by Ben Giove

The collapse of FTX has wreaked havoc across crypto, tanking markets, wiping out firms, and damaging trust in the industry.

Don’t get it twisted – This is one of the most devastating events in the history of space. However, there are still reasons to be optimistic as we begin to recover and rebuild the industry.

One silver lining from the FTX implosion is that it’s likely to catalyze adoption of DeFi, as crypto once again has woken up to the risks associated with transacting within opaque, custodial entities.

An area of DeFi that is well positioned to capture this newfound demand for non-custodial, transparent, and decentralized solutions are decentralized perpetuals (perps) exchanges.

Perpetual Futures are futures contracts that do not have an expiration date, as they continuously roll-over. To keep a position open and tether the price of the perp with that of the underlying asset, traders will make continuous interest payments. The rate of payment is determined by trader positioning and is known as the funding rate.

This design and the ease of managing these positions have led perps to explode in popularity and establish the sector as a core component of crypto market structure. Perps volumes exceed that of spot, as it’s the primary way for traders to open leveraged long or short positions.

Centralized exchanges are the go-to venues to trade perps. However, a cohort of steadily-growing DeFi protocols have emerged as viable alternatives poised to capture flow in a post-FTX world.

Given that on-chain DEXs have a very small percentage share of futures open-interest, the near-term (let alone long-term) addressable market for these protocols is considerable.

Furthermore, unlike CEXs, investors may have the opportunity to capture the upside of this trend, as the leading perps DEXs all have tokens, many of which have been outperforming the broader market.

So… which are the leading perpetual exchanges? What are their tokenomics like? Which protocol has the best chance of “winning”?

Let’s find out.

dYdX

Protocol Overview:

dYdX is the protocol most analogous to centralized exchanges, as it utilizes a central limit order-book model. This order-book model, along with hefty incentives, has enabled dYdX to onboard institutional market makers and build out deep liquidity for the major large-cap assets listed on the DEX. dYdX is also highly performant, as it is built on StarkEx, an L2 that enables it to offer gasless trading. A notable drawback of this decision is a lack of composability, as apps built on StarkEx cannot interoperate with one another.

dYdX is planning to launch its V4 on its own application-specific blockchain built on Cosmos. The chain, which is scheduled to launch Q2 of 2023, will enable the exchange to become more decentralized, as it will no longer have a centralized matching engine. However this will come at the cost of security, as dYdX Chain will need to bootstrap its own, unique validator set.

