Over the past couple of years, airdrop mania consumed the attention of large swathes of the crypto community. It doesn’t take a gigabrain to figure out why. Airdrops are essentially free money, sometimes a lot of it. And who doesn’t like free money?

Airdrops have been touted as a killer Web3 marketing tactic, a great way to drum up hype around your project, boost adoption, and gain traction in a competitive market.

New and established platforms alike seem to love them. Just over the past few months we’ve seen high profile airdrops of Optimism’s $OP, Hop’s $HOP, Apto’s $AP, and several others. There are many more to come.

There’s an important question that needs to be asked though…….

Do they actually work?

It’s a complicated one to answer, and depends largely on what we define as “working”. To investigate we need to dive into the on-chain data.

We’re going to dig into one of the biggest airdrops of them all, Uniswap’s $UNI drop of September 2020. Since it was the largest and highest profile airdrop in recent history, and spawned countless imitators, it will serve as a good case study for the model as a whole.

What are Airdrops?

Let’s briefly explain what an airdrop is for any crypto newbies reading this.

An airdrop is when a protocol “drops” tokens into the wallets of certain users, usually members of their own community who have fulfilled some specific criteria which varies from drop to drop.

What’s the rationale for them? It varies, but typically the goals are one or more of the following:

- Reward loyal users, some are quite lucrative

- Marketing – build hype, gain attention, increase adoption

- “Decentralize” the platform by distributing governance rights to the community

The first ever airdrop was way back in 2014 when “Iceland’s Bitcoin”, Auroracoin, was airdropped to the country’s citizens. In a sign of things to come, $AUR pumped soon after launch to $61 before dumping dramatically and staying there. It’s currently sitting at a little over 3 cents.

Since then there have been many airdrops, with mixed results.

The daddy of them all though was Uniswap’s $UNI drop a little over two years ago. It reignited enthusiasm around the model, helped take Uniswap to market dominance, and served as a model for the future.

Two years on through, it looks like it didn’t live up to its promise. Let’s find out why.

The Uniswap Airdrop

On September 17th, 2020, Uniswap airdropped $UNI to over 250k addresses which had previously interacted with the protocol. Eligible addresses had interacted with the platform before September 1st 2020, and were granted at least 400 $UNI tokens.

Overall, the distribution was quite skewed. The vast majority of addresses – 93.8% – received less than 412 $UNI.

On the other end of the spectrum, over 250 addresses received 250,000 $UNI. These were mostly historical power users, large LPs, and $SOCKS holders.

Since airdrops are essentially free money, you’d expect the vast majority of those eligible to scoop it up. And that (mostly) happened, with 90.8% of wallets claiming their tokens within the first month.

Not all were so fast though. Throughout 2022, around 70-100 addresses have been claiming $UNI per week. Also, there are still 30,000 users who haven’t yet claimed the drop at all – after over 2 years – leaving over $84 million dollars in $UNI on the table.

So most people claimed, and some are still claiming today. So far, so good. Let’s look at what happened next.

What Happened to the $UNI airdrop recipients?

One of the goals of airdrops is to seed the token among the user base, boosting retention and laying the groundwork for its usage in governance and the community.

In Uniswap’s case, while most wallets claimed the airdrop, whether any of the other goals were achieved is debatable.

Only ~7% of wallets that received the airdrop are still holding $UNI…….

Worse still, the of the remaining ~7%, the majority have sold at least some, and only 1% of wallets increased their $UNI position :

The vast majority simply dumped the token, and only 3% didn’t sell at least some. It seems like neither governance rights in the protocol nor the potential future value of the token was attractive enough to outweigh the “free money” aspect.

Some users may still hold $UNI that we can’t account for because they transferred it to another wallet, but it doesn’t look good…..

The sharpest decline occurred immediately after the airdrop. Over 75% of wallets dumped the token within the first 7 days.

The dumping continued, at 80% within the first 30 days and 85% within the first 90 days. As we stand now, 93% of airdroppers have sold all their $UNI.

Of course, there’s nothing wrong with selling an airdrop. Some users may need the money or are more interested in investing elsewhere. They might also lack faith in the platform and want to cash out for as much as they can, while they can.

