Degen’s Talk

2023 Predictions

Compared to the trend of 2021 where the market went from bearish to bullish, the year of 2022 is certainly an extremely turbulent period to remember. The crypto market is constantly eliminating and evolving as more projects and approaches emerge. Therefore, we invited some of our friends to join us in making 10 predictions for 2023.

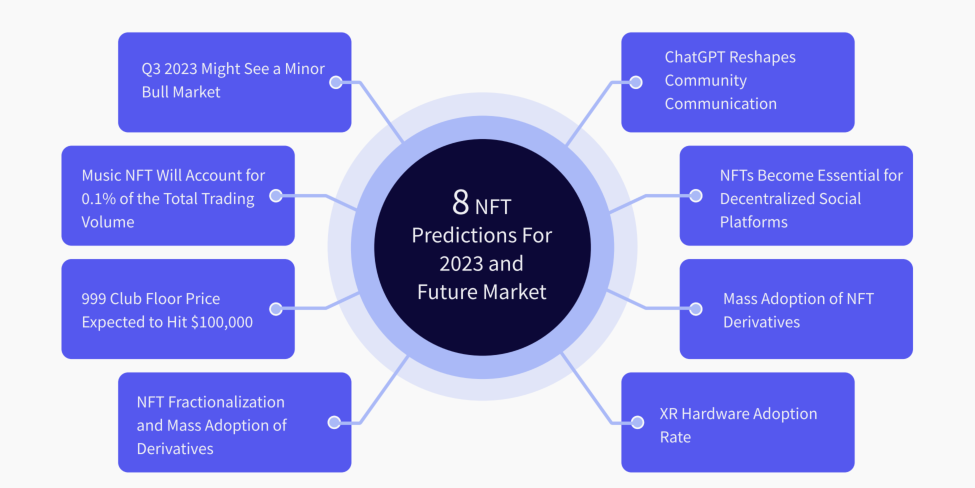

Q3 2023 Might See a Minor Bull Market

2022 was a year of growth for NFTs, but at the same time it also gave rise to bubbles. Manipulation like flipping and scams allowed some to reap short-term profits. In the second half of the bear market, we saw projects that stood out due to their innovative approaches. In the meantime, 2022 was a year of continuous growth where many projects were still undergoing development amidst the chaos. An example of this is the metaverse that was heavily invested in 2021.

For entrepreneurs, 2022 was a tough yet progressive year. 2022 saw a general downward revision of valuation in the capital markets for the track of financed businesses due to the fact that investors value business models and profitability over concept-driven short-term growth. In the second half of the year, along with heightened capital costs induced by the Fed’s interest rate hike, the market underwent a shakeout. Some projects sought acquirers due to funding shortfalls, while others coped by downsizing. All of this allowed the market to better reflect the capital value of projects. After the reorganization and washout of 2022, 2023 will turn out to be a year of financing and acquisitions.

Ethereum will remain the most dominant blockchain in the industry. After The Merge, the blockchain will see its first upgrade in the second quarter of 2023, shifting step by step towards a full proof-of-stake model. In 2023, Ethereum will still be the most important and the most active chain for NFT launches, and its market share and adoption rate are predicted to expand as well. Besides that, we shall also keep an eye on the applications of layer 2 (L2) projects.

According to the technology adoption lifecycle, NFTs are now over the “inflated expectations” and “bubble bursting” periods, which means that established projects have now produced successful works, such as Yuga Labs’ series, Axie Infinity, etc. These projects have risen to the top of their respective categories, while many others did not survive the battle due to timing and competency. Survival of the fittest has eliminated a large number of projects, while the user base of NFTs is transitioning from early adopters to the early masses. This phenomenon is similar to the bubble-bursting period that happened between 2016 and 2017 after the ICO wave of the crypto market subsided.

Roughly speaking, the current volume of the NFT market is approximately similar to the volume of the crypto market in 2017. After the total market cap of the crypto market first reached $20 billion in January 2017, a period of decline began, losing a quarter of the total market cap in just two weeks. The market then took time to improve and recover, which eventually kicked off a new bull market. In a similar sense, the NFT market will likely experience an adjustment period as well, implying the transition of NFT investing from “ponzi” to value investing. The possibility of a minor bull market in mid-2023 is high.