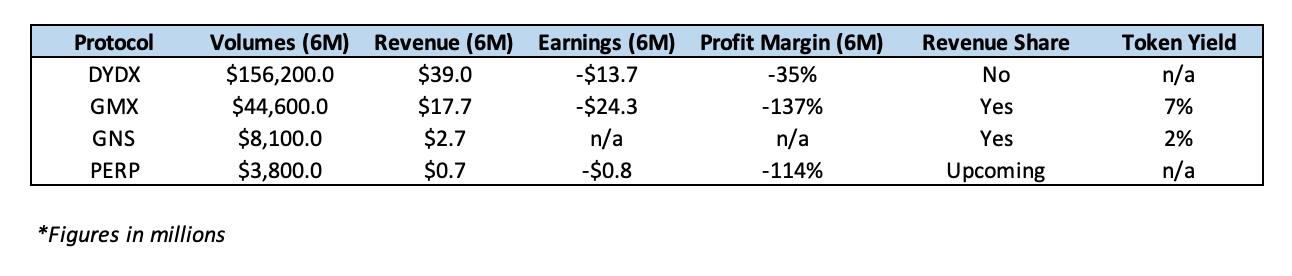

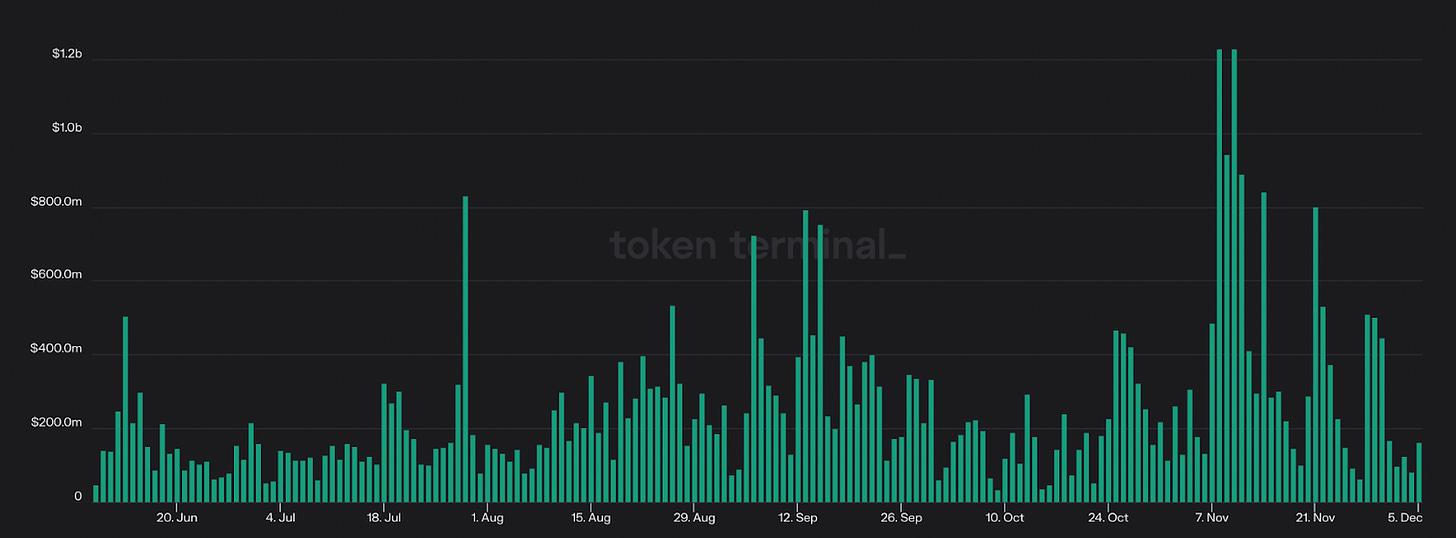

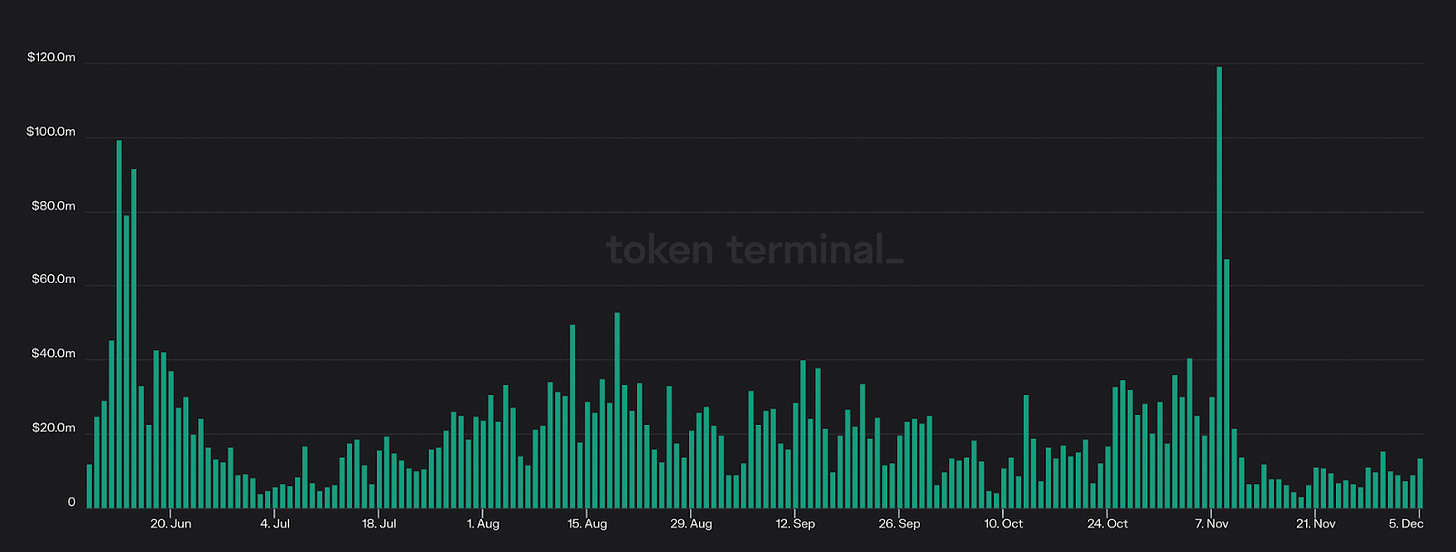

dYdX is currently the largest on-chain perpetuals exchange, generating more than $156.2B in volume (~78% market share) and $39.0M in revenues over the past six-months. However, as a result of the aforementioned incentives, the protocol operated at $13.7M loss during this period, with profit margins of -35%.

Tokenomics:

dYdX is governed by the DYDX token. Notably, DYDX does not have any fee sharing in place, with revenue generated by the DEX going directly to dYdX Trading Inc, a centralized company that works on protocol development. The token has some utility as a protocol backstop, though its primary usage is to incentivize liquidity and trading activity. It’s possible that with V4, the DYDX token will be used to secure the dYdX Chain, with stakers able to earn emissions, trading fees, and MEV. However, this decision will have to pass a DAO governance vote.

GMX

Protocol Overview:

GMX has taken DeFi by storm.

