From DEX Offering Raises to Security Token Offerings, Learn the Pros and Cons of Each Method

by Russian Defi

There are several fundraisers in the space. Every week, you may see us bring our weekly fundraisers to Illuminati; however, knowing what types of raises are occurring can often come with some challenges.

DEX Offering Raises🎯

Decentralized finance often confuses a large portion of the crypto economy due to the technicalities. However, how you can raise capital in defi differs in many ways, and there are a range of methods that protocols/projects may adopt to achieve this goal of fundraising.

IDO – Initial DEX Offering 💸

Many of us may already be familiar with IDOs if you have entered any pre-market investment round; it’s one of the events in which you may look forward to getting a rough idea of the price of your asset on the market.

However, for those who may not know what an IDO is –

An IDO is an “Initial DEX Offering”, which means that it’s a way in which teams allow investors to buy their newly listed token through a decentralized exchange.

Decentralized exchanges are on-chain platforms that distribute holders’ wallet keys to them, giving full ownership of the token to the holder rather than having the token stored on the exchange by a centralized party that may lock your funds, as we have seen recently with FTX.

Usually, the IDO allows investors to lock their funds in a smart contract, which is often seen as a more attractive outlook for investors as it gives them access to immediate liquidity and immediate trading. However, there can be difficulties. The main aim of an IDO is to raise funds from retail investors by giving them access to cheaper tokens than in the later stages of the project’s lifecycle.

IDO PLATFORMS: DAO Maker, Polkastarter, BSC Pad, Pancakeswap & Uniswap

Projects may choose to use different IDOs to distribute tokens at a fair price while still managing to raise funds from a large pool of investors.

IBCO – Initial Bonding Curve Offering🤜🤛

As we know, even though we strive for true decentralization, this isn’t always the case, meaning not everything is as fair as it seems. It might seem like an excellent opportunity to invest in IDOs, thinking you are early when investors are already waiting to dump on you.

Therefore, a new concept that has been rationalized is IBCOs.

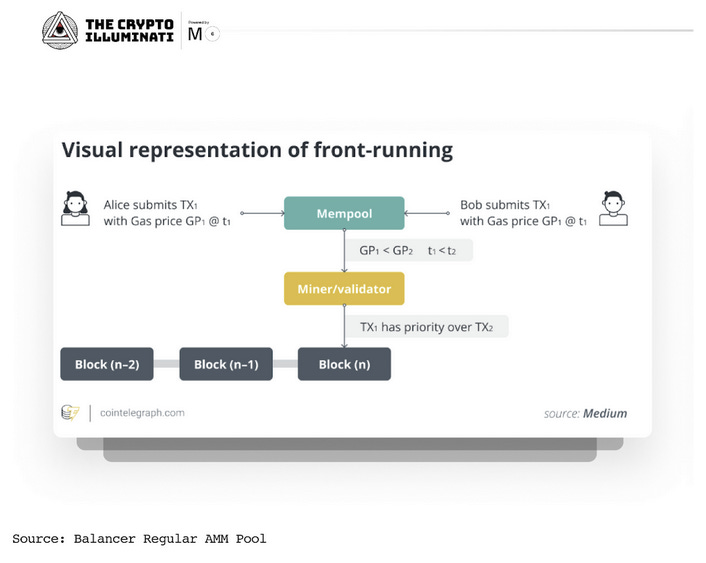

IBCOs are meant to prevent investors from practicing front running. Front running is when you place a transaction on a blockchain in a queue, knowing that a future transaction is pending on the block from which you can secure a profit.

To counteract this, IBCOs are designed so that when investors put more capital into the bonding curve, the token price will increase from the initial value. You may think, “but the people who invest first will get cheaper tokens”?

This method of raising is concluded through investors paying based on the FINAL settlement price. It doesn’t matter when you contribute, as investors receive a portion of the token allocation based on the share of capital contributed.