Music NFTs are the next hype

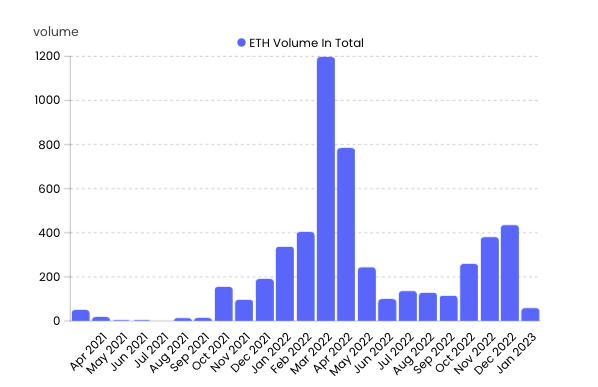

In the midst of a short-term bear market of 2023, there is a slow recovery in the trading volume of music NFTs compared to the sluggish state of the overall PFP market. Music NFTs reached a second minor peak in December at around 422 ETH. At present, the music market remains occupied by a small group of creators and traders as whales and degens are sticking to PFPs for the moment.

Nevertheless, we realized that 2022 marked the beginning of a new wave of music NFTs, particularly with the addition of several startups in the music NFT sector like Sound.xyz and Catalog, which are dedicated to bridging music distribution and collection together. These platforms emphasize “owning” your favorite songs. Since all songs are based on the Ethereum blockchain and have a clear structure of royalties and profit distribution indicated in the contract, the income transparency of artists is guaranteed.

Currently, the business model of music platforms such as Spotify is based on monthly or annual subscriptions, and according to its last annual report, the company’s total revenue for 2022 was $12.184 billion — up 11.57% YoY, while the number was up 27% in the year before. The subscription-based model is almost saturated and it will be increasingly difficult to acquire new subscribers. In addition, the video-oriented music market will capture more market share as new streaming platforms such as Netflix and TikTok take on the music industry. Traditional music streaming platforms as well as record labels will need to come up with new distribution and commercialization models.

Currently, the average price of one music NFT in the market is 0.1 ETH, and 75% of NFTs at this price are not of the 1/1 type. While web3 music platforms will give rise to new business models like fan-based and community-based subscriptions, music NFTs bring many other benefits too. According to David Greenstein, co-founder of Sound.xyz, music NFTs allow artists to keep 100% of their creative rights while also making them more approachable to their audience, which will in turn encourage their audience to become “early investors” as well.

Essentially, music NFTs will transform the current ways of music distribution and monetization. However, it is worth noting that a driving force is required to push these changes through. The long tail effect also exists in the music market. By understanding that there are plenty of other talents waiting to be discovered, we can predict that, in the future, talent scouts will no longer be confined to agencies, but also include the fans and communities of artists.

ENS domain name continues to appreciate in value. 999 Club floor price is to exceed $100,000.

The emergence of ENS provided a solution to confusing crypto addresses by replacing lengthy Ethereum public addresses with a simple name. April 2022 saw the first spike in the sale of Ethereum domains on OpenSea, with daily trading volume reaching 6,875 ETH. Apart from that, a 119% increase in the number of ENS domain registrations and a 7% increase in the total number of active .eth domains was also recorded. By the end of September 2022, daily trading volume doubled to reach 12,327 ETH. The YoY growth of ENS transactions increased by nearly 2133%.

To date, 2.82 million Ethereum domains have been registered by nearly 630,000 unique holders, each with an average of 4 to 5 domains. Since April 2022, there has been a growing discussion around rare ENS domains and the creation of the 10K Club for Ethereum domains. Many users are interested in numeric ENS domains, such as 123.eth.

On the other hand, some are also buying ENS domains at the price of the ENS domain itself. For 3-digit numeric ENS domains, there are a total of 444 holders and the current floor price is above 20 ETH, while 4-digit domains have a total of 3,686 holders and the floor price is now at 1.3 ETH. As more people realize the value of domain names and value the sense of domain identity, the floor price of 999 Club NFTs is expected to exceed $100,000.