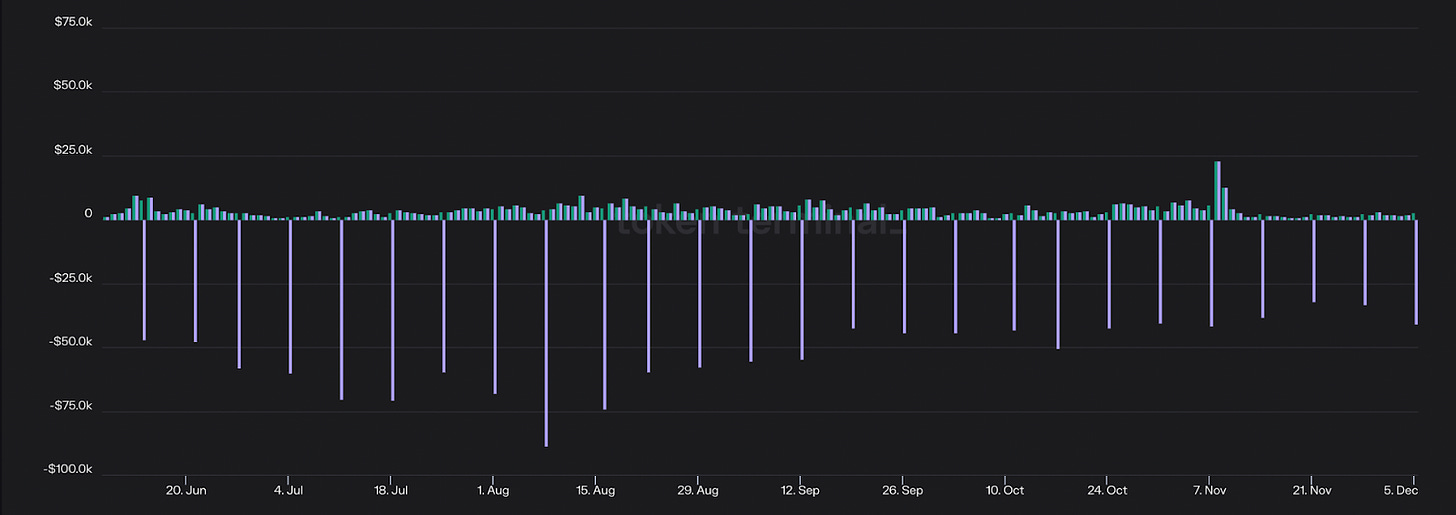

The protocol utilizes a unique model where users can provide liquidity to an index-like basket of assets known as GLP. GLP, which is composed primarily of ETH, wBTC, and stables, acts as the counterparty for traders on the DEX who borrow from the liquidity pool to open up a leverage position. This means that GLP takes on “profit and loss (pnl) risk” in that it accrues value when traders make an unprofitable trade and vice versa. GLP earns a 70% cut of trading fees which are paid out in ETH and has been among the highest sustained sources of yield in all of DeFi, routinely netting between 20 – 30% APR.

GMX offers traders 0% slippage, as it uses oracle-based pricing through Chainlink. However, this dependency opens the protocol up to the risk of price manipulation exploits, as an attacker can manipulate an assets price feed in order to profit on GMX and drain GLP. The protocol does have parameters in place to mitigate this risk, such as OI caps, while limiting its selection of supported assets. GMX also faces scalability concerns, as its reliance on CEX price feeds means it can only scale with the liquidity on those venues.

GMX has grown its market share significantly over the last six months from 9.3% to 16.3%. The protocol has even had days in which it has generated more fees than Uniswap.

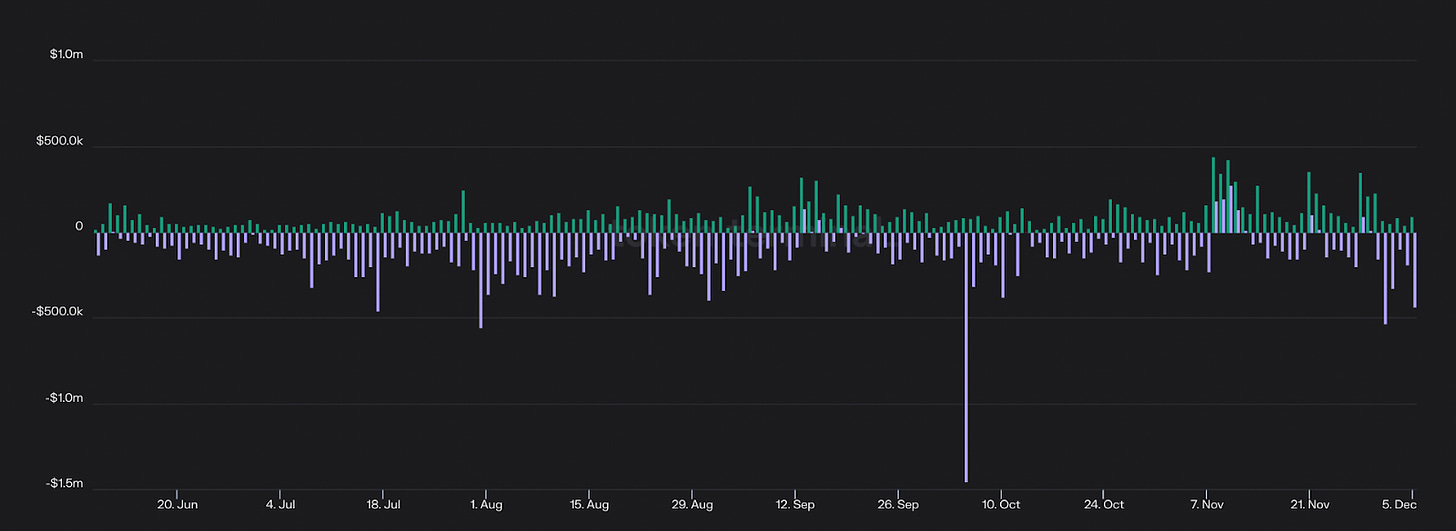

In aggregate, GMX has generated $44.6B in volumes and $17.7M in revenues, operating at a $24.3M loss over this period, with margins of -137%.

GMX has emerged as a core primitive on Arbitrum with a 40% share of TVL on the network, and projects such as Umami Finance, Rage Trade, Vesta Finance, Dopex and building on the platform and sourcing GLP liquidity.

