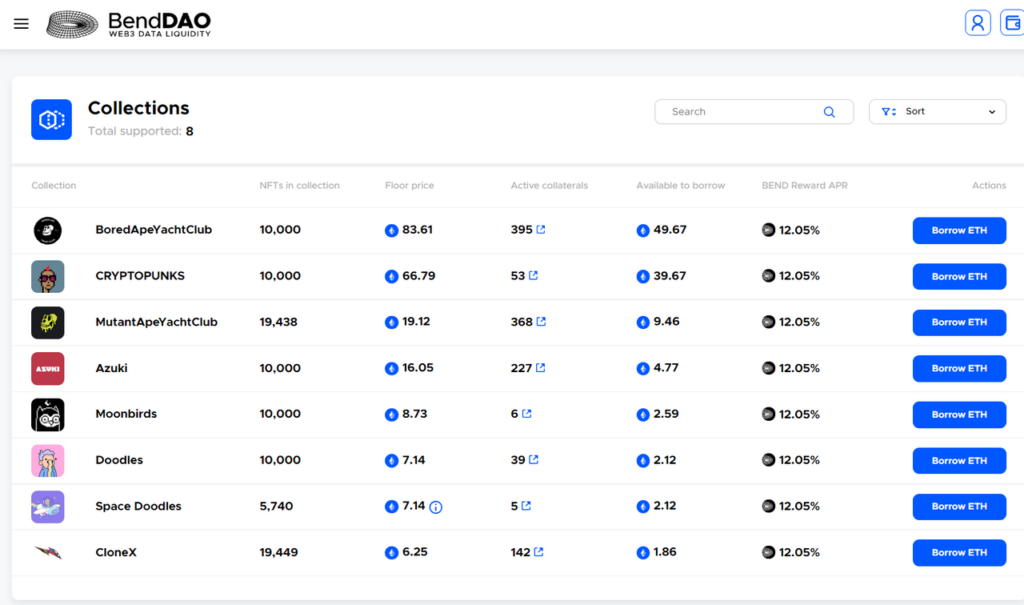

Peer-to-pool protocols accept blue chip NFTs as collateral and then lend out cryptocurrencies. BendDAO, which fell into a liquidity crisis last year, requires lenders as liquidity providers to provide ETH to the liquidity pool. On the other hand, borrowers use NFTs as collateral.

In addition to the above two, the current design of NFT lending is still developing. This includes the NFDP model proposed by JPEG’d, and Perion’s lending that focuses on GameFi assets.

Buffeted by massive waves of fluctuation, shrinking liquidity was a frequent menace in the crypto market in 2022. The extreme market environment tested the feasibility of various NFT lending models. It also tested the risk management ability of various lending protocols.

