SBF Bahamas Hearing

Just before the hearing in the United States, SBF was finally arrested in the Bahamas, and SBF himself attend a hearing in the Bahamas. SBF’s parents stopped their jobs at Stanford to come to the Bahamas for the hearing. In the meantime, the current CEO and restructuring officer of FTX, John Ray III, spoke all the secrets frankly in a hearing held in the United States.

SBF was finally arrested, but what is puzzling is why Did the Bahamas decide to arrest SBF just right before the U.S. hearing?

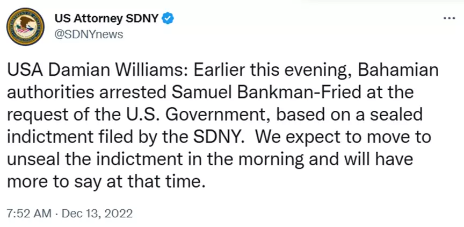

The video of SBF being arrested shows he is wearing a black suit with a white shirt, which is more formal than his previous interview clothes. The Bahamas responded that they arrested SBF in response to the request of the US government. The Bahamas said that after receiving the official notification from the United States, it will cooperate with the extradition of SBF to the United States for trial. In addition, Prime Minister Philip Edward Davis of the Bahamas said: The interests of the Bahamas and the United States are the same.

During the hearing in the Bahamas, SBF told the judge that he had been a vegetarian for a long time, and the local prison is unable to provide him vegetarian diet. In addition, SBF said that he suffers from long-term depression, insomnia, and ADHD, whether he can use 250,000 US dollars to post bail, and then wear an electronic anklet, stay indoors, and report to the police every day. The judge said NO to SBF since he has a significant absconding risk, and suggest SBF take medicine directly from his parents.

SBF is currently being held in Foxhill, the only prison in the Bahamas. Next year, on February 8, 2023, the extradition hearing for SBF will be held, to discuss if he should be sent to the United States for trial. This is the charge of the Bahamas side.

The United States prosecutes SBF for both criminal and civil offenses. The indictment of the Southern District Court of New York states that SBF is charged with conspiracy to commit money laundering, conspiracy to commit wire fraud on customers and lenders, conspiracy to commit commodities and security fraud, and separate wire fraud on customers and lenders. Each of these eight criminal indictments can be sentenced to a maximum of 20 years, all add up to a maximum of 115 years in prison.

In addition, the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission also filed a civil lawsuit against SBF. The civil accusation is that SBF has been planning fraud through the FTX exchange for many years. Since May 2019, it has raised more than 1.8 billion US dollars, when SBF introduced this investment project, he told investors that FTX is a safe and responsible platform. Subsequently, SBF embezzled the deposits of FTX.com without customers’ authorization, paid them to Alameda Research, a quantitative trading company, and even falsely reported the financial status of Alameda Research. If SBF had not been arrested by the Bahamas, he should have attended the hearing in the United States online on Dec. 14th.

Forbes obtained draft testimony from the SBF to Congress:

SBF said: He feels that John Ray III, the new executive of FTX, is simply trying to profit from the whole thing of FTX bankruptcy, he is not here to help. SBF said during the progress that he applied for bankruptcy and reorganization of FTX, many others pressured him, including the General Legal Counsel of FTX US. He believes these people are trying to profit from the bankruptcy. Therefore, FTX was forced to quickly file for Chapter 11 bankruptcy in a short period of time. SBF believes that these people are replicating Enron’s bankruptcy case, taking advantage of the legal failure to benefit from it. In addition, SBF said that he tried to contact John Ray III, he sent 5 emails to him, but John Ray III never respond.

FTX Group U.S Hearing(John Ray III)

SBF was supposed to attend the hearing of the US Congress on the 14th online but was unable to attend because he was arrested in the Bahamas. FTX’s new chief executive and restructuring officer, John Ray III, attended this hearing.

Senator Ann Wagner:” Mr. Ray, Mr. Bankman Fried has apologized for “mistakes” he has made. based on your review, is there a way to know if the transfer of FTX customer funds to Alameda research was done by mistake?”

John Ray III:” I don’t find any such statements to be credible. I accept the position of chief executive officer of FTX in the early morning hours of November 11. It immediately became clear to me that chapter 11 was the best course available to preserve any remaining value of FTX. Therefore, my first act to CEO was to authorize the chapter 11 filings. I’ve implemented a five-part bankruptcy plan.”

Later, John Ray III was asked how long it would take to complete the five-part bankruptcy.

reorganization plan. John Ray III suggested that it was not something that could be resolved in a few days, but they will report on the progress of their asset liquidation each week.

