On factors driving the emergence of digital assets, challenges to mainstream adoption, and forecast of progress in the coming years.

Contents

- Introduction – Overview of industry report

- Proof in the Numbers – Statistical look at current crypto adoption rates

- Missing Links – Addressing roadblocks to mainstream cryptocurrency adoption

- Players Behind the Coins – Inside the key actors shaping the future of money

- Cracking the Hype Cycle – Requirements for cryptocurrency to reach the masses

- On the Horizon – Outlook of key trends and developments shaping digital finance

- Conclusion – Final takeaways of industry report

- Resources – Works Cited

Introduction

Overview of industry report

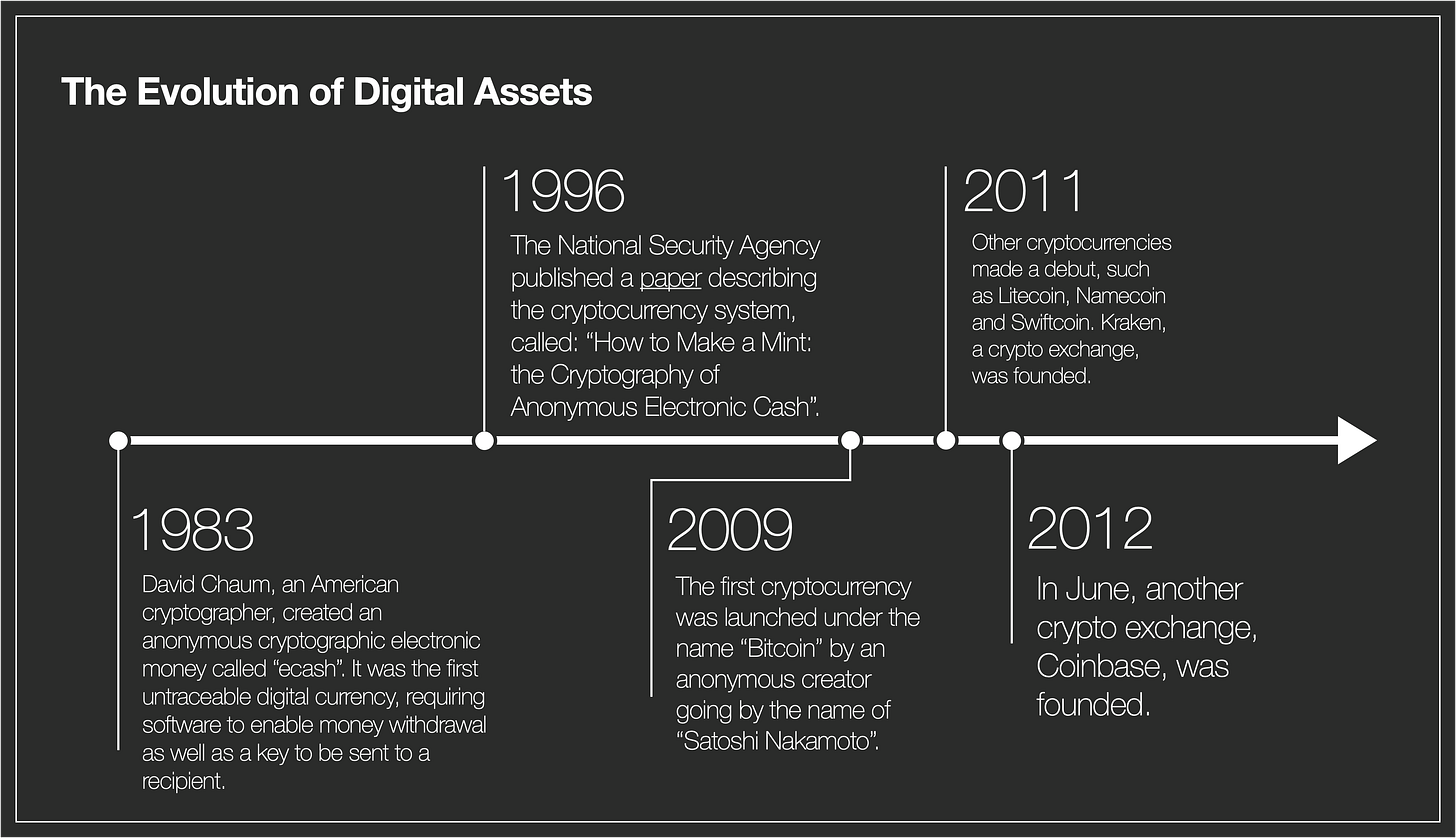

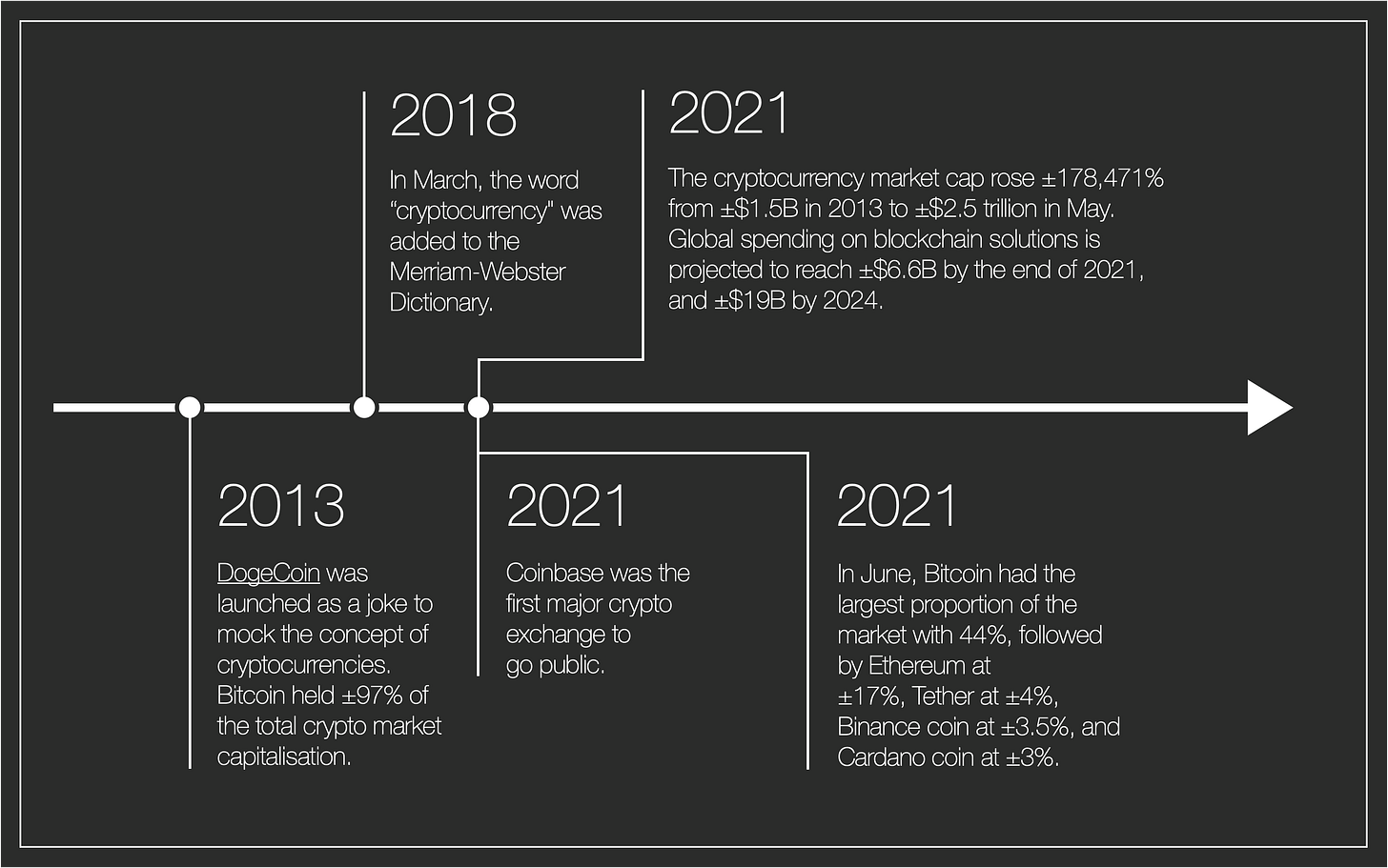

“Cryptocurrency” has been a buzzword in the financial world for more than a decade, with Bitcoin leading the way. As the first and most well-known protocol in the space, Bitcoin showed how blockchain technology enables money transactions without the use of trusted third parties (e.g. banks). While it was initially met with doubts and criticism, cryptocurrency has steadily grown in popularity over recent years. The explosion of interest can be observed with more new players entering the market (Figures 1a, 1b). Established businesses have also started to examine ways in which they can incorporate blockchain elements into their operations.

Many experts believe that cryptocurrency has the potential to revolutionise the way we conduct financial transactions. Some even argue that it could replace traditional fiat currencies entirely in the future. Others go deeper to explore the underlying blockchain technology and how it could drive the next evolution of the Internet, a more decentralised version coined as “Web3”. With cryptocurrency and its wider impacts slowly entering mainstream consciousness, the spotlight has turned to whether the industry can achieve mass adoption. At present, there are still major obstacles to overcome before digital assets can become a primary form of transaction.

This industry report aims to provide both a qualitative and quantitative view of the current state of crypto adoption. The purpose is to understand the importance of this nascent industry and its future outlook. The report hopes to provide insights and recommendations for retail users, developers, businesses, as well as policymakers seeking to foster the growth of this new form of finance. Ultimately, the findings show that Bitcoin, Ethereum, and other digital assets are no longer just buzzwords; they are slowly transforming the way we think about money.

Proof in the Numbers

Statistical look at current cryptocurrency adoption rates

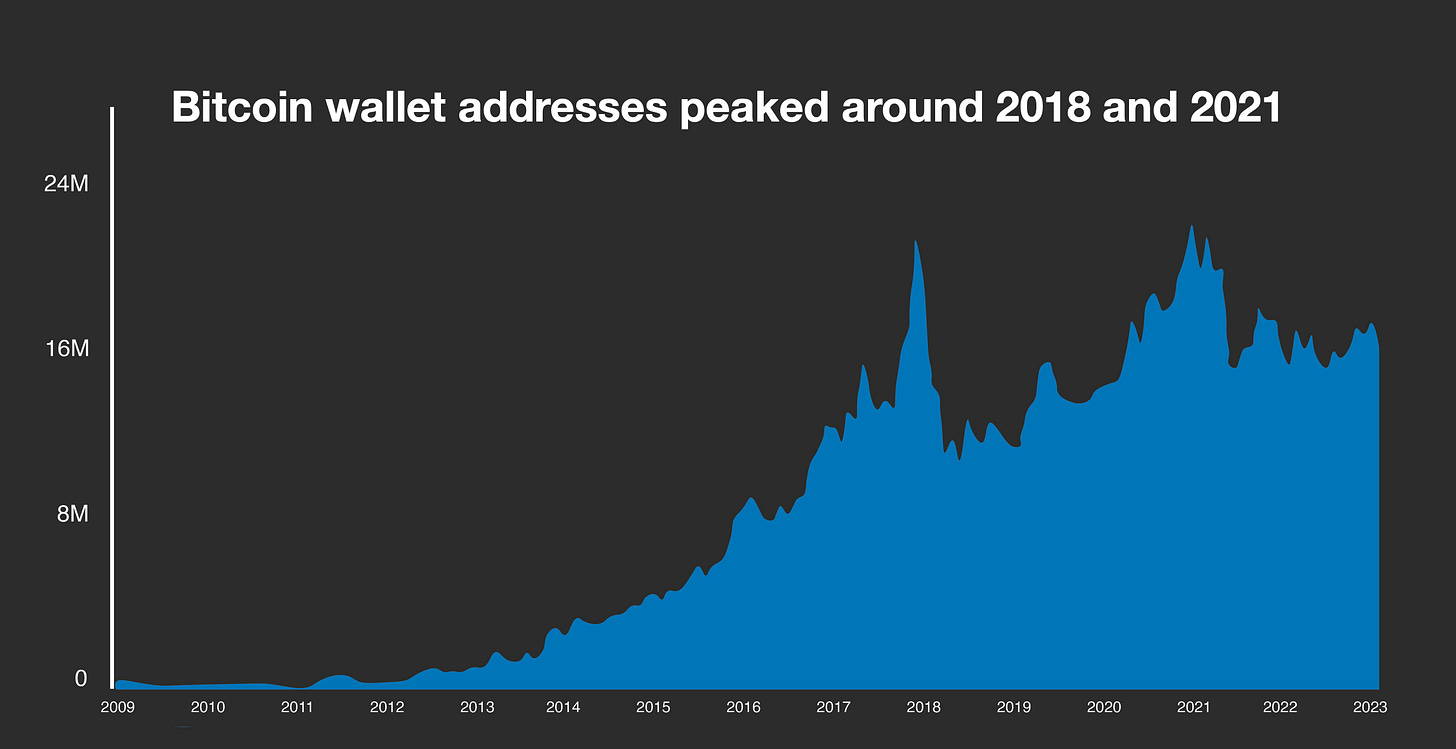

From Internet forums to Wall Street boardrooms and the Supreme Court, cryptocurrencies are becoming the hottest topic of debate. The growing mainstream awareness of digital assets has been powered by the rise in adoption over the past few years. The global user base of cryptocurrencies has surged almost 190% from 2018 (De Best, 2023). In 2021, the number of unique active wallet users peaked at 106 million. Most crypto owners resided in Latin America at 46%, Asia-Pacific at 45%, and the United States at 44% (Gemini, 2022). Such global trend was partly driven by well-established multinational corporations expressing their interest and plans to adopt cryptocurrency, from the likes of Tesla and Starbucks to Mastercard, Visa, and PayPal.

In 2019, the emergence of the COVID-19 pandemic further accelerated the adoption and interest in cryptocurrency. Fiscal policies around the world caused governments to print money aggressively, reducing the value of fiat currencies and causing inflation. Digital assets became more widely seen as a safe store of value and a hedge against rising prices. Individuals stuck at home also finally had time to set up a Bitcoin wallet, attributing to a rebound in active users globally (Figure 2).

However, the total number of new crypto wallet users dropped in 2022 as the industry suffered the so-called “crypto winter”. The value and market capitalisation of the digital asset industry saw a prolonged period of decline, marked by bearish market sentiments. Falling prices quickly spawned a downward spiral that triggered fears among investors, leading to further sell-offs and price declines.

The crypto winter that began in 2022 were largely triggered by various factors, such as uncertain market conditions, security breaches, hacking incidents, and regulatory crackdowns. In November 2022, negative media coverage on the collapse of FTX, one of the major trusted crypto exchanges, took a toll on the industry’s reputation.

During a typical crypto winter, numerous crypto or blockchain-based firms would struggle to survive as they face funding challenges, reduced liquidity, and overall decline in user trust. Some projects may even shut down completely. However, crypto winters can also create opportunities for investors and businesses that are willing to weather the storm and invest in the long-term potential of digital currencies.

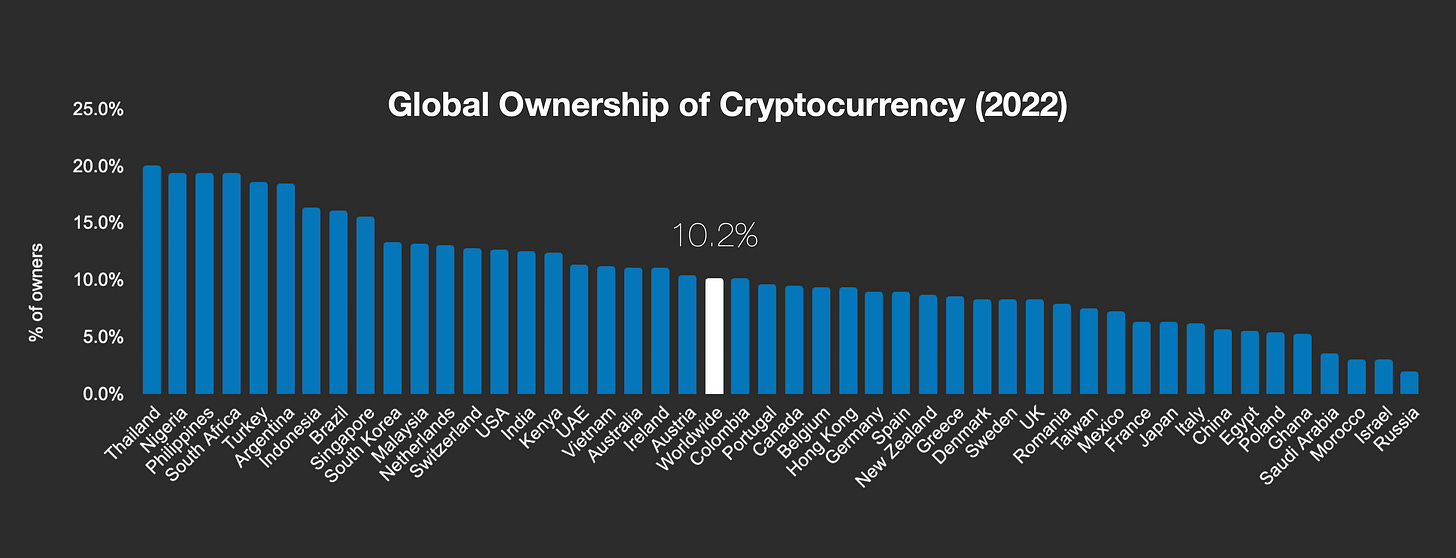

As of November 2022, the number of crypto users worldwide is around 320 million with a penetration rate of approximately 4.3% (Li, Wei, et al., 2022). Overall, Asia has the largest user base at 40%. Thailand, in particular, has emerged as the top crypto trading hub in the region (Figure 3). Thai crypto users cite investment value as a major reason for purchasing digital currencies (Bangkok Post, 2022). The country’s retail market has also been open to crypto. Industry conglomerate Central Retail has set out plans to launch a blockchain-powered supermarket in partnership with digital tech asset platform Zipmex (The Nation Thailand, 2022). However, it remains to be seen how Thailand will progress in terms of adoption. The Thai government has banned crypto payments in 2022, while the country’s central bank is signalling tougher rules for trading and investment since FTX’s collapse.

