by Ben Giove

2022 has been a bleak year for crypto with stablecoins, hedge funds, lenders, and exchanges all imploding in horrific fashion.

Much of the space crashed and burned, but pockets of growth remain amid the carnage. One prime example of this secular growth is the Layer-2 ecosystem.

Ethereum’s preeminent scaling solutions quietly experienced a breakout 2022, with extraordinary growth in key KPIs while achieving numerous milestones at both the infrastructure and application layers.

With this in mind, let’s recap L2’22 and see whether 2023 will be another breakout year.

Metrics Snapshot

– TVL 💰

The USD value of assets bridged onto L2s fell 28.6% from $5.7B to $4.1B. However, this is likely attributable to a fall in crypto prices rather than a withdrawal of user funds, as ETH denominated TVL rose 120.6% from 1.6M to 3.4M. This suggests that net-of-prices, L2s, saw significant liquidity inflows in 2022.

– Transactions 📈

Arbitrum saw significant growth in transactions throughout 2022, as a result of increased traction in native dapps such as GMX, as well as the Nitro upgrade which dramatically reduced transaction fees. The network’s transaction count has risen 590% between Q1 and Q4 from 5.0M to 34.9M.

Optimism has also seen substantial growth in transactions, likely due to increased activity following the OP launch and subsequent incentive programs. Optimism processed 3.2M transactions in Q1 and 30.3M in Q4, a whopping 846.7% increase between these two periods.

– Users 👥

Arbitrum experienced strong growth in active users over the course of 2022 driven by, as previously mentioned, usage of applications like GMX as well as the Nitro scalability upgrade. The L2 saw its number of average monthly active users surge 559.1% from an average of 91.8K in Q1 to 605.0K in Q4.

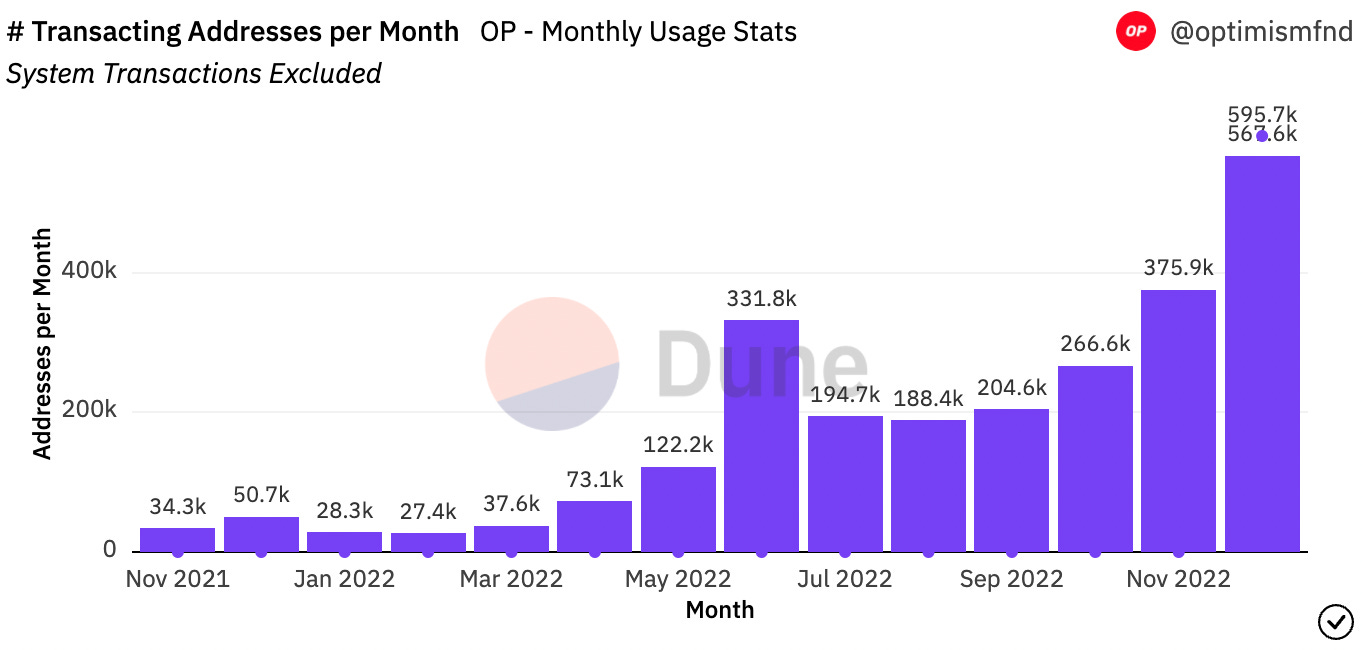

Optimism also experienced a significant increase in users over the course of 2022. Riding the wave of the previously mentioned token launch and incentive programs, Optimism saw its monthly active address count soar 1118.7% from an average of 33.1K in Q1 to 403.4K in Q4.

Highlights 🥳

– Rise of GMX

GMX emerged as 2022’s breakout L2-based dapp. While on-chain activity dried up and prices tanked, the Arbitrum-based decentralized perpetuals exchange soared in usage, leveraging the increased throughput of L2s by facilitating $81.4B in trading volumes and generating $33.0M in revenues. GMX has emerged as a core Arbitrum primitive, accounting for 39.5% of the TVL on the network, with numerous projects such as Dopex, Vesta Finance, Rage Trade, Umami Finance, and others building on GMX and integrating GLP, the platform’s liquidity token.

