By Anutosh Banerjee, Robert Byrne, Ian De Bode, and Matt Higginson

While buffeted by the recent market downturn and bankruptcies, digital assets and the technologies underlying them still have the potential to transform business models across sectors.

The past few months have been a rough awakening for many Web3 enthusiasts: the market prices of major cryptocurrencies have declined significantly, the trading volume of non-fungible tokens (NFTs) has slowed, and, most importantly, some pioneers of the space have declared bankruptcy because of failed risk management and misuse of consumer funds. Yet even as the debris continues to fly, business leaders shouldn’t confuse market fluctuations or bad actors with the potential uses of digital assets and the technologies that underlie them.

While there are very real risks from this nascent technology and its uses, applications for the next generation of the internet continue to spring up in a growing number of industries with potentially transformative effects.

The financial-services industry has largely led the way in adopting some of these nascent digital technologies and assets—at its peak, the daily volume of transactions processed on so-called decentralized-finance exchanges exceeded $10 billion.1 Volume has since dropped to about $2 billion, largely in line with asset prices. Learnings from the financial-services experience—both the ups and the downs—are helping to inform usage in other sectors, which now include real estate, gaming, carbon markets, and art, among others.

How far and how fast these technologies and their uses will spread remains to be seen; the journey is proving bumpy, with ongoing challenges ranging from poor user experience to fraud. Crucially, the regulatory picture for Web3 remains unsettled, with calls for greater clarity on some assets and more consumer protection for funds held in custody. Yet understanding the core features of this new digital wave and the potential disruption it could bring remains important for business leaders in a wide range of sectors. To that end, this article is a primer on the fundamentals of Web3: what it is, the pillars on which it is built, what it can and cannot yet do, the significant risks and challenges it needs to overcome, and the implications for stakeholders as it continues to evolve. Future articles will look at more specific aspects and use cases in greater depth.

MOST POPULAR INSIGHTS

- 2022: The year in charts

- 2022: The year in images

- The state of AI in 2022—and a half decade in review

- Pixels of Progress: A granular look at human development around the world

- What matters most? Six priorities for CEOs in turbulent times

Understanding the disruptive potential of Web3

The core distinctive feature of Web3 is the decentralization of business models. To that extent, it marks a third phase of the internet (hence “Web3”) and a reversal of the current status quo for users. While the first incarnation of the web in the 1980s consisted of open protocols on which anyone could build—and from which user data was barely captured—it soon morphed into the second iteration: a more centralized model in which user data, such as identity, transaction history, and credit scores, are captured, aggregated, and often resold. Applications are developed, delivered, and monetized in a proprietary way; all decisions related to their functionality and governance are concentrated in a few hands, and revenues are distributed to management and shareholders.

Web3, the next iteration, potentially upends that power structure with a shift back to users. Open standards and protocols could make their return. The intent is that control is no longer centralized in large platforms and aggregators, but rather is widely distributed through “permissionless” decentralized blockchains and smart contracts, which we explain later in this article. Governance—and this is one of the trickiest aspects of Web3—is meant to take place in the community rather than behind closed doors. Revenues can be given back to creators and users with some incentives to finance user acquisition and growth.

What does this mean in practice? Essentially, it could mark a paradigm shift in the business model for digital applications by making disintermediation a core element. Intermediaries may no longer be required with respect to data, functionality, and value. Users and creators could gain the upper hand and, through open-source rather than proprietary applications, would have incentives to innovate, test, build, and scale.

