The Big-Three players are jockeying for position amidst a hazy regulatory environment

by Chris Powers

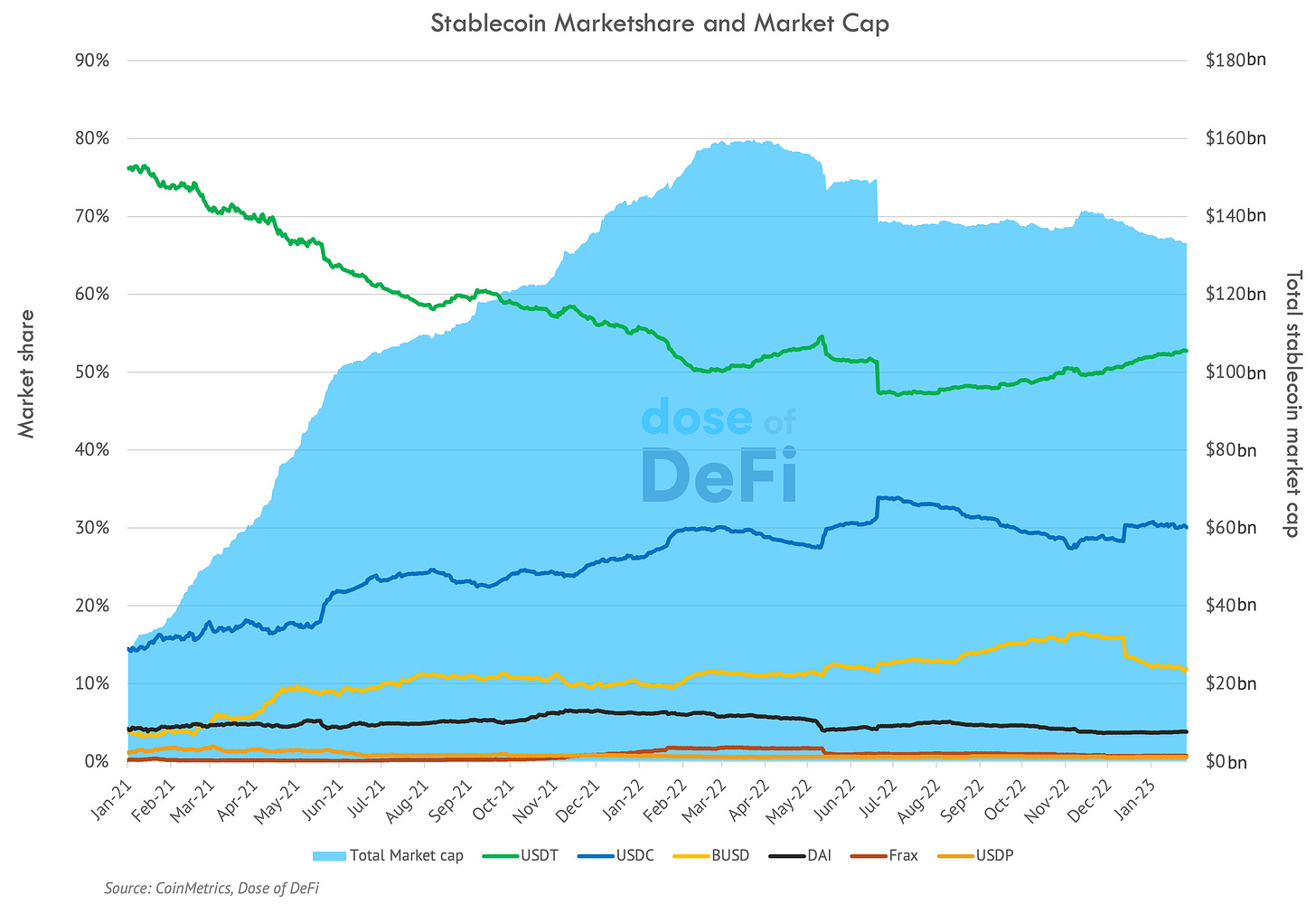

The stablecoin market is simmering down after a tumultuous year. Stablecoins are arguably crypto’s most successful product, or at least the one with the easiest path to mass market adoption. A huge boom started at the end of 2020, as more experimental algorithmic stablecoins popped up with a promise of being a perpetual stability machine. They attracted deposits with high yields through token emissions, and easily bootstrapped liquidity to other stablecoins through Curve pools. Many algorithmic stablecoins since failed, but none more spectacularly so than the $40bn collapse of Terra.