Regarding centralised exchanges (CEXes), the US ranks top in the absolute number of crypto users and market size, followed by South Korea, Russia, Turkey, and Japan. In general, all these countries have relatively crypto-friendly policies. In South Korea and Japan, there has been a significant growth in popularity for digital currencies among the youth population. Due to high income inequality and housing bubbles, young adults increasingly believe that the opportunities once available to previous generations are now largely unattainable. Cryptocurrencies and stocks serve as viable alternatives to boost their income. Over in Russia, the government has been warming to digital assets in the face of US sanctions as well as the cost of its war in Ukraine. Separately, Turkey has been long plagued by hyperinflation with cryptocurrencies emerging as a monetary alternative.

It is a relatively different picture with regard to decentralised exchanges (DEXes), where trades and transactions are executed entirely on the blockchain without any central authority or third party. The United Kingdom, France, Germany, and Canada are seeing the largest traffic in this area (Li, Wei, et al., 2022). This is due to the macro makeup of these countries – strong economic development, established financial systems, as well as comprehensive investor education. Since decentralised finance (DeFi) platforms are more complex and risky, they are largely skewed towards professional and experienced traders with a higher threshold.

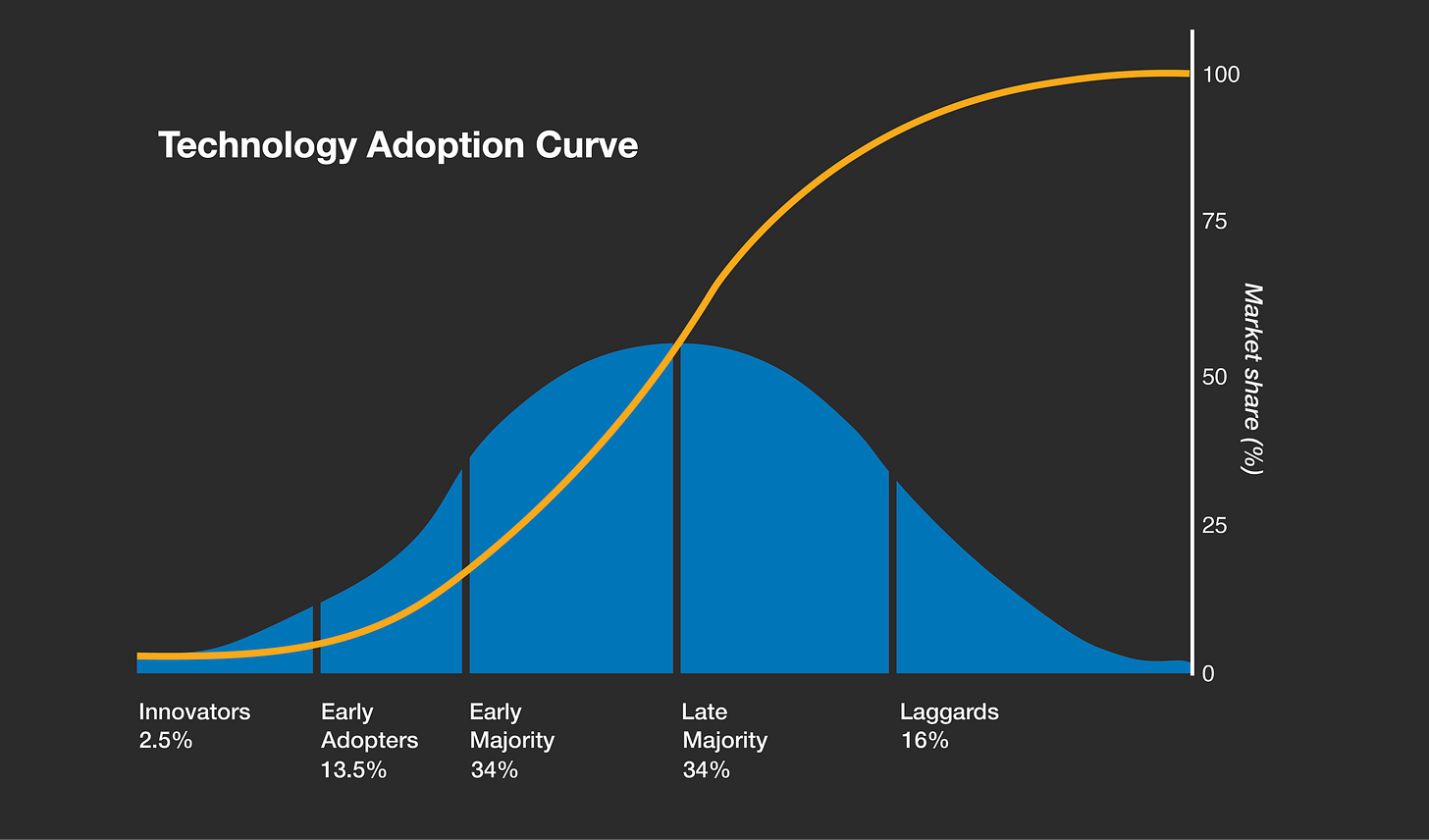

Examining Technology Adoption Curves

Previous market cycles have shown that cryptocurrencies can be extremely volatile, observed by significant price fluctuations that have attracted investors seeking high-risk, high-reward opportunities. However, the path towards greater adoption is more than simply the appeal of a get-rich-quick scheme. The patterns of how technological innovations are adapted by people and grow in market share can be closely studied through Everett Rogers’ Technology Adoption Curve (Figure 4). Also known as the Diffusion of Innovation theory, the curve charts how people, organisations, and firms learn and adapt to new technologies. It classifies technology consumers into five types: innovators, early adopters, early majority, late majority, and laggards.

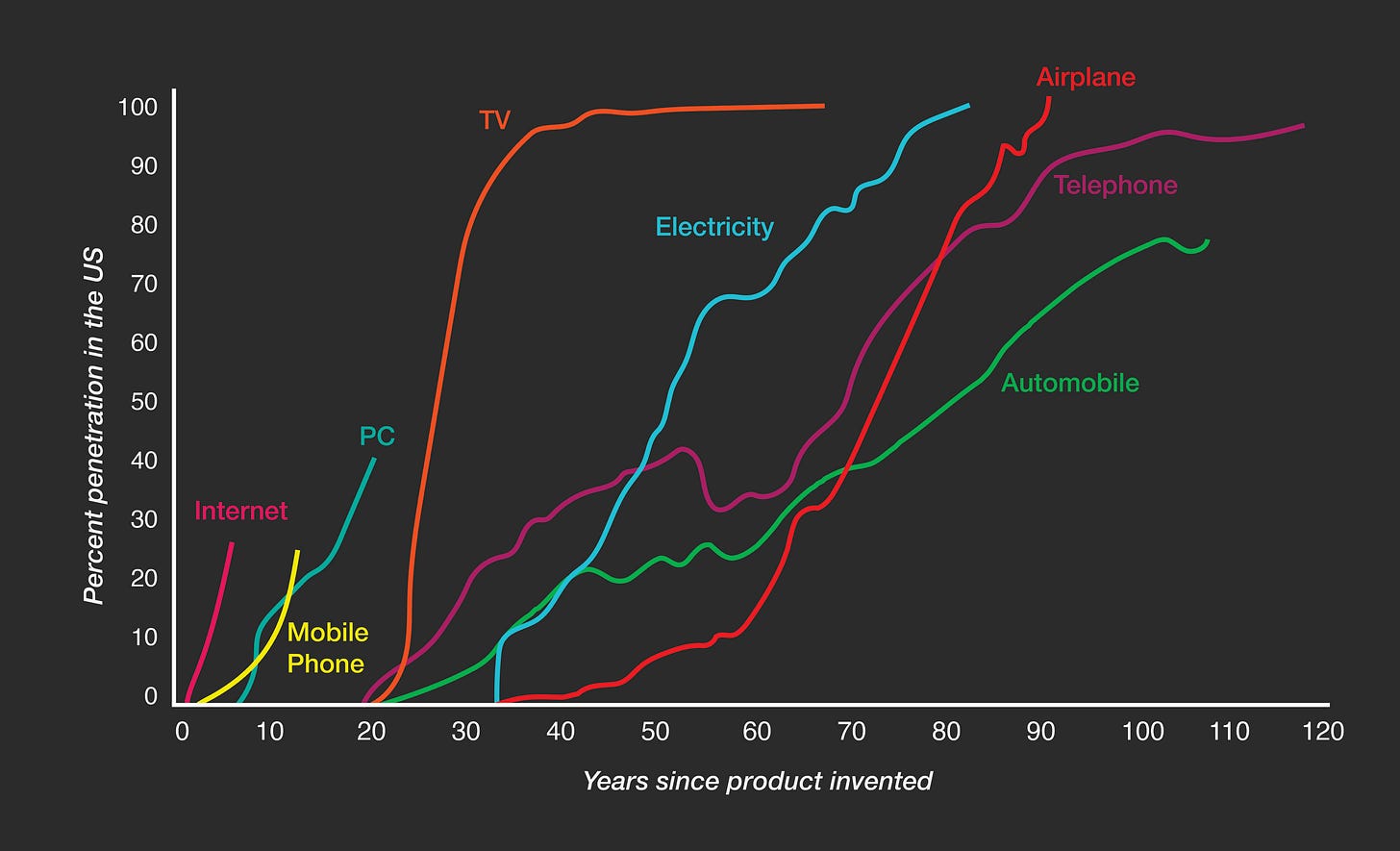

The S-shaped diffusion curve suggests that there is only a relatively small fraction of potential users during the early stages of innovation, until the adoption pace hits an inflection point and grows exponentially. Historical data show that factors, including expected performance benefits, ease in usage, social influence, and infrastructure support, could impact the adoption rate of a particular innovation (Figure 5). The Technology Adoption Curve implies that winning over most- if not all – categories of adopter is crucial to implementing a new technology. Essentially, much of what drives the perceived value of a product – and thereby adoption rate – rests in network effects. The more users there are, the more valuable the new technology becomes.

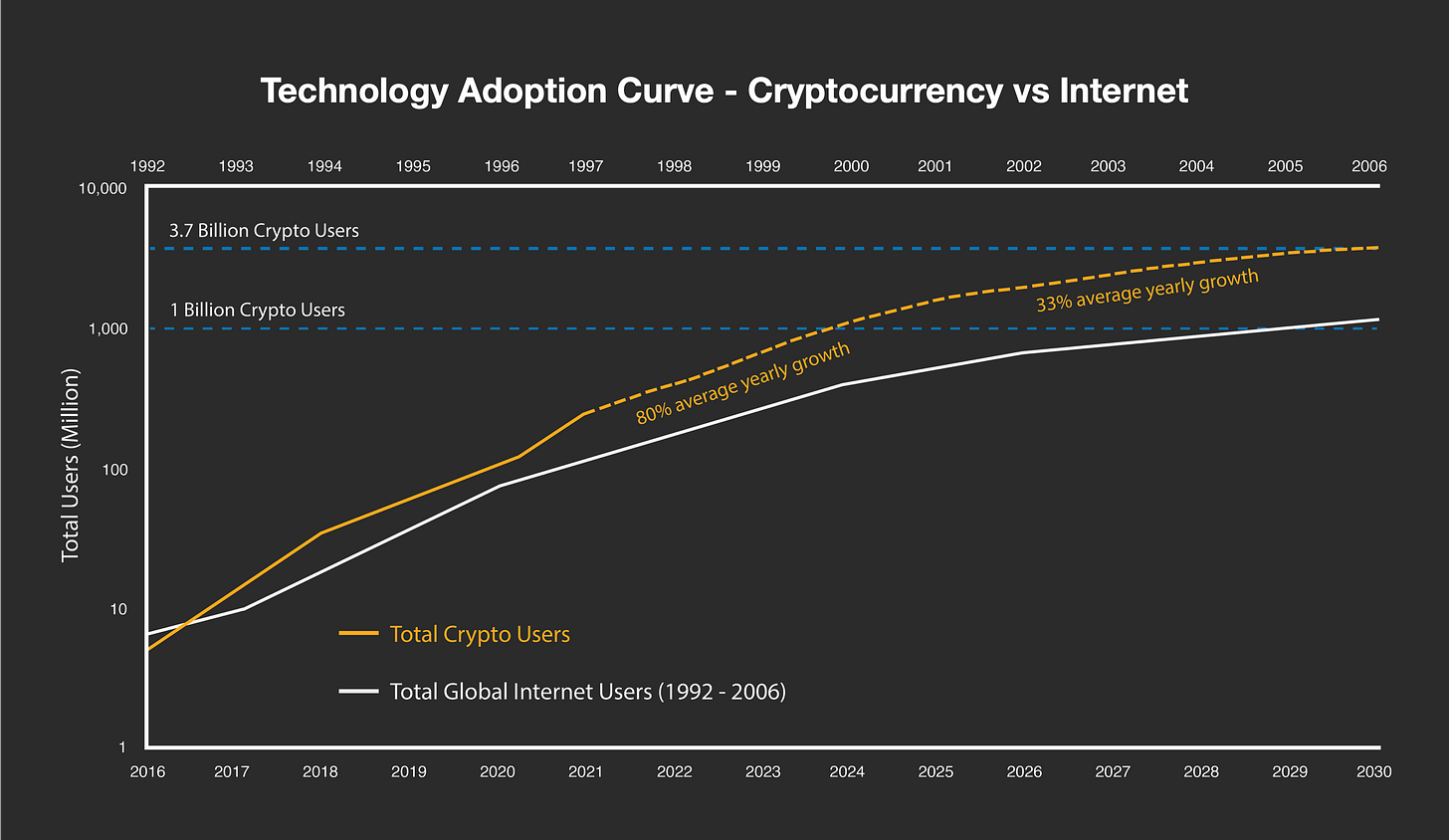

In the case of cryptocurrency, the rate of user growth for Bitcoin, in particular, is increasing faster than the Internet in the late 1900s (Figure 6). If the trend stands, there will be one billion crypto users by earliest 2024 – more than three times the current estimate. The difference in adoption rates could be tied back to the Technology Adoption Curve, where a product has higher chances to be adopted by users if it has a higher perceived value. To become widely adopted, the Internet required significant investment in infrastructure, such as routers, fibre-optic cables, and data centers. On the other hand, cryptocurrencies can be bought and sold online using existing technology.

Multiple past research have verified the theory that the perceived value of a technology and its likelihood of adoption are correlated. A study of Chinese online gamers and their use of digital currencies shows that the perceived usefulness of Bitcoin, in particular, lies in its perceived ease of use (Nadeem, Liu, Pitafi, et al., 2021). The findings identify that advantages related to transaction processing are central to why respondents believe that Bitcoin is easy to adopt, which enhances its perceived value. The factors include the digital currency’s low fee as compared to credit cards, fast transaction time, and seamless cross-border usage.

While there are historical data to show how digital currencies are outperforming the Internet in terms of adoption pace, it is important to note that such comparison may not be wholly convincing. The two technologies operate in different domains, signifying different types of network effects and impacts on society. As such, the following sections of this report will dive deeper into the various nuances of cryptocurrency adoption.

Missing Links

Addressing roadblocks to mainstream cryptocurrency adoption

There is no exact definition of when the “crypto tipping point” will occur or what it would look like. The term refers to when digital currencies reach critical mass adoption, bringing about a remarkable shift across the global financial landscape. Some experts believe that the tipping point could occur when a certain percentage of the world’s population owns or uses digital assets (Gemini, 2022). Others predict that the decisive moment hinges on major corporations and financial institutions adopting and investing in cryptocurrencies (Wilkins, 2021). Regardless of what the specific metric is, the premise of the crypto tipping point can be based on a critical juncture where digital currencies are no longer seen as a niche interest or speculative investment. Instead, they are broadly recognised as a legitimate and valuable asset class.

The crypto tipping point has the potential to enact structures and policies regarding the way the world interacts with money. However, considering its current state, the industry must first address the following risks and challenges.

Negative public sentiment

Public perception of cryptocurrencies often tends to the downside, largely stemmed from media portrayal. News coverage by mainstream platforms typically sensationalise or exaggerate negative events, rather than featuring positive developments in blockchain technology. From a business perspective, scandalous stories are more profitable for the media as they attract higher engagement, traffic, and viewership. Granted, numerous adverse industry events unfolded in 2022, from the downfall of Luna and FTX to the meltdown of well-known companies, such as Celsius and Voyager Digital (Ledbetter, 2022; Kim, 2022; Duggan, 2022; Yang, 2022). To the public that are otherwise unaware of the true nature of these debacles, the negative press only serves to emphasise the risky and volatile nature of cryptocurrency. Skepticism further increases, creating challenges for individuals to recognise the potential of digital assets and blockchain technology.

Ambiguous regulations

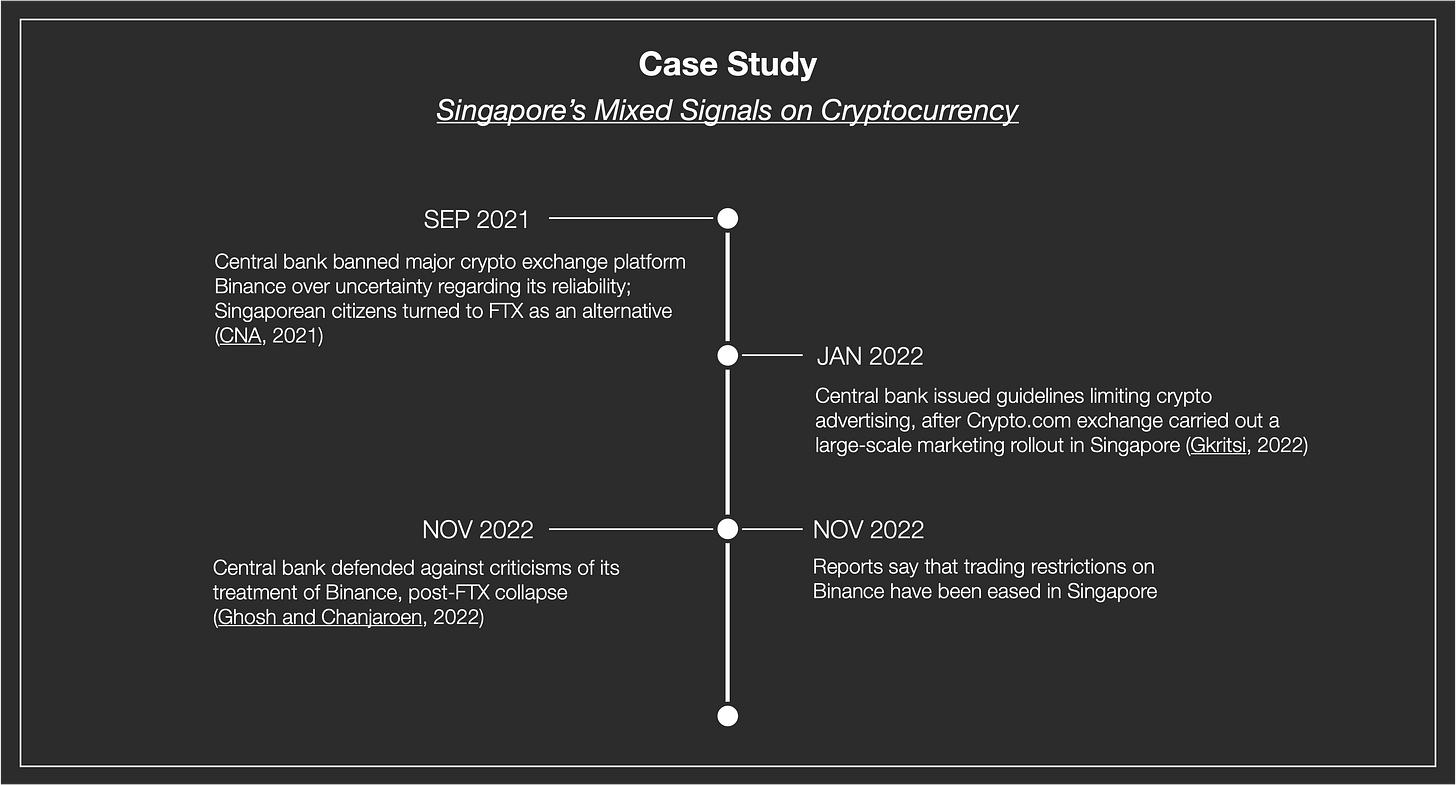

Cryptocurrencies currently exist in a regulatory grey area, which has led to constant confusion and fear among investors and the general public. Some countries tend to take a reactive stance regarding digital assets, banning the access to certain crypto-related applications whenever negative press or public backlash arises (Figure 7). Users of forbidden platforms are left with no choice but to quickly move out their funds for fear of losing their investments.