The building blocks of Web3

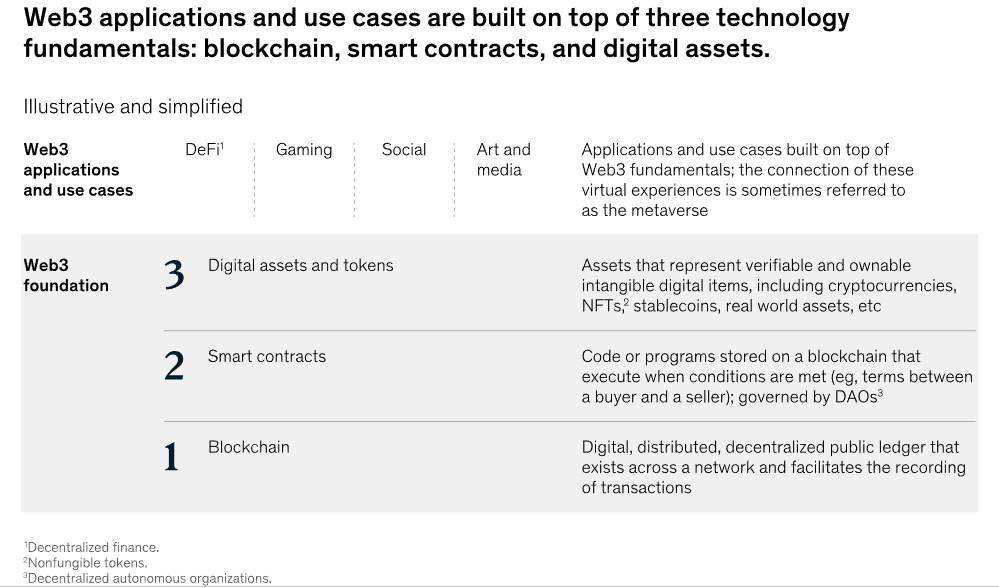

The disruptive premise of Web3 is built on three fundamentals: the blockchain that stores all data on asset ownership and the history of conducted transactions; “smart” contracts that represent application logic and can execute specific tasks independently; and digital assets that can represent anything of value and engage with smart contracts to become “programmable.” Each of these three fundamentals has layers of complexity and nuance, and each is evolving in an effort to overcome startup troubles and structural weaknesses. In this primer, we mainly cover the high-level aspects of these fundamentals (Exhibit 1):

Blockchains as open-data structures. In Web3, application data are no longer stored in private databases but rather on an open-data structure that anyone can write to and read from. This open-data structure is the blockchain. Blockchains operate as public databases that store and secure all relevant and transactional data. They are often referred to as “distributed digital ledgers,” meaning that the core databases are duplicated and spread among multiple participants in a network of computer servers called “nodes.” The “blocks” in blockchain are individual segments of data that are interlinked or chained together. As new data are added to the network, a new block is created and attached permanently to the chain. All nodes are then updated to reflect the change. The lack of central data storage is a critical differentiator from traditional databases. Among other advantages, this means that the system is not subject to a single point of failure or a single point of control or censorship. User data are no longer fragmented across platforms, nor are they proprietary or for sale.

Exhibit 1

Smart contracts as disintermediated functionality. Smart contracts are software programs stored on the blockchain that automatically execute a verified transaction based on predefined and agreed parameters. They require careful preparation and setup because they are often deployed as immutable programs, but once in place, they can be executed rapidly and cost-efficiently without the need for intermediaries and their extractive revenues. The logic of an application is predetermined in the contract and can be difficult to change once deployed. These applications are often governed by a decentralized autonomous organization (DAO), a form of collective governance by users of the application who own governance tokens of the smart contract. If the DAO is set up correctly, no company can unilaterally decide to change the parameters of the application. This stands in stark contrast to Web2 applications, which give companies sole discretion over specific parameters like pricing.