With the right airdrop though, it can be more lucrative to hold onto the token. Most Uniswap users cashed out in the early days when $UNI was $2-$4. Perhaps they regret it though – since the price surged through early 2021 to a peak of $41. The average airdrop would have been worth $12,000 at the top!

Wallets that never touched their initial claim remain in profit.

So we know that a lot of users dumped the airdrop, for better or worse. What about the rest, did many remain loyal to the token? Did they, as envisaged, go on to become influential pillars of the Uniswap community?

Looking at the top 5000 $UNI wallets today – only 10.5% of them were airdrop recipients. To make it into this category, you’d need to hold at least 780 tokens, worth around $5k. This is double the average airdrop, which alone would merely put you in the top 10k.

Over 230k wallets hold $UNI, but the top 5000 wallets hold 56% of the total supply. Of course the airdrop whales are still represented at the top, but the average recipient isn’t.

Like all things in finance – the top holders control pretty much everything…..

If the goal was to give a stake in the protocol and governance power to the early adopters, it seems that it failed……

Did $UNI Airdroppers Remain as Users?

So we’ve established that few airdroppers held onto their $UNI, even fewer increased their positions. But did they at least stick around as active, engaged users of the platform itself?

Ummmm, not so much.

At the time of the airdrop, recipients made up a significant chunk of the platform’s active user base – around 40% of weekly volume and 60% of active traders.

This figure declined significantly in the following 6 months, dropping to <10%. Around 1 year after the drop, they dipped to 5% and have stayed in that region ever since.

This can be partially explained by the fact that Uniswap’s total userbase grew significantly through this period. The original users make up a smaller slice because of the explosive growth. But that’s not the whole story…

The number of airdroppers actively trading declined in the weeks and months following the drop, falling from over 62k weekly traders in mid September 2020 to around 10k a year later.

This continued through 2022, and by September was down to only 4k!

Upon further analysis, most of these wallets are inactive on Ethereum. 50% have not been active in the past 610 days.

Only 25% of $UNI airdroppers have been active in the past year. The issue, it seems, isn’t the retention of airdrop of wallets to Uniswap, but keeping these wallets active on Ethereum in general…..

So if most of these wallets are inactive and only compose 5% of active traders, how much volume do they account for?

You might guess that volume dropped along with general usage. Surprisingly though, the airdrop wallets are making some some massive trades and were accounting for 15-40% of weekly volume through much of the period where they were <10% of users.

In August 2022 though, something changed, and airdropper volume makes up less than 4% of the total now.

Why? We can only take an educated guess. The most likely reason is a decrease in the activity of high-rolling Whale swappers. The exact reason these wallets went inactive is unknown, but due to the suspicious timing it could be connected to The Merge.

What to make of these numbers?

Obviously, the majority of airdrop recipients have churned. But they still comprise an important cohort of Uniswap users, and until very recently punched way above their weight in volume terms.

While the airdrop seems to have not boosted high level retention, it did connect with and reward some early adopters who remained as core platform users until the present day. We have to ask though – can the airdrop be credited with any of this?

Non Airdrop Wallets

We’ve established that, with notable exceptions, the majority of airdrop recipients neither hodled their $UNI nor stuck around to use the protocol.

Quite the opposite in fact, they were dumping it like nobody’s business. How about the people they dumped it on though? How have they been interacting with the protocol?

825,000+ wallets that did not receive the airdrop have held $UNI at some point. As the price of $UNI began to climb, new wallets began to buy in fervor. At its peak in May 2021, 29.3k new wallets bought $UNI.

As the price began to decrease though, so did the number of new wallets holding the token. $UNI’s price never recovered, though the token never died completely either. In 2022, only 1500 – 3000 wallets per week have been buying the token for the first time.

So the wider crypto public started to lose interest as the price dropped. Did the wallets who bought on the secondary market hold onto their $UNI though?

Well, for most of them – not really.

74% sold off all of their $UNI. Interestingly though, 26% have held on to their tokens:

Recall that this is a much higher % than the airdrop wallets themselves (~7%)!