Crypto owners themselves have also become wary of retroactive regulations due to various episodes, including the US sanction of crypto mixing service Tornado Cash over suspected financial crimes. The move led to the arrest of a developer linked to the platform, causing widespread outrage among crypto and privacy advocates (Copeland, 2022). Another example of potential action against crypto users is the introduction of a US Senate bill to crack down on money laundering and terrorism financing via cryptocurrency (Warren and Marshall, 2022). Titled the “Digital Asset Anti-Money Laundering Act”, the bipartisan bill has been criticised as an “opportunistic unconstitutional assault on cryptocurrency self-custody, developers and node operators” (Van Valkenburgh, 2022). Over in the Asia region, there are mixed signals given by the Chinese government. On one hand, crypto-related activities are banned in China. Yet, authorities are reportedly backing Hong Kong’s push to become a crypto hub (Zheng and Wong, 2023).

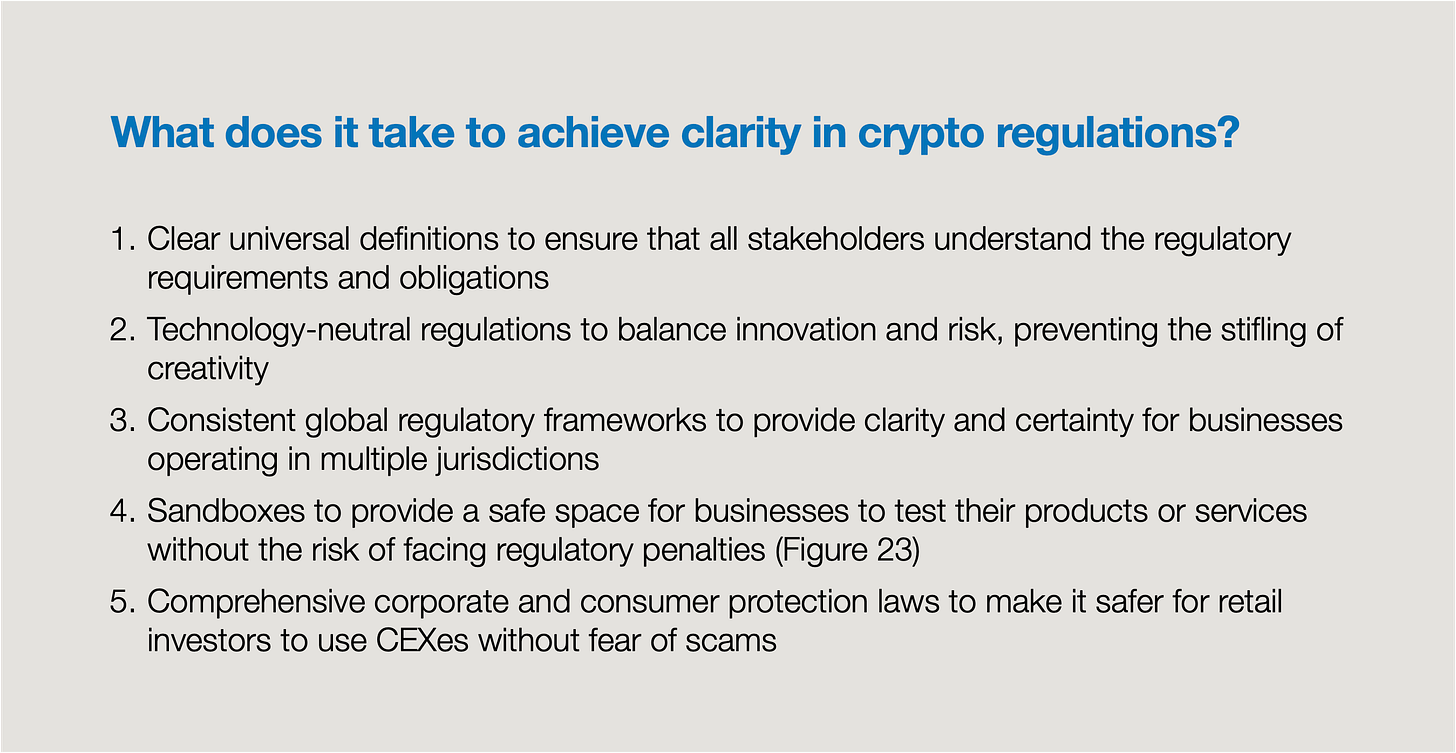

It can be observed that the spectrum of industry backlash spans from retroactive lawsuits against failed crypto companies in the US to a broader fear of capital outflow in China. The lack of clarity and consistency in crypto regulations both regionally and internationally causes uncertainty, hindering growth in public confidence. Multiple existing reports have already called for proactive communication and collaboration between governments, firms, crypto players and the general public (White, Buonocore, et al., 2022). At the same time, key actors involved must consider the underlying ethical arguments regarding an individual’s right to autonomy. This could affect the extent to which governments should enact policies to protect the well-being of their citizens.

Real-world utility

At present, cryptocurrencies remain primarily seen as a speculative financial asset. In turn, the underlying blockchain technology that powers digital assets are mistakenly viewed as simply a means of making money. Such perception, combined with high price volatility, makes cryptocurrency incompatible with most investors.

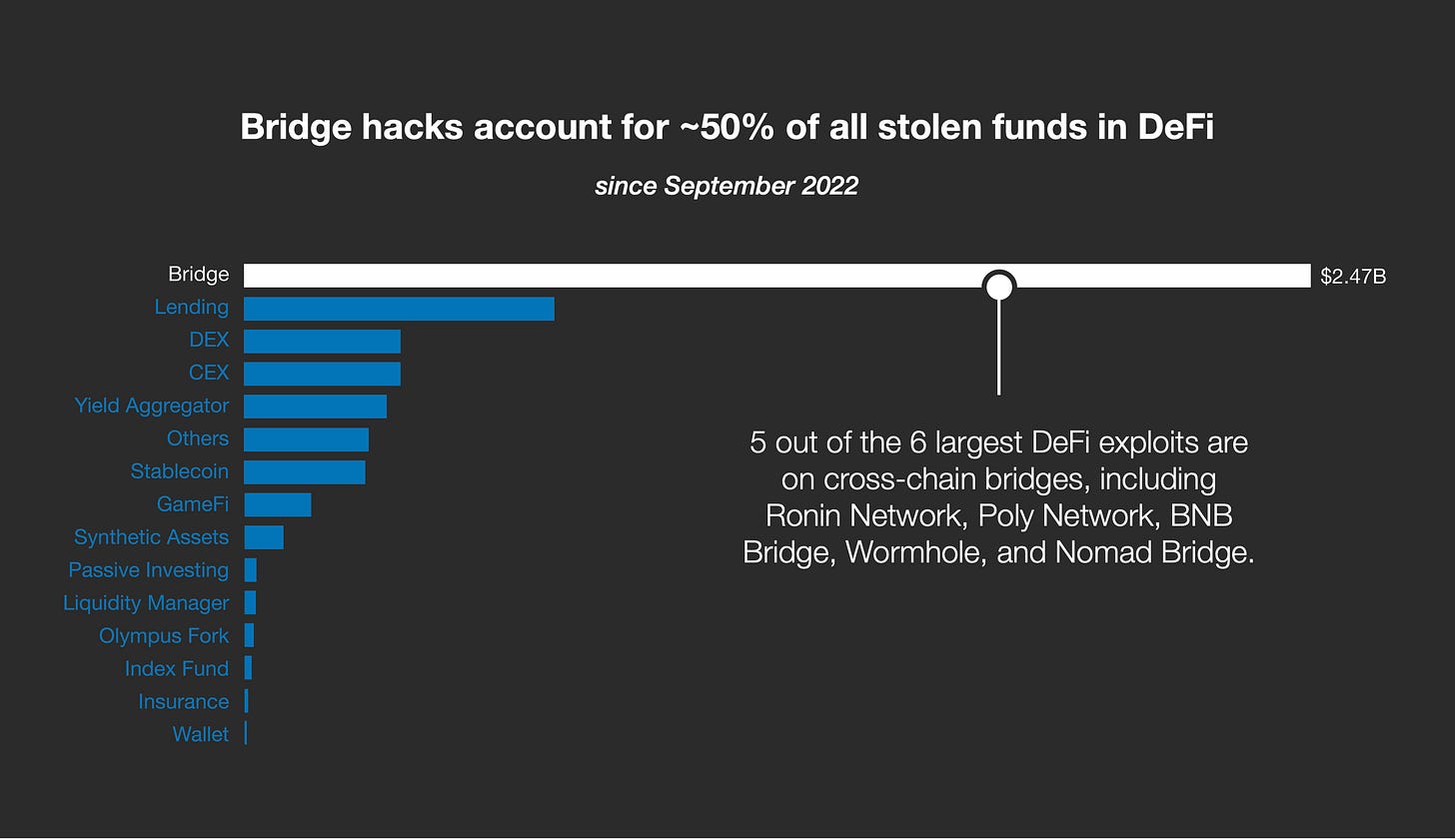

The idea that the crypto industry is solely based on financial gains is compounded by the fact that DeFi applications and firms make up some of the more well-known names in the industry. Due to major developments in this blockchain vertical, individuals can now easily generate tokens without any coding expertise. While this presents opportunities for innovation, it also has led to abuse and exploit by malicious actors. Undoubtedly, the slew of hacks and security breaches has painted DeFi under a bad light with the media often likening the field to a Ponzi scheme (Kamau, 2022). Since 2020, there have been more than 130 reports of DeFi hacks amounting to approximately $4.2 billion lost (ChainSec, 2023). Such negative news tend to overshadow not only innovations in the field, but also the broader vision outlined in Satoshi Nakamoto’s Bitcoin white paper – a more open and transparent financial system without the control of centralised firms and institutions (Nakamoto, 2008).

A similar fate has also fallen upon NFTs, or non-fungible tokens. This crypto niche has often been viewed as a speculative trading tool with “NFT Trader” gradually becoming a somewhat acceptable profession. Currently, much of what populates the NFT niche are drawings of avatars with the quintessential representation being a cartoon of an ape à la the Bored Ape Yacht Club project. This has led to a misguided view that NFTs are merely digital art that hold no intrinsic value. It ignores the underlying technology and NFTs’ ability to provide other use cases, such as proofs of assets ownership. However, so far, no NFT-related applications or projects have yet been built that can fully utilise the potential of blockchain.

Culture

The cultural gap that exists between the crypto community and the wider public serves as another roadblock to adoption. The Web3 community has been criticised for being an echo chamber with “ego and entitlement” rampant in the space (Siu and Lee, 2022). A major tendency is to focus on new and shiny tech rather than on fostering real understanding. Such gap is exacerbated by the use of industry lingo-centric memes, cryptic terms as well as an exclusive circle that is only understood or accessible to those already in the Web3 community. This natural divide can be observed in the industry’s penchant to coin those with limited crypto knowledge as “normies” (Bitcoin Manual, 2021). Cryptocurrencies are also often portrayed solely as financial tools, alienating those who are less interested in finance. Thus far, efforts to bridge this gap have been limited. Applying the Technology Adoption Curve in such context, so-called crypto normies could be classified under the categories of “Late Majority” and “Laggards”. As such, winning over these types of adopters is just as relevant for cryptocurrency and blockchain to achieve mass adoption.

Education

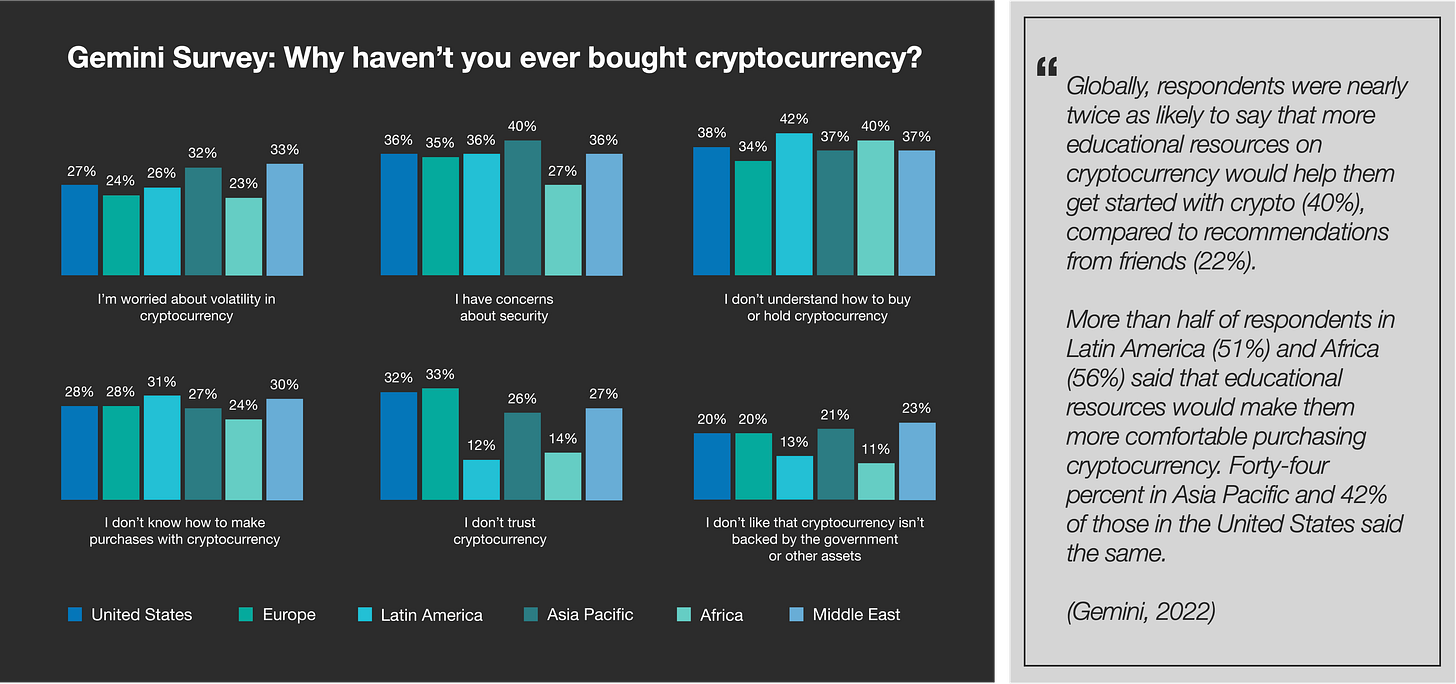

While much has been touted regarding the benefits of decentralisation, the concept rarely gets to the hearts of potential users outside the current crypto and Web3 community. The technical aspects and jargons within the fields of digital currencies and blockchain technology remain daunting for many, sparking the need for simplification. A primary reason for why individuals avoid cryptocurrency altogether is a general confusion and lack of understanding about the space (Figure 8). While it can be argued that the onus is on individuals to seek out information themselves, the resources available remain incomplete and scattered. The existence of “crypto maximalism” – the belief that only one cryptocurrency or blockchain protocol will ultimately dominate the market – among certain factions underscores the need for the industry to provide more objective educational materials to the wider public.

As such, the existing gap in education may be linked to the current state of the crypto culture. Instead of creating divisions and existing within echo chambers, industry players could benefit from helping the wider public understand what makes crypto different and how the technology could improve their lives.