Digital assets and tokens as decentralized ownership. Digital assets are intangible digital items with ownership rights. As such, they are supposed to represent verifiable and ownable digital values—although in many geographies, the legal framework surrounding these digital assets and their ownership rights is not sufficiently clear yet. These assets exist on the blockchain across applications and can engage with smart contracts. Broadly speaking, there are currently five types of digital assets:

- native tokens, which are the monetary incentives used to compensate nodes for maintaining and updating the respective blockchain

- stablecoins, which are supposed to represent cash on the blockchain and are pegged to fiat currencies like the US dollar, or central bank digital currencies (CBDCs), which are regulated by a central bank 2

- governance tokens, which are tokens that represent voting rights on the functional parameters of smart contracts

- non-fungible tokens (NFTs), which are a unique, indivisible digital asset with provable ownership

- digital assets that represent claims on real-world assets such as commodities, real estate, or intellectual property, and are “tokenized” into divisible digital assets on the blockchain

While each digital asset has a specific functionality, asset ownership information is no longer stored on private, regulated ledgers (such as those of a bank) but on the blockchain, enabling user-owned value that can be stored, verified, and transacted independently of third parties. In addition, these assets can engage with smart contracts and be put to “productive” use—for example, earning yield for their owners as they are autonomously deployed by these contracts.

Bringing Web3 to life: Automated lending as an example of what may change

To illustrate the disruptive potential of Web3, it is best to start with the use case where Web3 found its first product-market fit: financial services. Remittances, asset swaps, trade finance, and insurance have all begun to employ smart contracts to achieve automation efficiencies. Lending may demonstrate one of the most compelling implementations of Web3 to date.

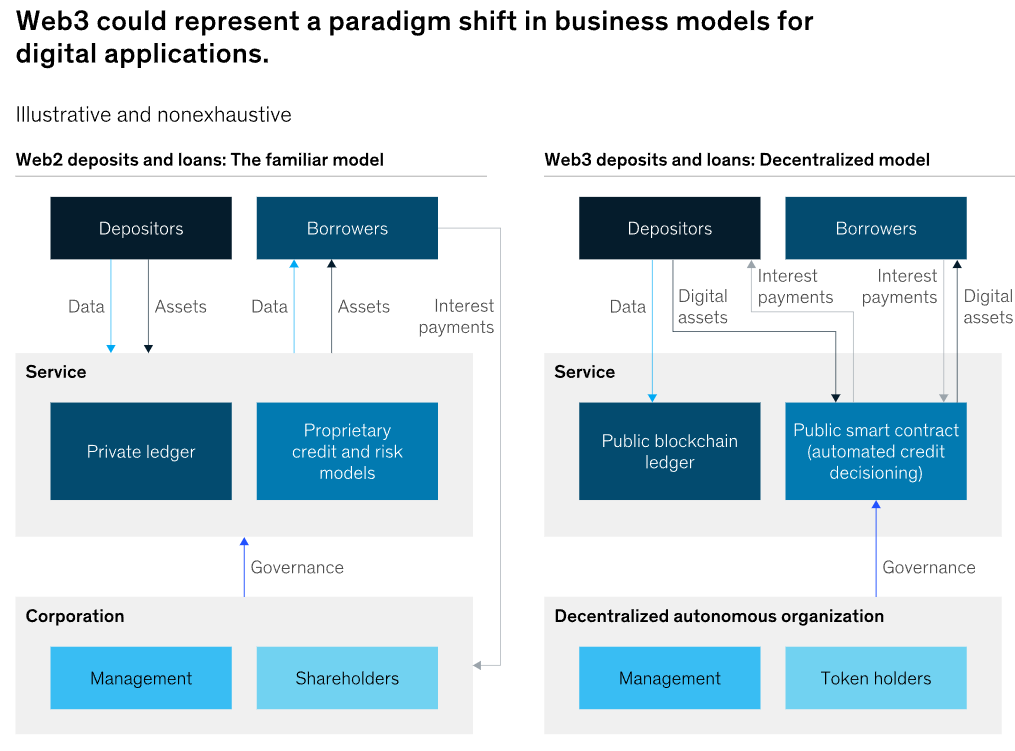

In today’s legacy financial services, lending relies on the bank as the trusted intermediary to safeguard funds and originate loans (Exhibit 2). Depositors provide funds in return for a small amount of interest. The bank then performs record keeping on a private ledger and assembles information about potential borrowers to determine their creditworthiness and the price of their loan. Additional fees charged to borrowers fund these activities and provide revenues to the bank’s management. In recent years, however, with rates at historic lows, very little interest was returned to depositors.