ChatGPT transforms NFT community interaction and user stickiness

ChatGPT was undoubtedly one of the hottest topics of 2022. A number of startups have emerged along with the trend. Their services are based on the open source OpenAI database, but also finetune it to specialize in specific areas like law firm documentation or copywriting for marketing campaigns.

NFTs are based on community and consensus, and carry an inherent cultural and memetic attribute compared to traditional financial products. The voting and decision-making mechanisms in the community partly reflect the bottom-up culture of NFTs. Today, Discord is still the main site of communication for most NFT communities, and each community designates an administrator to answer community questions, organize events, maintain order, etc. Also, some communities have implemented bots to manage the community.

Since automated generation frees up the creativity and interactivity of a community, is there a chance that all this could be replaced by ChatGPT and OpenAI? For example, we could generate Christmas versions of Doodles and use ChatGPT to generate a story about the Ape that we hold. ChatGPT expands and extends the cultural narrative of NFTs and enhances the interaction and stickiness of the community.

XR hardware and NFT ownership will drive metaverse development

The development of the metaverse is closely related to the devices used and the real experience. While the 2D world composed of computers and projections might meet the needs of gamers, it is still difficult to achieve the desired immersive experience in the metaverse. Today, companies including Meta and PICO are vigorously developing AR infrastructure along with hardware facilities. AR glasses are now priced between $400 to $2,000, which is similar to the price of cell phones and tablets and these devices are able to satisfy family needs as well.

According to Statista, the global market size of XR in 2022 was about $25.2 billion, with total sales of about 13.2 million units of head-mounted devices and 3 million units for commercial use throughout the year. As we can see, the popularity and adoption of VR today is still at a very low level. By 2025, following the maturity of 3A metaverse gaming, sales of VR glasses and other devices are expected to increase by 20%.

As an early-stage product of the metaverse concept, blockchain games are one of the main application directions of NFTs at present, and have been integrated with the model design and concept design of P2E, UGC, VR, social, etc. since 2017 as NFTs have gradually become the core of the world economy.

Most of the NFT projects that have exploded in popularity last year have future plans involving games, which is sufficient to indicate that their integration with the gaming industry will continue in the upcoming year. Some web3 pioneers such as The Sandbox, Decentraland, and later Otherdeed have completed the basic virtual world construction. Subsequently, these developers will focus on game-support infrastructure such as virtual machines, data aggregators, etc.

SBT empowering carbon credits under the ReFi track

The Merge of Ethereum was one of the biggest events in 2022, and there were high expectations for the move to a proof-of-stake model. This is partly because of better scalability and applications, plus its friendlier low-carbon environment. Bitcoin has been widely criticized for its high energy consumption, and miners are gradually merging or shutting down as rewards decline.

In addition, “green computing” was a hot topic in 2022. With the rapid growth of major high-tech companies over the past 20 years, the increasing computing power and energy consumption poses a threat not only to the companies themselves, but also to the environment. It is essential to discuss how best to reduce the cost of energy consumption and optimize computing operation space.

As we all know, most mainstream NFTs are on the Ethereum blockchain. While Ethereum provides a bigger space for the subsequent development of NFTs, it also lowers the energy consumption of NFTs indirectly. Nowadays, some enterprises have been solving the problem from the aspects of NFTs and SBTs by combining carbon footprints and carbon credits.

These methods that bind identity with behavior and create green bank accounts have the potential to mitigate the carbon emission problem. On top of that, some companies have issued NFTs that support carbon neutrality. Getting people to mint these NFTs allows carbon credits to be burnt at some point.

However, the integration of carbon credits and NFTs will not make much progress in 2023 due to factors such as information asymmetry. Achieving a green economy is going to take time, but it will be accelerated with each positive step taken by web3 businesses.

The mass adoption of NFT derivatives

In the second half of 2022, we found that the liquidity of NFTs in the market gradually decreased. It wasn’t until December that we saw an improvement. There are multiple reasons for the low liquidity of NFTs.