Maturity of Infrastructure

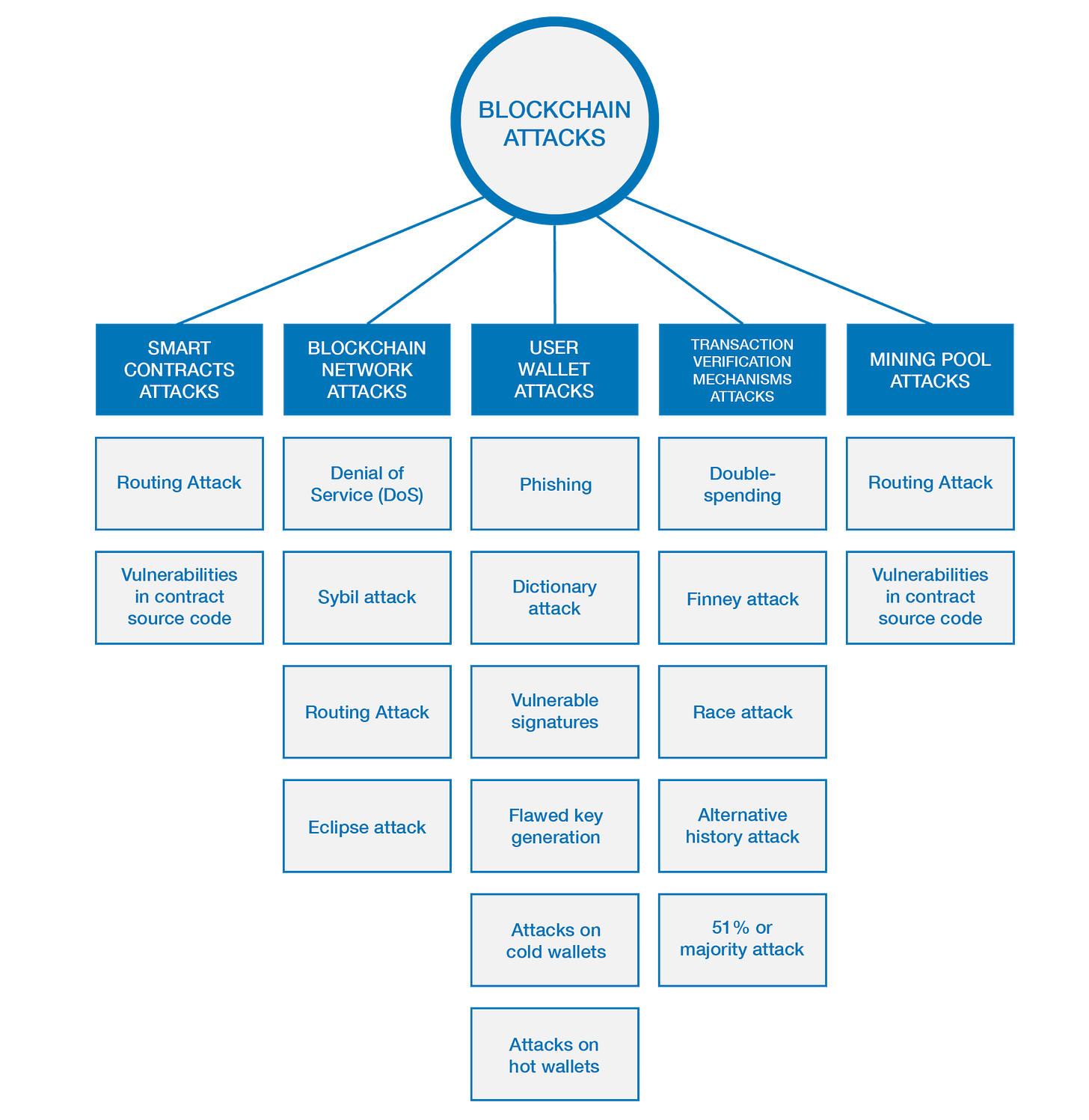

In 2022, the 10 largest crypto hacks and exploits alone saw more than $2 billion stolen from protocols (Coghlan, 2022). In particular, theft from cross-chain bridges make up approximately 50% of exploits in DeFi (Figure 9). Bridges are designed to transfer assets from one blockchain to another, but they are vulnerable as they serve as an additional point of target for hackers. Furthermore, many bridges are built differently than blockchains. The smaller community of developers working on bridges implies that the code is not as comprehensively reviewed for potential bugs. Thus, bridge hacks are typically caused by certain smart contract loopholes or compromised private keys. A case in point is crypto bridge Nomad – around $200 million of funds were stolen after developers configured its smart contract (Faife, 2022). The changes allowed users to authorise any withdrawals of funds to themselves without the need for programming skills. Such cryptocurrency hacks and exploits have put a spotlight on the nascency of the Solidity language used for smart contract programming. Calls have been raised for developers to adopt a different security mental model and exercise greater prudence when developing code.

Web3 protocols typically strive to maximise smart contract security through comprehensive internal reviews and bounty programmes, but these efforts occasionally fall short. To add, the onus for verifying smart contract security should not fall solely on users and much less the general public. Considering these factors, there remains a dire need for better smart contract security practices and tools as well as more comprehensive education and training for developers and users alike. Interacting safely with blockchains requires a high level of domain expertise, which serves as a barrier for potential crypto users. Storing seed phrases safely can be challenging, and the unfamiliar user flow means that individuals could be unaware of several potential attack vectors (Figure 10). This is partly due to the different paradigms between interacting with blockchain applications and traditional web apps, such as the shift from email logins to crypto browser wallets like Metamask. There have been cases where users, unaware that Metamask does not store any user data, would receive emails regarding their wallet accounts and end up losing their private keys (MetaMask Support, 2022).

As users are given more autonomy in managing their blockchain assets, more responsibility has fallen on them to ensure their own security as well. In the context of greater possibility for hacks and exploits, there is now a considerable need for more mature security infrastructure tools and protocols.

Players Behind the Coins

Inside the key actors shaping the future of money

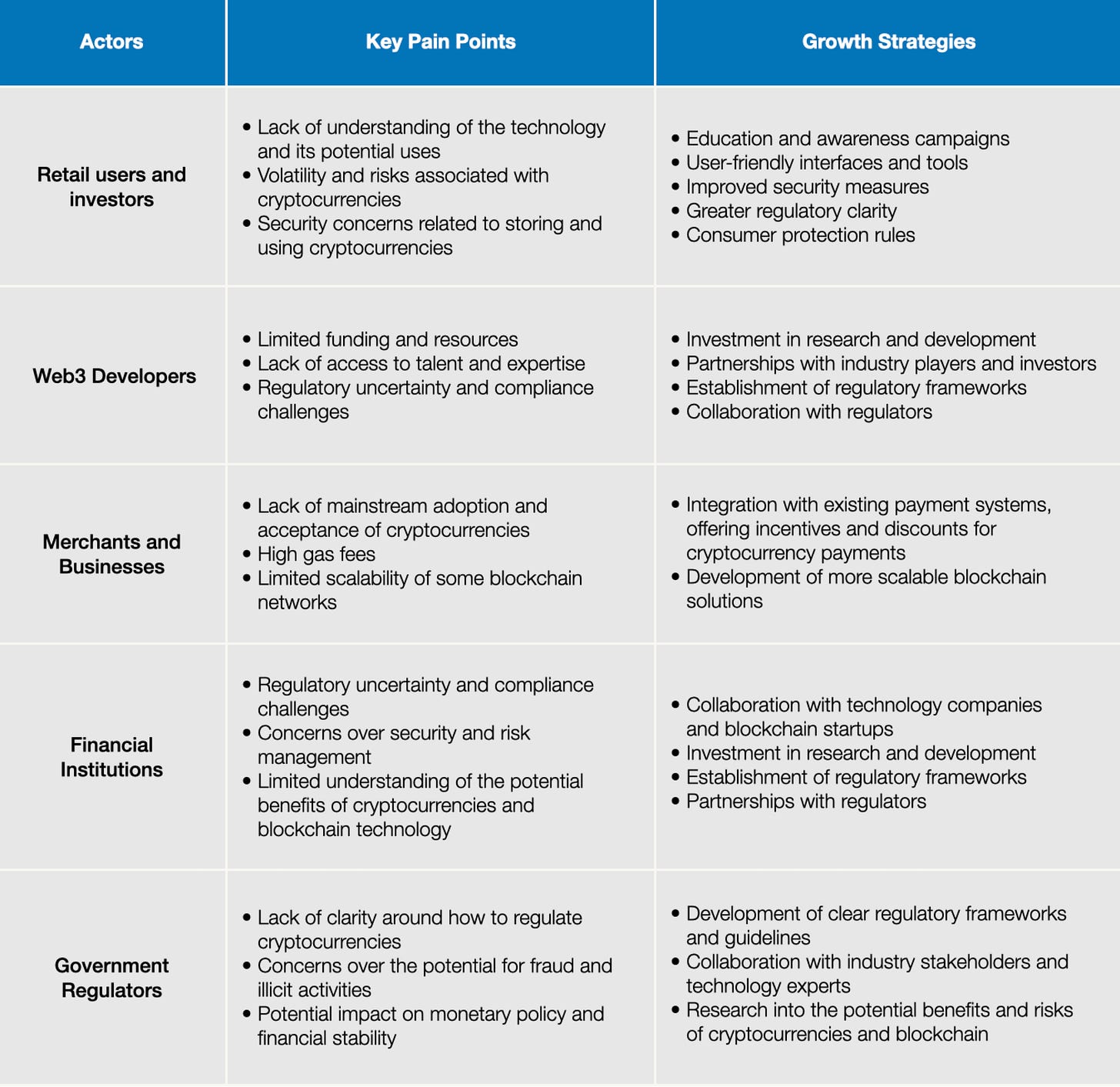

As part of a new technology adoption process, the cryptocurrency and blockchain community has to integrate social, cultural, and institutional factors into their approach. This requires an understanding of the extrinsic social networks and structures at play. There are five key actors that impact the progress of cryptocurrency: retail users or investors, Web3 developers, merchants and businesses, traditional financial institutions, and government regulators.

Retail Users

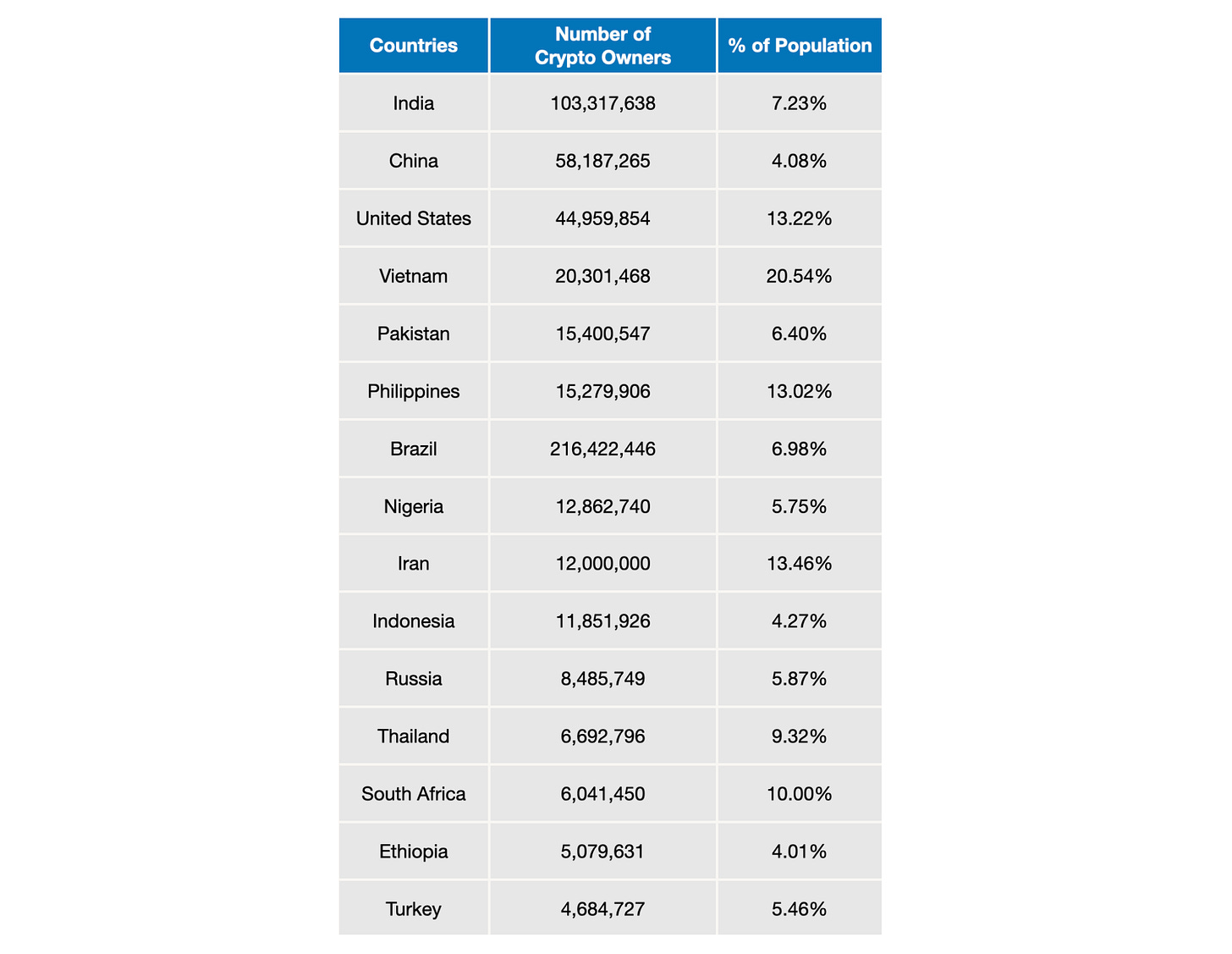

The widespread adoption of cryptocurrency will require a shift in consumer attitudes and behaviour. With the right incentives, it is possible to overcome current limitations preventing potential retail users entering the space. Consumer motivations can firstly be studied by observing the trend in global retail crypto adoption. As of 2023, developing economies with weaker monetary policies and currencies rank among some of the highest in the number of cryptocurrency owners (Figure 11).

India tops the list, despite uncertainty around the legal status of cryptocurrency in the country. In 2022, the government announced a 30% tax on profits and a 1% tax deducted at source (Tambe, 2023). The central bank is taking the matter further by pushing for a complete ban of the industry, calling crypto trading “nothing but gambling” (Kumar, 2023). However, a bill has not been tabled and the government has since softened its stance on cryptocurrencies. For Indian retail investors, digital assets are seen as a viable alternative investment given the country’s high inflation, devaluation of the rupee, and a struggling banking system. The country is also a major recipient of remittances, coming from millions of Indian workers living and working abroad. Cryptocurrencies offer a cheaper and faster way to transfer money across borders, which is especially attractive to those who send money home to their families.

Other developing and emerging countries on the list, such as Vietnam, Pakistan, Philippines, and Brazil, are also facing similar economic challenges that have attracted retail users to invest in digital assets. Partly due to limited access to traditional banks, these populations believe DeFi platforms offer new and potentially more accessible financial services without the need to go through intermediaries or central authorities. Having more control over their personal money, a global accessibility of transactions, as well as greater investment opportunities are what primarily motivate crypto users in such regions.

Web3 Developers

Since its inception, blockchain, the underlying technology behind cryptocurrencies, has been developed and refined by a growing community of Web3 developers. To effectively gauge the development ecosystem, it is useful to consider the download rates of two key Web3 libraries – Ethers.js and Web3.js. Approximately 146,000 developers were installing either of these two toolkits on a weekly basis back in 2018. This figure has grown steadily over the years, increasing by 10 times in 2022 (Alchemy, 2022). The trend shows growing developer interest in building applications on Ethereum, the top most active blockchain in the world.

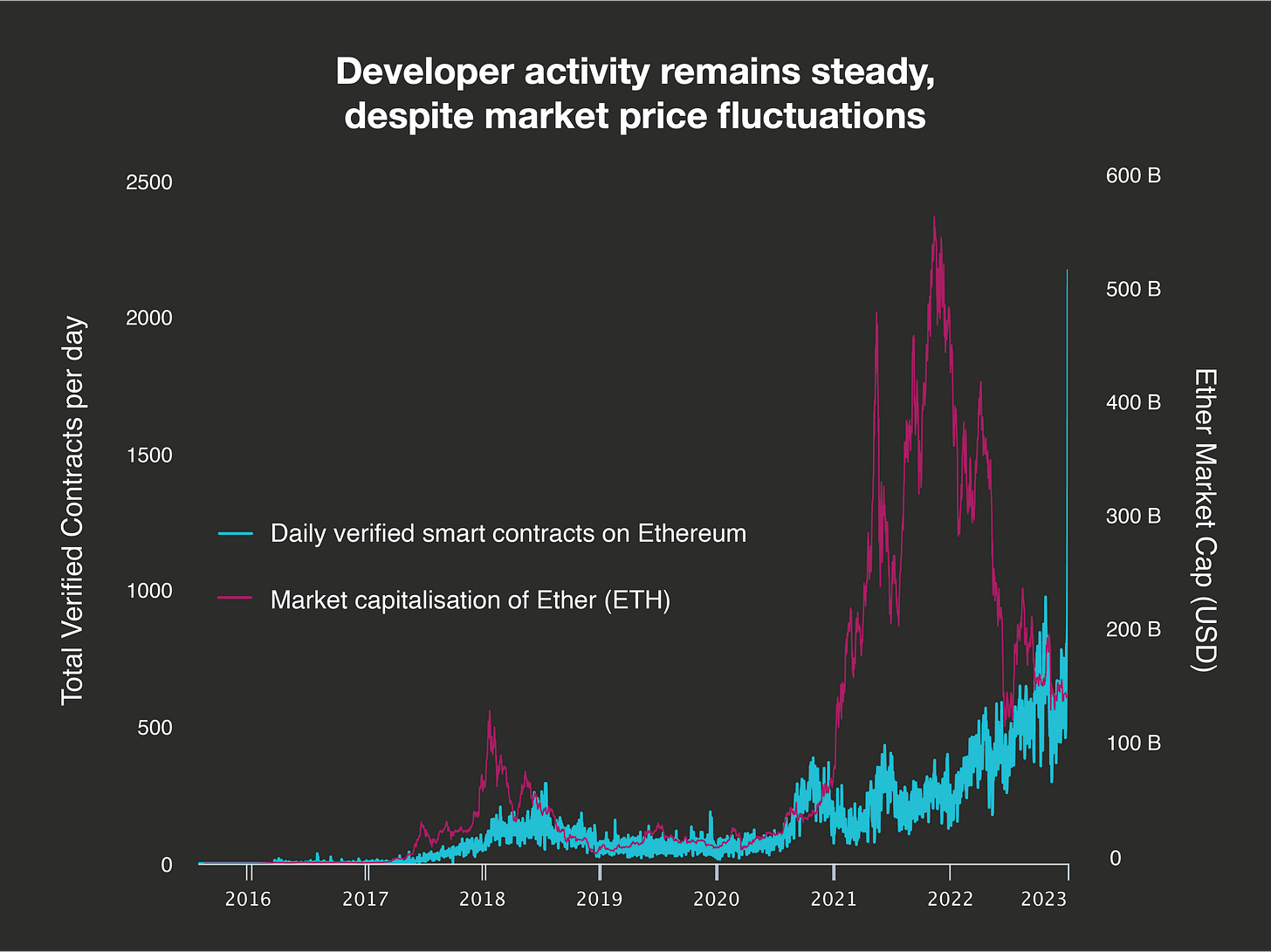

Unlike retail investors, price fluctuations are less likely to affect developers. Historically, when prices rise, the number of active builders deploying smart contracts on a monthly basis also grow. However, even during bear markets, developer activity continues to remain steady as can be observed during the periods of 2018 to 2020 as well as 2022 to 2023 (Figure 12).