Exhibit 2

With Web3, depositors still seek to earn interest on their deposits, but instead of entrusting their funds to a bank or nonregulated platform, they themselves hold their funds in a noncustodial wallet that represents an account on the blockchain. All ownership and transaction data reside on the blockchain rather than with the bank or nonregulated entity. Customers no longer entrust their funds to a company to lend them out; instead, they can deposit their funds as liquidity into a smart contract. The smart contract effectively escrows these funds and only disburses them when preestablished conditions are met. Borrowers still look for loans but can only receive funds from the smart contract (which were originally provided by the depositors) after the borrower has posted sufficient collateral. By taking out a loan against collateral, borrowers can still enjoy potential price appreciation of the collateral and create liquidity without incurring a taxable event (which would occur when selling).

All terms of the loan, including the loan-to-value (LTV) ratio, interest paid, and liquidation thresholds, are predetermined by the logic in the smart contract and are available transparently to all participants. Borrowers still pay interest rates on their loans, but these interest rates no longer accrue to management and shareholders. In this instance, the contract has neither management nor shareholders; it is governed by a DAO that often has no claim on any of the revenues. The interest on loans is paid into the smart contract and disbursed back to the original depositors of the liquidity. Credit risk is minimized because of overcollateralization requirements and automatic liquidations. More than $200 billion in loans was disbursed last year from the largest Web3 lending platforms—and cumulative bad debt is currently roughly $1 million, despite significant volatility.3 Web3 lending platforms continued to operate even during the market turmoil. No deposits were lost or frozen, and withdrawals continued to occur. One prominent failed crypto lender even continued to pay back its loans on Web3 platforms to regain its collateral after it filed for bankruptcy.

This example underscores how the role of the bank as a custodian, central ledger, and credit decisioning engine can be disintermediated. The traditional interest payment revenues associated with this service accrue to the depositors, rather than to the bank’s management and its shareholders. The smart contract itself often accrues zero revenue, but sometimes will accrue a small spread used for insuring funds. And in recent months, as the price of the underlying loan collateral has fallen, loan liquidations have been triggered automatically by each smart contract without creating delinquencies associated with each loan.

Web3 effectively enables traditional revenue streams to accrue to the users of a platform, enhancing the user value proposition relative to their Web2 equivalents. The lending example also shows how Web3 may enable services to be delivered more cost-effectively and 24/7 through shared infrastructure, compliance, and automation.4

Web3 effectively enables traditional revenue streams to accrue to the users of a platform, enhancing the user value proposition relative to their Web2 equivalents.

While deposits and loans were one of the first examples with product-market fit, other decentralized finance (DeFi) use cases have emerged, most notably swaps. A similar logic applies here: the Web3 implementation enables traditional revenues in the form of trading fees to accrue to depositors (in other words, liquidity providers) of the smart contract instead of the traditional central-exchange company. Liquidity providers for some of the most popular swap pairs (such as Ethereum and USD Coin) were averaging a trading-fee revenue of 30 to 70 percent of the capital provided last year.5 Once again, the DAO that governs the smart contract earns no revenue; all revenue accrues to depositors rather than to the management of a central exchange. While past returns were relatively high, consider the return on equity that organizations could make if they were able to materially reduce trading administration costs through a smart contract and outsourced their infrastructure costs through blockchain, not including essential risk-management and compliance professionals. Web3 could lead to pricing-power compression (in other words, lower fees) due to the open-source nature of the protocols and automation.

