In this episode of Bankless Shows, Itay Vinik, Co-Founder & Chief Investment Officer at Equi joins Ryan and David from Bankless to discuss Itay’s outlook on 2023 and beyond.

Read our notes below to learn more.

How Itay Got Here

- Itay started a hedge funds trading volatility and has been exposed to the markets for 15 years.

- Itay’s hedge fund focuses on delta-neutral strategies on DeFi.

- Exited CeFi lenders when Luna crashed.

Inputs on Terra/LUNA

- All DeFi projects are funded by VC money.

- Decided to focus on other assets after Luna collapse anticipating contagion effects.

Itay’s Sentiment

- The goal is to protect capital as even diversification won’t work at the current macro environment.

History of the Macro Environment

- The U.S. became the central currency after the Second World War.

- In 1971, Nixon dropped the U.S. out of the gold standard and the modern era of high inflation began.

- In the 1980s, Volcker raised interest rates to double digits to bring inflation down.

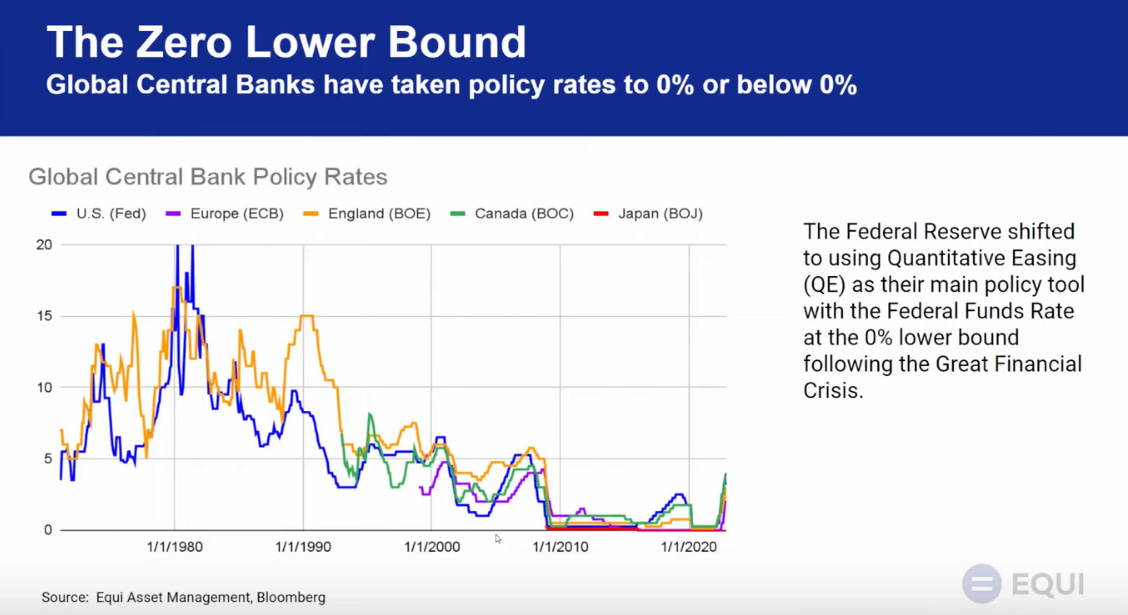

Global Central Bank Policy Rate

- Global Central bank Interest rates since then have been near 0 after the global financial crisis of 2008.

- Quantitative Easing started after the financial crisis when more money was printed into supply.

- Ben Bernanke felt justified in printing money because of the thesis that it will cause a wealth effect (the idea that people will spend more looking at the stock market rising).