One is that unlike fungible tokens, non-fungible tokens have different rarity and characteristics from each other and are difficult to be exchanged directly. Rarity and characteristics are some of the most important factors in assessing the value of an NFT, and can also vary depending on personal preferences.

Second, the overall penetration and adoption rate of the NFT market is less than 1% compared to the overall crypto market. There are still many people who do not know what NFTs are or do not recognize the future market value of NFTs. Of course, this also has a lot to do with the high participation threshold of the NFT market. In 2022, Reddit NFT drove awareness of NFTs to more than 3 million people on the platform. Besides, credit card payment NFTs also emerged into public awareness.

The third reason is the lack of application scenarios. At present, most of the applications related to collections are still limited to NFTFi and financial derivatives. There is insufficient momentum to push for mass adoption. Fourth, some people wish to buy into top blue chip projects, but the general public can hardly afford the price of a complete NFT, not to mention participating in its community. Last but not least, liquidating an NFT can take very long and lacks flexibility, which explains why NFT holders generally have a low utilization rate of their assets. Holders do not have adequate hedges.

In response to these problems, a number of NFT applications have evolved. For example, NFT crowdfunding platforms, fractionalization platforms, staking and lending platforms, leasing platforms, etc. There are also a large number of NFT option platforms under development, and it is not difficult to see that in 2023, there may be a number of institutions, including hedge funds, entering the NFT field and thus driving the financialization of this industry.

NFTs become essential for decentralized social platforms

One of the most fundamental differences between web2 and web3 social media lies in the difference of their information distribution models. Web2 uses the all-too-familiar personalized recommendations with smart algorithms. Content in web2 is PGC and UGC, which is then shown to users based on tags by centralized social media platforms.

On the other hand, information in web3 is distributed through social recommendations. According to the theory of six degrees of separation, each user becomes the central node of information distribution. Every creator will own a DAO with them being the central node. Then, they will be able to share and distribute information and NFTs to their followers. This process will trigger smart contracts that give out token rewards.

Last year, multiple social media giants entered the web3 space such as Twitter, Meta, Instagram, TikTok, YouTube, and Reddit. They have started to compete for seed users of web3 through supporting NFT features and issuing NFTs. Some of them, including Reddit and 9GAG, have obtained great success, which will in turn encourage other social media giants to do the same.

Furthermore, web3’s native social protocols are booming as well. Web3 social platforms like Lens Protocol allow everyone to be the center of their own content distribution. With unified personal accounts and the complete freedom of personal data usage, social interactions are recorded in the user’s own ecosystem. Hence, NFTs will be a necessity of decentralized social platforms.

New consumer market to be created by “sports events + fan economy”

Looking back at the many touch points between NFTs and the sports industry in 2022, the latter has been actively exploring the business value of NFTs. Examples include the NBA’s new experiment in outsourcing + card sales (The Association NFT) and Sorare’s brand engagement + GameFi development. Compared to categories like GameFi and art, the collaborative marketing of the World Cup, sports superstars, and NFTs that took place in the second half of the year has demonstrated business opportunities to third-party distribution platforms.

After nearly five years of progression, sports event NFTs have evolved to a greater level and now cover various major sporting events around the world (FIFA, NBA, NFL, etc.). In the face of a high potential fan-based market, some developers have scrambled to capitalize, but how will traditional sports events and web3 create a new integrated consumer market? In 2023, perhaps we will find out.

Aside from this, NFTs are also reshaping the concept of “rights” and “ownership”. Event participation can be integrated with identity authentication, and NFTs quantify the concept of communities and groups in a traceable way, allowing for better distribution of rights and digital authentication.

For instance, you could launch a movie-themed NFT collection and all holders form a core community to get subsequent airdrops and special rights. You could select holders by SBT, and each SBT is obtained by the act of attending and buying tickets offline. These are recorded on the blockchain and are not transferable. Thus, behavior is able to be tracked and quantified. Likewise, rights and benefits can be better issued more accurately according to user behaviors. Ultimately, the community will be able to gather its most suitable members.