Product market uses have in some cases been primarily speculative. Yet the growing range of applications in financial services is indicative of the meaningful innovation that Web3 can generate. Before the recent market downturn, more than $250 billion was actively put to use in smart contracts, yielding autonomous returns for its depositors.6

As such, in DeFi, automated and programmable smart contracts for lending, trading, derivatives, and insurance, among others, have begun competing with traditional intermediaries, including banks, brokers, and insurance agents. In some cases, they offer solutions to challenging features of traditional finance such as counterparty risk, high transaction fees, long settlement times, the large share of value captured by intermediaries, system opacity, and a lack of interoperability. If businesses currently provide services that can be coded into an automated smart contract, they would do well to take notice.

Finally, despite the recent market downturn, the speed of innovation is unlikely to slow. Thousands of new developers are joining the Web3 movement every month.7 Given the open-source nature of the technology, developers can easily develop new applications by building on established programs that have been battle-tested and proved under severe market conditions. It may be hard for even the largest organizations to compete with this scale of global developer base and innovation, and the speed could accelerate as more users and developers join.

Risks and challenges of Web3 that still need to be addressed

Web3 is now spreading into many other sectors, including the social sector and carbon markets, art, real estate, gaming, and more. It is also a building block for an interoperable metaverse, an entirely virtual parallel universe under construction that is attracting massive investment from consumer companies and venture capitalists, among others.8 As with any new technologies billed as disruptive, it remains to be seen just how revolutionary blockchain, smart contracts, and digital assets will prove to be. While skepticism is significant among some parts of the public, especially following the steep declines in the valuation of digital assets and the recent bankruptcies of some funds and consumer deposit companies, user interest remains high and engagement is growing, especially for younger generations. In a recent McKinsey survey of 35,000 active online users in some of the largest digital-asset markets—India, Singapore, the United Kingdom, and the United States—20 percent of respondents age 25 to 44 said they own digital assets. Two-thirds of those had already made payments using digital assets (presumably for peer-to-peer payments or Web3 commerce) and just over half had used NFTs as a form of digital identity or performed play-to-earn activities with digital assets.

Before it can fully establish itself, Web3 will need to overcome continuing challenges, obstacles, and risks for both consumers and institutional participants.

Web3 will nonetheless need to overcome continuing challenges, obstacles, and risks for both consumers and institutional participants before it can fully establish itself.

The chief challenge is regulatory scrutiny and outlooks. Regulators in many countries are looking to issue new guidance for Web3 that balances the risks and the innovative potential, but the picture remains unsettled. For now, there is a lack of clarity—and jurisdictional consistency—about classifying these assets, services, and governance models. For example, smart contracts are not yet legally enforceable. This in turn limits the potential for institutional adoption, especially by heavily regulated entities. Governance remains a work in progress, and the integrity of decentralized autonomous organizations—the collective community mechanisms that are supposed to oversee this new decentralized world—varies widely and is often not yet rock-solid (as some recent examples in DeFi have shown), although it is evolving.

Furthermore, the user experience in this new ecosystem is not yet ready for mainstream adoption. Interfaces are often poorly designed, and the underlying technology is still too cumbersome for users to have a seamless experience. Security is also a concern: until users have peace of mind, they will likely not adopt this technology en masse. Fraud continues to be a risk, with a variety of “rug pulls,” Ponzi schemes, and social-engineering scams dogging the nascent sector, while know-your-customer and anti–money laundering procedures are often lacking. While Web3 ultimately will put the user value proposition front and center, the current state of consumer protection is clearly insufficient.

Indeed, a prominently featured concern is that users engaged in Web3 may not fully understand the risks of decentralized technology, thus expecting the same type of protections they are used to from centralized (and often regulated) entities. For example, transactions on the blockchain, by their very nature, are irreversible, so the concept of clawbacks or user fund retrieval does not currently exist (although it is technically possible).