Projects That Have Concluded IBCOs –

LBP – Liquidity Bootstrapping Pool💧

A method of fundraising that projects may use that isn’t as familiar to some of us is LBPs.

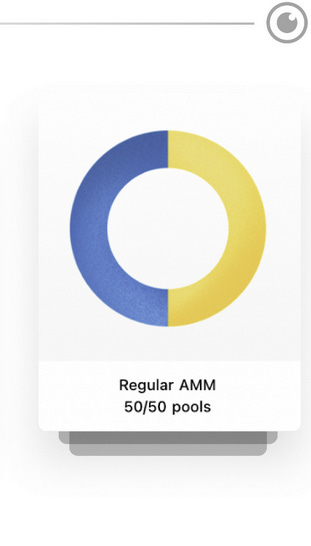

Balancer is an automated portfolio manager and trading platform built on Ethereum. Using Balancer’s smart pools, LBPs is a method that projects may adopt to sell tokens through a configurable AMM (automated market maker).

These pools often have a split between the token that the team is attempting to raise for and another collateral token that is USUALLY a stablecoin like $USDT/$USDC/$DAI.

Example Of AMM Smart Pool

The people who control the LBPs can change the parameters that it relies on, such as; Pausing Swaps, Decline Price, and Keep Price Relatively Stable.

LBPs are an effective way for projects that want to host a token sale while building liquidity.

STO – Security Token Offering 🚨

As there has been a primary focus on crypto projects being scrutinized as securities by the likes of the SEC, it made sense to cover ways in which projects can offer security tokens to raise funds.

An STO is the distribution of a crypto ‘security’ token that represents an entitlement to either a stake within the project or a % of profits from that project. The exchange is Investor X’s contribution to Project X’s reward.

This works hand in hand with the concept of tokenization which fuels the crypto movement as a whole. Equity, in many ways, can be tokenized, and an STO represents that.

As you can already imagine, this can be perceived as a method favored by institutions to enter the blockchain space as it offers a sense of real-world securities into blockchain tokenization with; Equity Tokens, Debt Tokens & Asset Backed Tokens.

ICO – Initial Coin Offering 🪙

Going back to the grounds of familiarity for some of us is the infamous ICO many of you around the crypto economy may or may not have heard of.

ICOs are one of the most common methodologies for fundraising as they are the crypto counterparts of IPOs (Initial Public Offerings) in TradFi markets.

Probably causing the burst of the 2017 bubble, ICOs give grave details on information through whitepapers or pitch decks detailing; tokenomics, aims, objectives, team members & industry research.

ICOs have a range of rounds with different token prices and vesting schedules, offering the earliest investors opportunities to get in as early as possible. Most projects underwent an ICO phase as, once again, it’s one of the most common crypto fundraising methodologies.

The ICO Craze In 2017🛁

As I wasn’t around in crypto in 2017, I can only reference the extent of my knowledge of what happened that year. Essentially, we saw a massive shift of focus onto the $ETH ICO craze, where there was a significant demand from investors for investing in startups before they were on the market. The way an ICO is conducted.

As we know today, this “spray and pray” tactic doesn’t always bode well. Investing in startups is incredibly risky as you are assuming an idea presented to you by a pitch deck/team without any guarantee that it will work or even launch on the market in some cases.

In 2017, we saw an EXPLOSION of ICOs on the Ethereum blockchain, housing over 800 ICOs, raising an estimated USD 20 billion, which was on the receiving end of the BRUTAL bear market, which went on for multiple years.