This may be due to secondary buyers seeing $UNI as an investment whereas airdroppers saw it as free cash. A lot of secondary buyers may also be underwater on their investment and reluctant to sell, hoping to hold on until another DeFi “blue chip” bull run.

Governance

What’s the value of these kinds of tokens anyway? Some refer to them as “utility” tokens, in this case the utility being the ability for $UNI holders to participate in protocol governance.

1 $UNI token represents one vote on a given proposal. Wallets have the choice to vote themselves or delegate to another address to vote on their behalf. This was actually one of the stated intentions of the airdrop, to decentralize the protocol and allow the community to build up the DEX. To give the early adopters a stake in the future direction of the protocol.

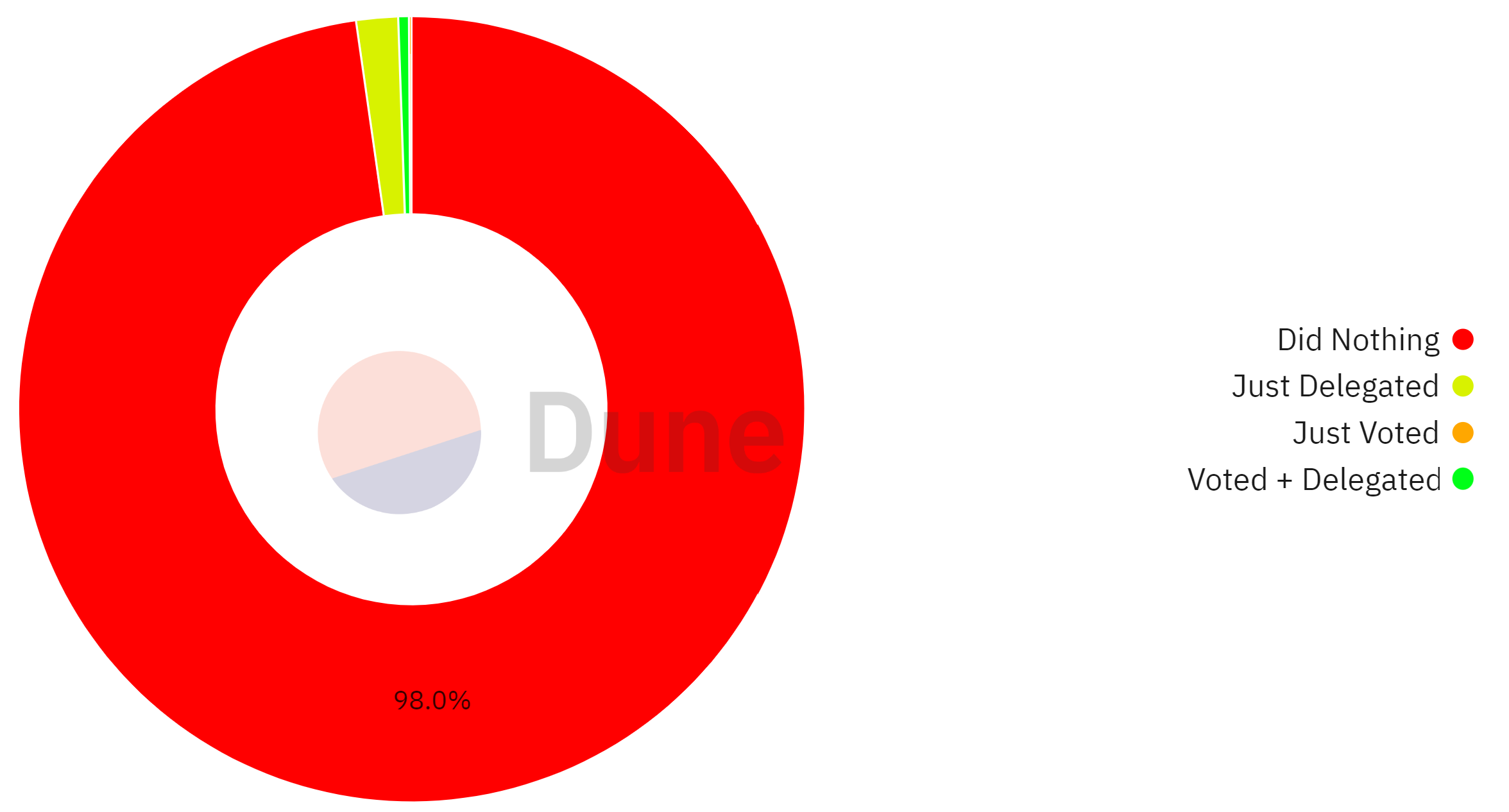

Did it work out? Again, alas, not so much. Close to 98% of airdroppers did not take part in the governance process at all. The reasons? Most likely due to early sell offs and general lack of interest.