The technology itself may not be ready for mainstream adoption. Data privacy in the current system is arguably lacking. For example, while wallets are initially anonymous, existing tools are getting better at attributing wallet identity based on transaction history. Once anonymity is lost, all transactions can potentially be viewed anywhere in the world. While this public nature can be beneficial, users will likely need to have access to on-demand privacy for the technology to have mainstream appeal.

Last, transaction cost is also a factor, making some of the technology protocols too expensive to use at present. For example, fees paid to complete and record a transaction on the Ethereum blockchain (so-called gas fees) could be prohibitive for users in large parts of the world, while cheaper and faster alternatives do not typically have the same level of resilience or operational uptime that is needed for mainstream adoption. Smart-contract resilience is unproven, with new exploits of weaknesses in new code or “logic hacks” happening weekly, and the accuracy of “oracles”—that is, information feeds that are used in decisioning by smart contracts—continues to be a work in progress. Web3 infrastructure needs to continue to evolve to become more robust—many critical services are often too centralized or too sensitive to failure. Finally, given their environmental footprint, proof-of-work blockchains could present specific adoption challenges for users, corporations, and regulators at a time of growing attention to environmental, social, and governance issues, although the footprint of proof-of-work blockchains is continuously evolving, and there is ongoing work to reduce it.

Imagining the Web3 endgame

The above examples highlight both Web3’s disruptive potential and its still-nascent implementation. Regulatory oversight, user experience, and the underlying technology will all need to further mature for mainstream adoption to occur. Leading Web3 players and others who are starting to use the technology are aware of these challenges and are actively working to address them, often funded by extensive venture capital (VC). Indeed, VC investments in Web3 exceeded $18 billion in the first half of 2022,9 remaining on track to top the full-year total VC investments of $32.4 billion in 2021. Despite these early challenges, adoption of Web3 applications has occurred at an exponential pace,10 driven by the enhanced user value proposition and disintermediated business models.

The above examples highlight both Web3’s disruptive potential and its still-nascent implementation. Regulatory oversight, user experience, and the underlying technology will all need to further mature for mainstream adoption to occur.

For all the technical complexity and unanswered questions, Web3 remains an important internet trend to watch, and C-suite executives across a range of sectors may want to keep it on their radar, if only because of the potential for rapid disruption that it represents. Executives could develop a deliberate strategy by asking how Web3 native companies could disrupt their industry and what challenges and opportunities this might present.