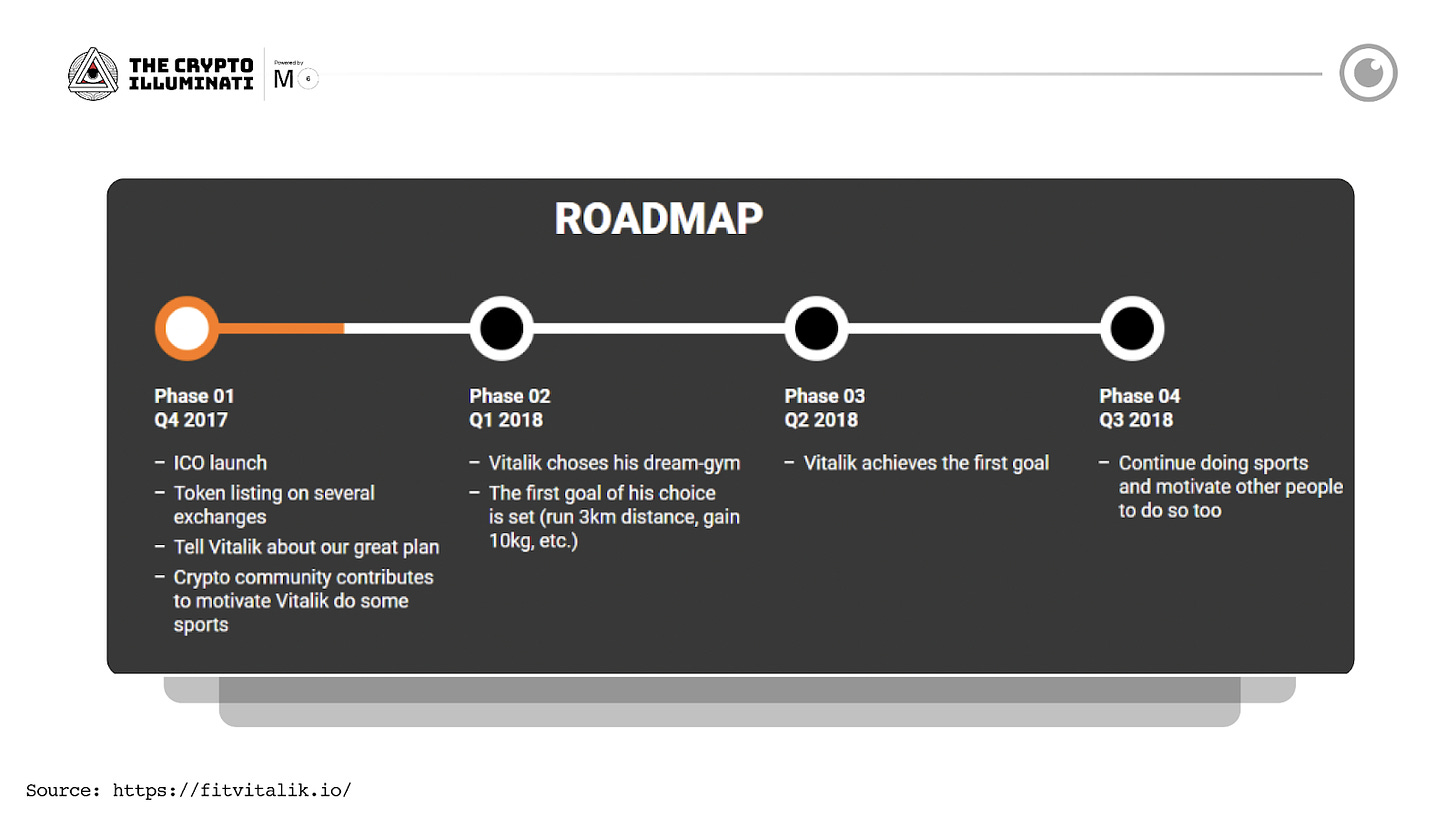

This method may have proved fruitful during the bull run; however, as we know, that doesn’t last forever, and many investors in those projects held their tokens into oblivion. Here is an example of a roadmap from a 2017 ICO.

As you can tell…🤡

Final Thoughts 🤔

With the amount of data that flows through every week aggregating and analyzing the raises in the market, there should be a widespread emphasis on providing the correct information to assist with using the data to the best of your ability.

Not every project may hold an ICO, which may impact the price, distribution, and overall sentiment toward projects, which is why it’s essential to know the differences.