While this has caught the attention of policymakers around the world, to us, there are two more important stories. First, the rise of the Big Three (USDT, USDC and BUSD) and the scramble to draw competitive battle lines. Second, the emergence of a handful of much smaller on-chain competitors that are still innovating in product design.

On top of these competitive and regulatory dynamics, the market for stablecoins has shifted dramatically. The recent high interest-rate environment represents a huge revenue opportunity for centrally-issued stablecoins, but also lowers the appeal of on-chain stablecoins, with more attractive yields available in TradFi.

All in all, stablecoins are likely to continue to be the tip of the crypto spear in terms of penetration into traditional finance and global payment networks. Regulatory pressure will tighten, but it’s hard to see how a cohesive regulatory structure could emerge anytime soon (from Washington D.C. anyway). The most interesting aspect – at least to us – continues to be the on-chain innovation that stablecoins have the power to unlock in credit markets, as well as the emerging opportunities in programming and tokenization.

Regulatory response and the arrival of the Republicans

Last year was a tough one for crypto investors. The average investor impact from the huge drawdown in asset prices pales in comparison to those who lost all (or nearly all) their funds in Terra, 3AC, Celsius, or FTX. And these days, what happens in crypto doesn’t stay in crypto; regulators and politicians quickly jumped on these failures as an opportunity to introduce more stringent regulations.

Washington D.C. has also gone through a big change. After the most contentious vote for Speaker of the House since the Civil War, Republicans finally took control of the House of Representatives after winning the midterm elections. Typically seen as the more pro-business party, the Republicans are likely to push back on calls for stricter regulation – though these days it’s hard to understand where their support lies.

For stablecoins, this means that comprehensive regulation is unlikely to arrive in this congressional term. Furthermore, with control of the House, Republicans now oversee committees, which have subpoena power. Here’s a run down of who’s who: the previous chair of the House Financial Services Committee, Maxine Waters (D-CA) – who as an aside had an oddly close relationship with SBF – introduced a restrictive stablecoin bill in 2021. The new chair, Patrick McHenry (R-NC), has criticized SEC Chair Gary Gensler for his regulation-by-enforcement approach that is “stifling American innovation”. McHenry is also creating a new subcommittee on digital assets, chaired by French Hill (R-AR). The biggest crypto advocate in Washington is Tom Emmer (R-MN), who has now become the House Whip (the third most powerful member of the House). He recently tweeted “gm” and openly praises the value of decentralization and the ownership economy.

The establishment of the Big Three

No one is watching this political saga unfold more closely than the three largest stablecoins (USDT, USDC, BUSD), which are already lightly regulated. Each of them has blocked transactions to certain addresses at the request of the US government. USDC and to a lesser extent BUSD (or Paxos) has been calling for more stablecoin regulation, seeing it as a way to assuage fears from institutional investors, and distance themselves from “stablecoins” like Terra. A vanilla stablecoin bill that regulates the assets that large stablecoin issuers can hold is the only thing we can imagine coming out of D.C. this term. Still, regardless of how that shakes out, the battle amongst USDT, USDC, and BUSD is shaping up to be a much broader clash of empires.

Tether (USDT) is the OG stablecoin, with roots tracing back to 2015 on the Bitcoin sidechain Omnichain. It’s still the market leader, but that lead has shrunk, from 75% market share to just over 50%. Unlike USDC and BUSD, it hasn’t bent over backwards to please US regulators. Yet given its core reliance on the dollar banking system, it doesn’t have much of a choice but to comply with their rules. Tether also has a more limited redemption user base. BUSD and USDC both allow almost any user that KYCs to redeem stablecoins for dollars in their bank accounts. Tether, meanwhile, excludes US retail investors and has a 0.1% fee for redemptions (max $1,000) plus requires redemptions to be over $100,000. This means its peg is enforced by large market makers and exchanges.