Even so, a few airdroppers are still participating, and sometimes account for up to ~25% of the total votes!

So some of the airdrop whales, many of whom are directly involved with the project are participating. Retail, not so much.

Those who did not receive the airdrop showed similar participation rates. Even for the top 5000 wallets, only 15% participated in the governance process.

So it seems that in this case, the airdrop did not succeed in “decentralizing” the protocol by encouraging a wide array of users to participate in governance. It did however distribute power to a wider range of early “prominent” users who were incentivized to participate going forward.

For $UNI it seems that it is not what you can do for your protocol, but what your protocol’s token can do for you……

Was it Just Uniswap’s Airdrop?

Having 7% of airdroppers currently holding $UNI sounds bad, but perhaps we shouldn’t judge them too harshly. Is this the crypto airdrop norm?

Looking at drops that occurred in a similar timeframe to $UNI, there seem to be similar results. For example, only 7.9% of airdropped wallets for 1Inch still hold the token.

For three more recent airdrops, the numbers are looking a bit better. For example, after the $HOP airdrop 38.7% still hold the token.

Coming in second was $ENS with 23.9% of $ENS airdroppers still holding. Since $HOP was more recent it makes sense that is higher.

$LOOKS was worse with 85% dumping – particularly bad considering the high profile staking incentives offered with the token:

Although some of these seem like an improvement, the trend of users selling the airdrop continues. These may actually have worse retention rates than Uniswap if compared on the same timelines. We couldn’t find any major example where the majority of recipients held the tokens.

Is it because users don’t value the token’s utility, do they see airdrops as just free money?

Airdrops = a broken system?

Arguably, the current airdrop system is broken.

From a marketing perspective, it does help get more users to use the protocol and trade the token post-airdrop. It helped Uniswap to make a splash a couple of years back, and look at them now!

When it comes to decentralizing, democratizing the protocol by distributing governance tokens though – it seems like it doesn’t really work at all.

With $UNI and most others, the majority of users ended up selling the token and didn’t take part in the governance process at all. Instead, they dumped quickly after claiming the airdrop, often a bad decision from a financial point of view.

Why did they sell? The simplest answers are that they:

- Saw it as a free money “reward” and nothing more

- Weren’t interested in participating in governance

Is it reasonable to expect more? Thinking that the average user wants to dedicate their time and energy into protocol governance may be a flawed assumption. Most may just want a tool to use and nothing more. Is the case of the Uniswap airdrop evidence of this?

Imagine if Apple had dropped shares to early Mac users in the 90s and told them they’ get a (tiny) vote in board decisions. Would many have bothered, or would they too have sold most of them straight away?

There’s a potential counterpoint though. A small portion of airdropped wallets still play an outsized role in protocol governance. They’re actively trading high amounts of volume on the DEX, have (and exercise) influence in governance, and represent some of the top holders of the token. These are mostly whales though, who have outsized influence in everything.

If the true goal is the decentralization of governance, then we can’t call any of this a success. $UNI was one of the first and biggest, and other airdrops have fared no better. On top of this, the farming frenzy and ubiquitous sybil antics dent the reputation of airdrops further and add additional selling pressure on top.

To end on a positive note – each airdrop provides valuable lessons to the next. With the unprecedented transparency of open on-chain data, these lessons are available to the whole community. We can see what went well and what didn’t.

Taking these lessons, protocols can iterate on the current model, improving it to not only help themselves but also to better incentivise the community to participate in decentralized and democratic governance.

For more – take a look at the full dashboard…….

.png)

.png)

.png)