by @cryptokhan

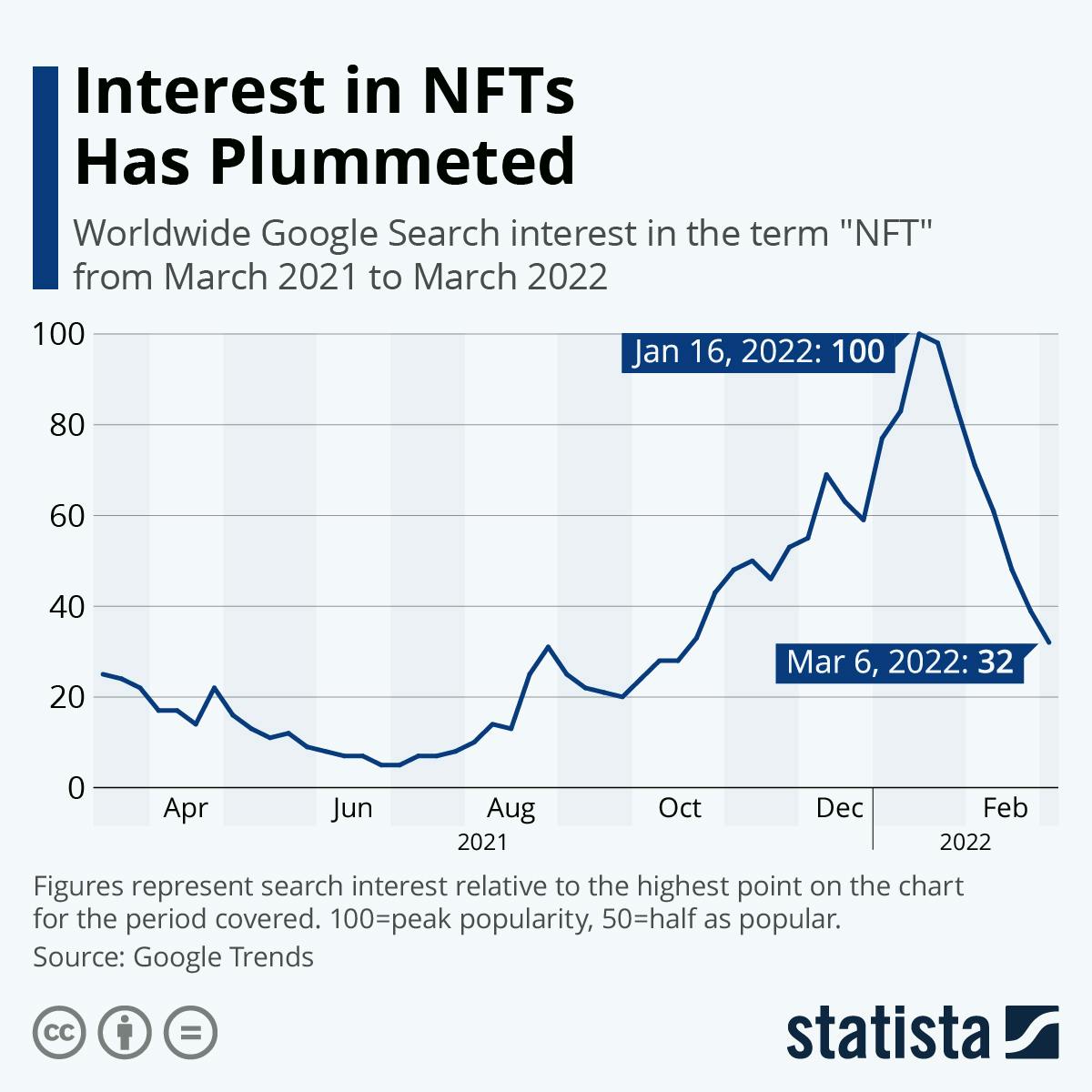

As headlines in 2021 bubbled with stories about pixelated images being sold for millions, the NFT bubble gently curated its eventual burst. Whether or not you liked the idea of a token, ape-like zombie-looking jpegs, a dog meme, or recordings of farts selling for outrageous figures, you were inundated with the news. The general consensus from the headlines was simple—NFTs are here to stay.

That soon changed. An NFT market that was bursting with energy earlier in the year began to see its value plummet. A general crash in the crypto market affected NFT sales. The market value of crypto art fell, and many speculators concluded that this was the end of the road for the nascent market.

Big Buys, No Gain

Many investors and Wall Street argued that the NFT bubble burst is just a sign of temporary distress in the market. Several signs point to the fact that this assertion may be untrue. The major signs of this burst include NFT prices falling drastically, a reduced transaction volume on NFT marketplaces, and low media coverage surrounding NFT sales.

First, DappRadar revealed a decline in overall trades and volume on OpenSea. In the past 30 days, the volume of transactions on OpenSea’s NFT market has decreased by 99% since the peak of NFT prices in May 2022. Remember that OpenSea is the biggest NFT marketplace, so success in this marketplace is important to the overall NFT market. OpenSea handled over $2.7 billion worth of NFT transactions in May 2022. Trading volume for NFT sales had fallen all the way to $9.34 million by the end of August 2022.