Tokenomics:

GMX is governed by the GMX token. Tokenholders can stake their GMX to earn a 30% cut of protocol revenue paid in ETH, escrowed GMX (esGMX), as well as boosted rewards when providing liquidity to GLP. To date, GMX stakers have earned more than $34.6M in fees, with the token currently boasting an ETH-denominated yield of ~7% (this excludes esGMX emissions).

Gains Network

Protocol Overview:

Gains Network is another fast-growing DEX.

Gains utilizes a somewhat similar model to GMX, but rather than provide liquidity to a basket of assets, users instead do so to a DAI-only vault. Like GLP, the vault acts as the counterparty for traders on the DEX, with users depositing DAI collateral to open up long or short positions. Users can also LP in the vault, where they will earn trading fees and internalize trader profits and losses.

Gains has several unique characteristics, such as supporting equities and forex in addition to crypto. The exchange is a “degens paradise” as it supports between 100-1000x leverage, among the highest of any DEX depending on the asset class that users are trading. However, this comes at the cost of scalability, as users can only deposit a maximum of $75,000 of collateral. The exchange also limits trader profits to 900%.

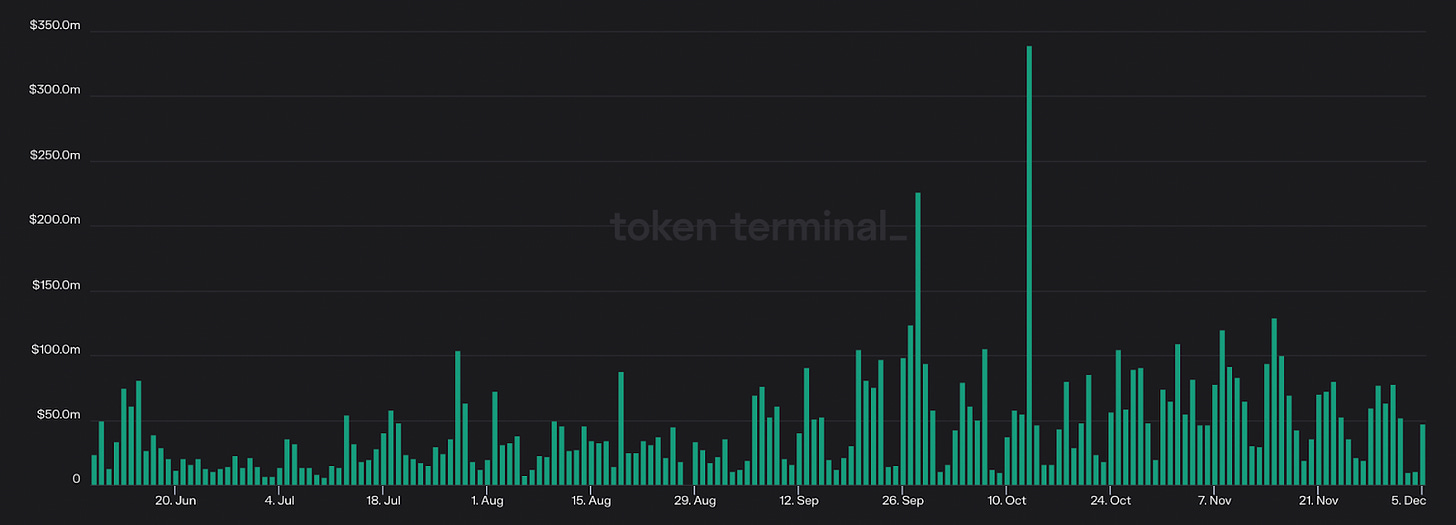

Gains has facilitated $8.1B in trading volumes while generating $2.7M in revenue over the past six months. Gains is currently deployed on Polygon, though the protocol is planning to deploy on Arbitrum in the near future.

Tokenomics:

Gains is governed by the GNS token which can be staked to earn a share of trading fees generated by the platform. GNS also benefits from a burning mechanism, as when the DAI Vault is greater than 130% collateralized, excess deposits are used to buyback and burn the token.