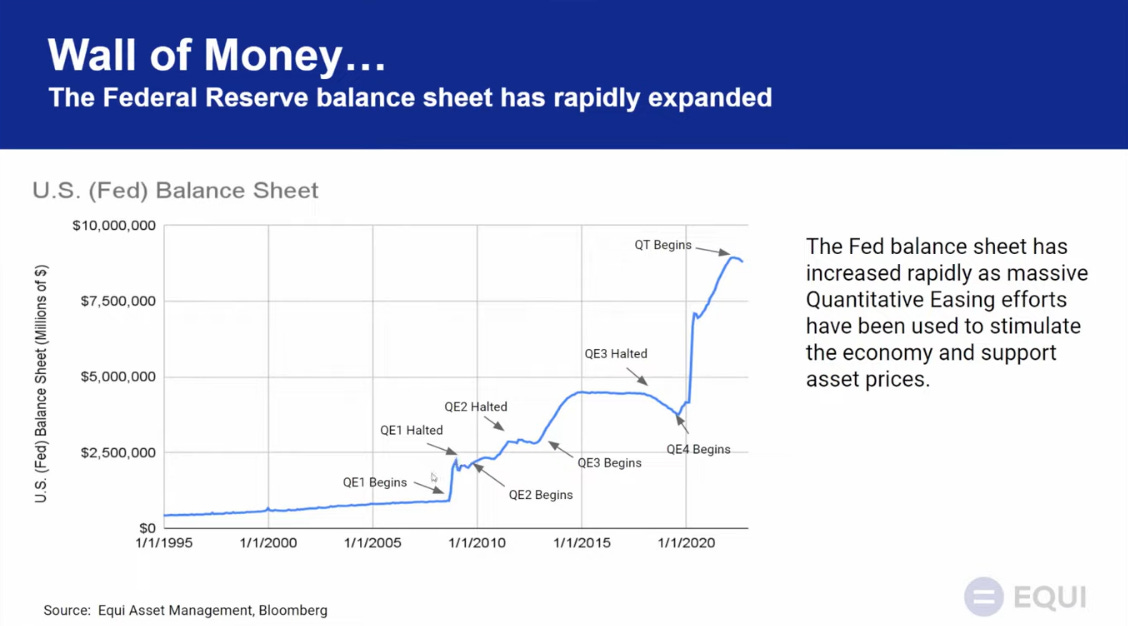

U.S. Fed Balance Sheet

- Every time the FED stopped printing money, the economy went into crisis.

- FED decided to double the balance sheet in 2020 during COVID.

- The FED creates money out of thin air and buys U.S.Treasuries giving money to the U.S. government.

Nasdaq-100 Index & Fed Balance Sheet

- During COVID, The FED added a lot to its balance sheet and it was very good for risk assets.

- Now, a small decline in the balance sheet causes a lot of pain in the markets.

- Markets have become more dependent on the liquidity from the FED.

Pandemic Support Programs

- The reason for inflation during money printing during COVID was because there was a monetary stimulus to people but nowhere to spend it.

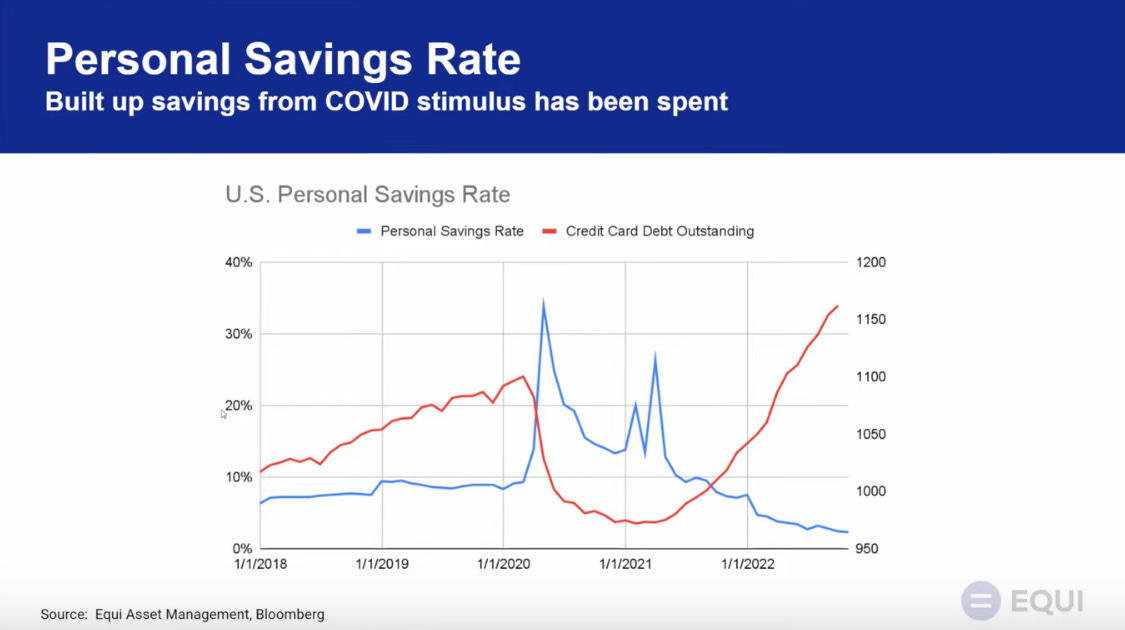

U.S. Personal Savings Rate

- It is seen from the above chart that people’s Personal Savings Rates were up after the COVID stimulus but now the Credit Card Debt Outstanding is at an all-time high while savings are at an all-time low.

U.S. M2

- M2 money supply has seen a 40% increase in 2020.

Where Are We Now?

- FED has realized they have made a mistake and trying to fix it by raising interest rates and taking $100b/month out of circulation (like the burn mechanism in crypto).

- FED cannot print money this time as inflation is already high.

Inflation

- Inflation is expected to decelerate and massive layoffs could help bring the inflation down.

Housing

- Mortgage rates are going up and buyers cannot buy.

- Sellers cannot sell as they are locked into low rates.

- The labor market crash might cause a crash in the housing market.