This growth, along with strong tokenomics that incorporate revenue sharing, has led to the GMX token being among the best performing assets in all of crypto, rising 87.4% and 487.2% against USD and ETH respectively in 2022.

– L2 Tokens Drop

Several prominent L2s released tokens in 2022.

The most notable of these is Optimism, who airdropped 5% of the OP supply to early users and stakeholders. This token launch catalyzed an uptick in user activity and liquidity on the network, with its TVL rising 86.9% since its May 31 release date.

Another L2 that launched their token was zk-rollup provider StarkWare. StarkWare, which announced a raise at a mammoth $8B valuation in May, dropped their STRK token in mid-November, though it is not yet tradable.

OP, and of course STRK, have yet to unlock their full value accrual capabilities in being used to decentralize the Optimism and StarkWare sequencers respectively. Nonetheless, their rollouts are an exciting first-step in L2 token design, and will continue to serve as an important strategic tool for each network.

– zkSync Goes Live

The zkEVM is considered to be the holy grail of scaling solutions, as it conjoins the network effects and development tooling of the EVM with the immense throughput of zk-rollups. zkEVMs were thought to be many years away from seeing the light of day.

Yet nobody seemed to tell zkSync, who launched their zkEVM, zkSync 2.0, mainnet in October. While it’s worth noting that the network is “baby alpha,” the first phase of a three-stage rollout, and is currently not open to contract deployments or end users, the network reaching production still represents a monumental achievement in scaling.

Lowlights 🫤

– dYdX Dips

A major lowlight for the L2 ecosystem in 2022 is the impending loss of dYdX to Cosmos.

In June, the perpetuals exchange announced that it will be migrating away from StarkEx, instead choosing to launch its V4 as its own application-specific blockchain built using the Cosmos SDK.

This represents a material blow to the current L2 landscape, as dYdX is the largest decentralized perpetual exchange by volumes, facilitating $461.2B in trading volumes over these last twelve months. dYdX has also led to speculation that many other prominent dapps would also migrate from Ethereum, eschewing the L2 ecosystem by choosing to build their own sovereign chain.

This mass-exodus has not yet taken place: Yet dYdX’s decision is a stark reminder that L2’s will continue to face fierce competition.

– Centralization Vectors Remain

It may be harsh to call this a “lowlight” – But many L2s still continue to operate with major trust-assumptions. For instance, both Arbitrum and Optimism have yet to fully implement trustless fraud-proofs and decentralized sequencers. Furthermore, each network remains upgradable by the core team (albeit with a time-lock delay).

This is understandable as rollups are novel tech, and these centralization vectors serve as guardrails to prevent the loss of user funds. However, these trust assumptions nonetheless remain a source of risk heading into 2023.

Outlook 🔮

There are numerous exciting developments for both incumbent and new L2s in 2023.

Let’s touch on a few of them below:

Arbitrum

Arbitrum has numerous catalysts that should spur growth in 2023.

Along with the seemingly endless amount of innovative DeFi apps launching on the L2, the network is poised to benefit from the resumption of Arbitrum Odyssey. Odyssey is an event designed to encourage usage of notable dapps on the network by rewarding users with NFTs. Odyssey was postponed in its second week due to causing a spike in gas fees, but should resume in the near-future.

Odyssey is also likely to serve as a precursor for the launch of Arbitrum’s token. This token is likely to be airdropped to early users and Odyssey participants, while being utilized by dapps for incentive programs. Arbitrum is keeping the details of its token very close to the chest, but if (when) it does launch, it is likely to lead to a considerable surge in user activity and liquidity inflows into the network.

Optimism

Optimism is also poised to see another year of stellar growth in 2023.

Along with the continued rollout of OP incentives and an upcoming second airdrop, Optimism is poised to see a major scalability improvement with the launch of Bedrock. Bedrock, which is currently live on testnet, is an upcoming network upgrade that is expected to reduce the cost of submitting calldata to L1 as well as enable support for “alternative proof systems” like zk-proofs. Bedrock (along with the upcoming implementation of EIP-4844, which will dramatically reduce gas costs for all L2s) should lead to massive scalability increases for Optimism.

Optimism is also poised to see increased adoption of the OP Stack, a development framework that enables the creation of custom-L2s. The OP Stack is poised to see increased adoption with the launch of Aevo, a decentralized options exchange from Ribbon Finance that will be built on an L2 which leverages the stack.

“Alt” L2s

The “big-two” optimistic rollups are not the only ones poised for big 2023’s.

There are numerous L2s set to achieve milestones, such as mainnet launches of zkEVMs from Polygon and Scroll.

As previously mentioned, zkSync is slated to continue its phased rollout to support smart contract deployment, and eventually, usage from eager degens such as myself.

In addition, other networks, such as Fuel, a highly scalable ORU that utilizes Swell as its programming language, are also slated see further traction as developers become more comfortable with their tooling.

As we can see, L2s were a rare pocket of growth within the ecosystem in 2022.

There were many highlights, and yes, some lows, but Ethereum is scaling, and 2023 is shaping up to be another gangbusters year for L2s.