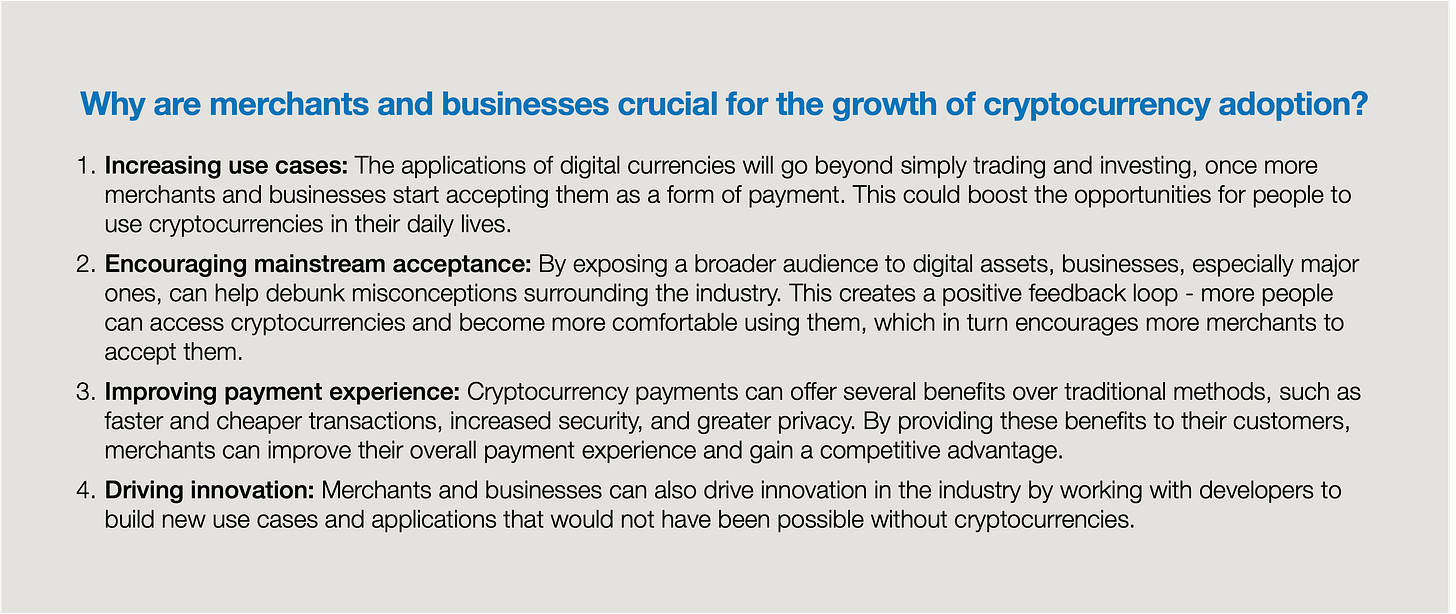

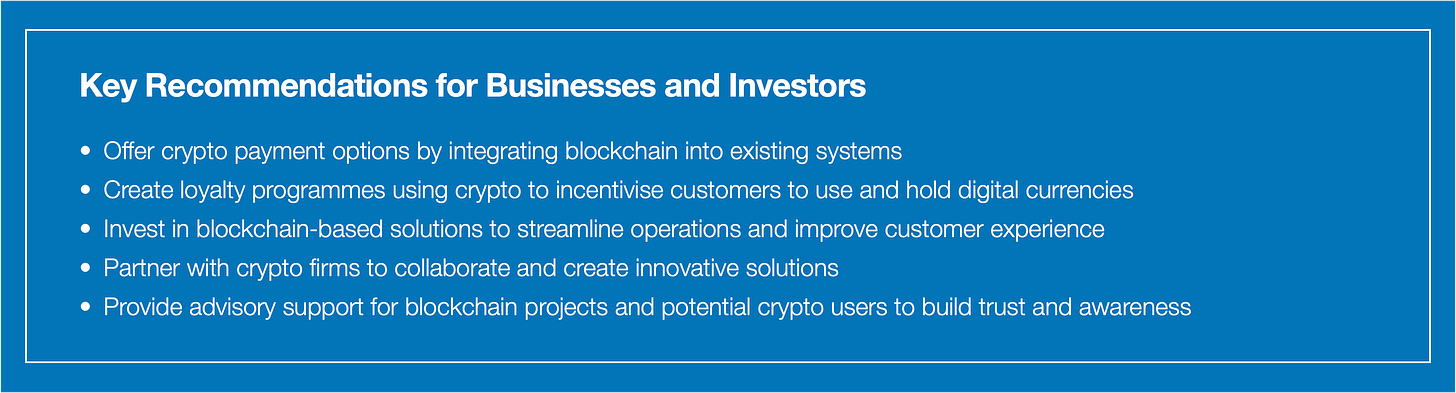

Merchants and Businesses

The adoption of cryptocurrencies by the wider public is practically impossible without the role of merchants and businesses. They help create a more robust and active ecosystem that bridges individual users to cryptocurrency and blockchain applications. At the same time, their position requires balancing other stakeholders, including financial institutions and government regulators.

The first known merchant to accept Bitcoin as payment was a programmer named Laszlo Hanyecz, who famously traded 10,000 BTC for two pizzas in 2010. This transaction became known as the “Bitcoin Pizza Day” and is now celebrated annually by the crypto community. In the following years, a small number of merchants began to accept Bitcoin as payment for their goods and services, including some online retailers and independent businesses.

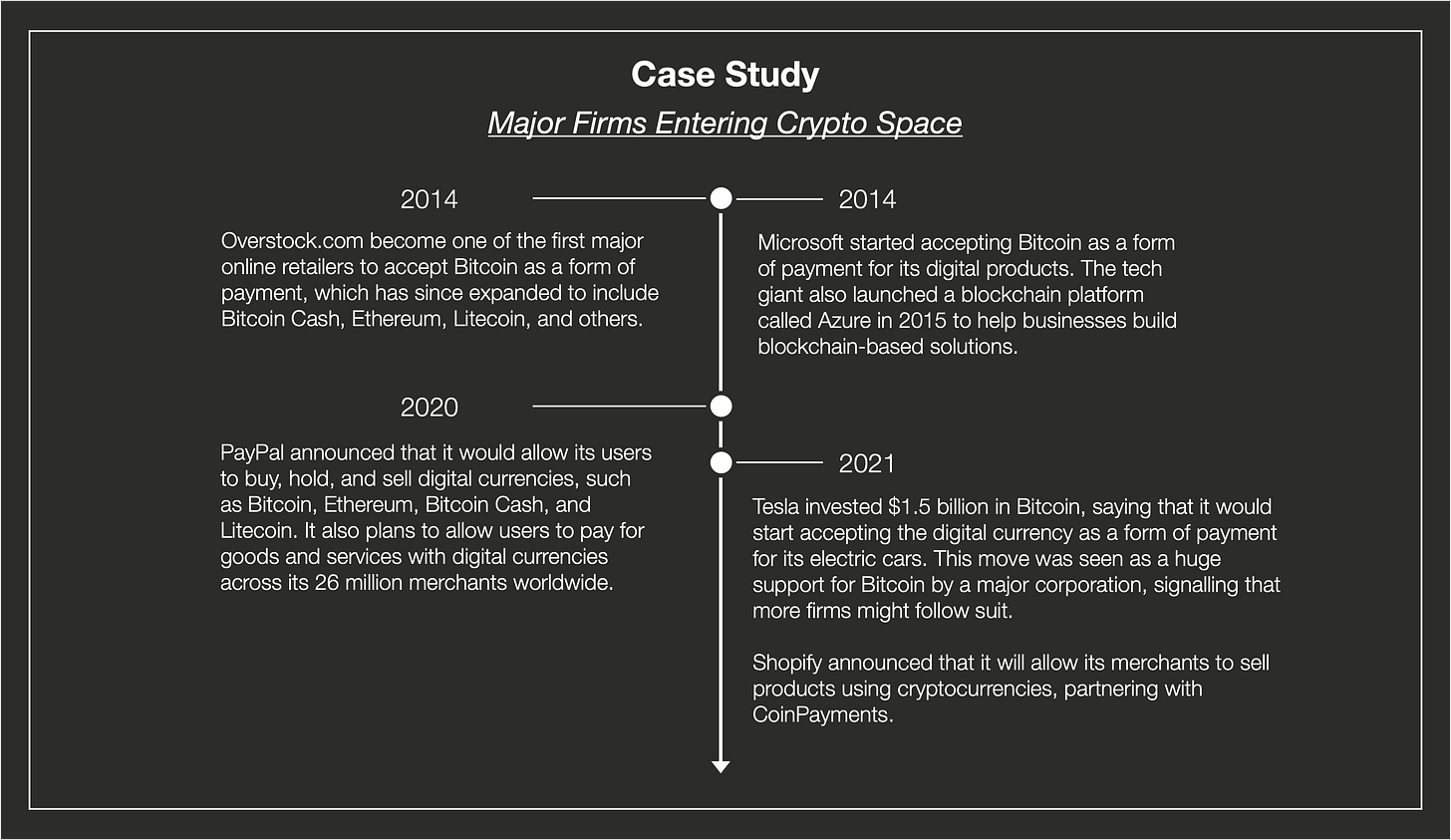

However, it was not until 2014 that major multinational firms began to take notice of Bitcoin’s potential as a payment method, with this trend expected to grow further (Figure 13).

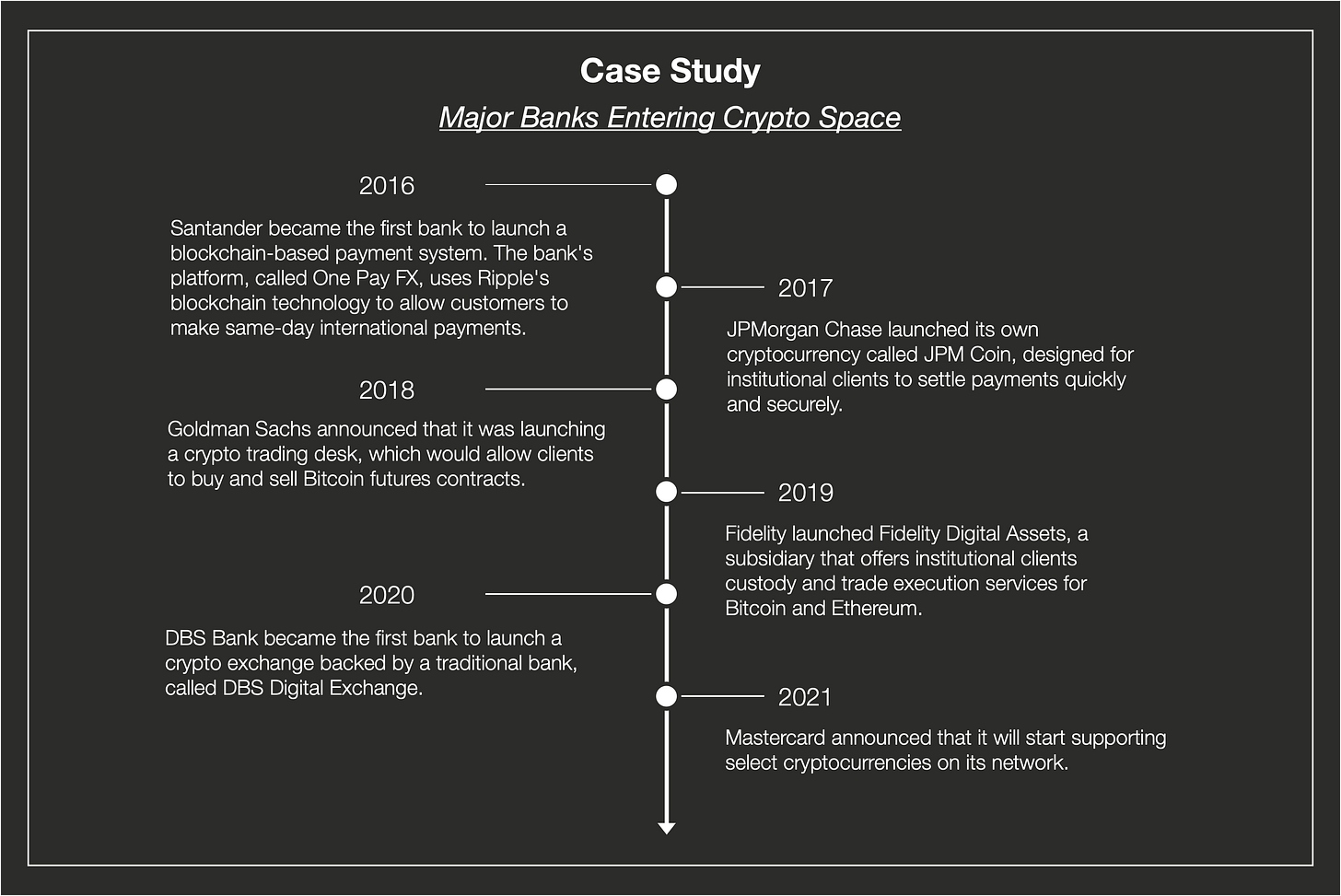

Financial Institutions

Despite the negative backlash over multiple large-scale crypto meltdowns in 2022, financial institutions continue to show a gradual interest in the industry. Many banking heavyweights have largely recognised the value of crypto as alternative investment vehicles for both corporate and retail clients. Some have already made significant moves towards adopting blockchain technology and cryptocurrency in their business operations (Figure 14).

Traditional finance players are also increasingly exploring the idea of tokenising real-world assets. Tokenisation helps increase the liquidity of traditionally illiquid goods, such as real estate or fine art, by allowing fractional ownership and trading. The key purpose is to make these assets more accessible to smaller investors. Additionally, tokenisation provides transparency and an immutable ledger that tracks ownership and transaction history. This helps to reduce the risk of fraud since all parties can have access to the same information. There are operational benefits as well, such as streamlining asset management, eliminating the need for intermediaries, as well as automating administrative tasks.

Governments

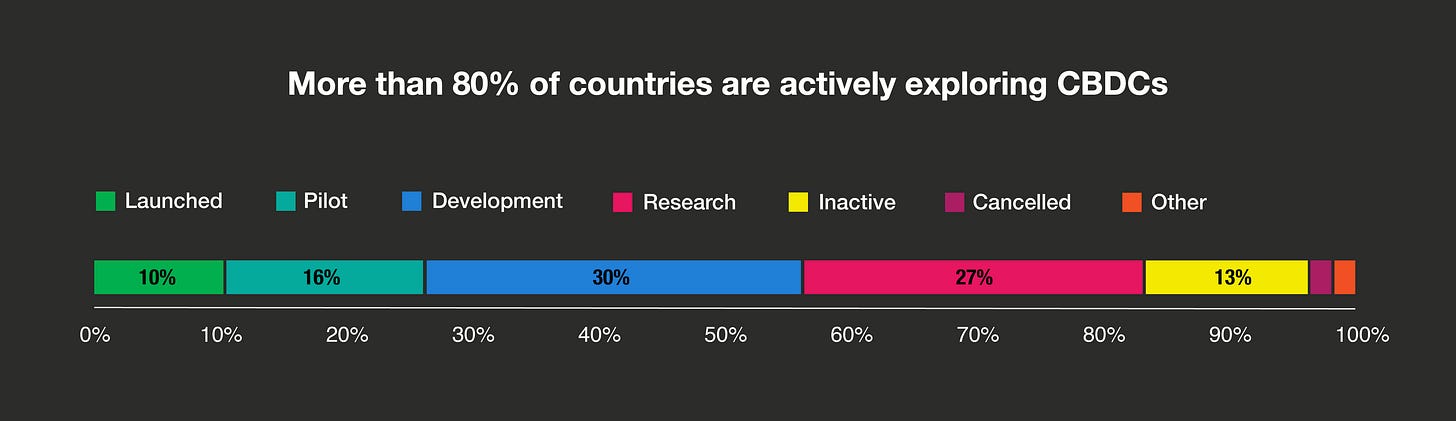

Despite the contradictory stance given by regulators around the world with regards to cryptocurrency, a growing number of central banks are recognising the need to provide alternatives in order to meet increased demand for digital payments. This factor has largely powered the emergence of Central Bank Digital Currencies (CBDCs), virtual money backed and issued by a central bank (Figure 15). Other political factors, such as financial sanctions on Russia, have also triggered the start of cross-border CBDC projects.

Currently, 114 countries comprising over 95% of global GDP are actively exploring the use of CBDC (Atlantic Council, 2023). Among these governments, at least 11 – predominantly in the Caribbean region – have fully launched a digital currency. Over in China, the country’s pilot is set to expand to most of the population in 2023. Other governments, such as Australia, Sweden, and the European Union, are also working alongside several traditional financial institutions and think tanks to develop CBDC frameworks.

One of the primary goals for many of these government-backed projects is to reduce some of the inefficiencies and frictions presented by fiat money. In a world where electronic payments are becoming increasingly prevalent, digital fiat serves as a natural evolution to sovereign money. Furthermore, economic inclusion may strengthen as people who are unbanked or underbanked could have greater access to financial services. This helps to reduce poverty and inequality, contributing to overall economic growth.

Despite frequent news of reactive regulatory crackdowns, the entrance of governments into the crypto space could spell good news for the industry in various ways:

- Increase the legitimacy of digital currencies

- Drive awareness of cryptocurrency among the wider public

- Create healthy competition between CBDCs and other digital currencies for market share, urging greater innovation and development in the industry

Ultimately, when it comes to user acquisition, pain points matter. These are any issues or concerns that make it difficult or even undesirable for individuals to use a particular technology. As such, understanding and addressing the pain points of the different crypto players is vital for driving adoption. If a product has too many pain points, users may be discouraged from utilising it, leading to low adoption rates and limited growth. On the other hand, if pain points are effectively addressed, users are more likely to adopt and use a product or technology that clearly solves their problems and makes their lives easier. The following table outlines the key pain points and growth strategies for the different actors that impact crypto adoption (Figure 16). The list is not exhaustive, and may vary depending on the specific context and circumstances.