Market Share Carved Up by Marketplaces

Marketplaces

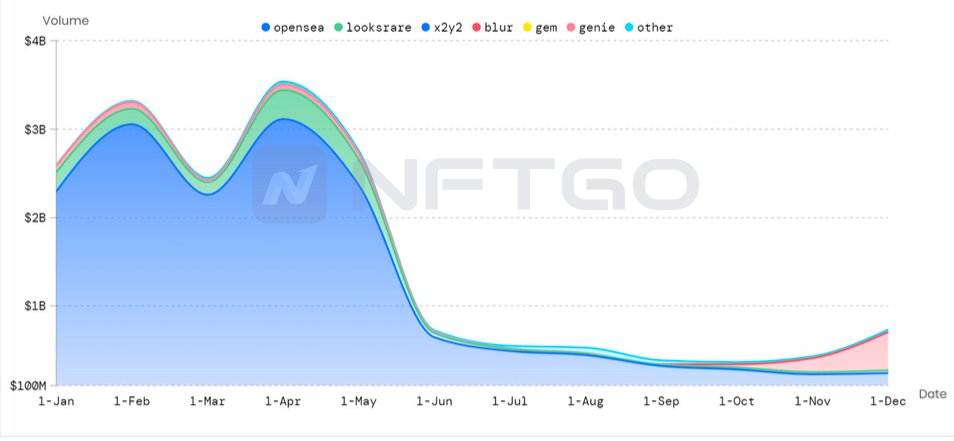

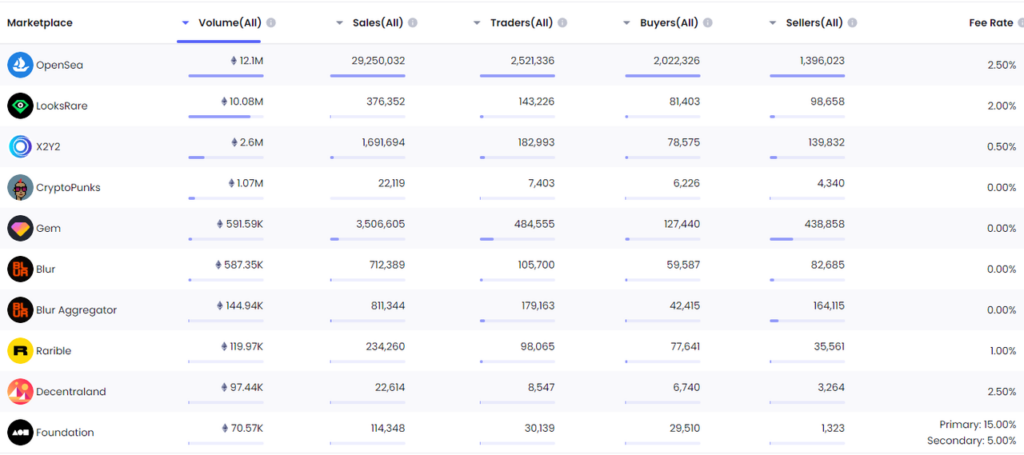

In January 2022, LooksRare and its token were launched. It used low transaction fees and token rewards to attract users to trade on its platform. LooksRare climbed to the top of the trading volume chart in just a few days, which posed a threat to the biggest trading platform — OpenSea.

Then, X2Y2 went online and airdropped tokens to attract OpenSea’s user base. It then launched a series of pending order rewards, gas fee refunds, and transaction rewards to seize market share. In October of 2022, Blur, a combination product of a marketplace and an aggregator, went online. After its launch, Blur announced its zero transactional fee policy and announced two rounds of airdrops for traders. It even had four times more trading volume than OpenSea in December, which made quite the impact on the latter.

This series of events escalated the “NFT marketplace battle” and further encouraged the establishment of other marketplaces with the aim of seizing market share from OpenSea.

Aggregators

Competition among marketplaces has also created opportunities for NFT aggregators. Products such as Gem and Genie aggregate the prices of multiple NFT marketplaces to allow for easy comparison. At the same time, they support easy scanning and also save gas fees. The product design of Gem and Genie led to them being acquired by OpenSea and Uniswap respectively. The industry has also noticed the potential of NFT aggregators, several of which launched in the second half of the year including Blur and Element.

New innovations from project developers has accelerated the evolution of NFT marketplaces. It’s led to the enrichment of features on various marketplaces, such as transaction rewards, zero transaction fee, custom royalties, etc. This has successfully popularized the names of multiple project developers during this period. However, thanks to OpenSea’s long-established brand name and first mover advantage, major NFT project developers and NFT traders still prioritized OpenSea.

In response to the the affect of wash trading, NFTGo.io launched a filter feature for wash trades. In addition, NFTGo.io also has an aggregated trading feature.

Lifting Copyright Restrictions and Royalty Income

CC0

All creators who label their NFT creations as CC0 are giving up their ownership of the NFT from a legal respect. Anyone can freely re-create these CC0 NFTs. Discussions about NFTs and CC0 can be traced back to many OG projects like CryptoPunks, Nouns, and mfers.

In August of 2022, PROOF Collective announced that it would move the Moonbirds and Moonbirds Oddities collections to CC0. PROOF unilaterally changing the license is evidence that holders of Moonbirds NFTs do not actually have the right to use the IP. Through this incident, people have realized the difference between “ownership of NFT” and the “right to use NFT.” The question of whether or not NFTs should go CC0 has been a hot topic.

Royalties

In August 2022, NFT marketplace X2Y2 announced that users could now choose the percentage of royalties (0%, 50%, 100%) to pay to NFT creators when trading NFTs on its platform. In the early days of NFTs, marketplaces such as OpenSea introduced the royalty mechanism to attract artists and creators to distribute their works.