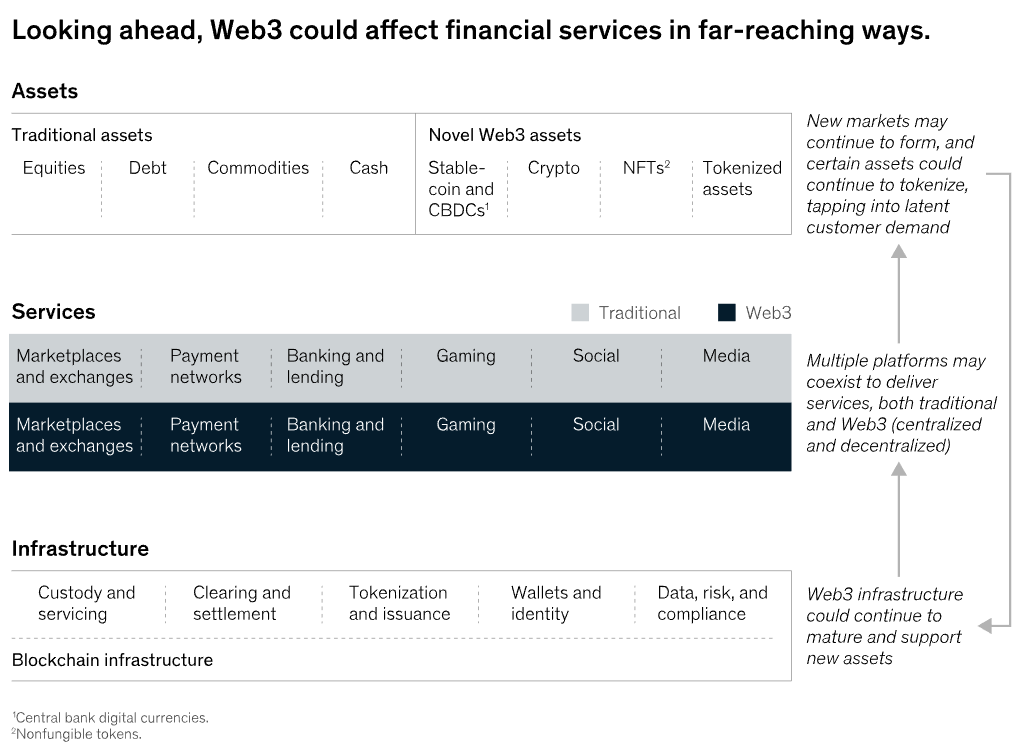

If the disruption does take place, it and other associated opportunities for incumbents (depending on their risk appetite) are likely to happen across three levels: assets, infrastructure, and services (Exhibit 3).

Exhibit 3

Assets. Novel and unexplored assets (including stablecoins, CBDCs, governance tokens, NFTs, and tokenized real estate, among others) could continue to form, driven by new use cases and expanding latent retail and corporate demand. Certain assets could also continue to tokenize, indicating that for many assets—including bonds and commodities—both their traditional and tokenized versions may coexist. As such, the opportunity for corporations would be to facilitate access to new Web3 assets such as NFTs or look to bring existing assets into a Web3 ecosystem. This could be done by using tokenization services to bring realworld assets, such as bonds, music, or art, into Web3 environments.

Infrastructure. As new assets emerge, core infrastructure will likely continue to evolve and mature to support them. There is a need for more infrastructure related to custody and asset servicing, clearing and settlement, tokenization and issuance, risk and compliance, and wallets and identity, to name just a few areas that are currently insufficiently addressed by legacy players. Incumbent banks and others have an opportunity to partner with Web3 native companies to innovate their own offerings and support the maturation of the Web3 infrastructure that is needed for mainstream adoption.

Services. As the infrastructure to support Web3 native assets matures and the technology continues to evolve, new Web3 native equivalents that replicate some of the functionality of existing services could emerge. We are already starting to see the emergence of Web3 native marketplaces, payment networks, and deposit and loan platforms. Many expect the emergence of Web3 gaming, social, and media platforms—the Web3 metaverse—to be next. While it may be hard to predict which use cases will scale fastest, multiple platforms, both traditional and Web3, may coexist to deliver similar functionality. Each, however, may have a different value proposition: the traditional service may have higher consumer protection and better user experience, while the native Web3 version may have better economics for the user or operate around the clock. Incumbents may increasingly partner with Web3 disruptors that serve as a bridge to deliver or tap into new services. The winners of this trend may figure out how to bring new and enhanced value propositions to their existing user base while retaining some of the economics and robust compliance and consumer protections of traditional services.

Web3 is still a world in the throes of creation. Many issues, including questions around regulation, will need to be resolved before it convincingly scales up to reach mass adoption. Yet the value proposition for consumers at the heart of it—one that unifies data, functionality, and value, and in doing so creates opportunities for new and more efficient forms of applications and asset ownership—is a powerful one. If history is any guide, companies large and small, as well as the public and social sectors, may want to take note of the inroads Web3 is already making and start thinking about responsible ways to interact with it. Incumbents that fail to do so may suddenly find themselves overtaken by a fast-moving set of new technologies, new assets, and new ways of doing business.

ABOUT THE AUTHOR(S)

Anutosh Banerjee is a partner in McKinsey’s Singapore office; Robert Byrne is a senior partner in the San Francisco office, where Ian De Bode is a partner; and Matt Higginson is a partner in the Boston office.