Terawulf’s newest nuclear-powered Bitcoin miner in Pennsylvania isn’t the firm’s first attempt at going green.

by Tim Hakki

In Northeast Pennsylvania, a unique Bitcoin mining experiment is about to come online.

Called Nautilus, Terawulf is spinning up a nuclear-powered mining facility.

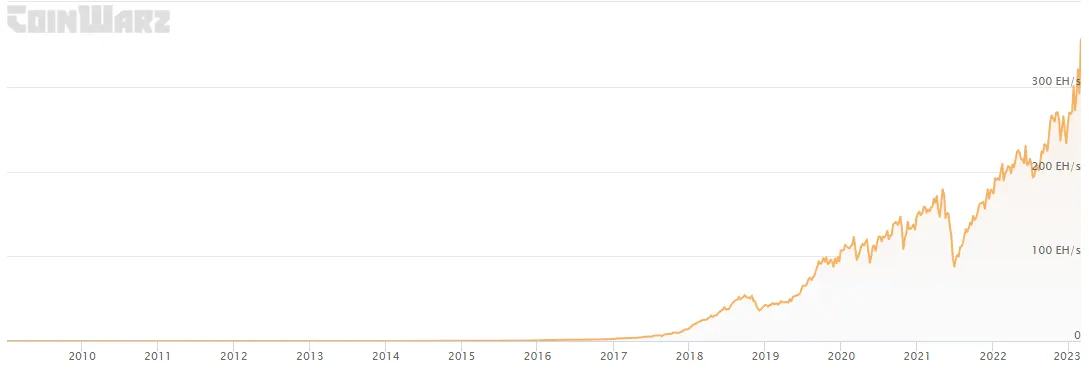

First announced back in 2021, Terawulf said that when Nautilus is at full capacity later in Q1 this year, the facility’s fleet of 15,000 mining rigs will have a hash rate of 1.6 exahashes per second (EH/s). That amounts to 1.6 quintillion hashes every second, or about 0.54% of the total computational power of the entire Bitcoin mining network today, which is currently running at 294.09 EH/s.

More importantly, though, none of this new mining capacity will be powered by fossil fuels, potentially addressing years-long criticism of the premier cryptocurrency.

Bitcoin uses a proof-of-work (PoW) mining algorithm to validate transactions and secure the network. Miners, or computers optimized for verifying transactions and getting rewarded in Bitcoin, currently consume around 117 terawatt hours a year—the equivalent of a small country.

This figure doesn’t look like it will be slowing down anytime soon, either, as miners continue to deploy updated machines and even whole new fleets. The amount of global computing power used to mine Bitcoin, understood as hash rate, has been on a steady rise since 2016.

It’s not just miners watching this chart, either. With roughly 62% of the current energy mix powering all those machines coming from fossil fuels, regulators are taking note too.

Just last year, New York signed a two-year moratorium banning any new fossil-fuel-powered Bitcoin miners to set up shop within state boundaries. A similar proposal targeting proof-of-work (PoW) mining was also put before European lawmakers, who comfortably voted it down.

When asked if he had any concerns about a regulatory clampdown on PoW-based mining, Terawulf’s co-founder, CTO, and COO Nazar Khan told Decrypt that he hopes “they take input from people like ourselves.”

Terawulf takes aim at green Bitcoin mining

Founded in 2021 by Nazar Khan and Paul Prager, who were senior executives of Beowulf, an energy infrastructure company Prager had launched in 1990, Terawulf pitched itself as a “leading sustainable Bitcoin mining company.”

When he began learning more about crypto in 2017, Khan had already spent over twenty years developing and operating power-generation facilities in the U.S. and abroad.

“Once I started to understand how Bitcoin mining worked, it was clear to me that efficient and economic Bitcoin mining was heavily dependent on infrastructure and the cost of energy,” Khan says of his early days networking with miners.

“Pick the name of a Bitcoin miner and I’ve probably talked to them at some point, trying to find a way to work together,” he told Decrypt. “I said, ‘hey, I know power, I know energy, let me find someone who knows Bitcoin mining.’ It became very clear to me that the level of sophistication in the space around energy, energy procurement, and development was very low.”

A year before founding Terawulf, Khan’s team had also completed the construction of a large-scale facility for Marathon, one of the world’s largest mining companies.

This collaboration was followed by a call from energy company Talen, whose subsidiary, Cumulus Data, had built a data center adjoining the parent company’s 2.5 gigawatt Susquehanna nuclear power plant to host Bitcoin mining operations.

Thus, Nautilus was born.

Add Nautilus’ stats to the projected 3.8 EH/s capability of Terawulf’s hydro-powered Lake Marina facility on the western side of the state of New York and it’s clear that Terawulf will have one of the biggest Bitcoin mining operations in the world, powered almost exclusively by renewable energy.