This strategy by X2Y2 immediately drew public attention and at the same time divided opinion. Many of the project creators and developers expressed their opposition saying that this was not conducive to the continuous income of creators.

X2Y2’s “zero royalty” is relatively friendly to traders, which has also caused many project developers and marketplaces to launch similar features. For instance, DeGods removed royalties from all its affiliated NFTs, such as DeGods and y00ts. This has led to the development of customized royalties for subsequent marketplace launches.

Although X2Y2 immediately stated that 0% royalties are by no means the ultimate goal to strive for, and that they had canceled the flexible royalties setting in November to impose compulsory royalties, the move still inevitably ignited criticism.

PASS Empowerment and O2O Marketing

PASS

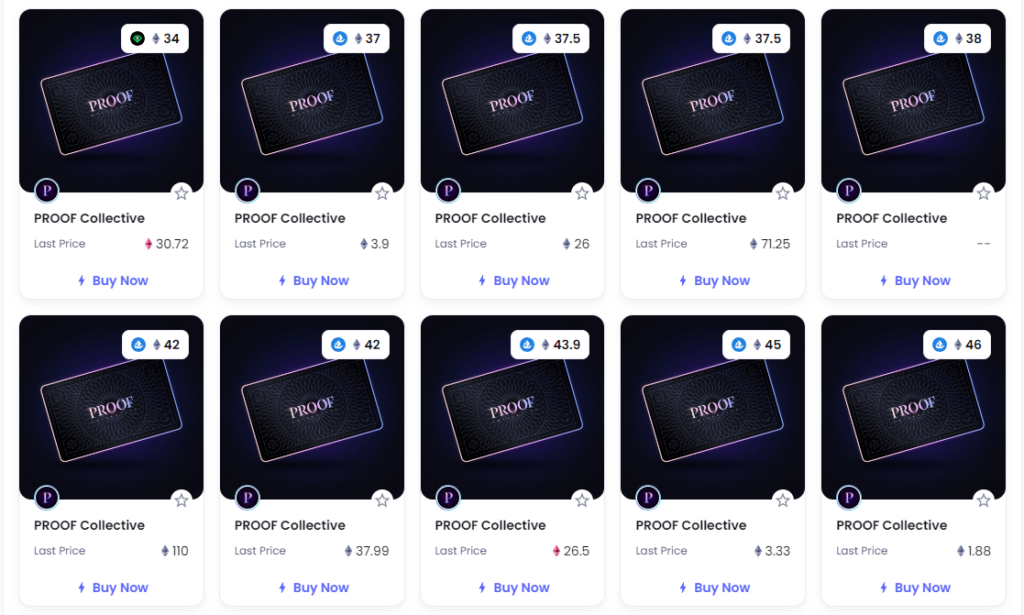

The boom of Moonbirds is inseparable from the community behind it. NFTs issued by communities like PROOF Collective, which is supported by KOLs in the crypto field, are identical to VIP membership cards that make people feel they can share and connect with industry leaders by holding that NFT.

In the meantime, Pass NFTs are connected to genesis NFTs and the sub-series NFTs (such as the relationship between MAYC and BAYC), which gives people the expectation of receiving airdrops and earning benefits in the future.

The success of Moonbirds and PROOF Collective has inspired more NFTs to develop on the concept of Pass cards, which then led to the emergence of a large number of PFP+Pass NFT projects being launched in May. It made people wonder about the impact the Pass attribute can have on NFTs. The types of Pass NFT issued since can be chiefly divided into Club, Alpha, Tools, and so on.

O2O

For a long time, the combination of NFTs and the offline world was limited to exclusive gatherings of NFT holders and the exchange of online points for physical goods. In 2022, as more and more entities entered the web3 field and issued their own NFTs, it triggered discussions on the integration of virtual and reality, among which there were many attempts to combine the physical business model with NFT marketing on-chain.

One model favored by brick and mortar businesses uses real-world rights and interests to attract people to buy NFTs, such as the NFT loyalty program announced by the coffee brand Starbucks last year.

Members holding the NFT have the chance to visit coffee farms in Costa Rica and enjoy a series of membership benefits. Starbucks uses NFTs as a tool to extend online promotion and gain more benefits through it.