John Ray III: “I detailed in my written statement, our overarching objective is to maximize value for FTX, customers, and creditors so that we can mitigate the suffering by so many. The FTX group collapse appears to come from the absolute concentration of control in the hands of a small group of grossly inexperienced, no-sophisticated individuals who failed to implement virtually any of the systems are controlled, they are necessary for a company entrusted with other people’s money or assets. Some of the unacceptable management practices I identified so far include the use of computer infrastructure that gave individuals and senior management access to systems that stored customer assets, without security controls to prevent them from redirecting those assets. Storing certain private keys, to access hundreds of millions of dollars in crypto assets without effective security controls or encryption. The ability of Alameda to borrow funds out of FTX.com, to be utilized for its own trading or investments without any effective limits whatsoever. the commingling of assets lack of complete documentation for transactions evolving nearly five hundred separate investments made with FTX group funds and assets, in the absence of audited or reliable financial statements. The lack of personnel and financial risk management functions and the absence of independent governance throughout the FTX group. A fundamental challenge we face is there were many respects starting from near zero, in terms of corporate infrastructure and record keeping that one would expect in a multi-billion-dollar corporation.”

John Ray III said that during the four weeks he took over the company, the problem he faced was that since FTX was founded, there were no documents to record these billions of transactions. In addition, these were all cryptocurrency transactions, so he felt that the technical problems are major. even now, he thinks the whole process is in its very early stages.

He’s cleared with a few things:

John Ray III: “first, customer assets at FTX.com were commingled with assets from the Alameda trading platform.

Second, Alameda uses client funds to engage in margin trading which exposes customer funds to massive losses.

Third, the FTX group went on a spending Binge in 2021 and 2022, during which five billion dollars was spent on a myriad of businesses and investments. Many of which may only be worth a fraction of what was paid for them.

Fourth, loans and other payments were made to insiders, in excess of 1.5 billion dollars.

Fifth, Alameda’s business model is a market maker, required funds to be deployed to various third-party exchanges, which were inherently unsafe.”

Margin trading is supposed to use the funds provided by a third party, which will magnify the result of asset trading. When the position is facing liquidation, the margin must be increased to ensure that the position will not be forcibly liquidated. However, Alameda’s position in FTX was privileged at the time and would never be liquidated, so if the price keeps falling, there will be no additional assets as margin, and it will fall infinitely. In addition, it was mentioned in the hearing that if SBF borrows money from FTX, no records are required.

Ann Wagner: “Mr. Ray (John Ray III), you have compared FTX as worse than Enron. Can you please elaborate on some of the specific ways FTX is worse than one of the largest corporate frauds in history?”

John Ray III: the FTX group is unusual in the sense of a dozen large-scale bankruptcies over my career including Enron. Every one of those entities had some financial problem or another. They have some characteristics that are in common, this one is unusual and it’s unusual in the sense that literally there’s no record keeping whatsoever. Employees would communicate invoicing and expenses on Slack, and they (FTX) use QuickBooks (a “junior level” accounting SaaS).

John Ray III adds that he does not underestimate accounting software such as QuickBooks, but because QuickBooks is a “junior level” accounting software that has been on the market for over 20 years. As introduced on the QuickBooks official website, the software is suitable for small businesses such as small restaurants, small grocery stores, etc. However, as a company with a peak market value of more than 30 billion U.S. dollars, FTX uses QuickBooks to keep accounts is very unbelievable.

John Ray III: “there’s no independent board (in FTX), we had one person really controlling this. No independent board that’s highly unusual for this size of the company and it’s made it all more complex because we’re not dealing with widgets or something that’s tangible. We’re dealing with crypto, and the technological issues are made worse when you’re dealing with an asset such as crypto.”

Senator Ann Wagner then asked John Ray III if SBF said publicly many times that the assets of FTX US were sufficient. SBF said that American users could get back 100% of their assets in theory. According to what John Ray III has learned, is SBF’s statement true?

John Ray III suggested that funds are mixed up with FTX.com, FTX US, and Alameda Research. It is not yet clear whether the US users, the international users, or creditors should be paid first. They are verifying the address and source of the wallets one by one to determine the ownership of the funds. At present, many wallets have not been found, and many assets that they do not know have not yet been discovered.

In addition, according to the hearing, withdrawals in the Bahamas began 24 hours ahead of FTX’s filing for bankruptcy.

John Ray III: “the accounts were unfrozen just in the Bahamas over 100 million dollars was released to approximately 15,000 customers in the Bahamas, and then the door was closed about the time of our chapter 11 file. There were communications between Mr. Beckman Fried and the Bohemian government, specifically related to this leakage of assets.”