2023

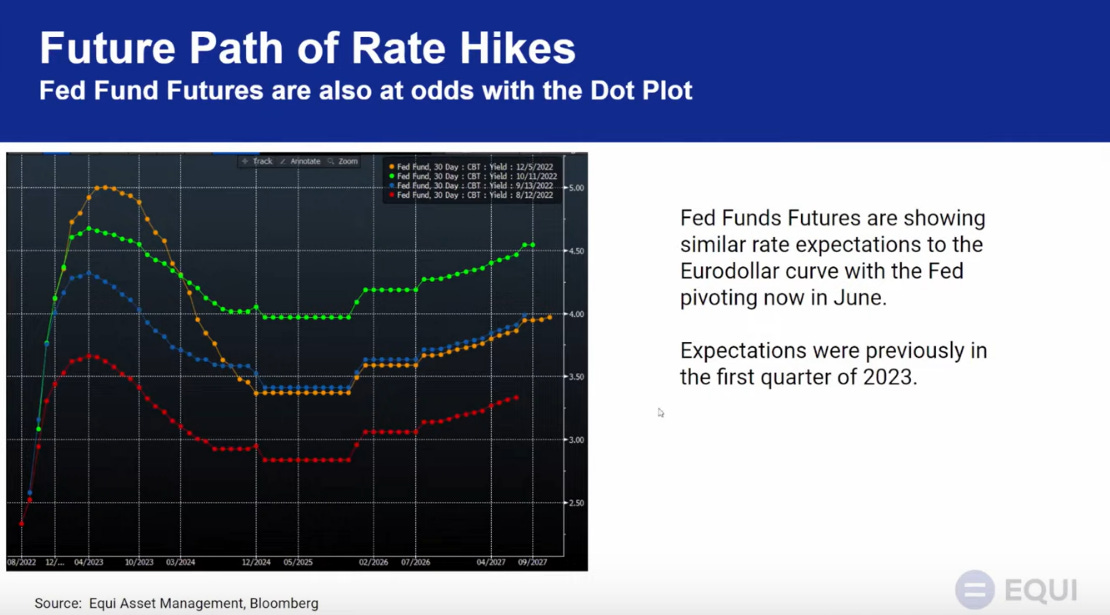

- The market believes that 4% interest rates are going to be in place for longer.

- The market also believes some sort of FED pivot could happen in June 2023.

- Rate cuts have saved the economy three times and rate cuts didn’t save the economy from a recession in the other three instances.

The Last Dance?

- Everyone is playing the liquidity trade.

- All the assets like S&P, crypto, and precious metals pricing are moving in a similar direction with different volatility.

- It is important to manage risks during tightening.

- Even Albert Einstein lost money FOMOing during his time.

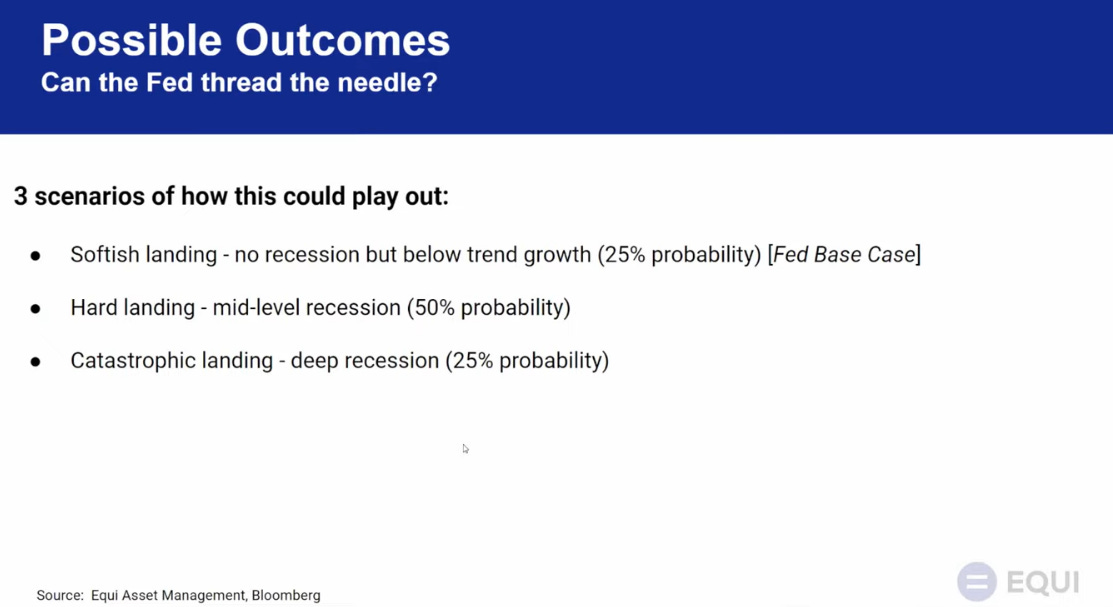

Possible Outcomes

- Soft landing is the hopium case where money printing is back and asset prices rise while risking higher inflation.

- Thinks a Hard landing is the most likely scenario, 2008 financial crisis was a hard landing.

- A catastrophic landing will be if there are systemic risks like the financial crisis.

Bull Market Mid-2023

- Markets could see a bottom in Mid-2023 as the stock market has been in a bear market for a year now and the usual bear markets are 18 months long.

The Dollar

- The dollar is being used as the reserve currency for trade worldwide makes it strong.

Itay’s Advice & Closing

- Increase your productivity, save more, and don’t overleverage.

- Market recovery from a recession is the best time to invest.