Cracking the Hype Cycle

Requirements for cryptocurrency to reach the masses

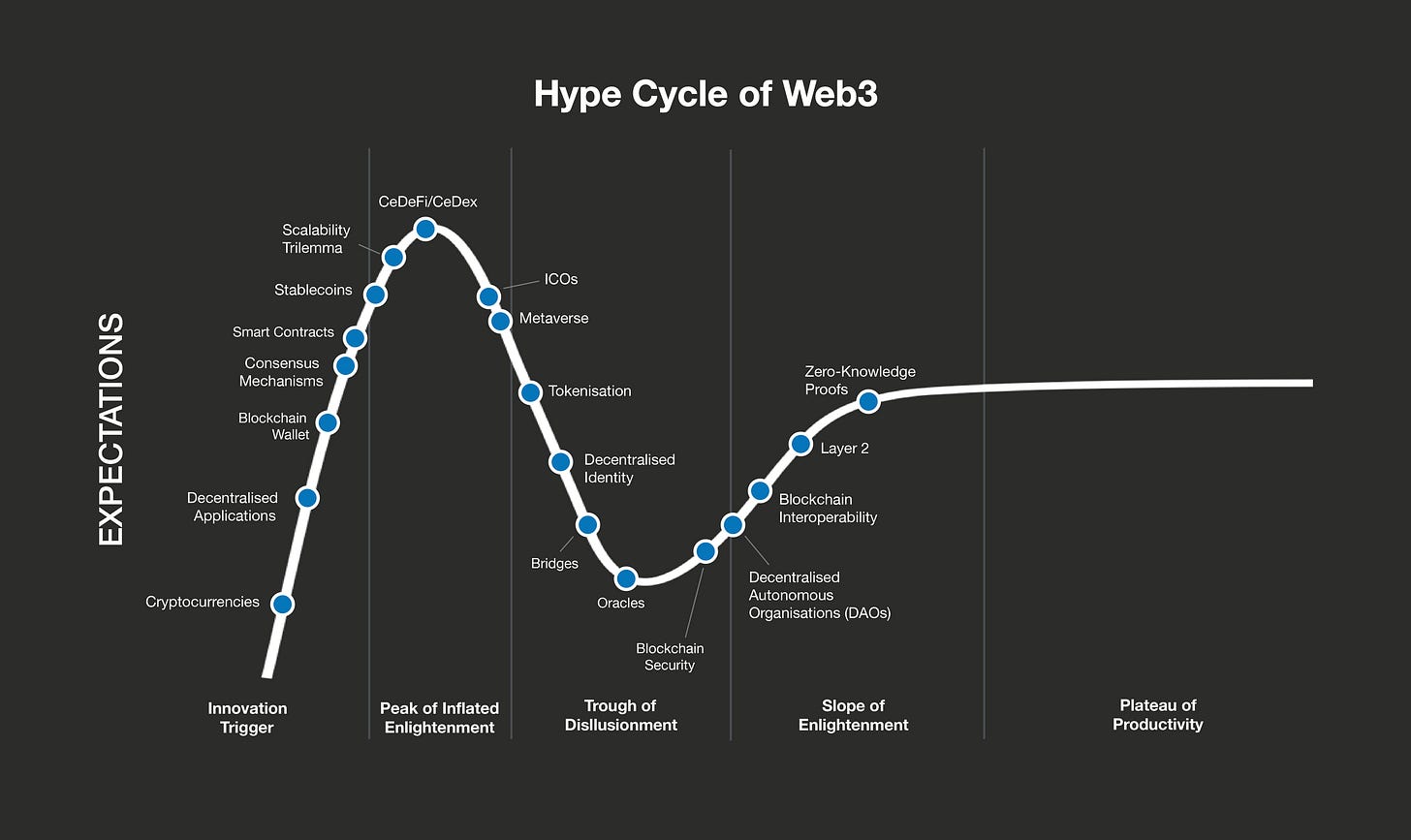

Some new technologies or products generate a lot of buzz and excitement, only to fade away just as quickly. This somewhat holds true in the fast-paced world of cryptocurrency and blockchain. It is not always simply a matter of luck or timing; there is actually a predictable pattern to the adoption and maturity of new technologies. Advisory and technology firm Gartner has developed a well-known tool, called the Gartner Hype Cycle, to analyse such trajectories (Gartner, 2023). From the initial hype and excitement to mainstream acceptance, the framework provides a general roadmap for understanding the various stages of technology adoption.

The hype cycle can be used to identify where a technology is currently in its lifecycle and to anticipate future trends in adoption and investment. By understanding the different stages, key industry players can make better decisions on where to channel their investment in order to accelerate growth.

When applying the Gartner Hype Cycle to the Web3 industry, it is clear that the underlying blockchain technology is no exception (Figure 17). While the original hype was initiated with the release of the Bitcoin white paper in 2008, it was only years later that the industry accelerated through the “Innovation Trigger” stage with the emergence of decentralised applications (dApps). This is where there is a potential technology breakthrough, garnering wide media interest simply on proofs-of-concept. The idea of dApps has helped power a number of innovative technological developments and projects over the years. The peak of the hype was hit with the emergence of centralised and decentralised finance platforms, signalling a major shift in tackling and improving scalability, privacy, and other characteristics of a blockchain.

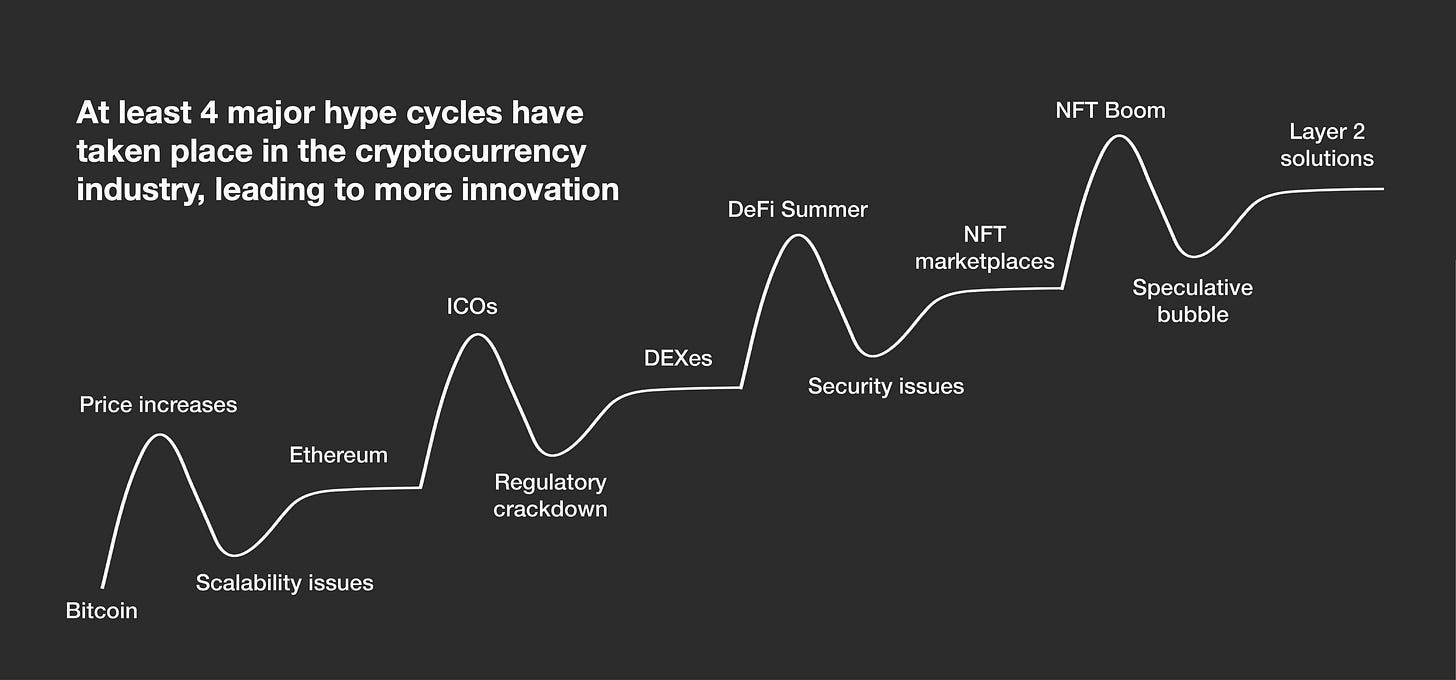

However, at the peak of the hype cycle, various individuals and entities, including those solely motivated by financial gain, will start to enter the space. Consequently, this could result in a range of events, such as scams, hacks, and bubbles, wherein projects or companies are significantly overestimated in value compared to their actual worth.

Zooming in on the various blockchain trends, it can be observed that the industry has experienced various mini hype cycles over the years (Figure 18). The multiple trends show that blockchain innovation has remained resilient as new developments generate hype every few years. Despite the initial enthusiasm eventually dying out, each cycle has resulted in genuine innovations that endure and disrupt.

It is important to acknowledge not only the recurring hype surrounding blockchain, but also how the target audience has changed over time time. Initially, only academics and technology professionals championed Bitcoin’s debut in 2008. However, when initial coin offerings (ICOs) arrived, venture capitalists soon entered the space as they were eager to finance promising projects. The more recent frenzy over “NFTs” also attracted corporate actors and major brands who recognised the potential for new revenue streams.

Overall, it seems that cryptocurrencies have moved past the initial hype, moving into a phase of more active and planned growth and development. While there are still challenges to overcome, such as regulatory hurdles and scalability issues, the resilience of blockchain technology is becoming increasingly clear. However, in order for the industry to move into the “Plateau of Productivity” stage, there are some requirements that need to be addressed.

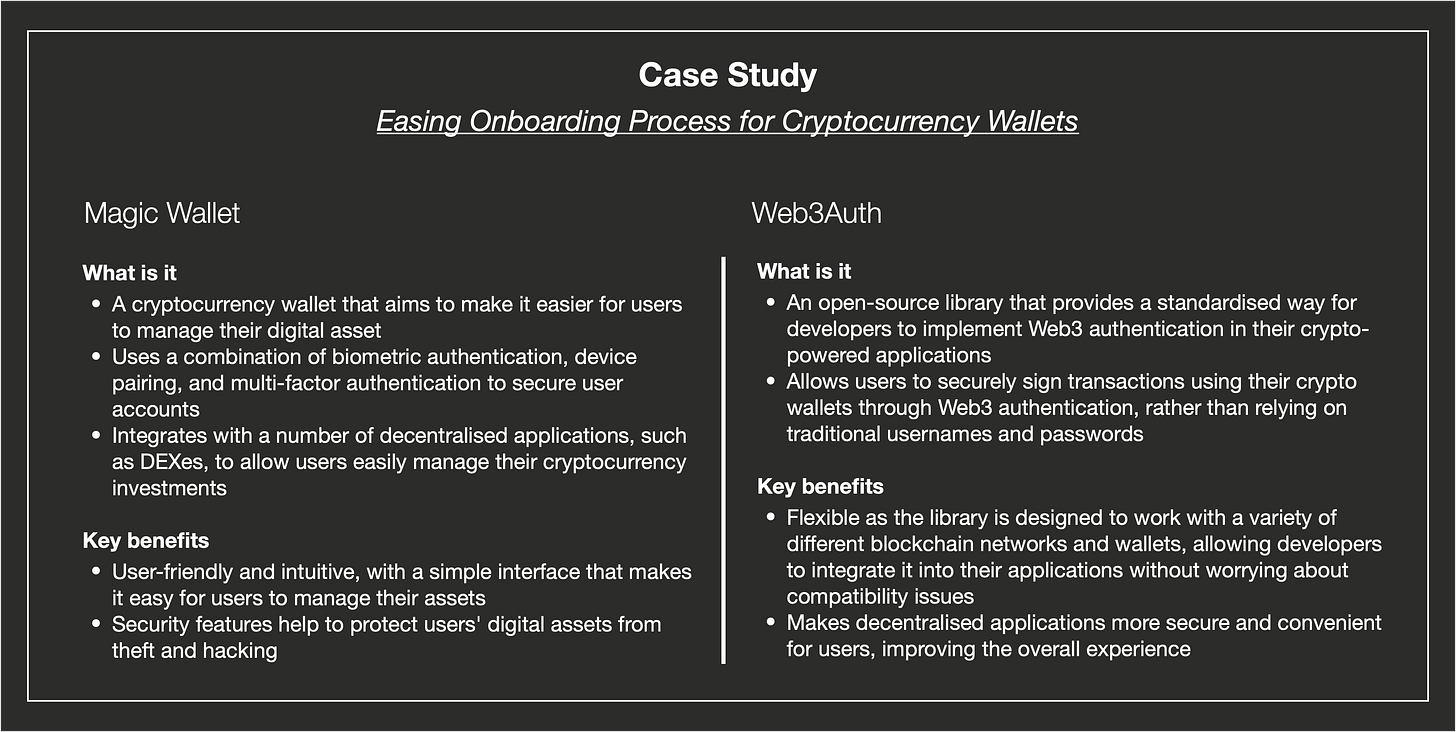

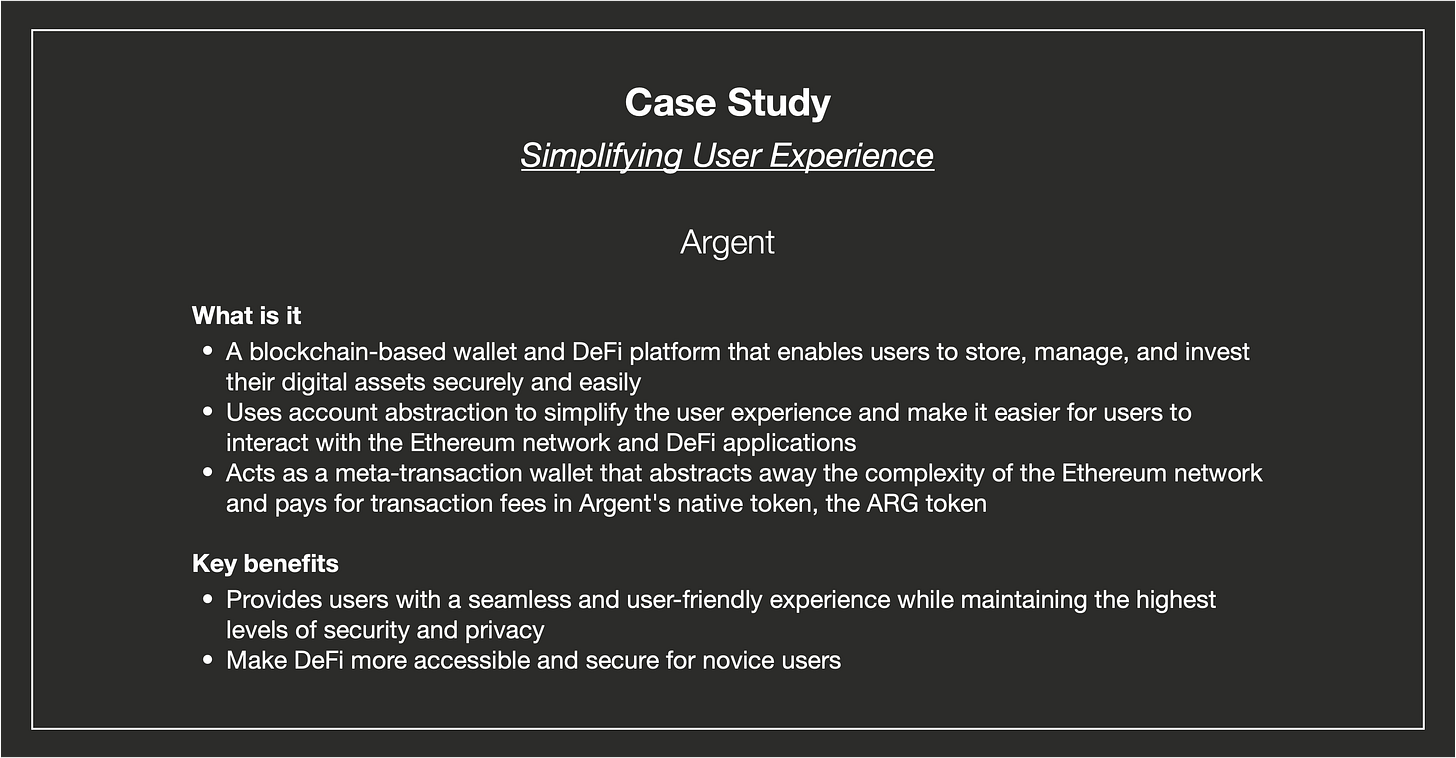

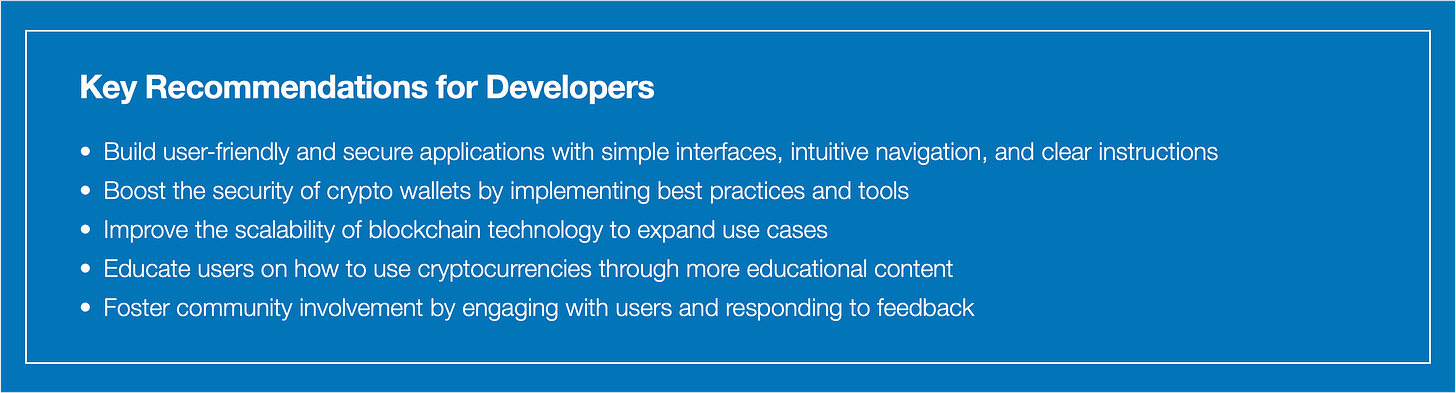

UI/UX Improvements

Due to the inherent technicalities of blockchain technology, improvements in user experience are essential to simplifying the usage of crypto applications. The current onboarding process is criticised as finicky, opaque, and inconvenient. Many technical details and domain-specific terms are used even during a simple token swap, making it difficult for novice users to follow along. In order to offer a familiar user experience akin to Web2, blockchain elements should be extracted from the interface. There are already various firms working to simplify the login process for cryptocurrency wallets alone (Figure 19). Others are striving to ease and enhance the procedure for submitting transactions. To streamline the workflow, tools like LiFi can ease the complex process of bridging tokens across chains. Additionally, human-readable wallet address solutions, like ENS, can make it easier to verify hexadecimal addresses; thus ensuring that funds are not being transferred to the wrong wallet.