Finally, GNS is utilized as a backstop, with the protocol docs stating that tokens will be sold in the event that the DAI vault becomes undercollateralized. As of writing, the yield for GNS stakers sits at ~2%.

Perpetual Protocol

Protocol Overview:

Perpetual Protocol utilizes a virtual-AMM (vAMM) architecture built on Uniswap V3. This enables the protocol to facilitate capital efficient trades (like V3) while utilizing synthetic leverage. This means that on Perpetual Protocol, users can trade assets like ETH and BTC without the need for the DEX itself to custody or settle trades with them.

Perpetual Protocol is deployed on Optimism, allowing the exchange to benefit from composability with other protocols on the L2. Several projects, such as Brahama, Galleon DAO, and Index Coop have built delta-neutral yield products that capture yield from the funding rate (the interest rate paid to open a long/short position) on the platform.

Perpetual Protocol has seen its market-share shrink relative to competitors like GMX, falling from 2.9% to 1.8% over the last six-months. The exchange has done $3.8B in volumes and $658K in revenue during that period, operating at a loss of $755K with margins of -114%.

Tokenomics:

Perpetual Protocol is governed by the PERP token. PERP can be locked for vePERP, a non-transferable token that entitles holders to governance rights, boosted token rewards for providing liquidity, as well as the right to allocate emissions across different liquidity pools on the platform. In addition, pending an upcoming governance vote, vePERP holders will be entitled to either a 25%, 50%, or 75% share of trading fees generated by the DEX. These fees will be paid to tokenholders in USDC.

The Next Wave:

dYdX, GMX, Gains, and Perpetual Protocol are not the only games in town.

Between the massive TAM and strong network effects of winning protocols, the decentralized perps sector is fiercely competitive with numerous projects looking to steal market-share from the incumbents.

Let’s briefly touch on a few below:

- Cap Finance (CAP) is an Arbitrum based DEX that offers 0% fees and prices assets via a unique oracle system. Cap is gearing up for its upcoming V4 launch, and has facilitated $1.4B in volumes and generated $614K in revenue over the last six months.

- Rage Trade is a newly launched exchange on Arbitrum. On Rage, users can provide liquidity to traders via “80/20” vaults that deposit idle assets into outside yield venues to increase LP returns. The protocol’s first 80/20 vault, which LP’s into Curve’s Tri-Crypto pool, currently yields 9.2% and has reached its current maximum capacity of ~$3.3M.

- Kwenta is an Optimism based-DEX that is built on Synthetix, utilizing its liquidity and Chainlink price feeds.

There are numerous other exciting protocols in development, such as Vertex, an order-book based exchange on Arbitrum, and Drift Protocol, with their V2 re-launch on Solana. Perpetual’s infrastructure is even being built out for NFTs with protocols like NFT Perp, another vAMM-based DEX that is launching on Arbitrum.

Conclusion

As we can see, each perpetuals DEX differs in protocol design, tokenomics, and operational performance.

Although Gains Network and Perpetual Protocol bring unique features and token designs to the table, as of today the sector is largely a two-horse race between dYdX and GMX.

dYdX has a clear lead in volumes and revenues while operating with higher margins. It also has the most scalable exchange model in the long-run in the form of a CLOB.

However, its tokenomics are worst in class. dYdX Trading, not the DAO or DYDX holders, captures all protocol revenues. The DYDX token also suffers from perpetual sell-pressure as a result of liquidity incentives, though this may change with the launch of dYdX V4.

GMX has emerged as a core primitive on Arbitrum, and seen its market-share grow dramatically in recent months. The tokenomics of GMX are stellar, as stakers can earn yield in ETH at a clip that currently exceeds the ETH staking rate.

Despite this, there are several features in the protocol’s design that limit scalability while introducing unique tail-risks.

Although it leads its rival on many fronts, DYDX is down 53.3% against GMX in the past six-months.

So while DYDX seems to have the superior product, the decentralized perpetuals sector appears to be yet another clear example that in crypto, the product is not the token.