But it’s about more than crypto miners tapping into abundant clean energy.

Khan said how the Terawulf team’s long experience in energy infrastructure can also help make operations like Nautilus and Lake Marina reliable consumers of Talen’s excess renewably-sourced electricity, but also responsive assets for local electrical grid operators.

The term “asset” broadly refers to mining farms that are both useful to have on a grid, and intangible assets to energy providers, offering high customer lifetime value (CLV)—essentially the value derived from having regular, dependable customers—thanks to their strategic locations that can keep energy prices low.

It’s all about location

In 2016, Beowulf parent company Riesling Power LLC bought a decommissioned coal plant in Somerset, on the western side of New York state. The Paris Agreement had been signed in New York City the previous year, leading to a 76% reduction in plans for new coal plants across the globe. The team knew they were essentially buying the plant to retire it.

The plant was integrated into the state grid through a network of transmission lines—those thick cables you see held up by imposing towers along global motorways. When it was operational, the transmission lines were rigged to move 700 megawatts of power out of the plant and onto the grid.

Due to Khan’s professional background in energy infrastructure, though, he knew Terawulf could just as easily move 700 megawatts of power into the site to feed a fleet of Bitcoin miners. https://decrypt.co/cryptocom/bitcoin

Khan then began sourcing energy for the site and found that the local zone (Zone A) of the grid—which is controlled by a not-for-profit company called the New York System Independent System Operator (NYISO)—produces “about four to five gigawatts” of power drawing from primarily renewable sources, namely hydroelectric power.

By March 2022, Terawulf’s first Bitcoin mine was operational: Lake Marina.

Of that five gigawatts, local demand only soaks up “a gig or a gig and a half” leaving an excess generation of more than three gigawatts to be conducted by transmission lines across the state, mostly to feed the Big Apple’s energy demands, known to the power industry as the “New York City load pocket.”

Knowing local energy demands is key for strategically placing mining plants. If you position massive electrical loads in areas of high demand, you’re not only going to get high prices, you may drive them up further.

“Bitcoin mining is one of the most efficient and economic load sinks around,” Khan explained. “We’re locating our loads in places where there’s high electricity supply and not much demand, so we can be a ‘sink’ to soak up energy at attractive prices while providing a way to sell electricity in places where there typically aren’t many buyers.”

Location is everything, but even more so for renewables. Nuclear reactors and hydroelectric plants don’t stop generating, and these facilities sometimes run for years without stopping.

And just as not having enough energy can cause rolling blackouts, like what was seen in Texas last year, having too much energy can be just as dangerous for a grid.

Herein lies another potential advantage of well-placed mining outfits.

They can turn machines off almost instantly during high demand or skim off excess energy from a grid when there’s a high supply.

Grid operators’ minds blown

The grid is designed to meet peak demand plus a margin, but it only hits peak demand for 50-100 hours a year, says Khan.

That’s generally not something to worry about for a mining farm soaking up abundant clean energy in a low-demand area, but if the grid gets too heated, Terawulf’s mines—and Bitcoin mines in general—can drop their demands in seconds.

This is thanks to a tool at grid operators’ disposal called Automatic Generation Control (ACG). ACG adjusts the output of generators at different power plants in a given area of the grid to maintain a balance between generation in a given area (the power produced) and electrical load (the power consumed).

If a grid operator needs to add 15 or 25 megawatts to an area where the load is tight, Khan explains, they send a signal to a power plant in an area with excess generation to tell it to come down. In other words, when operators need to add generation to an area, they have to bring it down somewhere else.

Typically, ACG has a 15-minute response time, so from the moment the grid operators send the signal to the plant to the moment the plant has achieved its satisfactory level, a quarter of an hour has passed.

For Bitcoin mining, the response time is more like fifteen seconds.

“[Grid operators’] mind is kind of blown when they think about it,” said Khan. “We have a load that’s responsive in 10, 20, 50, 100 megawatts in less than a minute, and you can bring it back up just as quickly. That kind of responsiveness is unheard of, and when operators understand how responsive we can be, they’re enamored with it.”

This rapid response time is due to the fact that a typical top-of-the-line Application-Specific Integrated Circuit (ASIC) or mining machine can be turned off in less than a minute, making even a fleet of them more responsive than a nuclear generator.

The signal to turn off can also be scheduled a day ahead or in real time with no difference in the ability of the electric load to respond. This isn’t the case with most industrial-scale loads.

Seen this way, miners like Terawulf emerge less as pioneers of green crypto mining, and more as another tool that grid operators can turn to maintain a delicate balance of supply and demand.

Miners can change their needs on a dime, soaking up excess energy when there’s a glut of energy, or turning their machines off in the case of higher demands elsewhere.