Furthermore, users require more guide rails to navigate through various processes seamlessly. For instance, the initial step of transferring funds from centralised exchanges to non-custodial wallets can often be an arduous task involving numerous technicalities. Additionally, long confirmation times on blockchains like Ethereum can be concerning due to the unfamiliar workflow. To keep users informed of the transaction status, especially while moving significant amounts of assets, it is essential to provide more concrete explanations and prompts. This necessitates the inclusion of experienced UI writers and UX designers in the Web3 space. While immutability cannot be removed from the blockchain, it is possible to reduce friction for users.

Practical Use Cases

It should be acknowledged that certain applications of cryptocurrency’s underlying blockchain technology may not be valuable for the wider public, such as the storage of large-scale data and gaming applications that call for high-performance servers. Resource-intensive computing is also generally not necessary for everyday users. Other functions, such as tokenising miles and loyalty points as NFTs, may be straightforward, but they may not significantly improve the user experience.

Consequently, in the eyes of the general public, there remains a need for more valuable use cases for cryptocurrency and its underlying blockchain technology. Without practicality, blockchain and digital currencies will remain confined to niche markets and the tech-savvy, preventing the industry from realising its full potential.

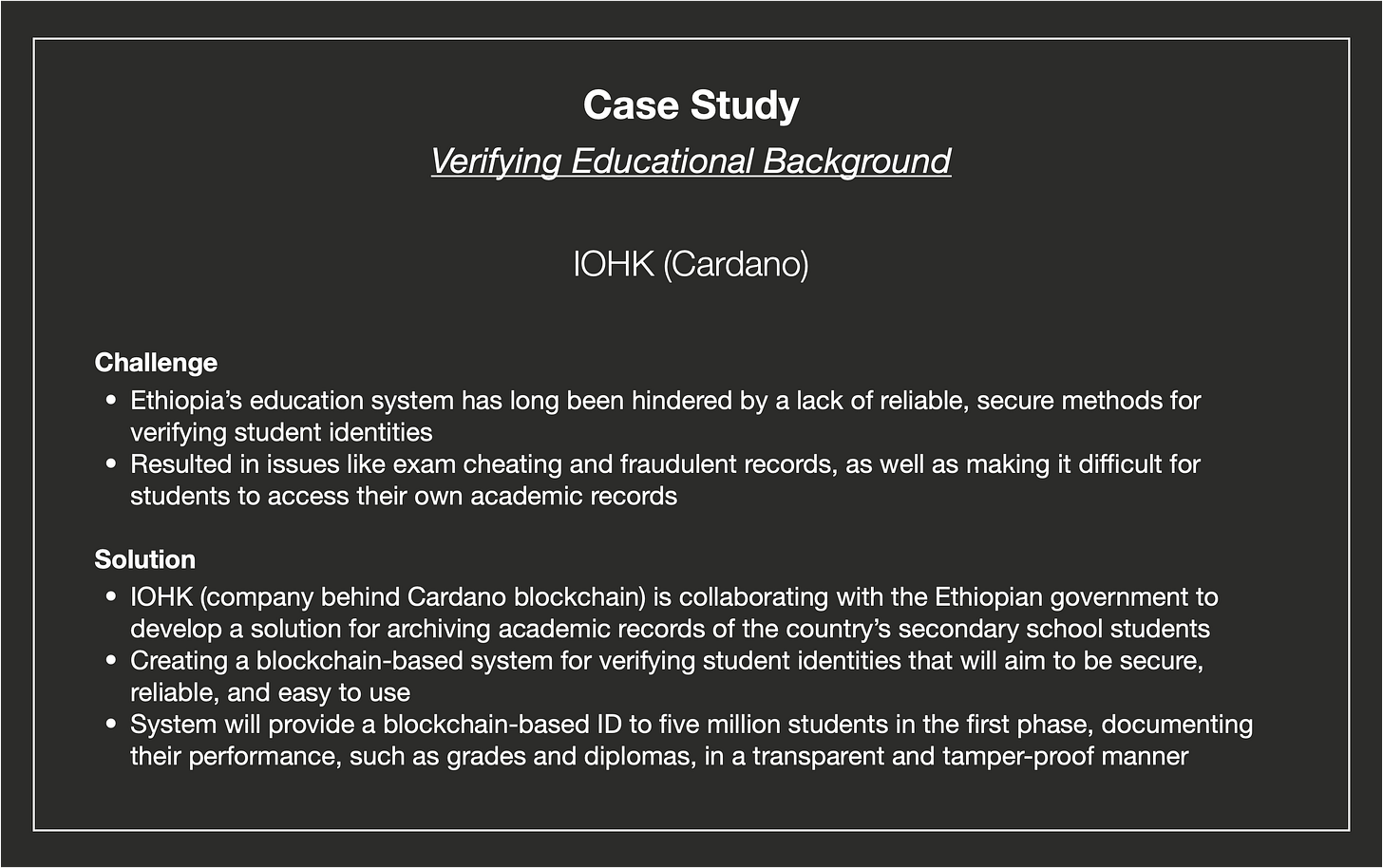

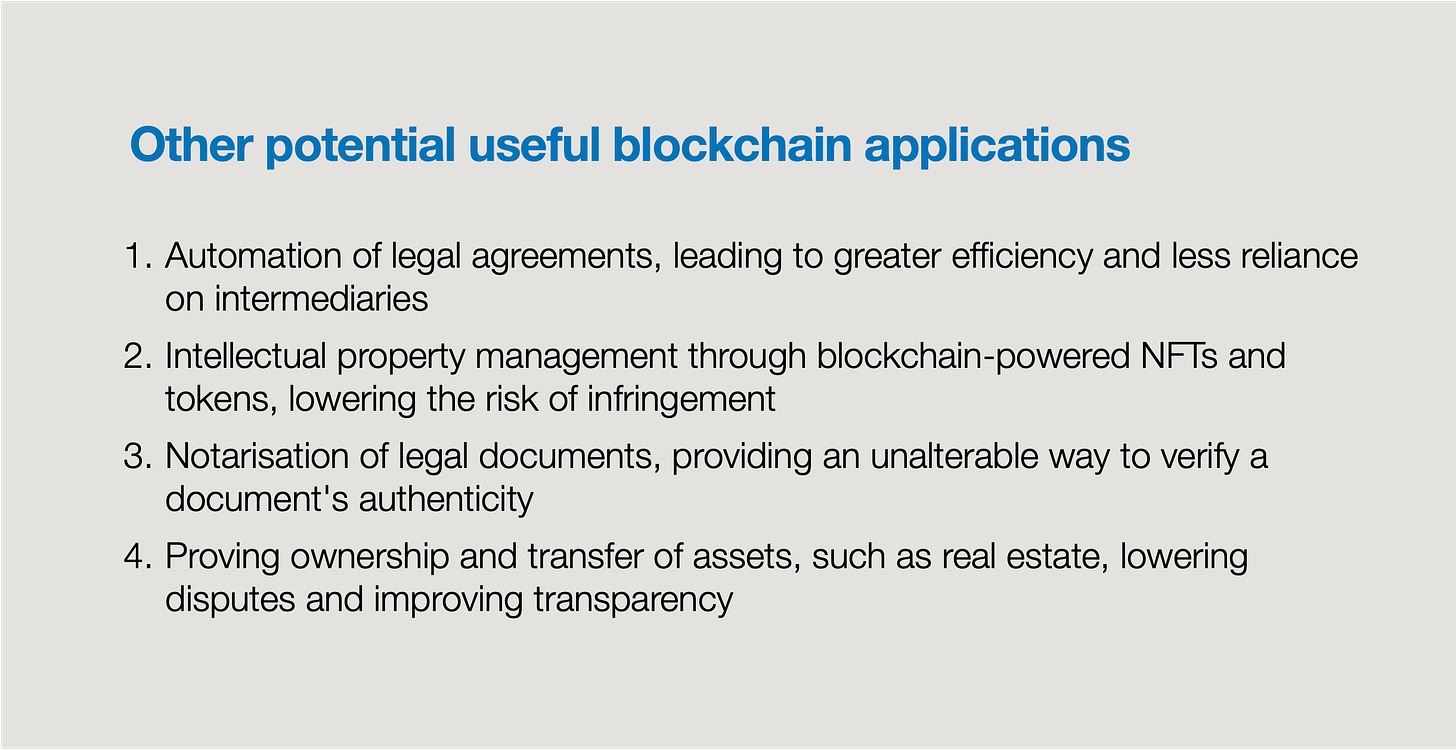

An example of a practical use case is identity verification (Figure 20). The immutable nature of the blockchain makes it an ideal repository for legal documents, educational certificates, and identity papers. This is a crucial benefit to the wider society since having an official proof of identity is a significant challenge globally. Approximately one billion individuals worldwide do not have any legal identification (Broom, 2020). In developing countries, traditional identity verification methods rely on paper documents that can be easily forged, such as birth certificates and education degrees. However, blockchain technology can serve as a solution by providing a decentralised identity record that is secure as well as verifiable. By storing identity information on the blockchain, no single entity controls the data, and authorised parties can access and verify the document as necessary. Furthermore, a cryptographic method, known as zero-knowledge (ZK) proofs, can be used to hide a person’s identity while proving their credentials, enhancing privacy and security.

Technical Improvements

In order to further accelerate crypto adoption, blockchain technology needs more upgrades. One critical area of improvement is scaling, which aims to increase transaction throughput and decrease transaction costs. Ethereum is pursuing a roadmap centred on rollups to make on-chain transactions more affordable for the general public and to enhance accessibility (Buterin, 2022). Several Layer-2 scaling solutions, including Optimism, Arbitrum, and zkSync, have already been integrated into the chain to serve this purpose. These platforms have made it less expensive and more accessible for individuals worldwide to utilise dApps and engage with the Ethereum ecosystem. The chain’s open-source community of builders also regularly introduces new standards to enhance the platform’s usability and accessibility. They include EIP-1559, which seeks to reduce transaction fees and increase efficiency.

Account abstraction marks another essential technical advancement (Figures 21, 22). It offers various features, such as multiple signing keys, social recovery, flexible gas token options, batching of transactions, and customisable functions. Implementing this solution can lead to more efficient, cost-effective, and user-friendly blockchain applications.

Another gap that should be filled is blockchain security. Given the relative nascency of the Solidity language as well as the emergence of the “smart contract” paradigm, it is crucial to adopt a different security mindset and exercise greater prudence when developing code. As previously discussed, smart contracts are still susceptible to various hacks and security breaches, despite strong emphasis on tackling these issues through measures such as smart contract audits. Nevertheless, these steps have not been sufficient. It should not be the responsibility of the general public to verify the security of the smart contracts they interact with. There is a significant need for more Web3 developers to learn how to implement security measures with an adversarial mindset, a requirement that slightly differs from those working in Web2.

Regulatory Clarity

Governments and financial regulators should properly evaluate blockchain projects and take a proactive approach rather than a reactive one. For example, Singapore’s ban on certain centralised exchanges as well as policies against crypto can be regarded as reactive and may not effectively protect citizens. Rather, there is a need for a more sound approach that educates rather than prohibits, recognising cryptocurrency as a legitimate technology.

Education

The crypto community already recognises the importance of education, actively trying to bridge the gap between the crypto and non-crypto populations. For instance, Ethereum has launched several initiatives to educate and onboard the next billion users, such as the Ethereum Foundation’s scholarship programme and community grants. These strategies aim to support more developers and entrepreneurs in building decentralised applications, creating a more accessible and inclusive ecosystem.

With more autonomy in managing one’s assets comes more responsibility, which makes it crucial to educate the public on how to interact safely with blockchain technology. There should be proper documentation of useful resources that range from storing seed phrases to avoiding phishing attacks. It is essential to provide clear, concise, and useful information to help people understand the technology and its potential, with a focus on building trust and reducing perceived barriers to entry.

On the Horizon

Outlook of key trends and developments shaping digital finance

While hype can sometimes lead to overinflated expectations and disappointment, it can also help drive innovation and investment in any technology industry. It is safe to say that progress in cryptocurrency and blockchain technology are not slowing down anytime soon. There are six emerging trends that all key stakeholders should look out for.

Zero-knowledge proofs

As a new technology paradigm, blockchain has the potential to facilitate the development of unique applications that were not possible with Web2 technology. The recent buzz around zero-knowledge (ZK) proofs has sparked discussions about their potential to enhance the capabilities and usability of blockchain. ZK proofs are mainly used to boost privacy and security by allowing users to prove the authenticity of data or transactions without revealing the actual details. Currently, ZK-proofs are largely used to improve the scalability of blockchains through the ZK-rollup technology, as well as privacy-preserving applications, such as Tornado Cash and Aztec. Yet, the possibilities of integrating both ZK-proofs and blockchain technology remain endless (Figure 24).

Decentralised social applications

There is an emerging trend of blockchain-based applications that are challenging the traditional social media model. They do so by providing users with greater authority over their data and content while emphasising privacy and freedom of expression. This marks a significant deviation from the existing social content creation model, enabling more resilience and less vulnerability to censorship or control by a singular authority. Rather than surrendering their data and content to a single centralised platform provider, users of these platforms can maintain full ownership over their work and information (Figure 25).

In particular, cryptocurrency has the potential to revolutionise the job hunting process through the creation of decentralised work applications (Figure 26). Blockchain-powered employment portals can help improve and expand the traditional job market by facilitating peer-to-peer job matching, removing intermediaries and their fees, as well as enhancing privacy and security for users. Job-seekers have greater control over their data and are able to choose who can access it, thanks to the enhanced privacy and security features of these portals.

Enterprise Adoption

While some companies may be jumping on the blockchain bandwagon based on hype, others are genuinely exploring the technology to develop appropriate use cases. However, it will take time for businesses to evaluate the feasibility of cryptocurrency and integrate it into their operations.

One example of a well-established company exploring blockchain technology is Visa. The multinational digital payments firm is currently looking into using Starkware for stablecoin payments. This would enable instant and cost-effective transactions while preserving user data security and privacy (Fernau, 2022).

However, as Instagram’s short-lived venture into NFTs and Meta’s attempt to establish a metaverse have shown, mistakes may occur along the way (Peters, 2023). The recent closure of Disney’s metaverse division is a clear indication of the obstacles that companies may encounter when trying to integrate blockchain technology into their business models (Whelan and Flint, 2023).

Moreover, there is a high risk of businesses expanding too quickly during crypto and tech bull markets and then laying off employees during bear markets. It is critical to take a long-term perspective and develop blockchain features that can strongly improve business processes and user experience. For everything else, traditional databases may suffice.

Solving coordination problems

In the realm of public goods, blockchain technology is being used in innovative ways to enhance funding, coordination, and incentive mechanisms. One promising approach is quadratic funding, which is a mathematical formula that pairs smaller individual contributions with larger contributions from a pool of funds. This helps level the playing field for smaller contributors and prevent wealthy donors from dominating the funding process. Platforms, such as Gitcoin Grants, offer support for public goods that includes open-source software, climate change solutions, Ethereum infrastructure, as well as education platforms.

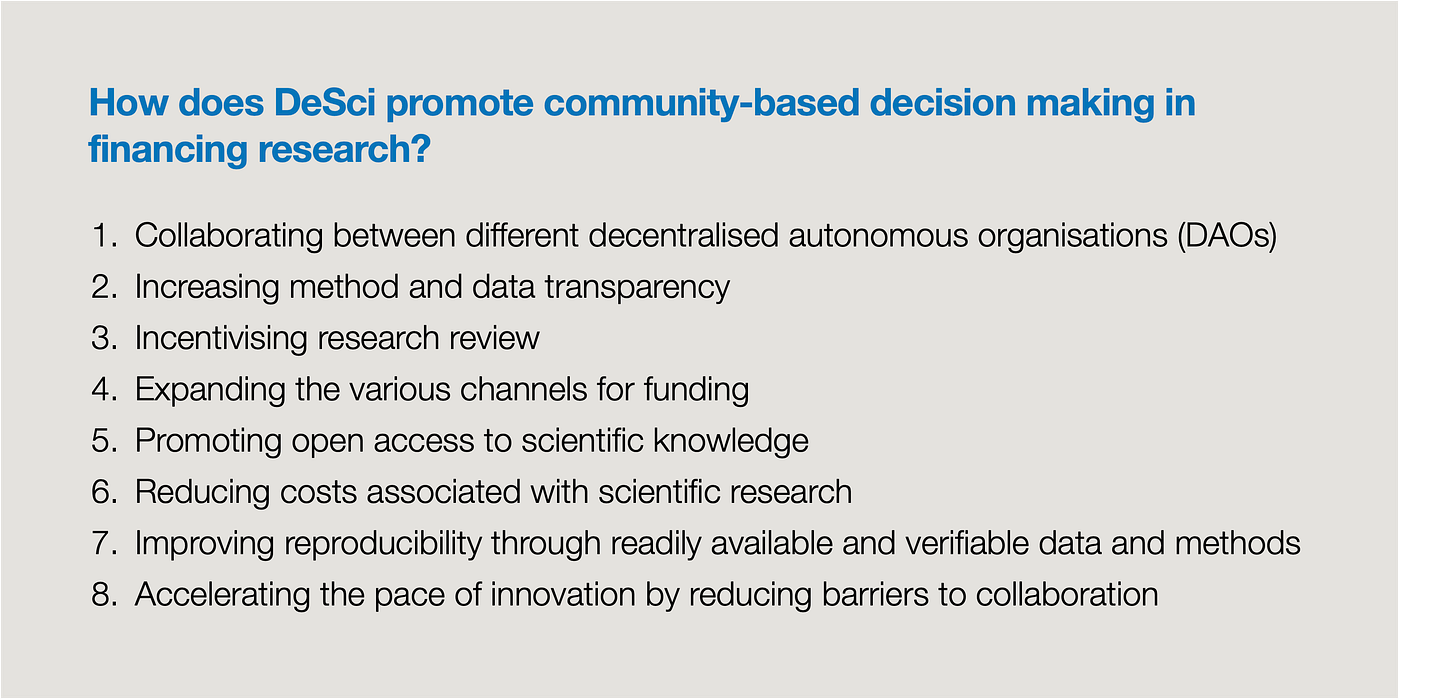

Another area where blockchain is making an impact is scientific research, which has long been plagued by issues such as centralisation, poor transparency, and lack of incentives for reviewing and gate-kept publishing. The Decentralised Science (DeSci) community aims to largely revolutionise scientific research by combining open science principles with novel coordination and incentive mechanisms.