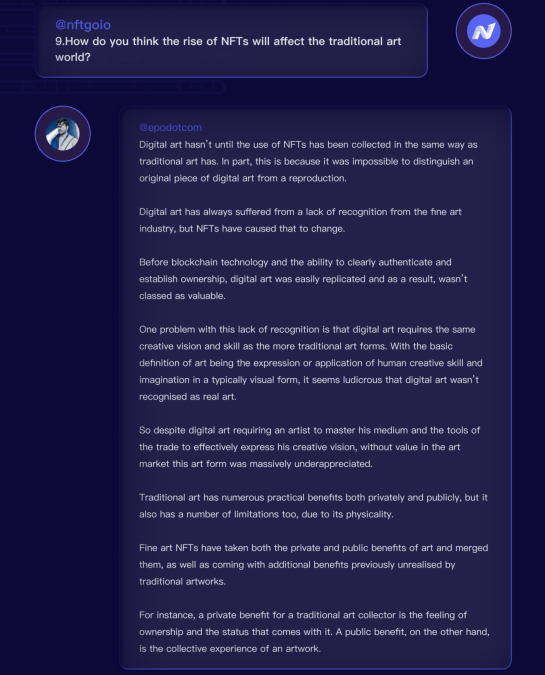

Generative art becomes the dominant collectible and revolutionizes the interaction between human and art

While the NFT market continues to be sluggish as the PFP narrative dried up in 2022, coupled with the crypto bear market, the digital art category, especially generative art, is seeing counter-trend growth.

NFTGo data shows that Terraforms by Mathcastles began to increase in floor price in August 2022, growing nearly tenfold at its December 2022 peak. On the other hand, in November 2022, Art Blocks launched a free mint of Friendship Bracelets by Alexis André to its holders. When the minting period ended in January 2023, the floor price was stable at around 0.5 ETH, with some rare ones reaching over 5 ETH.

A total of 38,431 NFTs were minted. Friendship Bracelets are not just visual experiences; the creators of the project have enabled consumers to interact with the NFTs — Terraforms holders developed their own creations based on Terraforms NFTs, while Friendship Bracelets creators taught holders how to weave an actual bracelet that resembles their NFT possessions.

In March 2021, Beeple’s EVERYDAYS: THE FIRST 5000 DAYS was sold for $69.35 million, making digital art the main driver of NFTs’ entry into public consciousness. As opposed to just changing the medium of drawing from paper to digital screen, generative art has a cryptographic nature, giving it endless application and interaction possibilities in the future virtual realm.

Art collecting has always been a niche discipline separated from the general consumer market and is deemed an “asset” as opposed to a “consumer good”. Entrepreneurs have been tirelessly trying to introduce artistic aesthetics, design, and rarity into the consumer market, hence the emergence of luxury goods, limited editions, and designer brands.

In the virtual world, generative art may become an equivalent of these luxury options — possibly to a larger market. This is because generative art possesses both aesthetics and rarity, and can be created at a lower cost, thus allowing for more price gradients. Additionally, generative art is free from the constraints of the real world, making it possible to interact with GameFi scenarios or the metaverse. Such possibilities will enable a wider and wilder imagination for the development of this niche.

Closing Thoughts

The NFT market endured a turbulent year in 2022. At the beginning of the year, we witnessed several trading booms in the market. However, in the second half of the year, a number of unforeseen and unpleasant events occurred, which changed many NFT believers into NFT doubters. History tells us that most innovations with asset attributes experience a period of inflation in their early stages. What comes after is the divergence of consensus, and ultimately, persistent investors.

Unlike short-term speculators, we, as constructors of the industry, are more concerned about the new improvements and innovations that NFTs have to offer compared to the existing ones. Will NFTs revolutionize the new and emerging industry led by web3? Nowadays, we are seeing more projects using NFTs as their foundation, and traditional industry giants are jumping onto the bandwagon as well. Most importantly, the public are gradually identifying themselves with NFTs. These changes have undoubtedly contributed to the growth of the industry and have strengthened our determination to explore the future of NFTs as this fascinating asset class evolves.