Another brick and mortar model is brands launching physical businesses offline. This is mostly done by the holder or project owners trying to open a physical location. For example, BAYC holders rely on their IP to run cafes, restaurants, beverage stores, and physical exhibitions.

The combination of NFTs and O2O has become more and more feasible with traditional businesses entering into the web3 field and the establishment of policies that favors the development of blockchain.

P2E and the Phenomenal Applications of the Metaverse

STEPN

At the beginning of 2022, the first generation of GameFi projects such as Axie Infinity bottomed out. STEPN became the primary project in the “X-to-Earn” field in 2022.

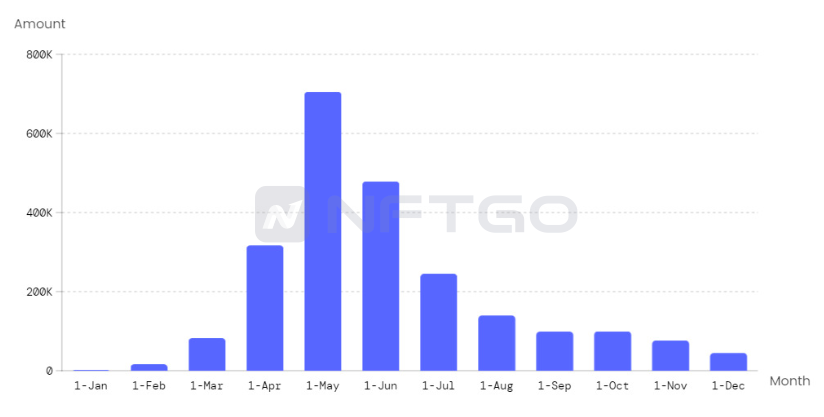

STEPN is a move-to-earn game where users earn token rewards on NFT sneakers by going out for a walk, jog, or run. With innovative mechanisms and product design, STEPN’s active users grew from 2,533 in January to more than 700,000 active users in May and has become one of the most popular NFTs on Solana.

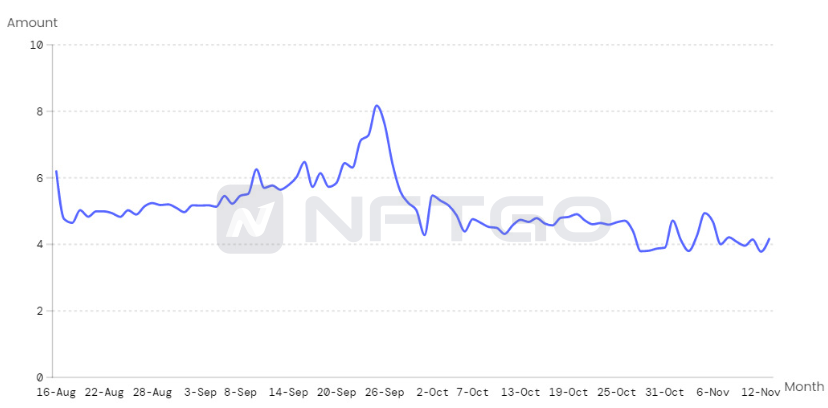

Daily transactions per user can measure user engagement and loyalty. On the 90-day daily trades chart, there are eight trades per user, but the average from August to November is about five trades. Daily transactions per user is a measure of how much a user is willing to spend on a game, which is a good indicator of a game’s popularity. Therefore, we can see that STEPN has an interactive function that attracts users.

For example, users are able to choose features such as comfort, resilience, luck, and efficiency for their NFT sneakers. These numbers contribute to the energy capacity of the NFT sneakers. Energy is a measure of time. One energy unit is equivalent to five minutes of exercise. STEPN seems to be successful in retaining users based on sports and games, and it’s clear that their user base frequently returns to the game.

However, the popularity of STEPN began to decline significantly in June. Its active users dropped from 470,000 to 100,000 in October. In addition, the FTX incident in November also significantly affected the price of Solana tokens and the number of users.

Overall, the number of active users of STEPN in the first half of 2022 demonstrated the success of walk-to earn games. The current NFT and private currency market has entered a recession period. In 2023, we should pay close attention to the growth of game users to ensure the continuous success of GameFi titles.