More autonomy and decentralisation

The growing trends towards greater autonomy, decentralisation, as well as privacy-preserving applications are likely to continue in the blockchain sector. At present, many Layer 2 scaling solutions are being built with centralised provers and sequencers that will maximise efficiency as well as optimise usability and performance. However, the ultimate aim is to decentralise this stack, and there are promising indications of progress in this direction.

Starkware recently released the source code of their sequencer, which is a crucial step towards organising and verifying transactions or events within a blockchain without relying on a central authority (Starkware, 2023). The platform’s overarching goal is increased autonomy and decentralisation. Optimism and Arbitrum are also pursuing similar objectives (Optimism, 2022; Offchain Labs, 2022).

The development of privacy-preserving tools and applications is another area to monitor. Through the use of an on-chain identity, users can obtain pseudonymous, undercollateralised on-chain loans by proving ownership of off-chain assets, reputation, and so on. This is done through the use of oracles and ZK proofs, among other methods.

Despite governmental crackdowns, privacy-preserving applications will persist thanks to the ongoing commitment of enthusiasts and developers. Some examples of up-and-coming privacy-preserving projects include Obscuro, which keeps all transactions encrypted (Arcane Group, 2022).

Environmental, Social, & Governance (ESG)

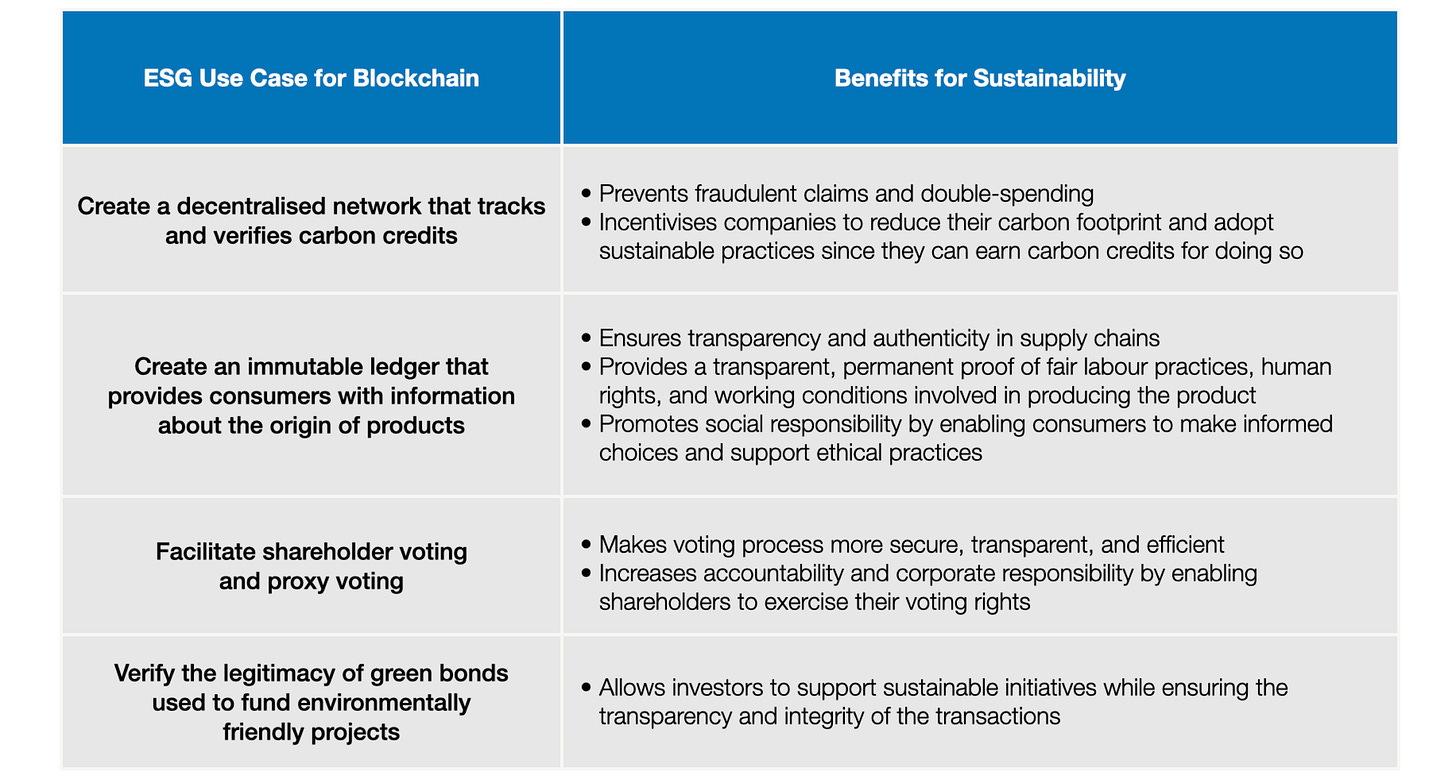

It is true that blockchain technology can create a high carbon footprint due to the energy-intensive process of mining and validating cryptocurrency transactions. At the same time, this can be offset through various ways to promote sustainability (Figure 27).

Conclusion

Final takeaways of industry report

This industry report shows that there are still challenges to overcome regarding crypto adoption, such as regulatory uncertainty and security. However, the benefits of digital assets for individuals, businesses, and even governments will power the resilience of the industry for years to come. If key players consider the following final takeaways, it is likely that the world will see even greater adoption of cryptocurrencies and the emergence of new use cases that have yet to be imagined.

Resources

Works cited

Alchemy. “Web3 Developer Report (Q3 2022).” Alchemy, October 13, 2022. https://www.alchemy.com/blog/web3-developer-report-q3-2022.

Arcane Group. “Reviewing Privacy-First Solutions for Web3 Developers.” Web log. Substack (blog), October 14, 2022. https://arcanegroup.substack.com/p/reviewingprivacysolutions.

Atlantic Council. “Central Bank Digital Currency Tracker.” Atlantic Council, April 18, 2023. https://www.atlanticcouncil.org/cbdctracker/.

Bangkok Post. “Cryptocurrency Curiosity Ramping Up.” https://www.bangkokpost.com. Bangkok Post Group, March 18, 2022. https://www.bangkokpost.com/business/2281054/cryptocurrency-curiosity-ramping-up.

The Bitcoin Manual. “What Is a Normie.” The Bitcoin Manual, October 21, 2021. https://thebitcoinmanual.com/btc-culture/glossary/normie-2/.

Broom, Douglas. “A Billion People Have No Legal Identity – but a New App Plans to Change That.” World Economic Forum, November 20, 2020. https://www.weforum.org/agenda/2020/11/legal-identity-id-app-aid-tech/#:~:text=A%20legal%20identity%20is%20not,according%20to%20the%20World%20Bank.

Buterin, Vitalik. “A Rollup-Centric Ethereum Roadmap.” Fellowship of Ethereum Magicians. Ethereum, September 2022. https://ethereum-magicians.org/t/a-rollup-centric-ethereum-roadmap/4698.

Caroli, Paulo. “The Technology Adoption Curve.” Caroli.org, March 24, 2016. https://caroli.org/en/the-technology-adoption-curve/.

ChainSec. “Documented Timeline of DeFi Exploits.” ChainSec, April 10, 2023. https://chainsec.io/defi-hacks/.

CNA. “Crypto Exchange Binance.sg to Close by February after Operator Withdraws Singapore Licence Application.” CNA. Mediacorp, December 13, 2021. https://www.channelnewsasia.com/business/binance-sg-singapore-close-withdraw-mas-application-2375571.

Coghlan, Jesse. “The 10 Largest Crypto Hacks and Exploits in 2022 Saw $2.1B Stolen.” Cointelegraph. Cointelegraph, December 30, 2022. https://cointelegraph.com/news/the-10-largest-crypto-hacks-and-exploits-in-2022-saw-2-1b-stolen.

Copeland, Tim. “Developers, Family Protest Arrest of Tornado Cash Developer in Amsterdam.” The Block. The Block, August 20, 2022. https://www.theblock.co/post/164657/developers-family-protest-arrest-of-tornado-cash-developer-in-amsterdam.

CryptoDeep. “Blockchain Attack Vectors & Vulnerabilities to Smart Contracts.” Publish0x, December 19, 2022. https://www.publish0x.com/cryptodeep/blockchain-attack-vectors-and-vulnerabilities-to-smart-contr-xlqxzyl.

De Best, Raynor de. “Crypto Users Worldwide 2016-2022.” Statista, March 8, 2023. https://www.statista.com/statistics/1202503/global-cryptocurrency-user-base/.

Duggan, Wayne. “Celsius Crypto Meltdown: A Crypto Lender in Crisis.” Edited by Farran Powell. Forbes. Forbes Media LLC, October 4, 2022. https://www.forbes.com/advisor/investing/cryptocurrency/what-is-celsius/.

Etherscan. “Ethereum Daily Verified Contracts Chart,” 2023. https://etherscan.io/chart/verified-contracts.

Faife, Corin. “Nomad Crypto Bridge Loses $200 Million in ‘Chaotic’ Hack.” The Verge. Vox Media LLC, August 2, 2022. https://www.theverge.com/2022/8/2/23288785/nomad-bridge-200-million-chaotic-hack-smart-contract-cryptocurrency.

Fernau, Owen. “Visa Unveils Plans for Auto-Payments from Self-Custodied Wallets.” The Defiant, December 20, 2022. https://thedefiant.io/visa-autopayments-self-custody.

Gartner. “Gartner Hype Cycle.” Gartner. Gartner Inc., 2023. https://www.gartner.com/en/information-technology/research/hype-cycle.

Gemini. “Global State of Crypto Report.” Gemini, 2022. https://www.gemini.com/gemini-2022-state-of-crypto-global.pdf.

Ghosh, Suvashree, and Chanyaporn Chanjaroen. “Singapore Defends Itself Against Binance Stance Post FTX Fallout.” Bloomberg. Bloomberg L.P., November 21, 2022. https://www.bloomberg.com/news/articles/2022-11-21/singapore-defends-itself-against-binance-stance-post-ftx-fallout#xj4y7vzkg.

Gkritsi, Eliza. “Singapore Looks to Curb Crypto Ads.” CoinDesk. Digital Currency Group, January 17, 2022. https://www.coindesk.com/policy/2022/01/17/singapore-looks-to-curb-crypto-ads/.

Glassnode. “Bitcoin: Number of Active Addresses.” Glassnode Studio. Accessed April 19, 2023. https://studio.glassnode.com/metrics?a=BTC&ema=0&m=addresses.ActiveCount&mAvg=0&mMedian=0&mScl=lin&pScl=log&resolution=1month.

Kamau, Rufas. “How the DeFi Space Has Become a Massive Breeding Ground for Crypto Ponzi Schemes.” Forbes. Integrated Whale Media Investments, May 17, 2022. https://www.forbes.com/sites/rufaskamau/2022/05/17/how-the-defi-space-has-become-a-massive-breeding-ground-for-crypto-ponzi-schemes/?sh=73ebbbc33e89.

Kemp, Simon. “Digital 2022: Global Overview Report .” DataReportal, May 4, 2022. https://datareportal.com/reports/digital-2022-global-overview-report?utm_source=Global_Digital_Reports&utm_medium=Article&utm_campaign=Digital_2022.

Kim, Whizy. “Sam Bankman-Fried’s Arrest Is the Culmination of an Epic Flameout.” Vox. Vox Media, December 22, 2022. https://www.vox.com/the-goods/23458837/sam-bankman-fried-ftx-sbf-downfall-explained.

Kumar, Harsh. “Crypto Ban In India: Is It Realistic?” Outlook India, January 21, 2023. https://www.outlookindia.com/crypto/crypto-ban-in-india-how-realistic-it-is–news-255416.

Ledbetter, James. “The Crazy Crypto Meltdown of Terra and Luna, Explained.” Observer, May 13, 2022. https://observer.com/2022/05/the-crazy-crypto-meltdown-of-terra-and-luna-explained/.

Li, Flora, Stefanie Wei, Barry Jiang, Nolan Liu, Johnny Louey, Siyu Chen, Andy Hoo, Mingwang Zheng, Jimmy Qi, and Lucio Lyu. “Global Crypto Industry Overview and Trends [2022–2023 Annual Report].” Huobi Research. Nansen, December 8, 2022. https://research.huobi.com/#/ArticleDetails?id=356.

MetaMask Support. “Email Phishing Notice.” Twitter, March 10, 2022.

We are continuing to receive reports of email phishing campaigns asking users to "verify" their wallet to comply with KYC regulations, along with other types of "verification mandates". These emails are SCAMS! MetaMask wallets are NOT ASSOCIATED with user email addresses!

— MetaMask Support (@MetaMaskSupport) March 10, 2022

Nadeem, Muhammad Athar, Zhiying Liu, Abdul Hameed Pitafi, Amna Younis, and Yi Xu. “Investigating the Adoption Factors of Cryptocurrencies—a Case of Bitcoin: Empirical Evidence from China.” SAGE Open 11, no. 1 (2021). https://doi.org/10.1177/2158244021998704.

Nakomoto, Satoshi. Thesis. Bitcoin: A Peer-to-Peer Electronic Cash System. Accessed April 20, 2023. https://bitcoin.org/bitcoin.pdf.

The Nation Thailand. “Central Food Retail Ties up with Zipmex to Launch SE Asia’s First Metaverse Supermarket.” The Nation Thailand, March 22, 2022. https://www.nationthailand.com/pr-news/business/40013692.

Offchain Labs. “Arbitrum Decentralization Update.” Web log. Medium (blog), November 16, 2022. https://offchain.medium.com/arbitrum-decentralization-update-39f093768c42.

Optimism. “Our Pragmatic Path to Decentralization.” Web log. Medium (blog), March 12, 2022. https://medium.com/ethereum-optimism/our-pragmatic-path-to-decentralization-cb5805ca43c1.

Pal, Raoul. Technology Adoption Curve – Log Scale. May 24, 2021. Twitter.

This concept in crypto can be best represented by this chart. Already it is the fastest rate of adoption of any technology in human history (113% per annum vs 63% for the internet). pic.twitter.com/XDeEPj2cPU

— Raoul Pal (@RaoulGMI) May 24, 2021

Peters, Jay. “Meta Gives up on Nfts for Facebook and Instagram.” The Verge. VOX Media LLC, March 14, 2023. https://www.theverge.com/2023/3/13/23638572/instagram-nft-meta-facebook-quits-digital-collectibles.

Rogers, Everett M. Diffusion of Innovations. New York: Free Press of Glencoe, 1983.

Siu, Eric, and Will Lee. “How To Deal With Entitlement In The Web3 Space.” Episode. Creators of Web3, November 2, 2022. https://podcasters.spotify.com/pod/show/creators-of-web3/episodes/How-To-Deal-With-Entitlement-In-The-Web3-Space-e1pls4h.

StarkWare. “Open-Source: StarkNet’s New Sequencer.” Web log. Medium (blog), January 25, 2023. https://medium.com/starkware/starknets-new-sequencer-339e63845003.

Tambe, Nikita. “All You Need to Know about India’s Crypto Bill.” Edited by Aashika Jain. Forbes. Forbes Media LLC, March 23, 2023. https://www.forbes.com/advisor/in/investing/cryptocurrency/crypto-bill/.

Token Terminal. Bridge Exploits. October 18, 2022. Twitter.

🌉 Bridge exploits account for ~50% of all DeFi exploits, totaling ~$2.5B in lost assets

— Token Terminal (@tokenterminal) October 18, 2022

These hacks can typically be attributed to smart contract loopholes (e.g. Wormhole & Nomad) or compromised private keys (e.g. Ronin & Harmony).

What will it take to create secure bridges? pic.twitter.com/LrVf0W0zeK

TripleA. “Global Cryptocurrency Ownership Data 2023.” TripleA. Singapore Fintech Association, April 14, 2023. https://triple-a.io/crypto-ownership-data/.

Van Valkenburgh, Peter. “The Digital Asset Anti-Money Laundering Act Is an Opportunistic, Unconstitutional Assault on Cryptocurrency Self Custody, Developers, and Node Operators.” Coin Center, December 14, 2022. https://www.coincenter.org/the-digital-asset-anti-money-laundering-act-is-an-opportunistic-unconstitutional-assault-on-cryptocurrency-self-custody-developers-and-node-operators/.

Warren, Elizabeth, and Roger Marshall. “S. 5267. The Digital Asset Anti-Money Laundering Act of 2022.” 117th Congress. US Banking, Housing, and Urban Affairs Senate, December 15, 2022. https://www.warren.senate.gov/imo/media/doc/Crypto%20National%20Security%20One-Pager%20draft_12.13.22.pdf.

Whelan, Robbie, and Joe Flint. “Disney Eliminates Its Metaverse Division as Part of Company’s Layoffs Plan.” The Wall Street Journal. Dow Jones & Company, March 28, 2023. https://www.wsj.com/articles/disney-eliminates-its-metaverse-division-as-part-of-companys-layoffs-plan-94b03650.

White, Kathryn, Claire Buonocore, Arushi Goel, and Sandra Waliczek. Rep. World Economic Forum. Accenture, July 2022. https://www3.weforum.org/docs/WEF_The_Macroeconomic_Impact_of_Cryptocurrency_and_Stablecoins_2022.pdf.

Wicher, Peter. “IOHK’s Cardano Blockchain to Bolster Ethiopian Students’ Identities.” ExO Insight. Ghost & Krabi, September 29, 2022. https://insight.openexo.com/iohks-cardano-blockchain-to-bolster-ethiopian-students-identities/.

Wilkins, Carolyn A. “Under the Western Sky: The Crypto Frontier.” Bank of England, November 22, 2021. https://www.bankofengland.co.uk/speech/2021/november/carolyn-a-wilkins-keynote-speaker-at-autorite-des-marches-financiers-annual-meeting.

Yang, Yueqi. “Crypto Broker Voyager Issues Notice of Default to Three Arrows.” Bloomberg. Bloomberg L.P., June 27, 2022. https://www.bloomberg.com/news/articles/2022-06-27/crypto-broker-voyager-issues-notice-of-default-to-three-arrows.

Zheng, Sarah, and Kiuyan Wong. “Hong Kong’s Crypto Hub Ambitions Win Quiet Backing From Beijing.” Bloomberg. Bloomberg L.P., February 21, 2023. https://www.bloomberg.com/news/articles/2023-02-21/hong-kong-s-crypto-hub-ambitions-win-quiet-backing-from-beijing.

Download the PDF version here:

Arcane Labs Report (Issue 01) – The Crypto Tipping Point

For more research and insights by Arcane Group, explore here.

Stay updated and follow Arcane Group on LinkedIn and Twitter.

[…] https://en.foresightnews.pro/the-crypto-tipping-point-industry-report/ […]