USDC aims to wrap itself in the American flag as much as possible. Some see its best case scenario as literally becoming the official US digital currency. No word yet as to whether the US government does acqui-hires. Since the beginning of 2021, USDC has consistently chipped into Tether’s lead until topping out around 30% market share in the last six months. USDC is hoping that as crypto professionalizes, institutional investors will come to prefer it over its offshore competitors. It’s not a bad bet. USDC is also less focused on CEX trading than USDT or BUSD. Instead, it has focused more on payments as well as plans for a Cross-Chain Transfer Protocol, aka a centralized bridge across the nine blockchains with USDC issuance.

BUSD is technically a US-based stablecoin. It’s owned by Binance.us and managed by Paxos, but they all serve fealty to the behemoth of Binance, which no one knows what jurisdiction it falls into.

Binance clearly sees a stablecoin as a fundamental element of its overall business, as shown by its announcement in the fall that it would “auto-convert” USDC on Binance to BUSD. Binance has not done the same to USDT, which is in seven of the top-ten pairs on Binance by daily volume.

Are these just money market funds?

The stablecoin business was very simple when interest rates were close to 0%. Some may have reached for yield (most notably Tether), but there was no expectation that this yield should be passed on to stablecoin holders. The massive rate hikes by the Fed and other central banks in 2022 reversed the yield opportunities for stablecoins. Previously, investors were willing to hold stablecoins instead of dollars in a bank because they could extract more yield on-chain. But now, deposit rates on Compound and Aave are around 2%, whereas even a US retail investor can get close to 4% interest in a bank savings account.

Centrally-issued stablecoins like USDT, USDC, and BUSD will need to figure out how to pass on some of this yield, whether to its largest users, or smaller players like Ondo Finance, which offer regulated, tokenized versions of traditional securities. These products are for accredited investors only, and while they have a minimum $100k purchase price, a 4.7% on-chain yield backed by short-term US government debt is very attractive.

We could easily imagine USDT and BUSD following in the footsteps of USDC and its parent company Coinbase, which now gives 1.5% interest to MakerDAO for all of the USDC it uses in its Dai peg-stability module (PSM). Other on-chain projects need fiat stablecoins for backing, so it’s not hard to envision more negotiated interest-sharing agreements between centrally-issued stablecoins and on-chain DAOs.

What does the future hold?

At this point in stablecoin market development, it might seem like a natural point for acquisitions or consolidation. Shareholders may decide it’s not worth spending money to undercut competitors and call a truce (like Uber did with Didi in China).

Yet it’s hard to imagine it playing out like that amongst the Big Three stablecoins, because each is the currency of a broader crypto empire. BUSD’s benefactor, Binance, is one of the largest private companies in the world and has maintained a 70%-plus market share lead on spot trading for years. It’s not going to wave the white flag anytime soon. Tether is owned by a holding company that also owns Bitfinex, which used to be a top crypto exchange, but now the cart is driving the horse. There could be a chance that Binance acquires Tether and Bitfinex, then offering BUSD to US investors and Tether to everyone else. Possible.

In our view, USDC is underrated in this matchup and not because of its Captain America schtick, but because USDC is the most widely used stablecoin in DeFi. It has the highest volume of any stablecoin on Uni v3 (three times more than USDT). USDC has more stablecoin deposits in Compound and Aave than BUSD and Tether combined. Binance has found success with DeFi on BSC, but its top BUSD pair (WBNB/BUSD) would be 39th if it were ranked against BUSD pairs on Binance, the centralized exchange. USDC, meanwhile, had a higher 24-hour volume in the Uni v3 WETH/USDC pool than the ETH/USD pair had on Coinbase, which owns half of USDC.

If the future is on-chain, then Tether and BUSD will one day be playing catchup to USDC. That begs the question as to whether stablecoins backed on chain (Dai, Frax, LUSD, etc) will have a leg up on USDC and the rest of the fiat-backed stablecoins. Look out for next month’s part two deep dive, where we explore that question and more.