By the end of 2021, the average price of an NFT stood above $3,000. In January 2022, the trading volume of NFTs was worth $17 billion. That number crashed to $400 million by November last year.

Are Crypto Apes Dead?

The value of different NFTs has plunged to almost irredeemable prices. In August, the prices of some blue-chip NFTs, notably Bored Ape Yacht Club, were cut almost in half. As of right now, the floor price is 67.89 ETH, or around $106,347.65. Their Mutant Ape Yacht Club prices have also decreased.

The newly debuted Moonbirdson Solana were also impacted by the current crypto meltdown. The floor price fell to 12.5 ETH ($19,580.88)

In addition, there’s also a loss of trust in the market as hacks and phishing attacks have continued to riddle the market. Money laundering and wash trading are the two most common NFT-related crimes, according to blockchain analytics firm Chainalysis. According to the firm, in 2021, over $10 million was stolen.

The massive hype that came with the market could be likened to the Tulip mania that occurred in the Dutch Republic between 1634 and 1637. The fear of missing out that came with the cool ape profile pictures overshadowed its possible use cases. As soon as the inflated prices reached an inflection point, they began to fall.

People cite confirmation bias as the reason for the falling prices of NFTs. There’s an element of truth in this. However, what appears to be a colossal collapse is barely half of the full picture.

I think that NFTs are a 4-year-old technology that has been propped up like a new release of a limited edition Mercedes. People have only paid attention to NFTs for two years and many still don’t understand it. The technology needs time to reach its potential.

Pending the growth, volatility in the NFT market is an indication of its immaturity. A technology that hasn’t enjoyed a decade of growth is likely to suffer from lack of trust and negative sentiments.

Despite the above, it appears that the digital monkeys are the only things that are down. But the death of NFTs isn’t here, just yet.

A Cleansing Event?

The NFT industry is treating the wreckage that came with 2022 as a cleansing event. There’s a general consensus that the hype that came with the market in the past four years brought bad actors and tourists to the industry. While it was good for business, the industry needs to recast its focus.

Many don’t like NFTs. Some say it’s bad for the planet, and others argue that it’s an overhyped status symbol for celebrities. The dislike fuels the negative sentiments surrounding the conclusive death of the asset class.

For me, NFTs have exciting potentials that have been inspiring communities to converge around novel projects. The use cases that NFT offers far surpass the popular discourse.

Beyond jpegs and memes, NFTs’ potential in the gaming industry is battle-tested. NFT allows gamers to own in-game assets like character skins, weapons, and unique and rare items. Blockchain-based games like Axie Infinity, Splinterlands, and Alien World incorporate NFTs.

The potential is huge from a business perspective. According to Fortune,the global gaming market is projected to grow from $229.16 billion in 2021 to $545.98 billion in 2028, at a CAGR of 13.20% in the forecast period, 2021–2028.

Many traditional game studios have turned to the possibility of introducing NFTs in their games. For instance, Electronic Arts CEO Andrew Wilson referredto NFTs as a crucial component of “the future of our industry” in late 2021.

In the area of digital identity management, NFTs can be pivotal in the creation of traceable, trustless, immutable, and virtually verifiable identities. As passwords can be stolen, and biometrics hacked, data stored on the blockchain is publicly available and almost impossible to breach.

As the adoption of the metaverse grows, NFTs can enable a human-like seamless identity credential between the virtual and physical worlds. It will allow users to own their data, removing ownership and control from corporations and the government. Users can decide to sell or rent out their data to algorithms or advertisers.

In the area of fashion and e-commerce, NFTs can offer users a particular digital experience. NFTs can be used for the tokenization of a deed of ownership for a virtual property or clothes for an avatar in the metaverse.

Companies like Nike have created Swoosh, a web3 platform to bring Nike NFTs to their customers. On the platform, customers can buy shirts and sneakers for their virtual avatars. Since its launch, Swoosh has made over $90 million in sales.

Also, Fortnite’s annual billions in revenuedemonstrate that people are willing to pay for clothes in the virtual world.

In fact, despite scathing reviews, monkey NFTs are still selling. The Bored Ape Yacht club still remains prominent in the NFT industry. There are still many worth over $100,000. In November 2022, Bored Ape Yacht Club NFT #232 sold for 800 ETH (or about $927,000).

End Of The Road?

The difficulties currently faced in the NFT market will be overcome, creating a more robust ecosystem of projects that will radically alter our way of life. McKinsey & Company projected that by 2030, the metaverse would probably be valued at $5 trillion. What is the major building block of the Web3 metaverse? NFTs. Another study predicted that the NFT sector would be worth $230 billion by 2030.

I predict that the battle-tested technology is bound to democratize how digital assets are bought and sold

With regulators closing in on cryptos, NFTs are laying the building blocks for the next generation of innovative products. The nascent industry may seem to be in distress, but a bubble burst doesn’t mean annihilation.